News

Why I think a brand-new Skoda Kodiaq cost me Rs 61 lakh; let me explain

I already pay toll taxes to drive on good roads, then what is Rs 5 lakh RTO charges for? To drive in the never-ending metro construction zone?

BHPian Jangra recently shared this with other enthusiasts.

Yes, you heard that right! Well, technically. Let me explain.

I'm a salaried employee, like many others here - a section of the population who doesn't get much tax relaxation. But, we are not here to talk budget.

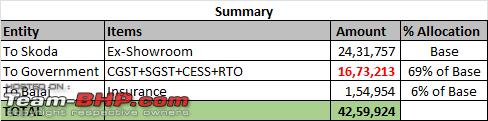

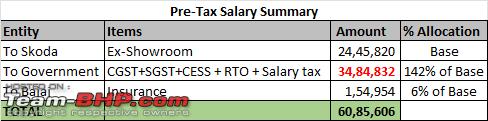

I recently bought a Skoda Kodiaq - Sportline trim for which I paid Rs 43,81,800. For this discussion, I would keep the extras like Maintenance pack, Fast Tag, Accessories etc aside and just focus on Ex-showroom, RTO and Insurance - which was 42lacs. Below is the breakup.

So basically only 57% of the total amount was received by SKODA!

It's a common analysis that one does in his / her head as to if it was worth it. And I do feel the Kodiaq is worth every penny of it. But paying 16 lacs, which is 69% of SKODA's receivable in taxes justified? I love India, but not its city roads. Driving experience lately in Bombay is not something to write about. I already pay tolls to drive on a good road, then what is 5 lacs RTO for? To drive in the never-ending Metro construction zone?

Then comes another thought (ONLY applicable to salaried ones). I pay with my after-tax money. Calculation of pre-tax is simple math, if 0.7x is 42.6 lacs, then x is 61.

So basically, I paid almost 35 lacs to the government to buy a 24 lacs car? While some may argue that this is not the right way to look at it, there is no denying that this is it. It was my choice and I'm not complaining. But I do feel as a taxpayer, returns from our government when it comes to infrastructure need a lot of improvement.

So why this post?

- Of the 43 lacs I paid, only 24 lacs gets in Skoda's pocket, want to know from other members if they feel it's fair?

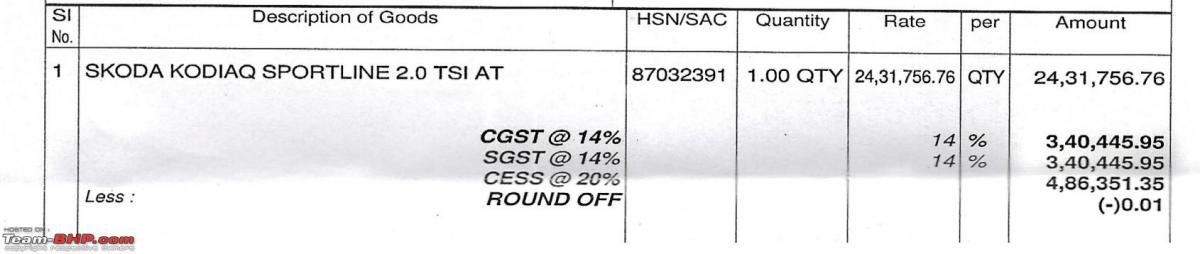

- Help someone who is unaware that ex-showroom cost consists of 48% taxes already.

Below is a snapshot of the tax invoice

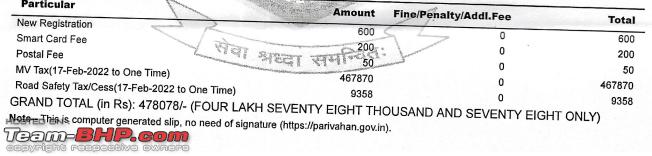

Below is the RTO Invoice

Below is the Insurance cost summary

Here's what GTO had to say about the matter:

We business owners definitely have it easier with car ownership costs than salaried folk.

- Depreciation benefits cross over a million rupees on expensive cars.

- Repairs, fuel, EMI interest, insurance etc. can be written off as company expenses, thus, getting you immediate tax benefits.

- We even get GST ITC (input tax credit) on the service & repair bills!

Here's what BHPian Vitruvius had to say about the matter:

Well, that's how the taxation system works. You're taxed when you earn, you're taxed when you spend, you're taxed when you save, and you're taxed when you die.

While taxation started off as a means of 'taking from the rich and giving to the poor', it has now trickled down to where everyone is paying taxes for just being alive.

My understanding of the taxation system changed completely when I read Robert Kiyosaki.

Here's what BHPian Turbanator had to say about the matter:

I totally feel for you. In none of the developed countries, taxes on Cars are so high. When someone says, Tax is a must and is applicable everywhere, I agree but to what extent? Paying 35% on your salary and then over 50% as GST and if the car you like is a CBU, 100% as customs, cannot be justified for a growing economy like ours.

In addition to the calculations you have mentioned, also factor the Tax part on that EMI! So, technically, if the car loan is 7-8% interest, you are actually paying 10-11% as there is no rebate on IT on car loans.

As I mentioned elsewhere, that’s the reason, most luxury cars are bought by HNI or Companies in India. Businesses or Individuals which have business income, book expense on purchase of the car, the interest they paid and even the RTO & Insurance is added while booking in the balance sheet. They also claim 15-30% depreciation and save on the overall income taxes they have to pay.

Highly unfair to salaried individuals in my opinion.

Here's what BHPian Vid6639 had to say about the matter:

I was recently doing a comparison on a corporate car lease which was being offered by my company.

The car lease comparison clearly shows that when you take a car on loan you pay 7-8% interest loan on the car loan plus 30% income tax on the entire EMI.

For my 30L loan on Kodiaq, I am paying 36L to the bank with interest and 30% on top of that 36L for income tax.

The car lease gives some relief as the monthly lease rental is deducted before and not part of your taxable income. It is offset by GST and perquisite tax as well as higher lease rental vs bank loan.

However, the entire equation changes when you change the vehicle to an EV. The EVs are only 5% GST whether outright purchase or lease.

I realised if you want to pay lesser GST, no CESS and buy a car on lease or loan it has to be an EV. Loan means 1.5L of the loan amount is non-taxable as well.

So truly speaking no point in complaining about these luxury SUVs having huge taxes as the govt clearly wants the people who can afford to pay maximum taxes for them to make the cheaper cars easier to buy for the mass population. On top of it, the promotion is towards EVs.

So buy that MG ZS EV over the Tiguan, Compass or Kodiaq and be happy you paid the lowest tax to the govt.

Check out BHPian comments for more insights and information.

.jpg)

_1.jpg)