News

How Tata Punch reached rank 1 in India: Case study on its rising sales

It was launched in Oct 2021 and its CNG version was introduced in Aug 2023. Then came the Punch EV earlier this year which had features borrowed from the Nexon EV.

BHPian pqr recently shared this with other enthusiasts.

2021: Tata Punch Market Entry

Punch was launched in October 2021, the very same month when it was awarded a 5-star rating for adult-occupant-protection after a frontal ODB crash test conducted by GNCAP under the old protocol. Punch was the second car to be based on Tata’s ALFA platform after the Altroz 4m-hatchback. At the time of launch, Punch was offered with a lone 1.2L three-cylinder naturally aspirated petrol engine mated to 5 MT or an option of 5 AMT semi-automatic transmission, priced between ₹ 5.5 and 9.4 lakh.

Tata Punch positioning

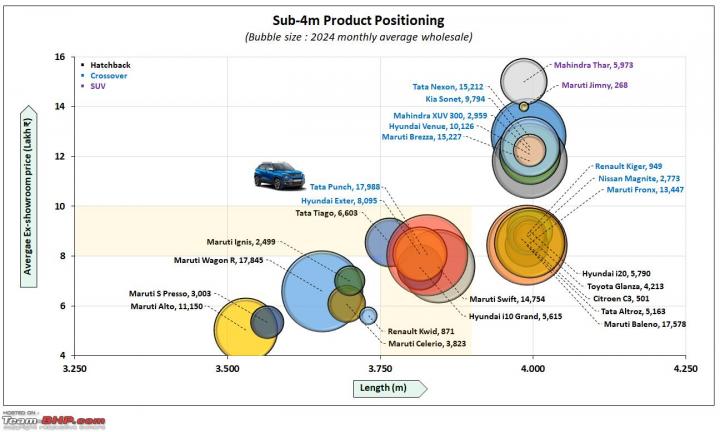

With crossover styling, Punch brought a new sub-segment of ~3.8m crossover into proper existence under the sub-4m umbrella. To make things simple, Punch is basically a Tiago-hatchback equivalent in the crossover segment, with higher ground clearance, an upright seating position, a commanding view outside, SUV styling, and sitting a level below its sibling Nexon, which is just under 4m in length.

The Hyundai Exter is its only direct rival right now in terms of footprint and pricing. Though there is a clear distinction in segments, as can be seen in the graph above, however, based on customer need and budget, low-end 4m-crossovers also come in close proximity, like the Nissan Magnite, Renault Kiger, and Maruti Fronx.

Tata Punch sales growth trajectory

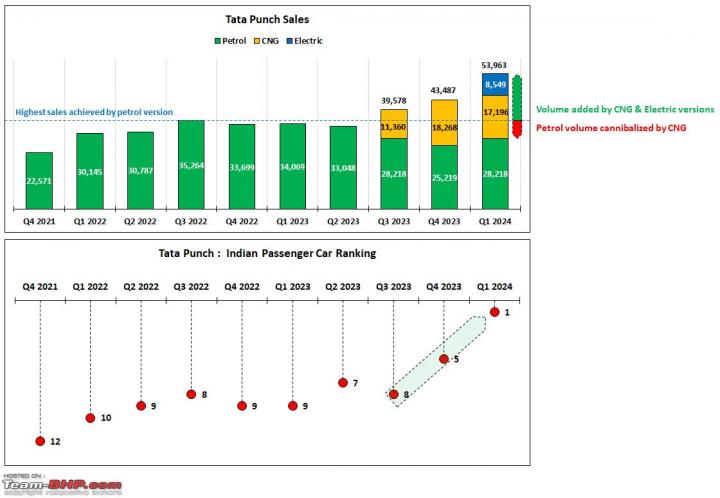

Soon after launch, Punch gained traction, started selling consistently over 10,000 units a month with a petrol-only option, and secured the top-10 rank for itself.

In August 2023, Tata introduced a dual-tank CNG option on the 1.2L 5 MT version priced between ₹ 7.1 and 9.7 lakh. From this time on, the entire Punch lineup was available with the option of a single glass pane openable sunroof. The CNG option took some sales away from the petrol version; however, it added 6,000 units’ of incremental sales a month. Thus moving Punch to the top-5 ranking in the last quarter of 2023.

Early in 2024, Tata introduced an electric version of the Punch with a dual battery pack option, each mated to a separate motor, priced between ₹ 11 and 15.5 lakh. Major changes to the Tata Nexon EV Facelift-2 battery pack were dubbed the Gen-2 EV architecture by Tata.

Essentially, the floor pan and central tunnel are highly modified w.r.t ICE-based ALFA platform to accommodate the battery pack under the floor. The front portion was given a complete facelift in line with the Tata Nexon EV facelift-2; the side and rear profiles remained the same. Interiors were thoroughly revised, with new features trickling down from the Nexon EV. Punch EV version has added another 2,800 units per month of incremental volume to overall sales, thus making it #1 in Q1-2024.

Product innovation driving sales

Exterior design and SUV stance: Tata here has been very successful in what other competitors were not able to achieve when it comes to compact SUV stance and appealing design for ~3.8m footprint. This has been the biggest driving factor behind Punch’s success from the get-go.

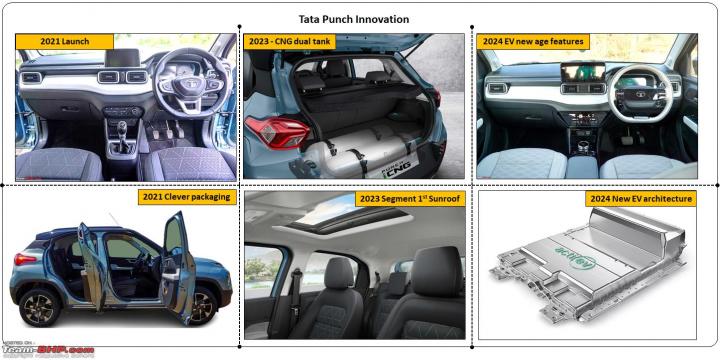

Packaging: Punch has always been at the forefront of innovation in several areas. Clever packaging and an upright dashboard, pushed all the way forward, ensured a lot of in-cabin space for a car with ~3.8m long footprint. Upright seating posture gave occupants a good commanding view, sought after in SUVs, and 90-degree opening doors ensured practicality of ingress or egress.

Safety badge: Sans Tata Safari and Harrier, safety already became a hallmark for Tata products by 2021. Punch achieved the best score by GNCAP under the old protocol just before launch in October 2021. That also added to the overall value proposition for a new breed of safety-conscious customers, especially when women in the family are key influencers in car purchase decisions.

CNG kit: 2023 saw a major update in the form of the CNG dual-tank and sunroof exhibited earlier at Auto Expo 2023. A major pain point in a car with a conventional CNG kit is the lack of usable boot space, which has never been addressed by any car maker. And here comes innovation from Tata Motors. 60L (water equivalent) conventional CNG tank was split into two 30L smaller tanks fitted next to each other, occupying spare wheel well space, thus liberating generous boot space above, and the spare wheel was moved underside. Dual CNG tanks mean higher cost, as there will be more surface area of tanks and additional valves and pipes, however, additional boot space is the value that Tata is able to deliver to customers that competitors couldn’t. That has adversely impacted sales of its direct rival Hyundai Exter with 60L single-cylinder CNG kit, as Hyundai has to sell that version at a discount.

Sunroof: Sunroof has always had a vanity value for Indian customers, irrespective of its functional value in the Indian context. And Tata was not hesitant to be the first to add a single-pane sunroof to a smaller car. Adding a feature that is high on the customer value driver list is always a clever move.

EV architecture on the ICE platform: Using the existing ICE platform to underpin EV is a highly cost-effective and risk-averse way of developing BEV cars for a market that is in a nascent stage of growth and customers are highly value-conscious. This is because the investment level is on the lower side due to shared-platform cost synergy, and if demand doesn’t pick up for EVs in general and not from the product per se, automakers can continue to sell the same car with other fuel options in their portfolio. The downside is also there in terms of the of the lack of flexibility in packaging batteries underneath the floor and in the in the fuel tank area. Here, Tata has had effective packaging in terms of space utilisation under the floor as well as the central tunnel zone. The end result is a low investment EV product with a quick-to-market presence. A win-win for customers and Tata Motors for staying competitive in the short and medium term.

Technological gaps that must be addressed

Having said all that, Tata still doesn’t have a best-in-segment or inspiring drivetrain option in the market. Maruti still has the best four-cylinder 1.2L naturally aspirated petrol engine that is highly efficient, relatively refined, trouble-free, and nice to drive. Maruti’s CNG offering continues to offer best-in-class fuel efficiency.

EVs still remain largely uncontested space for Tata so far. Since a large majority of EV components come from China, the competitive advantage of current Tata EV products could be vulnerable in the long term. After all, the ‘Kitna deti hai’ adage is going to be more prominent in the EV world than ever, whether Shailesh Chandra likes it or not.

In short, Tata still has a long way to go when it comes to in-house-developed drivetrain technology. That’s the reason why they lobby hard against complex technological innovations like hybrids.

Disruptive concept: From definitive SUV design to small crossover innovation

Brute, imposing, and intimidating are some of the words generously used for large SUVs, like the ones shown above, that Indians have been used to looking at over the last two decades. Proper embodiment of these words underpinned the success of Mahindra Scorpio in India.

But then it was not accessible to many, either due to its size, price, or practicality; however, the aspiration to own one as a status symbol always existed. So some marketers decided to sell the ‘piece’ of Scorpio’s success—that very sense of aspiration—in a more practical and accessible form by making it small yet proportionate and using monocoque construction for better practicality in an urban environment. Since these SUVs were bought mostly as 4x2, off-road credibility as the defining character of SUVs was never considered for crossovers in India. The idea was to deliver a ‘form’ factor rather than a 'substance’.

SUV concept embodiment trial in ~4m footprint

Initial attempts, though, never met any success in that very decade. Designers, engineers, and marketers could not get the entire packaging right for India. The Ford Fusion was overpriced, the Premier Rio was just a cheap Chinese CKD product, and the Mahindra Quanto (ladder-frame chassis) had a horrible design.

~4m Crossover concept success

The very first time someone got everything right on the sub-4m side, unique to the Indian taxation requirement, was the Ford Ecosport with absolutely right SUV proportions, under ~4m footprint. Maruti further improvised it with a Range Rover-inspired Brezza, and later Tata re-cast the mould with a coupe-inspired Nexon.

SUV concept embodiment trial – ~3.8m footprint

Still, there was no breakthrough in a segment below 4m (~3.8m) where hatchbacks were still thriving. Mahindra attempted hatchback-SUVfication with the KUV 100 but failed due to several reasons, mostly design-related. Despite success in 4m-segment with Brezza, Maruti continuously failed with contraptions like Ignis and S Presso. The audience simply refused to call it a ‘piece’ of SUV, even remotely.

~3.8m Crossover concept success

But out of nowhere, Renault's Kwid’s unique styling stirred a hornet's nest in the hatchback category. A car having a footprint bigger than the Maruti Wagon R, priced against the Maruti Alto, with very appealing SUV-like styling that includes muscular cladding and a slightly upright stance. But then neither envious Maruti nor Hyundai could bring a worthy contender, and complacent Renault, with poor product-life-cycle management skills, let the Kwid sink after the initial hype was over.

Six years after that, Tata was able to crack the ~3.8m crossover segment by packaging the Punch just right in terms of overall styling, SUV stance, and carving out generous in-cabin space. And to sustain the initial success, Tata has been innovative with Punch all throughout, and that’s how it reached the #1 position in the Indian market.

Perplexing consumer behavior

Sometimes, something doesn’t add up! The Hyundai Exter looks fine from the front, and from the side view, under the shoulder line, it is still palatable. But the overall roof line, C pillar, and rear end design have reminiscence of the ugly Mahindra KUV 100. It wouldn’t have successfully passed the static customer clinic (market research technique) likability test when Tata Punch was also a benchmark car, yet Exter is selling in quite good numbers.

And who knew that boxy design could prove to be a blessing in disguise for the Wagon R, which became the best-selling car in 2021 and 2022? An unaided questionnaire of customer clinic results shows that the 2018 generation Wagon R, due to its boxy design and slightly muscular wheel arches, resembles the silhouette of an SUV to general respondents. Unassumingly, that wagon shape, as the name also suggests, has been working in Wagon R’s favour now, given how the love for SUV silhouettes is growing in India.

SUV-inspired ‘form’ and ‘design direction’ are the present and future of the Indian car industry. Marketers, designers, and engineers should focus on innovation to meet consumers’s ‘needs’, ‘wants', and ‘aspirations’, as they did in the case of Tata Punch!

Image source: TeamBHP, Carwale.com, GNCAP, findblueprints.com & Tata Motors website.

Here's what GTO had to say about the matter:

Great analysis, PQR. Thanks for sharing. We all learn from your threads.

The Altroz is a decent performer at ~5000 units / month. But yes, it can definitely do better when you consider the sheer competence of the car. Heck, you can buy an Altroz DCT for the same money as a Punch AMT. Plus, compared to the Punch's weak petrol motor, the Altroz has superior turbo-petrol & turbo-diesel options.

I think it's the market's fascination with crossovers. The Altroz is squeezed between the Punch on one side & the Nexon on the other. Even Hyundai's i20 dropped to 5000 units in Feb 24. Maruti hatchbacks are the only ones that sell in 5-digits now.

The Altroz can do better with updates to the car & more aggressive marketing.

Here's what BHPian shortbread had to say about the matter:

While the success of the Punch and the senior longstanding stalwart Nexon is impressive, it's astounding how Tata is comfortable with Altroz's underachieving sales.

Altorz has a comprehensive line-up of petrol, turbo-petrol, CNG, diesel powerplants and manual and auto gearboxes, there's an Altroz variant for most people looking to buy a car in this particular segment. Nearly 5 years since launch and the car has not had a major facelift/relaunch. The i20 outsells the Altroz and let's not even talk about the Baleno (backed by a timely facelift) that beats it by 3:1! It's a low-lying fruit for Tata, but clueless as to why they're laggard in plucking it. Needs a facelift and a well-marketed relaunch desperately!

Also, why not repackage the bigger and short-lived (albeit well-packaged/engineered) Bolt/Zest as the next-generation Tiago/Tigor with a new top hat? They were bigger cars but served similar client profiles. Tiago/Tigor is almost a decade old now.

Tata's big Achilles heel is its really small model lineup and absence in many important segments. This means they must be on the ball in segments they're currently present in. The Punch being no.1 is a great feat no doubt, but I'm not sure for how long as this is something Maruti will never take lightly. Tata cannot rest on its laurels even for a brief moment.

Here's what BHPian Ananthang had to say about the matter:

Rear seat of Punch is very comfortable and better than Venue, Brezza. It can easily hold 3 adults, has fair thigh support and is not too tall.

For the middle class who want to buy their first car, they will not hesitate if it offers good space, easy to drive at a slightly higher cost.

Punch is successful because it is a VFM.

Here's what BHPian Mr.Beat had to say about the matter:

Fantastic analysis! Thank you, pqr.

I think credit is due to Tata Motors for developing a product based on market knowledge of Indian consumers' preference for SUVs or SUV-like products. They've marketed it very well, added innovations like the split CNG tank, and incorporated market requirements such as CNG and EV options, making the product attractive to almost any new car buyer. While the product may not be perfect, it follows a very Maruti-like approach: providing exactly what the customer is looking for and omitting things that customers don't consider dealbreakers.

Regarding the question of whether the Altroz is a laggard, it's more about the shifting consumer preferences towards SUV-ish body styles instead of traditional hatchbacks.

Check out BHPian comments for more insights and information.

.jpg)