News

Diesel engines in India: Study of their past, present & future

This study will focus on 2021 data first, as in 2020, many manufacturers were ramping up diesel engine production in a highly uncertain COVID-19 induced pandemic period.

BHPian pqr recently shared this with other enthusiasts.

BS6 emission norms came into force from 1st April 2020. Announcements for the same were made way back in 2016. Since then automakers in India were working to upgrade their engine portfolio to be compliant with the new rules. Petrol engine upgrade to meet new emission standard was relatively easy with a software upgrade, slight engine modification, in some cases use of an enlarged catalytic convertor and additional hardware like a particulate filter. However, diesel engine upgrade to new emission standard was a tough job, because of the high NOx content generated by diesel engines owing to the high pressure under which diesel combustion takes place inside the cylinders of diesel engines. Prices of petrol engine upgrade were not that high (₹10,000 - ₹30,000), but for diesel, it was substantial (₹40,000 - ₹1,20,000), as later needed complete new set of exhaust after-treatment hardware and re-engineering, besides software upgrade.

So, many companies have given up on diesel engines. Audi-Volkswagen-Skoda brands are owned by a single company, which was involved in a diesel emission cheating scandal globally known as ‘diesel gate’ in 2015. Their HQ in Germany was reluctant to support any further development of diesel engines for the Indian market, hence group as a whole in India has to drop the idea. Nissan-Renault alliance did try hard to upgrade the 1,461cc k9k series diesel engine with LNT (lean- NOx -trap) technology, but they failed to contain the NOx issue and had to give up the diesel engine. Last but not the least, Maruti failed to upgrade their in-house developed 1,498cc diesel engine due to high NOx content as they were not able to manage thermodynamics quite well. So their focus shifted to CNG, as an alternate fuel choice, which still is not able to fully compensate for the diesel engine sales void.

Result – diesel % mix settled around 18%. Though 2020 and 2021 diesel mix data are the same, volume is higher in 2021. This implies that demand does exist, but supply-side wariness, made the diesel engine market artificially limited to an 18% level.

Only a handful of diesel engines survived the very litmus paper test of new emission standards (BS6) adopted by the Government of India. But that is not all, the next round of tests is coming up in April 2023 – the second phase of BS6 - known as BS6 RDE (real-time-drive-emission). Threat looms over smaller 1,500 cc engine, rather than higher capacity engines, as the latter already uses Selective Catalytic Reduction (SCR) for NOx treatment. Engine with a displacement of 1,500cc or less used on monocoque chassis was made BS6 emission norms compliant by using lean-NOx-trap (LNT) technology which is a cost-effective technology because SCR technology uses much larger and expensive hardware. For the BS6 RDE phase, if small diesel vehicles have to be fitted with SCR, there would be additional costs, and some smaller vehicles may not be able to accommodate SCR hardware, and this may reduce the appeal of diesel engines for small cars. The new phase will test the willingness and technological competence of the current manufacturers.

This study will focus on 2021 data first, as in 2020, many manufacturers were ramping up diesel engine production in a highly uncertain COVID-19 induced pandemic period.

Let us start with having a look at the diesel engines that survived till 2021 and how they are performing right now.

2021 analysis - diesel engines that survived the BS6 challenge

Diesel engine manufacturers

- Hyundai-KIA has emerged as the largest diesel engine manufacturer in India followed by Mahindra.

- Mahindra the original UV maker of India is heavily reliant on a diesel engine for its entire UV portfolio.

- FCA India (now merged with PSA) has an innovative business model, where they directly compete in the market with their product (Compass) and also collaborate with other automakers by supplying their 2L diesel engine – the same engine does duty on Tata Harrier, Tata Safari (new) and MG Hector.

- Toyota India produces large-size diesel engines for its large-sized UV products with fat margin.

- Tata and Honda are the ones with their in-house 1.5 L diesel engine left with seemingly minuscule volume as of now.

- MG also introduced a 2L in-house developed diesel engine on Gloster.

- PSA is the only European manufacturer in India to introduce an imported BS6 diesel engine for its lone product (C5 Aircross).

- Isuzu has introduced a smaller 1.9L diesel engine in 2021 for its entire range of pick-ups and SUVs in the passenger vehicle category.

- Force motors use a 2.6L diesel engine for Gurkha - found in their other commercial vehicle range.

- 1,500cc diesel engine has become a mainstay of the Indian passenger car market for small and mid-sized products.

- Mahindra has a different derivative of a 1,500 cc engine for different product application.

- All large UVs uses 2,000cc+ sized diesel engine with SCR technology.

- 2,200 cc engine with a different state of tune is used across several Mahindra products.

- Hyundai-Kia runs the highest cost synergy as the same 1,500 cc engine does duty across their multiple products.

- There are hardly any takers for Hyundai’s product with the smallest (1,200 cc) diesel engine.

- Tata-Honda could be struggling to justify the business case for their in-house developed 1,500 cc engine.

- FCA has a win-win case in the 2,000cc category with its innovative business model.

- Toyota India with only 2 diesel products, produced nearly 73,000 large-sized engines in 2021, even ahead of Mahindra’s 2,200cc diesel engine.

Why buy a diesel engine passenger vehicle

Before deep dive analysis, it is important to encapsulate why diesel engine is preferred in some cases over alternate fuels in the passenger vehicle segment.

Advantage of diesel as a fuel for internal combustion engine

- Higher fuel efficiency

- Higher torque

- Relatively lower CO2

- Artificially lower price of diesel.

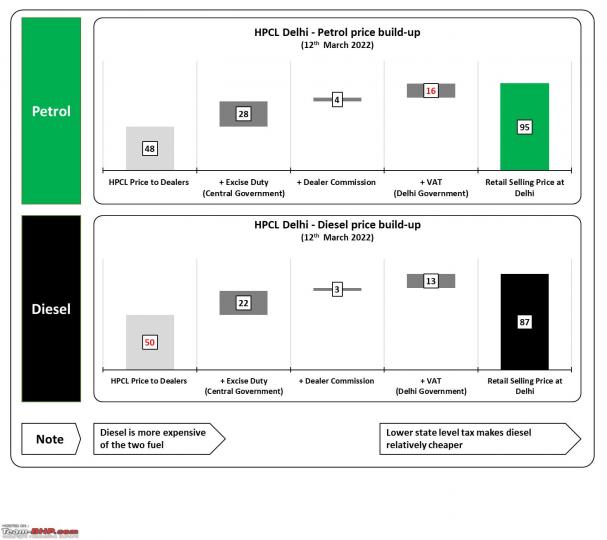

In India diesel is available at a lower price than petrol at fuel filling stations. But at the refinery level, diesel is costlier than petrol. This artificial price gap at the market level is all due to differential duty (excise) and tax (VAT) imposed by the Central and State governments respectively.

The fuel price gap plays a very crucial role in the fuel mix of the passenger vehicle market.

- Diesel mix grew from 43% to 54% when fuel price difference soared to 37% in 2012.

- Once price difference began to cool down, diesel mix too came down linearly, though at a different rate.

- When fuel price different started falling again since 2016, diesel mix too reduced over time.

- This became a trend for almost all the vehicle segments, except for body-on-frame chassis UVs, which is described in larger detail in the coming section.

The disadvantage of diesel engine

- Higher initial cost

- Low on power

- Higher weight

- Higher pollutant level (NOx and particulate matter)

Customer benefit statement

Higher fuel efficiency and relatively lower price (variable) of diesel as fuel lead to lower average running cost which offset the higher initial cost of purchase of vehicles with diesel drivetrain over petrol drivetrain and thus delivers higher monetary benefit over the long term, provided vehicle covers higher mileage every year. Also, higher torque is purposefully useful in case a vehicle has to carry more passengers or luggage or both together or is inherently heavyweight, besides that it also adds a fun element to the driving experience.

Needle mover - Automatic transmission

Availability of torque convertor gearbox or alternate automatic transmission has a significant impact on buying decisions for self-driven passenger vehicles. This impact becomes more apparent in the coming section.

Exceptional deterrent

Diesel vehicles older than 10 years need to be retired in the NCR region due to NGT orders.

Turbo petrol engine

Manufacturers these days have started using common technology of forced induction (turbocharging) and direct injection in a petrol engine to downsize the petrol engine and improve torque output. This is why, for similar displacement, turbo petrol engine cost the same as diesel engine, with power advantage and at par (nearly) torque output. Result – more fun to drive car - costing same as a diesel engine with relatively lower fuel efficiency.

Theoretical break-even point

The below graph (the ideal situation with assumptions) to a certain extent encapsulates the outcome of the customer benefit statement. The higher fuel price difference will lead to diesel advantage in monetary terms, but the lower fuel price difference will only prolong the return period on diesel-powered vehicles.

Deep dive analysis – segment-wise

Hatchback segment

After 2012, diesel mix started to drop in line with the fuel price difference. FCA sourced a 1,248cc diesel engine fueled the lead of Maruti products in every segment Maruti was participating. Maruti used to contribute nearly 40-50% of diesel hatchback sales during the 2012 to 2019 period. So once Maruti abandoned the diesel dream, the volume of the overall segment too dropped. Other manufacturers with a BS6 diesel engine could not cash in much, as an opportunity just vanished in thin air. The diesel engine in the hatchback segment seems to be on its last leg in the BS6 emission norms era.

Sedan segment

Besides Maruti, Tata and Volkswagen diesel sedans were contributing a lot to the diesel sedan segment in the early part of the decade. Then came Honda with its 1,500cc diesel engine on Amaze and City and diesel sedan sales reached nearly 80,000 units level for Honda.

Similar to elsewhere, the diesel mix in the sedan segment started to drop drastically after 2013. Maruti was a major benefactor (~50%) as well as a beneficiary in the sedan segment, as Dzire diesel sales crossed the 1,50,000 mark, partly contributed by the fleet segment. But when Maruti abandoned the diesel engine, not only diesel sedan segment collapsed but Dzire sales were bruised badly and failed to recover quickly with the petrol-only engine. Honda and Hyundai sales in the BS6 era are not remarkable either and slowly but surely diesel demise in the sedan segment is imminent.

Monocoque UV segment – SUV/MUV/Crossover

Split between monocoque and body-on-frame construction gives a more realistic picture of development. Diesel monocoque UV segment growth was fueled by Mahindra XUV 500, Maruti Ertiga, Renault Duster, and Ford Ecosport in the early part of the decade, each being a definitive product. The latter half of the decade was turbocharged (literally) by Maruti Brezza followed by Hyundai Creta. Diesel only Maruti Brezza sales even crossed the 1,50,000 mark in 2018.

Maruti diesel story and fall in fuel price difference – template - is also applicable here too, though with lesser impact, as Hyundai-KIA propped the entire segment in the BS6 emission era. Entry of Tata Harrier and Tata Safari (New) with FCA and Hyundai sourced engine and automatic transmission, respectively, is putting the segment back on volume growth trajectory without mix improvement.

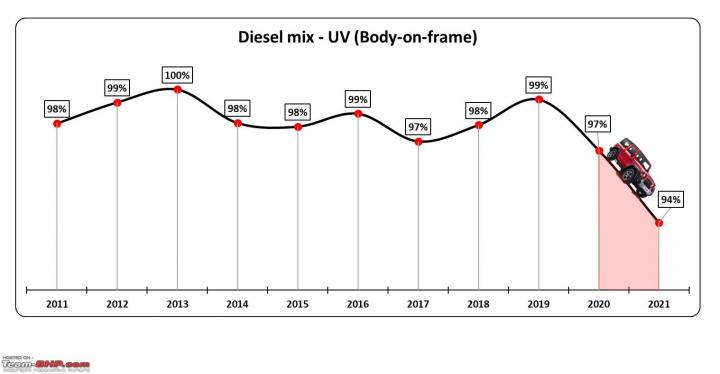

Body-on-frame UV segment – SUV/MUV/Crossover

The purpose of splitting UV on the chassis line makes more sense with the below graph, which is highly skewed in favor of diesel engines. 1-2% petrol mix in the early part of the decade was contributed by Maruti Gypsy. Toyota does have had petrol engine option for Innova, but absolutely nobody was buying one before 2016. In 2016, NGT has imposed a ban on 10-year-old diesel vehicles in the NCR region, and reluctantly diesel mix reached to measly 2-3% in recent years for the segment.

But Mahindra has bucked the trend by introducing petrol Thar with a 2L turbocharged engine and sweetening the deal with an option of a 6-speed automatic transmission. Thar petrol mix was at 35% level in 2021. Here changed value proposition (easy to live with everyday off-roader) of the Thar is the real reason. Now, it appeals to city dwellers with different lifestyle aspirations. Well, in reality, Thar is bought mostly to show off than any real hardcore off-road expedition. But then Mahindra has rightly figured out the very hidden emotional need and had shown the courage to develop and deploy a petrol engine for Thar. Some are trend followers and some just create one with Jeep Wrangler rip-off.

Product Analysis - How the value proposition offered by individual products affects diesel mix

Hyundai-KIA

It is pretty evident that Hyundai’s product portfolio still has diesel dominance. One major reason is Hyundai makes better diesel engines than petrol engines.

Maruti is well known for making refined and highly fuel-efficient small petrol engines, both the terms being relative. Hyundai since the Santro days (1998) could not match the fuel efficiency and refinement level of Maruti’s petrol engines and still couldn’t. Remember how Hyundai brought Eon as Maruti Alto’s killer. Eon was having a much better interior, and feel-good factor for that price, but vibrations of the newly developed 814 cc engine could be felt from the gear lever. How Eon performed? Eon got killed in an attempt to kill Alto. Many complaints that Maruti has always nursed the sentiment or rather an obsession of Indians for ‘Kitna deti hai?’ (what is the fuel efficiency?). Well, better fuel efficiency is a technological accomplishment that others failed to achieve. In the new realm of battery electric vehicles, ‘Kitna deti hai?’ (what is the range?), is even more vocal!

Alcazar: 1.5L diesel engine though has week proposition due to lower power output but compensate with the fuel efficiency, over 2L naturally aspirated engine option. But the overall product performance is subdued.

Tucson: 2L diesel engine with 8AT option is way more competent in the whole segment than a relatively weak 2L naturally aspirated engine with 6AT option.

Creta & Seltos: Price difference between diesel and petrol Creta is low, at ₹96,000 and consistent across variants and offered the right automatic choice for the fully-loaded top-end variant. In comparison, Seltos price difference is higher at ₹110,000 and doesn’t offer automatic transmission on the top-end fully-loaded variant, hence diesel mix of 53% and 45% respectively among them.

Venue & Sonet: Both offer turbo petrol in comparative trim level and hence such low price difference and also the diesel mix on the left side of 50%. Here Sonet trumps with a proper torque convertor automatic transmission option for diesel engine, so is the high mix of 39%, vs 21% of Venue.

Verna: Just like Sonet, Verna is the only product in the segment to offer a proper torque convertor automatic transmission option for diesel engine, hence a higher mix of 36%.

i20: Diesel engine price surcharge in the BS6 era is as high as 19%, thus eroding any long-term gain.

Honda

The diesel engine is more powerful on both WRV and Amaze w.r.t petrol engine and Amaze is also offered with CVT option for diesel engine, thus relatively higher diesel mix. Unlike Amaze, City doesn’t have diesel with automatic transmission option thus limiting its appeal for diesel engine, also, the petrol engine is much more powerful on paper and refined in person.

Mahindra

- Thar petrol mix of 35% is used case in itself, thanks to the overall refinement and availability of convenience offered by automatic option for urban jungle dwellers.

- XUV 300 has a better 4-cylinder diesel engine in comparison to 1st generation of 3-cylinder turbo petrol engine on offer. Petrol XUV 300 is being sold on higher discounts too, over diesel.

- With limited supply, it is too early to conclude anything on XUV 700.

- Can CNG set up on Bolero work?

Tata

The high price surcharge of the diesel engine is a major deterrent in the BS6 era especially fuel price difference is less and seemingly non-supportive. In-house developed Tata petrol engines are no match for Maruti’s engine but then they are getting the job done in the category. More than the engine it’s the overall value proposition and aggressive sales push that is leading to higher sales of Tata vehicles. The way electric powertrain is gaining prominence in current Tata products, discontinuation of 1,500 cc diesel make more sense – both financially and practically.

Toyota

Toyota is offering a poor petrol engine on the major UV product line, both in terms of performance and fuel efficiency. Whereas updated diesel engines of Toyota are way too good on most performance parameters. And nobody could ignore it. NCR is the region that mostly contributes to the petrol mix due to the seemingly unscientific NGT rule. This is unlike the case of Mahindra Thar petrol engine, which has better performance figures than diesel, the only downside is fuel efficiency.

MG

Unlike Tata, MG doesn’t offer automatic transmission for FCA sourced 2L diesel engines on Hector. So, if a potential customer wants to buy automatic Hector - has to settle down for lifeless petrol CVT Hector.

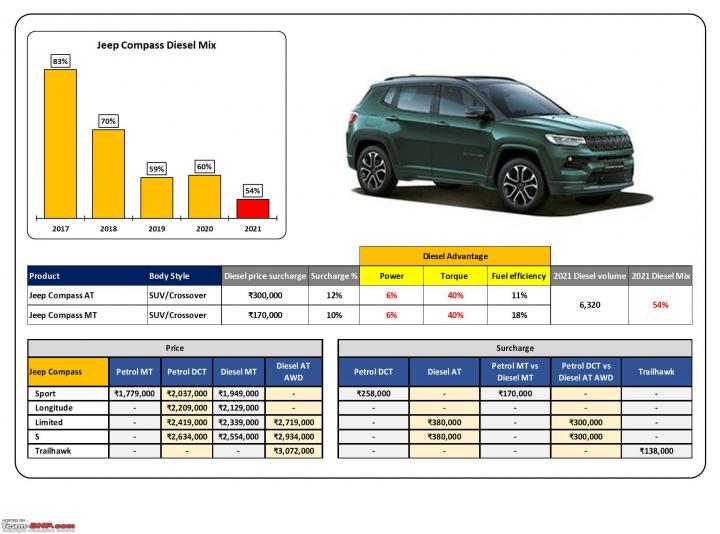

Jeep

Compass price and powertrain option are perplexing. Before 2020 there wasn’t any diesel automatic option, in today’s date diesel automatic is available from a steep price point of ₹27,00,000, that too with AWD option, making it ₹3,00,000 more expensive over petrol automatic. Petrol isn’t much fun to drive nor very fuel-efficient, but diesel pricing makes a case for the petrol engine.

Case study – products that not only survived but thrived with petrol only BS6 compliant engine

Maruti Ertiga

Second generation Ertiga with all new CNG thrust from Maruti has scripted a success story even without a diesel engine. More can be read here.

Skoda Superb 3rd Generation

Superb 3rd generation was launched in 2016, with a 1.8 TSI petrol engine with a choice of manual or automatic transmission and a 2.0 TDI engine with an automatic gearbox, both the engines producing near identical power figures. Diesel mix was low due to steep price premium charged by Skoda to the tune of ₹ 2,50,000, over petrol variant.

Come 2020, facelift Superb was launched with a new BS6 compliant 2.0 TSI petrol engine mated to an all-new wet clutch gearbox known as DQ381, replacing the notorious dry clutch DQ200 gearbox, and the diesel engine was discontinued. In 2021, Skoda further updated its top-end L&K variant with more bells and whistles, and the very year it posted its highest ever sales in 3rd generation product life-cycle. Single drivetrain with updated feature list has achieved new sales heights, which twin-engine strategy could not in the past, that too towards the end of PLC in an already diminishing segment.

What future holds for different diesel engines

This will depend on fuel pricing, the demand for diesel engines over petrol based on the overall value proposition each product holds after any upgrade needed for the BS6 RDE phase.

Hyundai-KIA

- 1186cc (3-cylinder-LNT) – with such low volume it may die even before 2023.

- 1493cc (4-cylinder-LNT) – willingness is sure is, as it became bread and butter engine for SUV/MUV lineup, but what about the cost-effectiveness in coming future? Can it do without SCR in the coming future?

- 1995cc (4-cylinder-SCR) – KIA’s future SUV/MUV lineup is the only hope as Hyundai is not able to sell Tucson in quite large numbers.

- 2199cc (4-cylinder-SCR) – Carnival is a huge car and needs strong diesel to pull and have pocket-friendly fuel efficiency or a strong hybrid like Toyota Vellfire, though the former will only work in KIA’s case.

Mahindra

- 1493cc (3-cylinder-SCR)– Bolero is using this version which is the mainstay of Mahindra in the semi-urban and rural market.

- 1497cc (4-cylinder-LNT)– New Creta rivaling product can make great use of the engine currently available on XUV 300.

- 1497cc (4-cylinder-SCR)– This engine is available on Marazzo only and its future is uncertain.

- 2198cc (4-cylinder-SCR) – that’s the bread and butter engine, so surely will thrive.

Honda

1498cc (4-cylinder-NSC-NOx Storage Catalyst)– new SUV products, if coming, are the only hopes, else Honda has to take a haircut on long term diesel engine investment.

Jeep

1956cc (4-cylinder-SCR) - FCA India is making money by selling engines, and these engines are Euro 6d compliant and software upgrades will sail them through the 2023 milestone. In the future PSA might also have this engine on C5 Aircross for India for cost synergy.

Tata

- 1497cc (4-cylinder-LNT) – volume is low, new Creta rivaling SUV/crossover surely need diesel engine, so Tata need to rethink if BEV/CNG portfolio can replace small diesel completely?

- 1956cc (4-cylinder-SCR) – Tata has been more clever and bought a nice 6-AT gearbox from Hyundai to make value proposition of Harrier and Safari (new) stronger than Jeep’s ZF source 9-AT gearbox.

MG

- 1996cc (4-cylinder-SCR) – Gloster diesel engine has to survive else customers will switch to Toyota Fortuner.

Toyota

- 2393cc (4-cylinder-SCR) – with 3% petrol mix, diesel is the only way, unless there is a competitive petrol engine.

- 2755cc (4-cylinder-SCR) – with 2% petrol mix, diesel is the only way.

Isuzu

- 1898cc (4-cylinder-SCR) – it is either ‘diesel’ way or highway.

Force

- 2596cc (4-cylinder-SCR) – used across commercial vehicle range of Force Motors, has huge backend cost synergy, that’s the reason to have this engine.

Check out BHPian comments for more insights and information.