News

2023-24 Indian car export analysis: Japanese & Koreans contribute 88%

The 4-door Maruti Jimny, a sales disaster in India, is saved by its export potential.

BHPian pqr recently shared this with other enthusiasts.

FY 2023-24 | Indian car export analysis | Japanese & Korean MNCs contribute 88% | Indian MNCs only 2%!

FY 2023-24 Export Highlights

- Industry: 6,71,756 units were exported from India; the growth rate was nearly flat at 1.3%.

- Brand: Maruti Suzuki is the largest exporter, with a 42% share, followed by Hyundai at 24%.

- Body style: Sedan export share is highest at 35%, followed by 30% of hatchbacks.

- Fuel: 98% of cars had a petrol-only engine.

- Product: The Maruti Baleno (Hatchback) was the most exported car, followed by the Hyundai Verna (Sedan).

- Export-only Products: Nissan Sunny (Sedan) and Mahindra KUV 100 (Hatchback) were export-only products from India with no domestic sales.

- MNC: The combined export contribution of Japanese and South Korean MNCs was 88%, whereas the Indian MNCs was mere 2%.

Indian car export industry

Over the last three decades, several foreign car makers, starting with Hyundai and Ford in the late 90s, have established an export-oriented manufacturing base in India as a clever strategy to mitigate the risk emanating from the local demand cycle and make India one of the global hubs of automobile production.

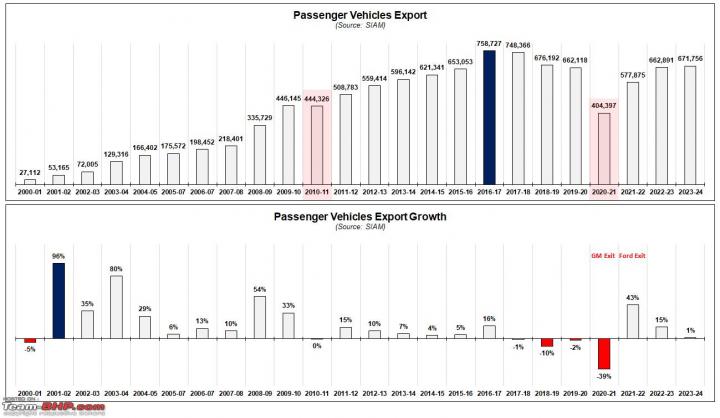

Exports from India touched peak in FY 2016–17, at 7,58,727 units. Since then, there has been a decline in exports. In the last fiscal year (2023–24), exports were near stagnant at 6,71,756 units, with just 1.3% growth over FY 2022–23.

Since the days of the highest exports (FY 2016-17) things have changed dramatically. Two American giants, GM and Ford (30% export market share then), have stopped making cars in India for domestic and export markets. Japanese MNCs gained a stronghold in exports, followed by South Koreans in FY 2023–24. Most exported product has changed from the Ford Ecosport (crossover) then, to the Maruti Baleno (hatchback), now.

What has not changed, though, is the dismal export share of Indian MNCs, namely Mahindra and Tata. Which is constant at ~2%, and volume-wise, has gone down by 651 units in the last seven years!

Exporter MNC’s country of origin

Foreign MNCs with operations across several continents have established India as one of their strong bases. And these MNCs now contribute 98% of the export volume from India. They have invested capital in India and created assets within the country that provide direct and indirect employment to many, besides capital infusion from their suppliers and port operators.

With the exit of Americans (except Jeep), Japanese carmakers took strong control of export volumes. Kia's entry and its strong export volume have taken Korean’s share to 32%. European’s export market share too has dropped in the past due to lower exports by Volkswagen (-42,672 units).

Brand

- Maruti-Suzuki, 55% owned by Suzuki Motors Corporation Japan remains the largest exporter of cars from India, accounting for 42% of the total export volume. It’s an incredible achievement for Maruti to double its export volume in the last 7 years.

- Hyundai’s volume has been consistent for a long time. Kia became the third-largest exporter of cars from India in a very short span of time, thus helping the plant production capacity to reach 95–100% utilization rate in the last fiscal year.

- Volkswagen and Nissan export over 50% of their production to international markets. Followed by Honda, Jeep, and Citroen, with over 30% volume.

- Despite a strong comeback in the Indian domestic market by Tata and Mahindra, their export volume is dismally low, with no progress whatsoever in the last decade. The irony is that within their group, they have software and service exporters like TCS and Tech Mahindra, which add a significant amount to Indian foreign exchange reserves.

Body style

Though in the Indian market, sedans and hatchbacks are dying breeds, there is demand for them in other markets. Thus, both body styles are being made in Indian factories and exported to foreign shores like Mexico, South Africa, etc.

Product: Export sales are higher than domestic sales

- Nissan has discontinued Sunny in India; however, its next generation is still being produced in India and getting exported to Mexico and Brazil.

- Mahindra is still producing diesel and petrol KUV 100, discontinued in India, and exporting them to Sri Lanka and some other markets.

- Hyundai has retained the Verna in the diminishing executive sedan segment of India because it has a substantial market globally, as is the case with the Volkswagen Virtus, Honda City, and Maruti Ciaz, thus making India a hub for global production.

- The 4-door Maruti Jimny, a sales disaster in India, is saved by its export potential.

Well, every market across the world is unique with varying tastes and preferences, which is why if some products have low or no demand in the domestic market, they can still be made for the export market with India as the base.

Product

Maruti Baleno (Hatchback) was the most exported car from India, followed by Hyundai Verna (Sedan) and Maruti Dzire (sub-4m sedan).

Read BHPian comments for more insights and information.

.jpg)