News

Interesting Report on the Indian Used Car Market

Click here to read the full report.

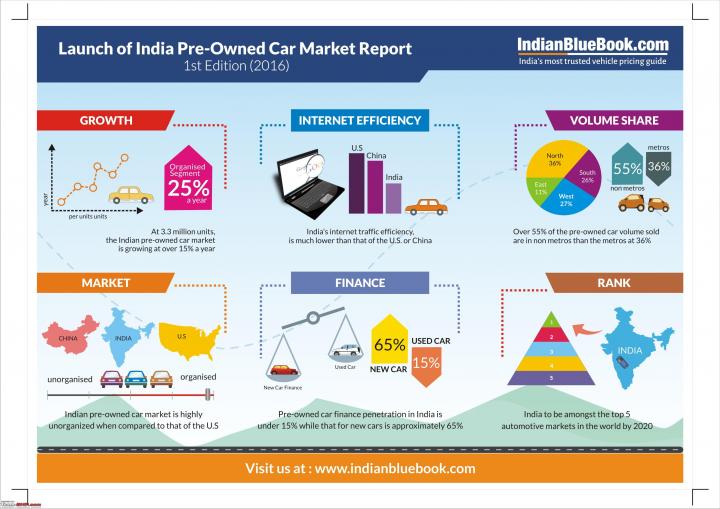

- Scale: Market has reached critical mass, shows significant potential

- India is expected to be amongst the top 5 automotive markets in the world by 2020.

- At 3.3 million units, the pre-owned car market is growing at over 15% a year (organized segment is growing at over 25% a year).

- Just under half (45%) of all pre-owned cars sold are in Metros. Non-metros account for over half (55%) the pre-owned car volume sold and are growing faster than the metros.

- The North leads the pre-owned car market in India. At 36% it represents the largest geography, followed by the West (27%), South (26%) and East (11%).

- The North and West regions exhibit more organized channels than in the South. The East, while more organized, is a significantly smaller market and also highly concentrated in a few areas.

- Structure: Largely unorganized retail & wholesale

- The market is supply-constrained, with inventory turns at dealers under 30 days vs. traditionally 60+ days in the U.S.

- Pre-owned car channels are highly fragmented with four primary market segments:

Organized: 12% market share. Average Volume at 16 per month

Semi-organized: 35% market share. Average Volume at 9 per month

Consumer to Consumer: 34% market share

Unorganized: 19% market share. Average Volume at <3 per month

- The unorganized sector is highly fragmented. It accounts for the bulk of the dealer population (58%) and only 19% of the total volume.

- Stage: Developed in some ways, nascent in many

- India’s motorization rate lies at 22 cars/1000 people. US is over 800 cars/1000 people with a car parc that is 10X that of India.

- Like that of the U.S., the pre-owned car market in India is larger than its new car market (1.2X). China’s pre-owned car market, though larger in volume compared to that of India’s, is less evolved at 0.5X that of its new car market.

- Scale and price point are major drivers – dealer productivity and gross margins make India a relatively shallow market (dealer economics).

- Indian pre-owned car market is highly unorganized, when compared to the U.S., but more organized than that of China.

- There is significant headroom for pre-owned car financing, with growth expected in the coming years – Pre-owned car finance penetration in India is under 15%, while that for new cars is approximately 65%.

- Finance penetration is significantly higher within the organized channel (40% across the metros and non-metros), while the semi-/unorganized channel is highly fragmented with higher channel costs for lenders.

- There are over 6,000 approved NBFCs in local markets that are funding pre-owned vehicles in India.

- Customer profile and buying behavior

- 50% of buyers are in the 25-34 years age segment.

- Average age of a pre-owned car at the time of sale is 4 years with average ticket size at INR 3-4 lakhs.

- For more than half (55%), a pre-owned car is the first in the family.

- Affordability, followed by value for money are primary reasons why customers consider pre-owned cars. The buyer looks for a trusted source and quality product to complete his pre-owned car transaction.

- Tags:

- Indian

- Sales & Analysis

- Used Cars

.jpg)