News

Sales & performance of foreign car companies in India in 2022

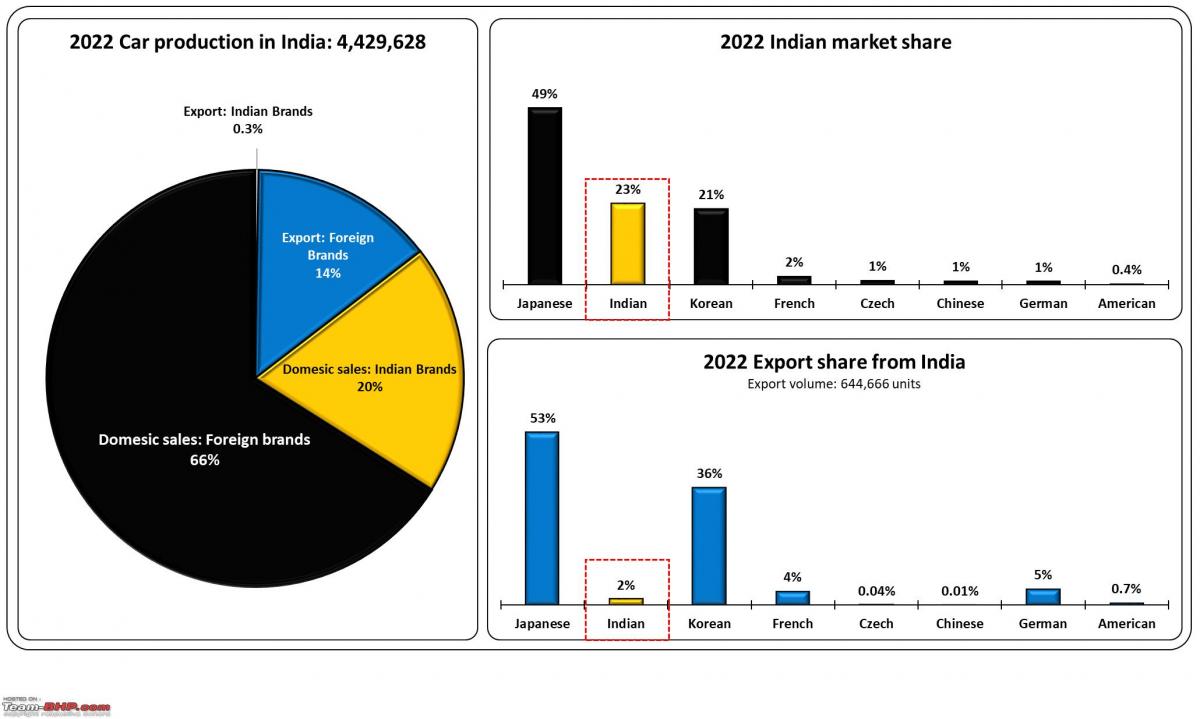

Foreign brands contribute to nearly 80% of the production of cars in India, thus creating assets in India through FDI or local investment.

BHPian pqr recently shared this with other enthusiasts.

2022 Analysis : Foreign car brands in India

In 2022, Indian car production reached its highest level of 44,29,628 units. 66% of those cars were sold by foreign brands in India and 20% by Indian brands.

14.6% of the total cars produced in India were exported across the globe. Despite three decades of presence in passenger vehicle manufacturing in India, the contribution of Indian brands to exports is a mere 1.9%. Japanese car brands contribute 53% of exports, followed by 36% of South Korean brands.

Foreign brands contribute to nearly 80% of the production of cars in India, thus creating assets in India through FDI or local investment that in turn generates direct and indirect employment for millions and also helps India earn foreign exchange through exports.

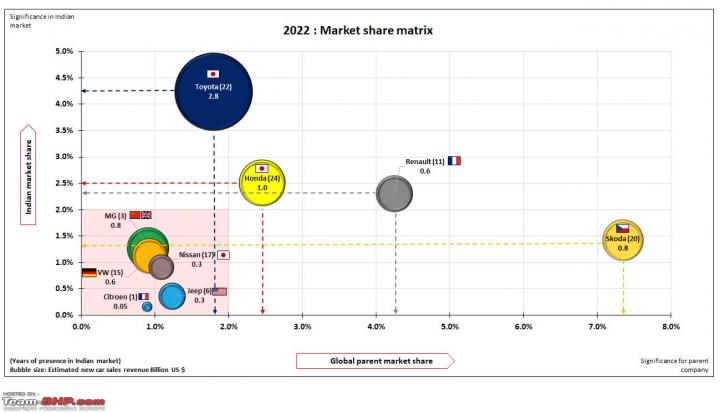

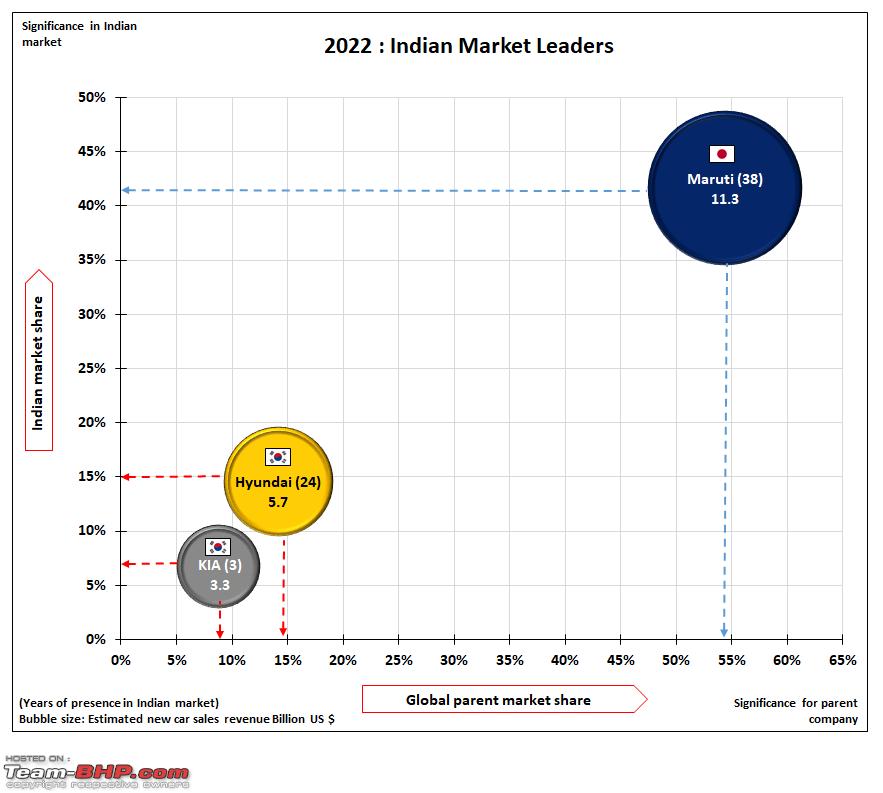

How important is an Indian subsidiary for foreign brands?

This raises the question of how significant these subsidiaries were to the parent company's portfolio. The size of their local market, their contribution to global sales, and the revenue they generate are all important. As in mass production, volume and market share are also key drivers of profitability.

What we also need to keep in mind is that the past or present is not the future. Every brand can still succeed if they focus on products with attributes that the Indian consumer values at the right price.

Here, brands can be broadly divided into two categories, as the top three brands skew the entire data set.

Category I: The Leaders

Together, the trio controls 63% of the Indian passenger vehicle market. Maruti, a subsidiary of Suzuki Motors Japan, has been present in the country for nearly four decades; Hyundai too has completed two and a half decades in India; and Kia is the new entrant with only three years of presence. The combined market share of Hyundai and Kia is half that of Maruti; however, their estimated revenue from new car sales is 80% of that of Maruti, as both have been quite entrenched in the fast-growing mid-size SUV segment in India.

Maruti-Suzuki

(Suzuki Motor Corporation, Japan, owns a 56% stake in Maruti Suzuki India Ltd. as a promoter.)

Maruti-Suzuki India is a very important subsidiary for Suzuki, as it contribute 54.4% of sales in 2022. Suzuki's biggest concern is that Maruti has lost nearly 10% of its Indian market share since its peak in 2018.

The reason for this is that Maruti's mainstay markets of hatchbacks and sedans were jolted in 2022 by shifting demand towards crossovers and SUVs. Maruti failed to address the changing trend of the Indian market in a timely manner by bringing in the appropriate SUV products for the Indian market ahead of competitors. The non-availability of diesel engines was partially substituted by CNG, which supported volume to a greater extent.

So, Maruti is working tirelessly now to bring the right set of SUV products to the Indian market.

Hyundai-Kia

(South Korean automaker Hyundai Motor Company owns 34% of Kia.)

In 2022, Hyundai India posted its highest-ever sales; however, they were marginally higher than 2018 figures, and market share was down by 2% from its latest peak.

Hyundai India controls 15% of the Indian market and also contributes 15% to the parent company. Thus being vital for Hyundai in the global scheme of things. Since Hyundai started its journey with an entry-level hatchback, it has always found it hard to sell premium products in India.

To address this challenge, Hyundai brought in the Kia brand from its global portfolio in 2019. Kia started its Indian journey with a mid-sized SUV and thus doesn’t face a premium brand image challenge. Kia did its homework so well that every product it introduced to the local market (except CKD Carnival) was a smash hit, and it hasn't had to offer any discounts in the last few years. Thus, Kia captured 7% of the Indian market share and contributed 9% to its parent company's portfolio in a very short period of time. As a result, Kia India will be very important for Kia, as it also sells relatively high-revenue earning products in India.

Together, both brands now command 21% of the Indian market, thus addressing Hyundai India’s long-standing stagnant market share challenge.

Together, they have timely shifted attention to the fast-growing SUV segment, thus having the right portfolio mix to address Indian consumers' needs and wants.

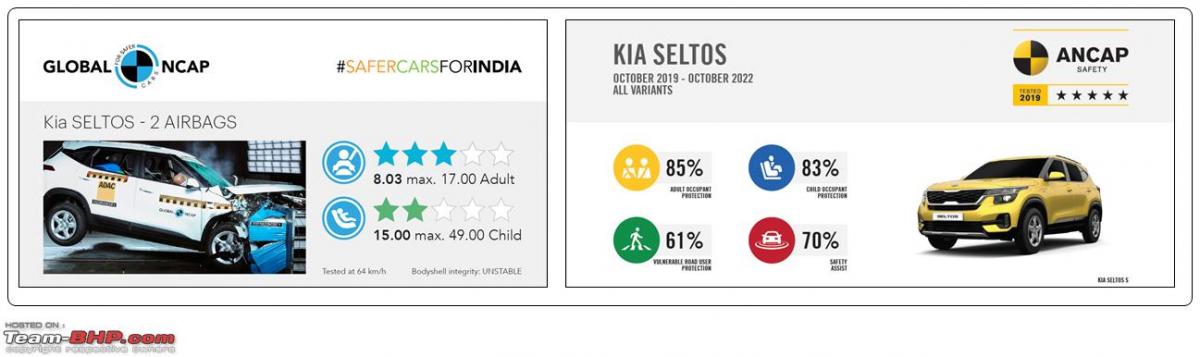

Because Indian consumers are not very safety conscious, so both brands have never produced vehicles with high crash test ratings for the country. Though they can (Kia Seltos ANCAP 5 star rating), they don’t (Kia Seltos nearly 3-star GNCAP rating), for the greed of profit!

Category II

This category includes brands with a less than 5% market share in India in 2022. Toyota, Honda, and Skoda spent nearly two decades in India and successfully sold their premium car lines for a good decade. Volkswagen, Nissan, and Renault entered India in the next phase, spent over a decade here, and are still struggling to gain meaningful market share. Last but not least, it's Jeep, MG, and Citroen, which are still young in the Indian market.

Honda & Toyota

(Country of origin: Japan)

Both Japanese brands started their Indian journey with mid-sized products followed by premium products, thus achieving premium brand imagery in India. To gain volume in the Indian mass market, they both ventured into the entry hatchback (Honda Brio & Toyota Etios Liva) and entry sedan (Honda Amaze & Toyota Etios) segments by the turn of the decade. Incidentally, hatchback products didn’t work for both.

Come 2022, Honda is selling nearly half of what it sold at its peak in 2015, and Toyota is selling nearly 50% of re-badged Maruti products, thus closing the gap in sales in 2022. Both brands' contribution to the global parent is currently close to 2%. Toyota still has the solace of selling high-value products from its own portfolio (Innova and Fortuner), thus the opportunity for higher revenue.

Incidentally, both have been trying to make strong hybrid technology go mainstream in mid-sized cars. The upcoming SUV is the last chance for Honda to revive its fortune in India, and Toyota is relying on its partnership with Suzuki for the Indian market's growth.

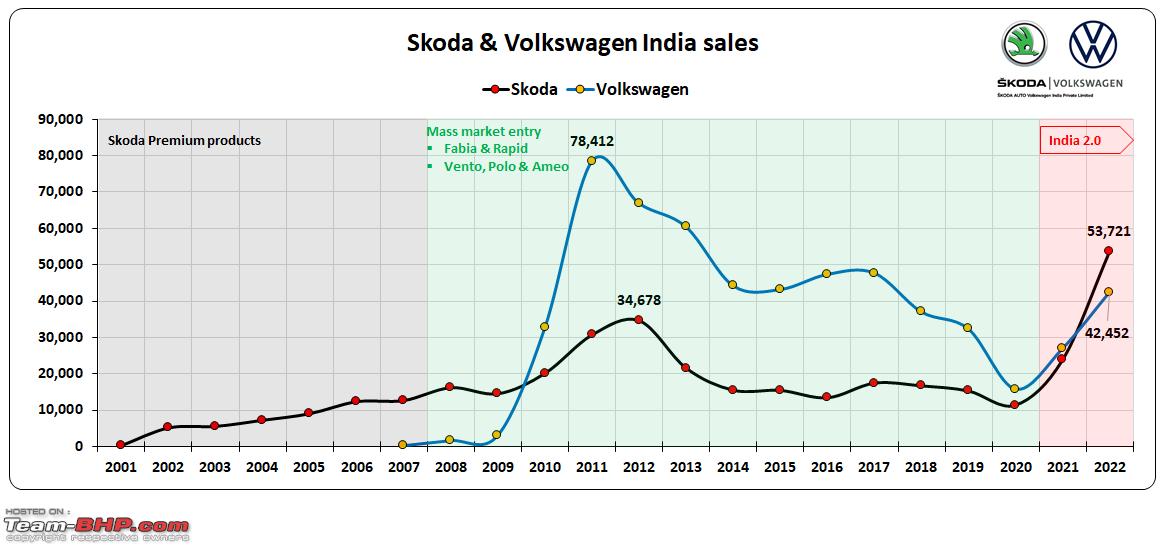

Skoda & Volkswagen

(Skoda Auto a.s. Czech is wholly owned by Volkswagen AG Germany's holding company.)

In 2022, Skoda India posted its highest-ever sales in India. Thus, relevance has increased for the global parent at 7.2% share, more so as Skoda globally crashed out of its biggest market, China, which used to contribute 30% of sales.

Volkswagen India's share of the Indian market and contribution to the parent company were close to 1% in 2022. In 2018, Volkswagen has already handed over its product development lead to sister brand Skoda in India under the India 2.0 program, which seems to be creating distance from the Indian market.

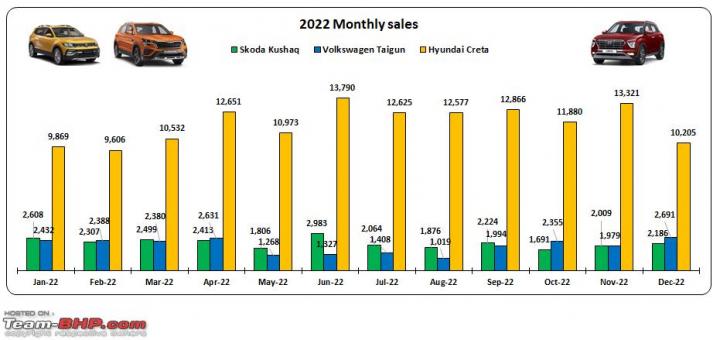

The first product, Kushaq from 2.0 program, was available at a ₹ 1.2 lakh discount near the end of the year, indicating that the price is not in line with Indian customers' expectations and that the future will be more difficult. In 2022, Volkswagen's product portfolio was reduced to just three products (Taigun, Virtus, & Tiguan). Taigun was also struggling throughout the year, and year-end discounts were in ₹ 1 lakh range.

Skoda and Volkswagen have both announced the launch of their second product (Slavia & Virtus) under their 2.0 project in 2022 to compete with segment leader Honda City. Honda maintained its lead in 2022, with the 4th and 5th generations on sale concurrently, but Honda was offering discounts all year, as City was in its third year of PLC. Things could change when City is reduced to only the fifth generation in 2023.

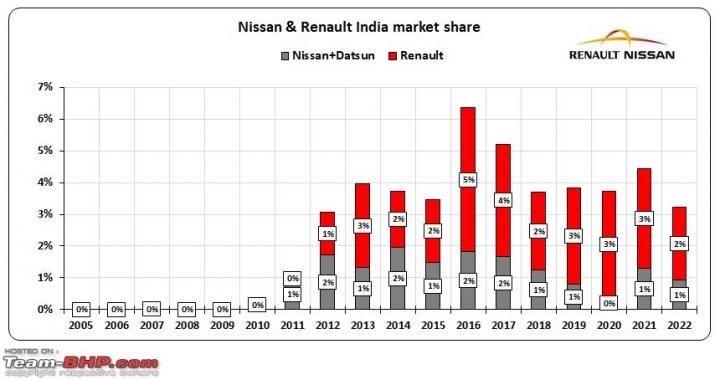

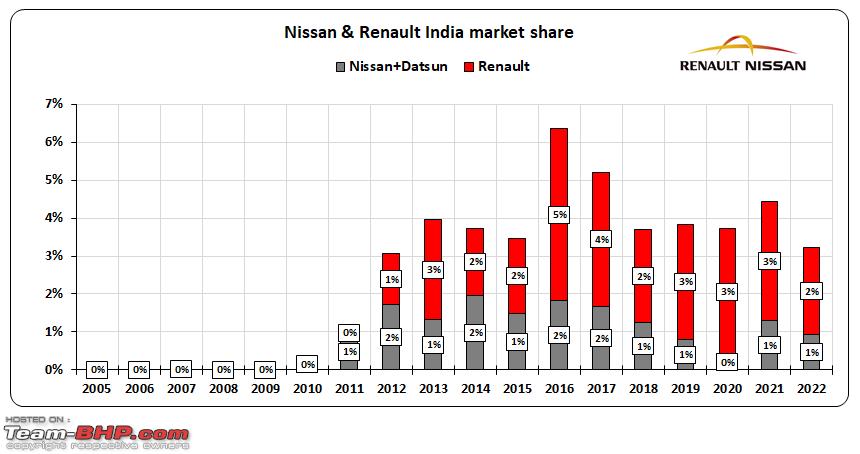

Renault & Nissan

(Renault SA France holds a 43% stake in Nissan Motor Co Ltd, Japan, the latter owns a 15% stake in the former)

Renault India has contributed 4% of global Renault sales. However, in India, its market share has reduced to 2% from a peak of 5% in 2016. This is worrisome for the parent company as it is reduced to just three products in India, all of which are in the budget category, selling at a discount in 2022. As a result, it has low revenue earning potential and "budget brand" label may limit its future ability to sell high-priced products in the Indian market.

Nissan India's share of the Indian market and contribution to the parent company were close to 1% in 2022. The revenue earned per car sale was also low, and on top of that, Nissan has just one product to sell in India. The right product (Magnite) at the right price brought Nissan back from its deathbed in 2021, so product portfolio expansion will only help its cause in the future. In 2022, Nissan India has discontinued its low-cost brand Datsun.

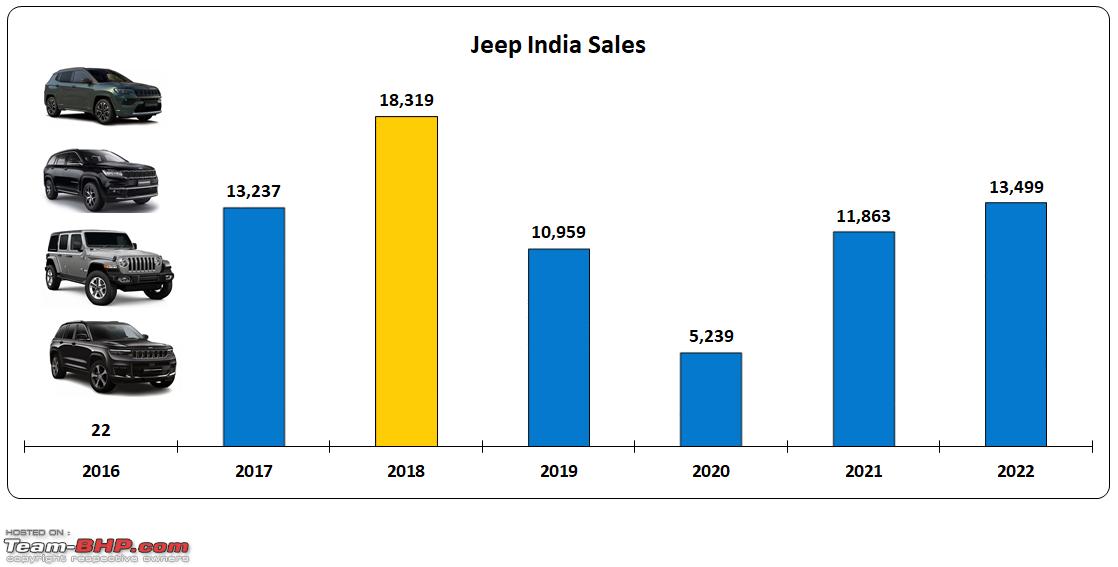

Jeep

(The American brand is part of the Stellantis N.V. group.)

In 2022, Jeep demonstrated a stronger commitment to the Indian market by launching locally manufactured Meridian as well as CKD assembly of the flagship Grand Cherokee in India. Jeep's share in the Indian market is below 0.5%, and its global contribution is nearly 1%. However, revenue earning potential per car is higher as Jeep is selling high-priced products in India.

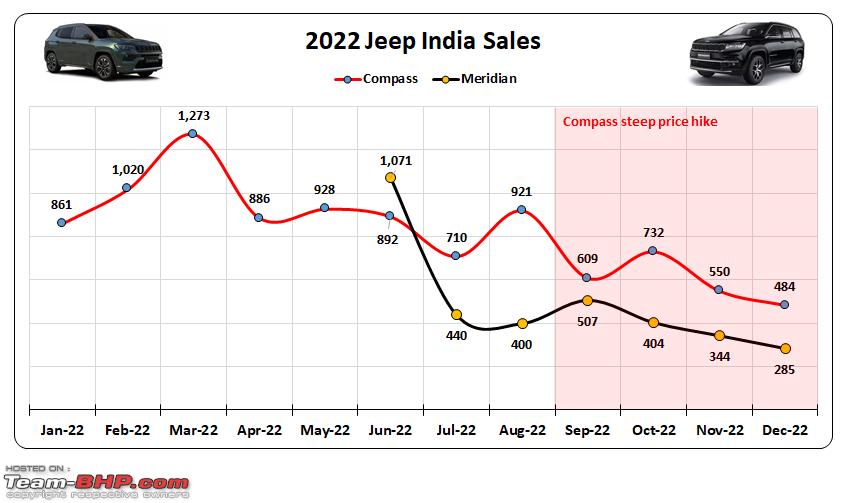

Meridian was the biggest launch for Jeep in 2022. However, within 4 months, it was available at ₹ 2 lakh discount, and towards the end of the year, it reached the ₹ 3 lakh range. Jeep India basically got three things wrong: first, it had the same power output as the Compass; second, the rear seat lacked a sliding function and width is also limited; and third, there was a significant price premium over the Compass that Indian consumers didn't like. Essentially, target customers thought of it as an extended Compass. A high price is offset by a discount, but volume remains limited to 400 units.

Jeep needs to sell close to 1,000 Meridian and 1,800 Compass a month to make forecasted profits. However, the steep price hike on Compass in September 2022 led to a drop in sales and a commensurate increase in discounts. In short, both the volume products failed to meet expectations in terms of pricing, thus having a bleak future ahead.

Citroen

(The French brand is part of the Stellantis N.V. group.)

Citroen's first mass-market product is the C3 hatchback. C3 is mechanically well sorted but is lacking in features. In the Indian market, the latter is a needle mover for customers, and the former isn’t much. The product's reception has been lukewarm, and by the end of 2022, a brand new product was selling at a ₹ 30,000 discount.

Citroen is either misreading the Indian market or simply following in the footsteps of its compatriot Renault's budget-friendly products. Citroen definitely does not have the right set of ingredients to succeed in the Indian market as of now, but the future may be different.

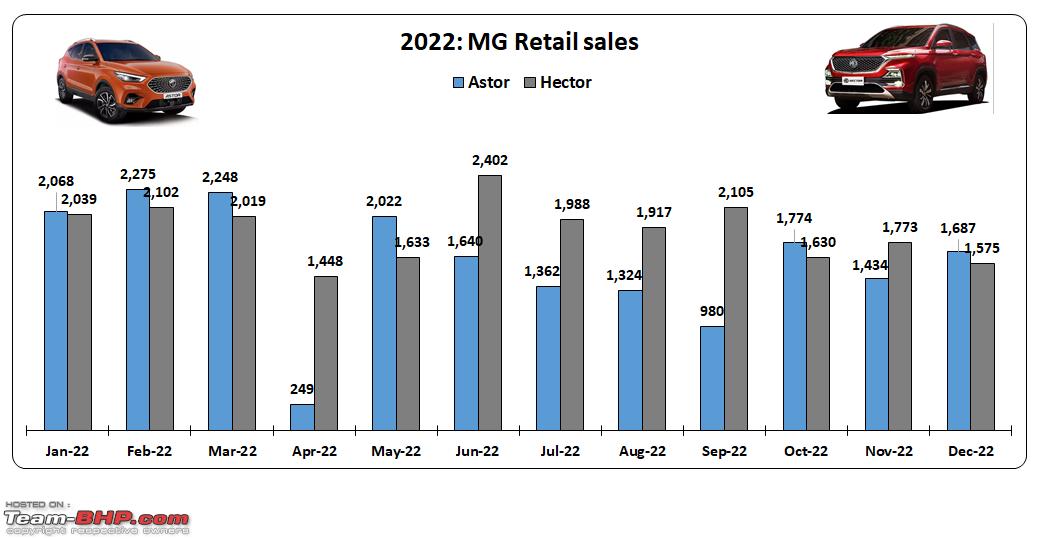

MG

(The British brand is part of SAIC Motor, China.)

MG India’s contribution to the global giant was nearly 1%; however, its revenue per car was higher in India due to high-priced products that sold in decent numbers. Astor, launched in late 2021, didn’t perform too well; its volume was even lower than that of old Hector, which was waiting for a facelift in 2022.

Though Kia and MG started their Indian journeys in 2019, Kia, due to its higher focus on product development for the Indian market, has taken a strong lead over MG.

Check out BHPian comments for more insights and information.

- Tags:

- Indian

- Member Content

- Yearly sales