| | #6631 |

| BHPian Join Date: Mar 2008 Location: Bangalore

Posts: 48

Thanked: 67 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| |

| | #6632 |

| BHPian Join Date: Jul 2021 Location: Mumbai

Posts: 188

Thanked: 324 Times

| |

| |  (5)

Thanks (5)

Thanks

|

| | #6633 |

| Senior - BHPian Join Date: May 2006 Location: Bangalore

Posts: 1,248

Thanked: 2,875 Times

| |

| |

| | #6634 |

| BHPian Join Date: Dec 2016 Location: BANGALORE

Posts: 302

Thanked: 1,327 Times

| |

| |

| | #6635 |

| Senior - BHPian | |

| |

| | #6636 |

| BHPian | |

| |  (1)

Thanks (1)

Thanks

|

| | #6637 |

| Distinguished - BHPian  | |

| |  (1)

Thanks (1)

Thanks

|

| | #6638 |

| BHPian Join Date: May 2023 Location: Mumbai

Posts: 113

Thanked: 417 Times

| |

| |

| | #6639 |

| BHPian Join Date: Mar 2008 Location: Bangalore

Posts: 48

Thanked: 67 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| | #6640 |

| BHPian Join Date: Oct 2018 Location: Various

Posts: 107

Thanked: 372 Times

| |

| |

| | #6641 |

| Team-BHP Support  Join Date: Sep 2010 Location: All over!

Posts: 8,176

Thanked: 20,583 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| |

| | #6642 |

| BHPian Join Date: Dec 2018 Location: Kolkata

Posts: 33

Thanked: 31 Times

| |

| |

| | #6643 |

| BHPian Join Date: Dec 2016 Location: UP-14/15, TS-09

Posts: 543

Thanked: 1,528 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #6644 |

| BHPian Join Date: Feb 2022 Location: Chennai

Posts: 652

Thanked: 3,229 Times

| |

| |

| | #6645 |

| Senior - BHPian | |

| |  (2)

Thanks (2)

Thanks

|

|

Most Viewed

.

.

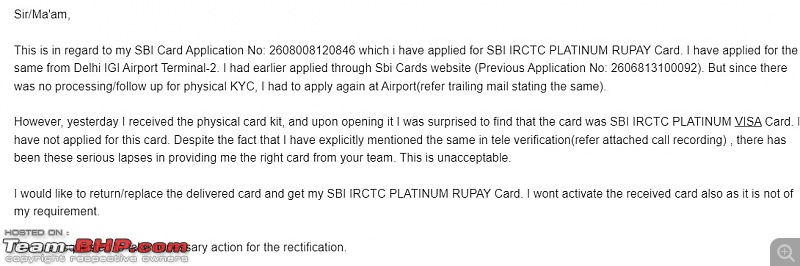

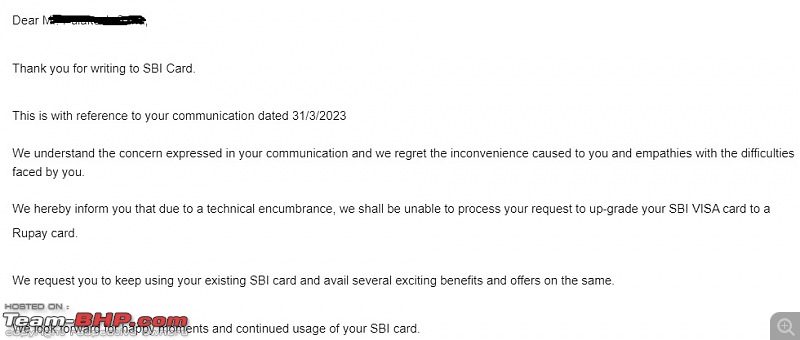

!!! I guess these guys will do anything to meet monthly/quarterly targets.

!!! I guess these guys will do anything to meet monthly/quarterly targets.