| | #751 |

| BHPian Join Date: Jun 2011 Location: Gurgaon

Posts: 149

Thanked: 64 Times

| |

| |

| |

| | #752 |

| Senior - BHPian | |

| |

| | #753 |

| Senior - BHPian Join Date: Dec 2007 Location: Gurugram

Posts: 7,971

Thanked: 4,799 Times

| |

| |

| | #754 |

| Senior - BHPian Join Date: Sep 2014 Location: Chennai

Posts: 5,025

Thanked: 9,247 Times

| |

| |

| | #755 |

| Senior - BHPian Join Date: Jan 2008 Location: Bombay

Posts: 1,480

Thanked: 1,094 Times

| |

| |

| | #756 |

| Senior - BHPian Join Date: Mar 2010 Location: Oslo

Posts: 1,816

Thanked: 417 Times

| |

| |

| | #757 |

| Senior - BHPian Join Date: Dec 2008 Location: Bangalore

Posts: 3,690

Thanked: 5,743 Times

| |

| |

| | #758 |

| Senior - BHPian Join Date: Jan 2008 Location: Bombay

Posts: 1,480

Thanked: 1,094 Times

| |

| |

| | #759 |

| Senior - BHPian Join Date: Mar 2010 Location: Oslo

Posts: 1,816

Thanked: 417 Times

| |

| |

| | #760 |

| Senior - BHPian Join Date: Dec 2008 Location: Bangalore

Posts: 3,690

Thanked: 5,743 Times

| |

| |

| | #761 |

|

Posts: n/a

| |

| |

| | #762 |

| Senior - BHPian Join Date: Jul 2007 Location: Gurgaon

Posts: 5,974

Thanked: 4,663 Times

| |

| |

| | #763 |

| Distinguished - BHPian  | |

| |

| | #764 |

|

Posts: n/a

| |

| | #765 |

| BHPian Join Date: Aug 2007 Location: Paradise (wish it was)

Posts: 449

Thanked: 365 Times

| |

| |

|

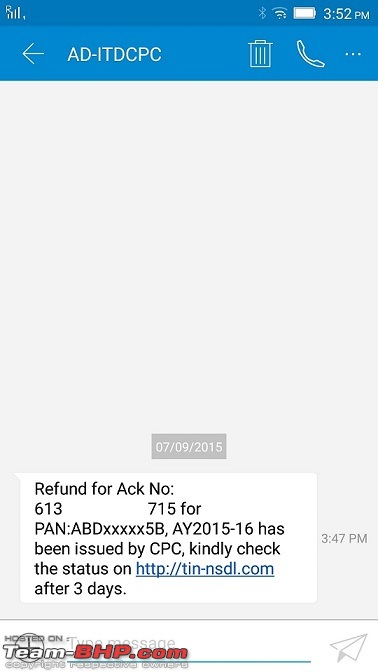

This time, they have credited more than what I had asked for. Earlier, I received the detailed assessment order too. Fantastic job.

This time, they have credited more than what I had asked for. Earlier, I received the detailed assessment order too. Fantastic job.