| | #586 |

| Senior - BHPian Join Date: May 2008 Location: Bangalore

Posts: 1,359

Thanked: 875 Times

| |

| |

| |

| | #587 |

| BHPian Join Date: Jul 2006 Location: hyderabad

Posts: 54

Thanked: 27 Times

| |

| |

| | #588 |

| Senior - BHPian Join Date: Sep 2014 Location: Chennai

Posts: 5,025

Thanked: 9,247 Times

| |

| |

| | #589 |

| BHPian Join Date: Jul 2006 Location: hyderabad

Posts: 54

Thanked: 27 Times

| |

| |

| | #590 |

| BHPian Join Date: Aug 2013 Location: Chennai and AR

Posts: 340

Thanked: 210 Times

| |

| |

| | #591 |

| BHPian Join Date: Jul 2006 Location: hyderabad

Posts: 54

Thanked: 27 Times

| |

| |

| | #592 |

| Senior - BHPian Join Date: Sep 2014 Location: Chennai

Posts: 5,025

Thanked: 9,247 Times

| |

| |

| | #593 |

| BHPian Join Date: Aug 2009 Location: Bangalore

Posts: 169

Thanked: 797 Times

| |

| |

| | #594 |

| Senior - BHPian Join Date: Sep 2014 Location: Chennai

Posts: 5,025

Thanked: 9,247 Times

| |

| |

| | #595 |

| BHPian Join Date: Aug 2009 Location: Bangalore

Posts: 169

Thanked: 797 Times

| |

| |

| | #596 |

| Senior - BHPian Join Date: Sep 2014 Location: Chennai

Posts: 5,025

Thanked: 9,247 Times

| |

| |

| |

| | #597 |

| BHPian | |

| |

| | #598 |

| Senior - BHPian Join Date: Sep 2014 Location: Chennai

Posts: 5,025

Thanked: 9,247 Times

| |

| |

| | #599 |

| Senior - BHPian | |

| |

| | #600 |

| Senior - BHPian Join Date: Sep 2014 Location: Chennai

Posts: 5,025

Thanked: 9,247 Times

| |

| |

|

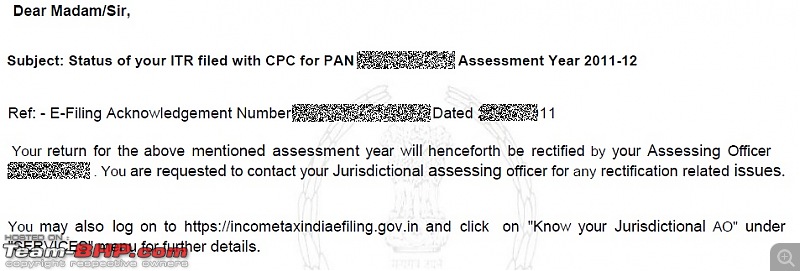

There is no "Know your Jurisdictional AO" menu in incometax website.

There is no "Know your Jurisdictional AO" menu in incometax website.