Quote:

Originally Posted by benz220  I am thinking of importing a set of 17 inch AMG wheels for my W124. Can anyone help with customs duty etc and possible problems of doing this? I am happy to pay the duty. |

I'm no expert when it comes to this, but sharing a few points:

1) Ensure the buyer's name mentioned in the mailing address & invoice matches your ID proof (eg. Aadhaar) !!EXACTLY!!. As for a corresponding address, it's easiest to ship to your Aadhaar address. If you need the package to be delivered elsewhere, other paperwork (lease agreement, electricity bill, etc) will be required in your name @ that desired address. If your name isn't on those documents, you might be able to get by with a NOC from the person whos name is mentioned. However, overall it's just easiest to ship to the address mentioned on your Aadhaar card.

2) Ensure the bill says "Invoice" or "Tax Invoice" and not Proforma Invoice

3) HSN Code must be mentioned on the invoice clearly & accurately. It is going to be the largest determinant of the Custom Duty you will be paying.

4) You can cross-check expected customs duty on import/export sites

like this, or better yet, use the

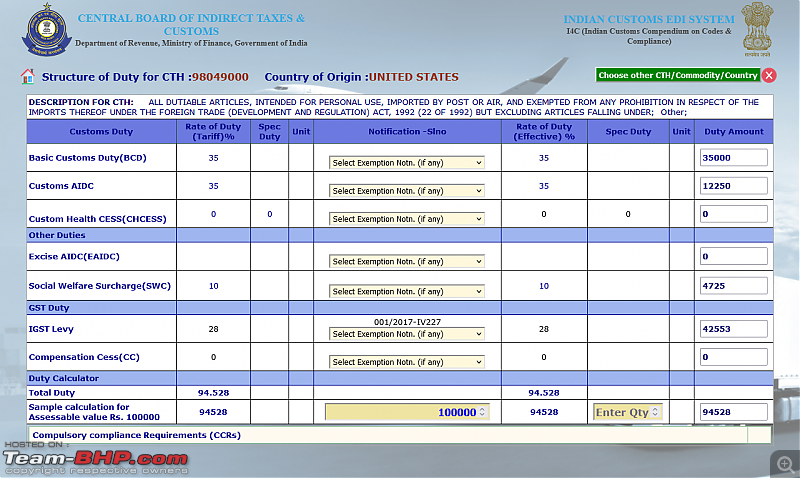

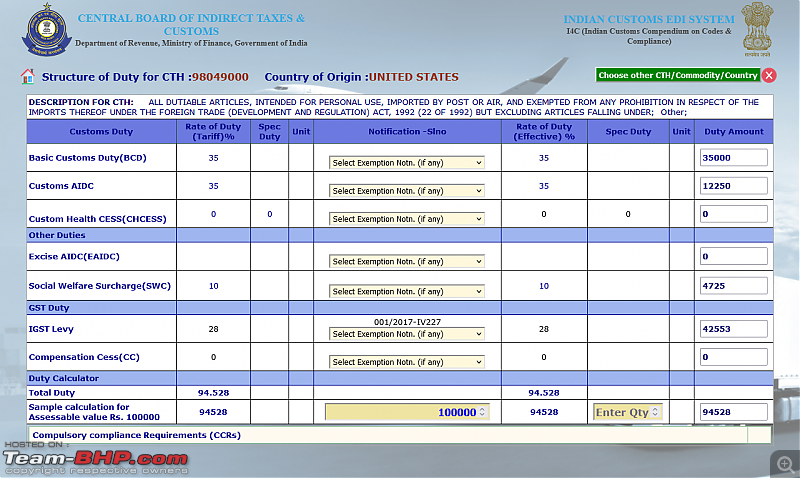

official ICEGATE website which gives you a very clear & accurate break-up:

(If you struggle to get to this page, step-by-step instructions are in post #9 below)

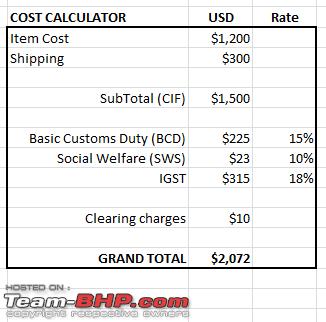

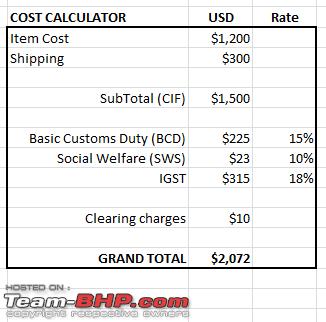

5) But it's not as simple as the Customs Duty you see above. The break-up and final amount will usually catch you by surprise. Points to note:

• Customs Duty will be calculated on the cost of goods + shipping

• There will be a Social Welfare Charge (SWS) which is usually 10% of the Basic Customs Duty (so ~1% overall)

• Countervailing duty (CVD) might apply (am not sure about this, but just mentioning)

• IGST (usually 12-18%) will apply on the total cost so far. Can be 28% for "jewelry" etc

Sharing the ROUGH Excel file for what it's worth: ROUGH Customs Calculator.xlsx

6) Do you have a personal GSTIN? If yes, you could mention it. (I'm not sure of the implications). Either way, you must at least share your PAN with the shipper, and they will need to mention it to the courier company / documentation.

7) If you're going to be importing as a business, there are some additional requirements. (eg. "AD Code" from bank)

8) Make sure you have the right shipping terms (INCOTERMS) mentioned by the supplier. Usually you want "DAP" (Delivery At Place). "DDP" (Delivery Duty Paid) sounds good, but I've heard it can be scammy at times. Check youtube for more info.

Source

Source

9) Usually if you use a reputed company like FedEx or DHL, they take care of EVERYTHING and deliver at your doorstep ("DAP"). They will send you a payment link for the customs charges, and you pay online, after which they deliver the item to you. FedEx typically has some "handling/processing" charges ~Rs. 500-800 from what I've seen. Don't hesitate to negotiate with the seller for a better FedEx/DHL price if it sounds too high (sometimes there's a priority & economy option they can choose between). In your case, the wheels are heavy AND big, so shipping is probably going to bite!

10) The shipper/clearer will send you some sort of break-up/invoice when asking for payment. This is usually decent, but doesn't have ALL the details. If you want all the details you could ask for the BOE (Bill of Entry) which will have things like HSN used, exact duty break-up, etc etc.

11) I'll say it again, if the customer name on the package do not match your Aadhaar (or whatever ID) exactly, then you're just asking for trouble.

12) Good shipping can be surprisingly fast. I've received stuff in 2-4 days from overseas.

13) Manage your expectations. And mentally prepare to pay a higher amount

. That way you wont be taken by surprise, and you'll be happy in the end no matter what you get charged.

(17)

Thanks

(17)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

. That way you wont be taken by surprise, and you'll be happy in the end no matter what you get charged.

. That way you wont be taken by surprise, and you'll be happy in the end no matter what you get charged.