Case 3 -I have share certificate of my dead parent who died a long time ago but my surviving parent is a joint holder

We had the share certificate. The first thing we tried was to demat along with the KYC details and SH13 form but it came back rejected as the shareholder details did not exist on record. It took a while to realise this as the Demat Account Provider never informed us and kept rejected certificate in a drawer.

Why?

As the dividends remained unclaimed, the monies and the shares reverted to the the IEPF (Investor Education and Protection Fund) and there is a process to claim this. We needed to contact the Ministry of Corporate Affairs. A messy, complex process you would think, not really! There are process issues to work around. This article will tell you how in detail:

Disclaimer. - Workflows change and are all over the place so I might not be accurate

The main issues were in the registration

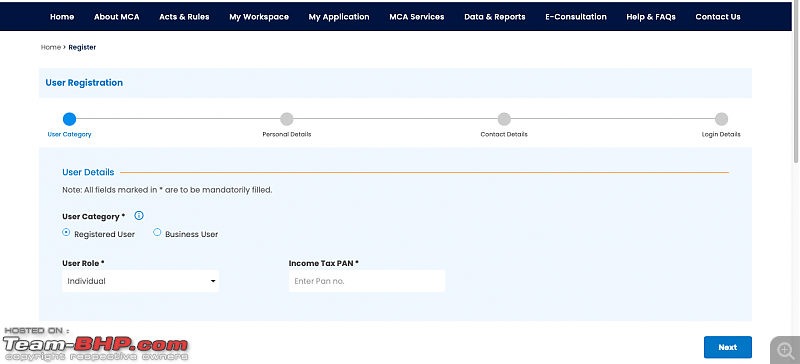

Go to mca.gov.in

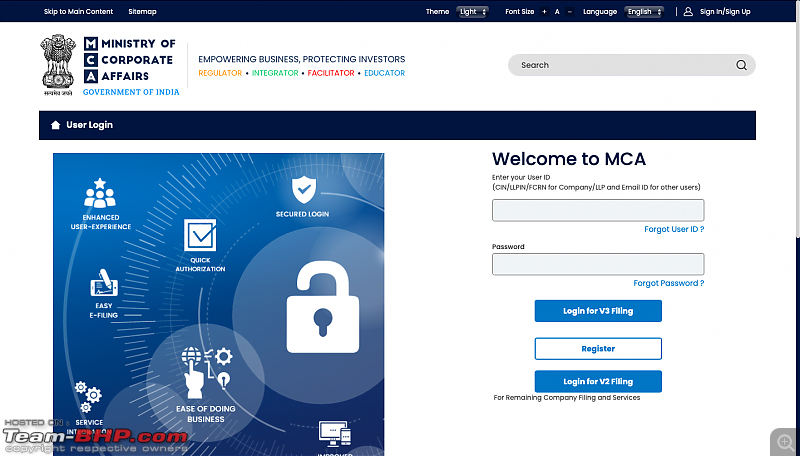

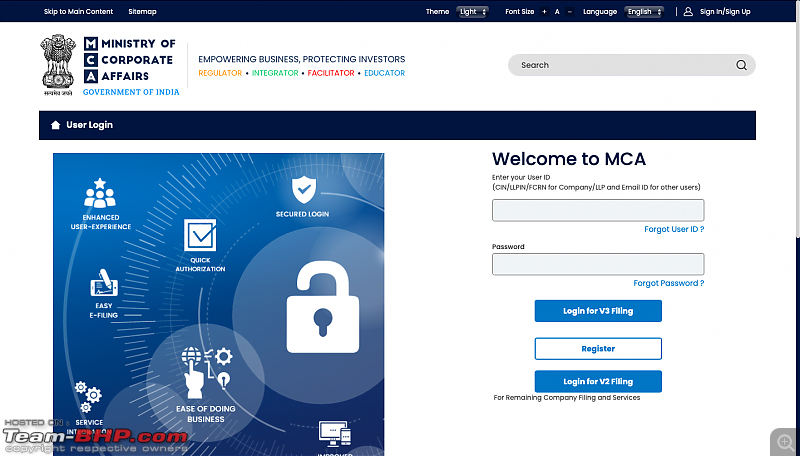

At the top right hand corner end, click on Sign in /Sign Up to get the following console

Click "Register"

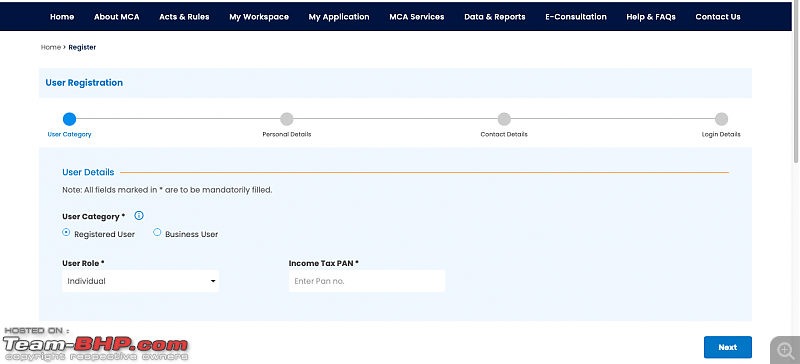

Complete claimant details - name and contact details, make sure it matches with the your Aadhaar/pan addresses

You get an acknowledgment. I was not getting anything. I cleared my cache and cookies and it started working. The next stage is to initiate the claim process on the IEPF website.

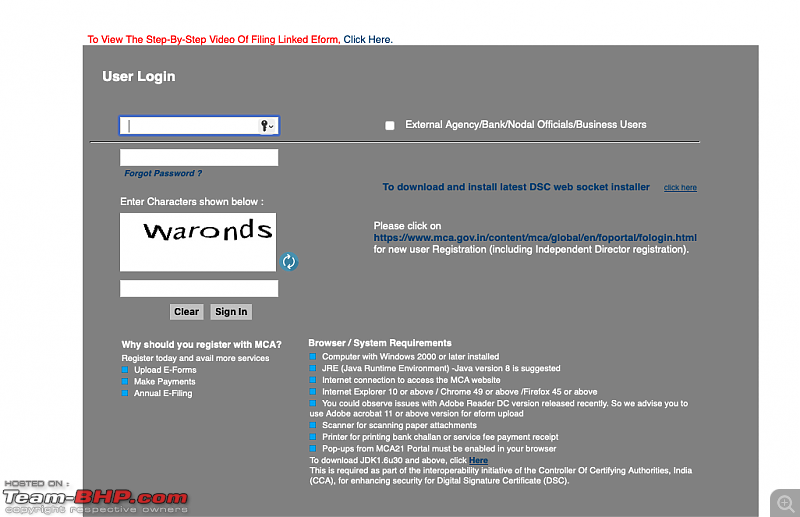

Login to the MCA website with your new credentials (the user ID is your email address) and select option for VF2 Filing

Select -MCA Services - IEPF-5

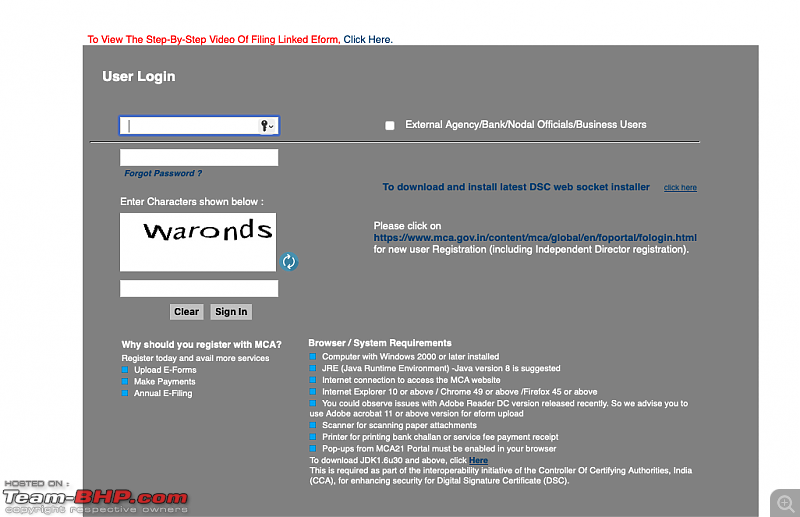

You come to another login console (we will come to that in a min!)

And then you get well and truly stuck as it needs to have a 10 digit user id when your email address is much longer. At this point, I would have given up but the amount was too much to lose.

All was not lost, merely log a ticket on MCA portal and provide your PAN number and they will change the user ID to your PAN number. Believe me when I say that the MCA are responsive. One ticket that I had not responded to, they actually called me!

UPDATE: I did a dummy run today with my details. The same issue happened but within 24 hours, I got a notification that my PAN no is my login

Now begins the process.

But before you begin, you need to get a lot of stuff together before you get complete the submission

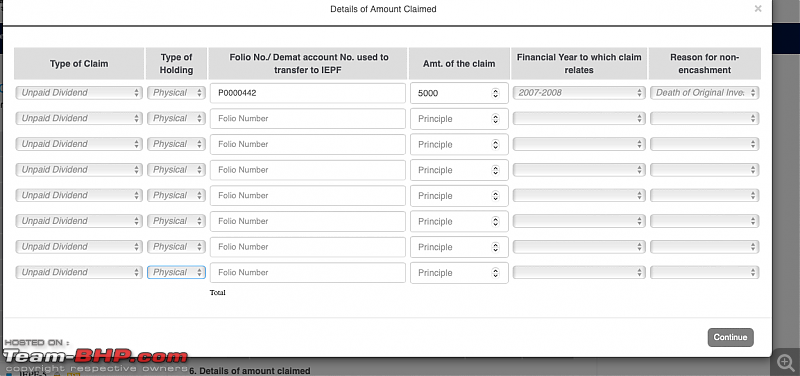

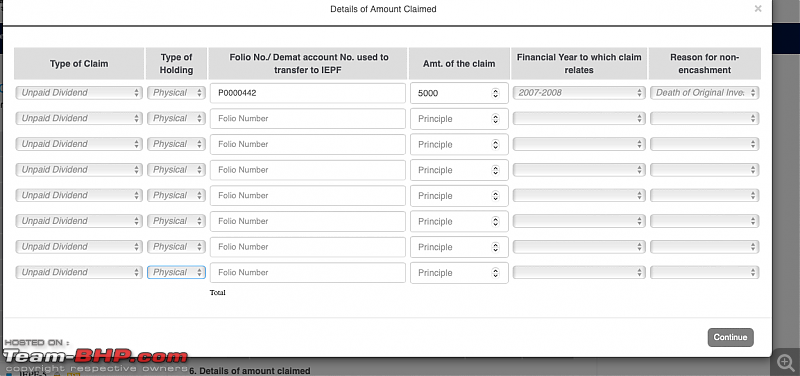

1: Tabulate and total the dividends in terms of amount and financial year

2: Prepare the signed Indemnity Bond format

3: Get all the KYC stuff along with SH13 completed.

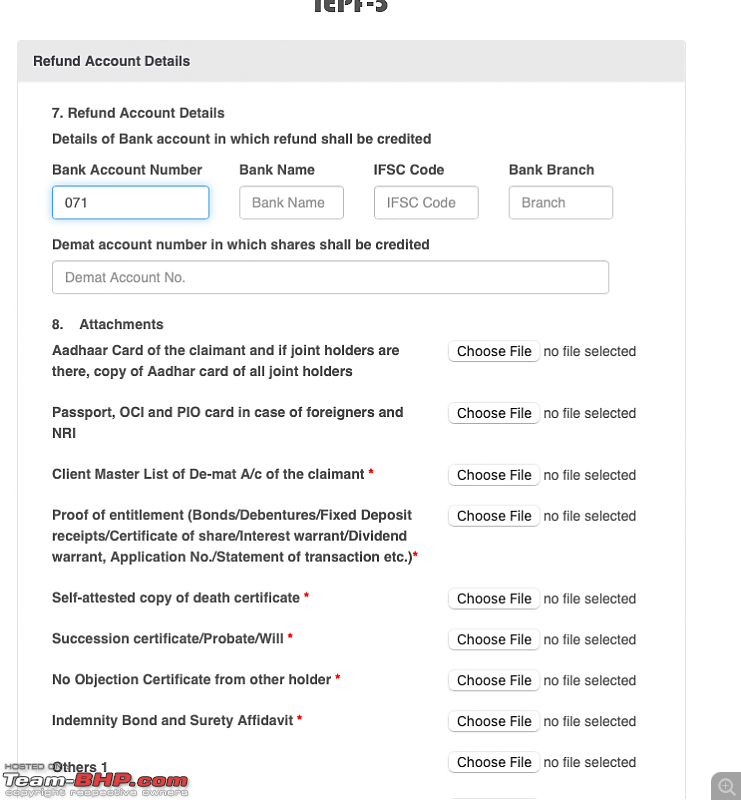

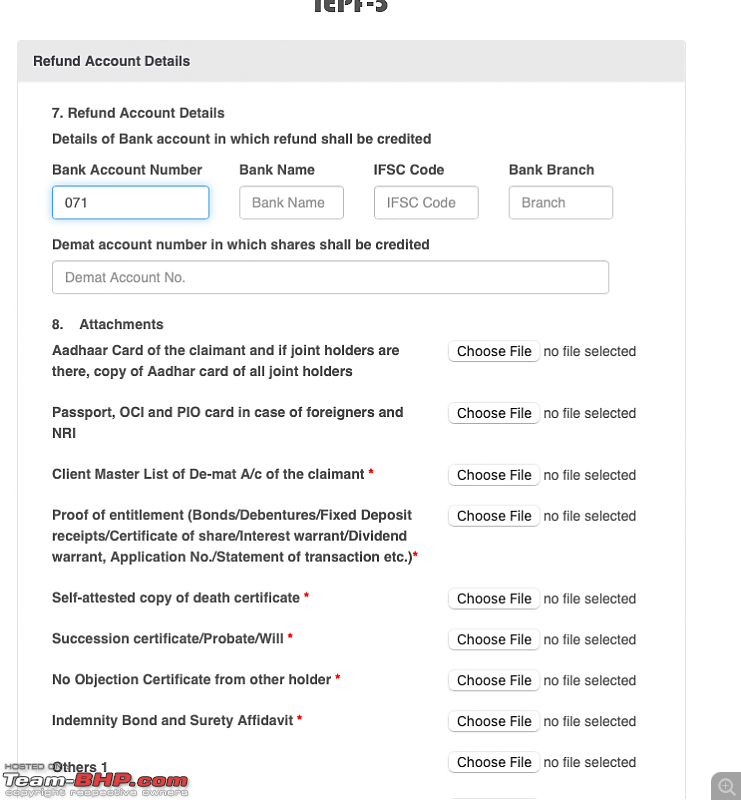

Now get the following together in pdf format and store in a folder

- Aadhaar of all claimants in one document

- Passport/OCI of any foreigners in one document

- Proof - Share certificate, dividend warrants (scan into one pdf document)

- Self attested death certificate

- Indemnity Bond and Surety Affidavit ( it is one document! - Format in this post)

- *Will/Probate/Succession Certificate

- Cancelled Cheque

- *No objection certification from any holder (required if other holders are abroad and you need to credit to someone in India)

Also ensure you have access to the email and the phone of the claimant

*Note Ideally, if there is a joint holder who is a spouse /sibling/parent or child, avoid the will/probate /succession stuff . More on this later

Now it is time to start the submission process

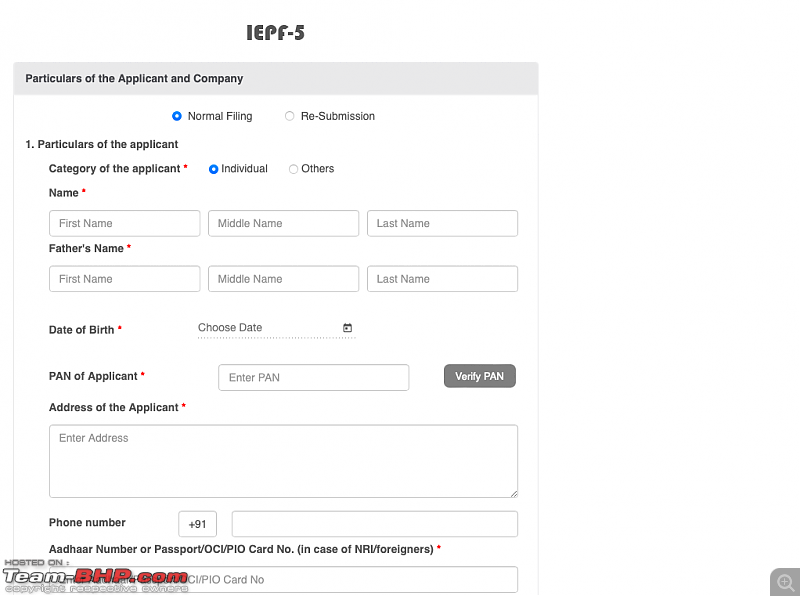

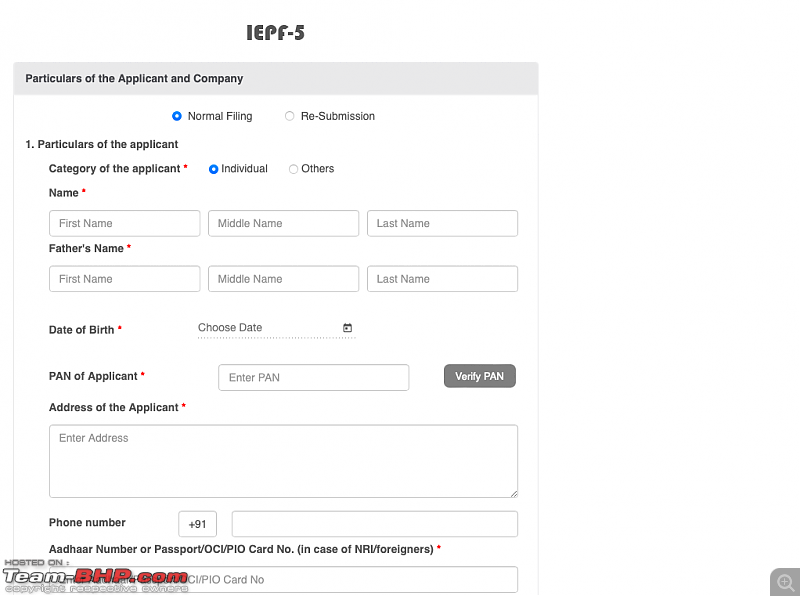

Select IEPF-5 and complete this screen

Make sure you have the right company/subsidiary etc. When you complete this, the name of the Company Nodal Officer, address etc come up. Take a snapshot or note details down. It is very important.

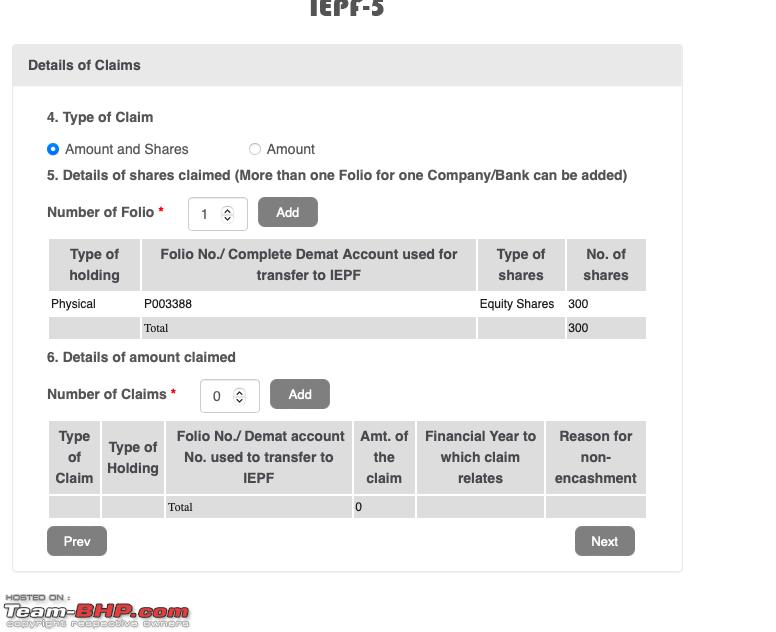

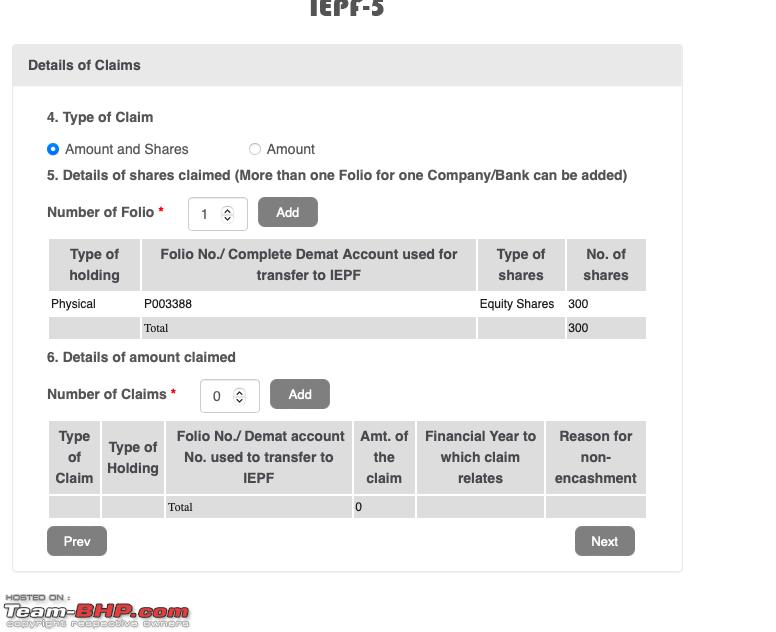

Then fill in the details - Amount and shares or Amount

The shares part is straight forward. The amount part is the tedious one - remember I suggested you compile a spreadsheet

Now its time to attach the files. Check and double check

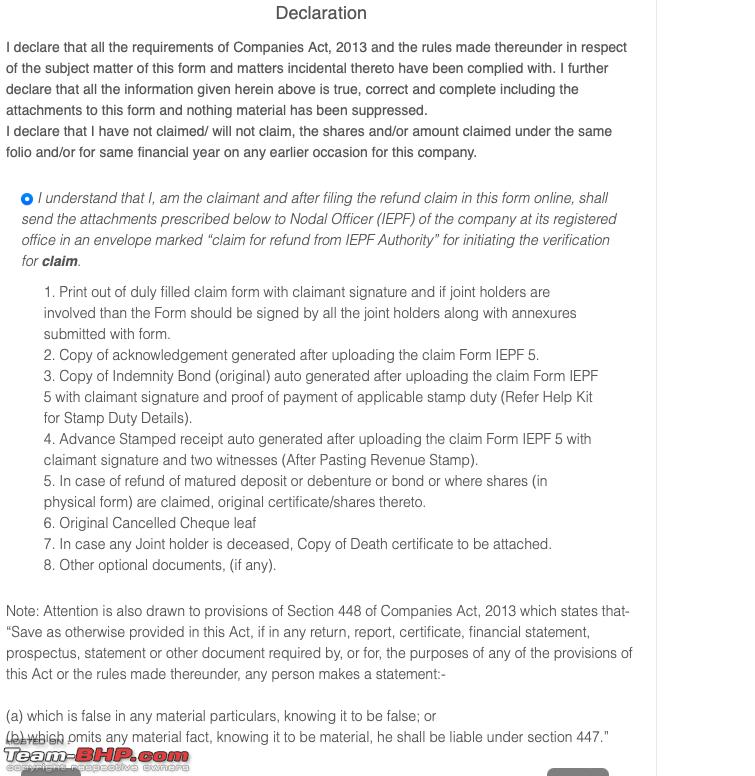

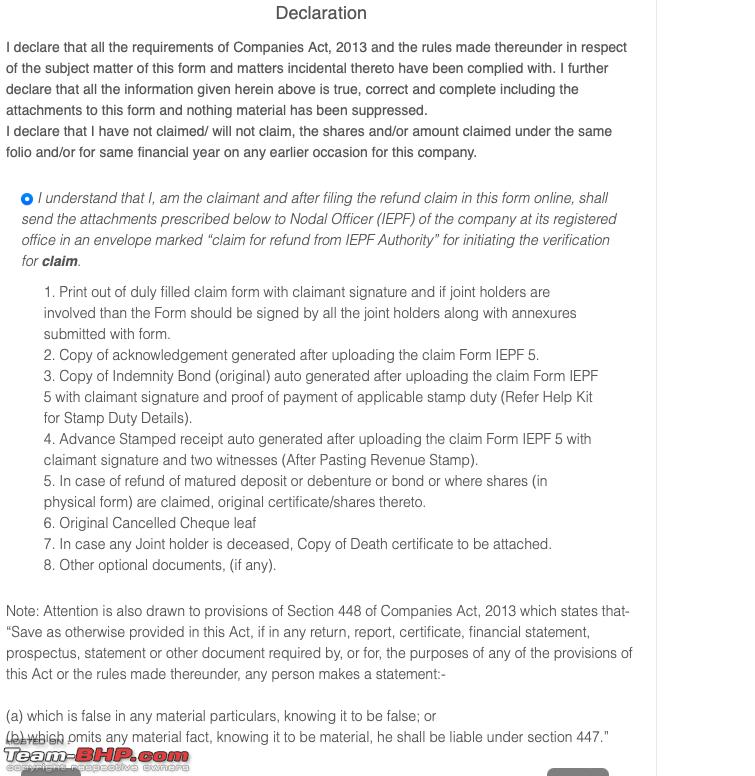

Complete the Declaration

You will then need to authenticate via phone and email as per Aadhaar (Thank you Nandan and Manmohan for this!)

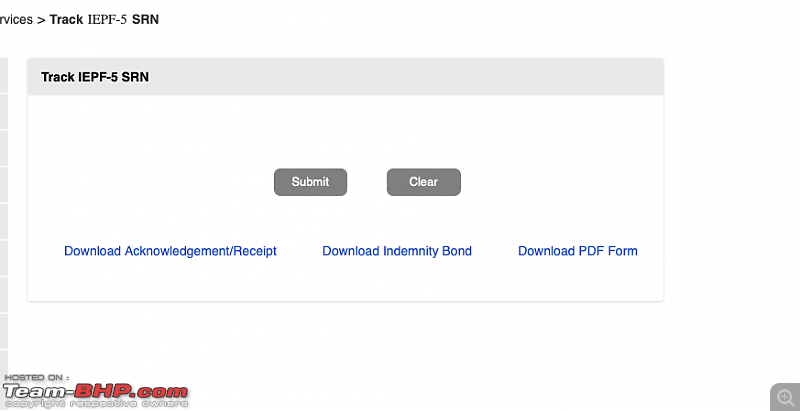

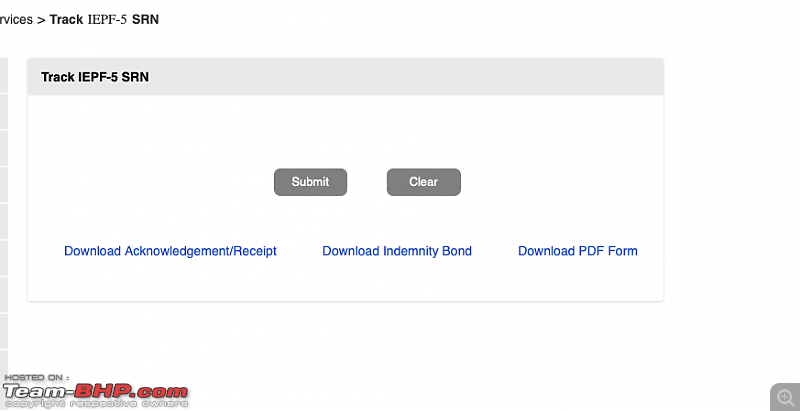

You then get an SRN no along with this screen. Forgive me but I forgot exactly how the SRN no came - on screen or in the workspace

Please then print out the acknowledgment and the form (I forgot the latter). You are normally expected to download the profiled indemnity form and print it on stamp paper but I found the format and completed it before hand. it is odd since once the application is submitted, you cannot change or add anything. The IEPF process is not clear on this.

Now take all the hardcopies in the list and the application form and send it to the respective company registrar along with the KYC forms. In my case, I sent everything except the form to the Registrar. Fortunately the Registrar found my number on the envelope and called me to send a copy of the form and the KYC documentation. This call was followed up with an email.

I followed up after a couple of weeks later, after internal approvals, he had processed the application and he provided the submission documentation, I then tracked everything on the IEPF website.

10 days late, IEPF reverted with a request for an affidavit as my fathers name was misspelt and a clarification on why I had got my siblings no-objection instead of direct transfer to joint holder. I had gone according to my fathers probate and will. In reality, I could have ignored and merely let the joint holder apply. I completed the documentation and sent to the Registrar

To track your application progress

Go to

Select Track IEPF5 - SRN status

You then get this screen

Log in and fight the Captcha with your eyesight and spell check

You will need to search for the week when you filed the claim

You then get a status

PEVR - Pending E-Verification from Nodal Officer

PAAO - Pending Approval Assigned Officer

PGGM - no idea what this meant but it is one step from approved and I might expect the shares to be credited in 3 months

Approved - you get notified when you reach this status

(33)

Thanks

(33)

Thanks

(21)

Thanks

(21)

Thanks

(22)

Thanks

(22)

Thanks

(22)

Thanks

(22)

Thanks

(37)

Thanks

(37)

Thanks

(2)

Thanks

(2)

Thanks

(5)

Thanks

(5)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks