| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  20,656 views |

| | #16 | |||

| BHPian Join Date: Aug 2017 Location: Bengaluru

Posts: 832

Thanked: 4,143 Times

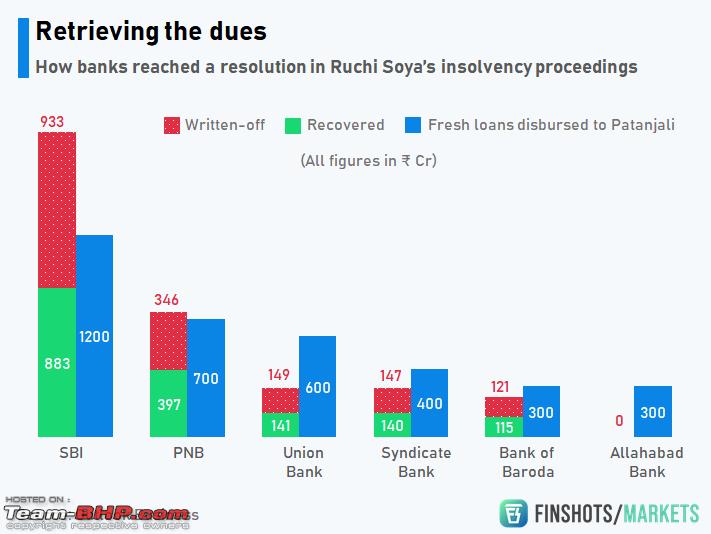

| Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Story of Ruchi Soya (Source) This is not a scam yet, but there are ample alarms that need to be talked about. Quote:

Quote:

Quote:

Last edited by Thermodynamics : 4th July 2020 at 19:56. | |||

| |  (31)

Thanks (31)

Thanks

|

| The following 31 BHPians Thank Thermodynamics for this useful post: | 2himanshu, alpha1, anantpoddar, ankan.m.blr, avishar, AZT, charanreddy, COMMUTER, dailydriver, deep_behera, digitalnirvana, DrANTO, greenoval, GSMINC, Herschey, Jaguar, mallumowgli, Night_Fury, ninjatalli, padmrajravi, PrasunBannerjee, rajvardhanraje, Roy.S, Shrayus_shirali, Sk8r, SnS_12, Sunny_team_bhp, theflyingguy, turbowhistle, ValarMorghulis, warrioraks |

| |

| | #17 | |

| Distinguished - BHPian  | Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Another big one in recent times was Theranos, which claimed to revolutionize blood testing and had huge valuations of almost 9 Billion USD. The company fell flat and closed overnight when all their claims were found false. Below are some extracts from Business Insider. Quote:

| |

| |  (9)

Thanks (9)

Thanks

|

| The following 9 BHPians Thank Behemoth for this useful post: | alpha1, digitalnirvana, greenoval, Herschey, PrasunBannerjee, rajvardhanraje, Shrayus_shirali, Thermodynamics, ValarMorghulis |

| | #18 | ||

| Team-BHP Support  | Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Quote:

Quote:

The next one brewing is the GVK-Mumbai airport scam. Charges are being filed about siphoning of funds Last edited by ajmat : 4th July 2020 at 22:27. | ||

| |  (9)

Thanks (9)

Thanks

|

| The following 9 BHPians Thank ajmat for this useful post: | AZT, digitalnirvana, DrANTO, Herschey, rajvardhanraje, Shrayus_shirali, SnS_12, Thermodynamics, turbowhistle |

| | #19 |

| BHPian | Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! The famous Norton Motorcycles scam should be added to the same list, in 2012 hundreds of elderly Britons were persuaded to transfer their pension funds into three Norton pension schemes and the company managed to fool the investors as well as customers who bought those expensive bikes. Customers had various complaints regarding the bikes and deliveries and the investors could not withdraw the money even after lock-in period. Link: https://www.team-bhp.com/forum/super...ensioners.html (The Norton Motorcycles scam! Cheats customers & pensioners) Last edited by turbowhistle : 5th July 2020 at 15:49. Reason: Typo |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank turbowhistle for this useful post: | COMMUTER, digitalnirvana, Shrayus_shirali |

| | #20 | |

| BHPian Join Date: Feb 2020 Location: Thane

Posts: 149

Thanked: 436 Times

| Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Quote:

One typical way of Mr Son's work was to offer atleast 10x more money and ask the beneficiary as to how he will use it. WeWork CEO asked for few hundred millions but Mr Son said what will you do if I give you 2 Billion. Oyo is another example. All this was investigated as people who contributed to $100 billion vision fund were asking questions even though everyone made good profits. Also the next vision fund was cancelled. Moreover there is a difference between a scam or failure of the financial model or system. 2008 recession was a result of wrong financial model but was not a scam. 2015 film 'the big short' explains the 2008 crisis in a simple way. Last edited by Chetan_Rao : 5th July 2020 at 19:17. Reason: Trimmed quote | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks Tucker48 for this useful post: | Shrayus_shirali |

| | #21 | ||

| BHPian Join Date: Nov 2019 Location: Toronto

Posts: 693

Thanked: 2,621 Times

| Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Quote:

Quote:

| ||

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank AZT for this useful post: | alpha1, COMMUTER, digitalnirvana, DrANTO, Shrayus_shirali, Thermodynamics |

| | #22 | |

| BHPian Join Date: Oct 2012 Location: Chennai

Posts: 828

Thanked: 3,482 Times

| Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Quote:

Sub prime crisis - out and out scam by pretty much every institution in the value chain, banks, mortgage brokers, rating agencies and only 1 banker was found guilty of this near $500bn + scam! Get this, to investigate and find the guilty, Obama appointed Holder as the AG. This man was a high paid lawyer on wall street for banks and after this role went back to being lawyer for them. Talk about conflict of interest. Interesting read on Holder https://www.rollingstone.com/politic...he-cold-49262/ Bank drug laundering scam - many top US / European banks, Wachovia, HSBC all laundered $10's of billions of Sinaola cartel drug money, they even tied up with the cartel in Mexican branches to ease their deposit process, not one person has seen jail time. Wells Fargo fake accounts scheme - this bank created millions of accounts for people who didn't ask for it, need it, weren't even aware of it. Even if you went in for an inquiry on a WF branch you will be saddled with 3 different relationships when you walked out, whistle blowers were sacked, careers ruined and a $185mn fine on a bank that makes $85bn in revenues annually. Deutsche Bank rigged the prices of gold and silver to benefit it. https://www.suissegold.ch/en/posts/d...fixing-scandal Danske (Danish) bank laundering scandal + bonus Standard Chartered laundering scam. Danske bank has laundered $250bn worth funds from Russia. 10 Estonian branch employees arrested and the CEO resigned but aside from a $500 mn fine that's it. SCB is a filthy bank with decades of laundering issues but they never ever fix it. https://www.forbes.com/sites/frances...nancial-crime/ Libor scandal - every single major bank was involved in a cartel to rig the Libor. No exceptions. These are just a few banking scandals in the past 20 years, not getting into accounting scandals, corporate malfeasance like Nestle and other areas. Nestle for instance convinced mothers in Africa that powder milk was better than breast milk. Millions of babies were killed by Nestle and it is one of the largest organisations today! https://m.ranker.com/list/nestle-bab...elissa-sartore They found that millions of babies were dying of malnutrition and diarrhea resulting from diseases like kwashiorkor and marasmus, brought on by protein deficiencies. Doctors traced these afflictions to the increase use of baby formula. Due to the growing dependence on formula, babies' immune systems were less able to develop, fight disease, and allow a child to survive infancy And I am not even touching on how till the 60's western firms used armies (of govts) as their private agents, like how AIOC(now BP) engineered a coup in Iran just because Iran wanted a 50% share in the revenues of its own oil. Not even going into how many many reputed names to this very day have deep Nazi (Coke, VW, IBM to name just a few), Slave trading and Opium trading links. The west is dirty, but one thing that they do well is cover it up with propaganda that makes us believe it is not. | |

| |  (13)

Thanks (13)

Thanks

|

| The following 13 BHPians Thank Stribog for this useful post: | ankan.m.blr, COMMUTER, digitalnirvana, Herschey, hothatchaway, InControl, mallumowgli, rajvardhanraje, Roy.S, Shrayus_shirali, SmartCat, V.Narayan, vennarbank |

| | #23 | |

| Senior - BHPian | Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Quote:

Can you imagine while SBI is still trading below its book value and the SBI Cards IPO shares available even today at below their IPO list price, why in the world would a no name company with absolutely nothing to show for trade at such a high premium. Always look at the fundamentals of a company, its shareholding pattern, promoters, promoter pledge and the amount of debt it has. If the fundamentals are good, your investment should generally grow in value in the long term. Last edited by longhorn : 6th July 2020 at 10:33. | |

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank longhorn for this useful post: | AZT, COMMUTER, PrasunBannerjee, rajvardhanraje, Shrayus_shirali, Thermodynamics |

| | #24 | ||

| BHPian Join Date: Apr 2019 Location: Bangalore

Posts: 414

Thanked: 3,877 Times

| Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Quote:

Quote:

Marketing junk bonds as AAA on the behest of the rating agencies which get a commission from their sale and knowingly dumping worthless investments to gullible people isn't a wrong financial model but a clear case of fraud. | ||

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank ValarMorghulis for this useful post: | InControl, Thermodynamics |

| | #25 |

| Senior - BHPian Join Date: May 2006 Location: Bangalore

Posts: 1,248

Thanked: 2,875 Times

| Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance!

Looks like our own BSNL is trying to pull one like this. I have an old BSNL prepaid number in my hometown. Went to get the SIM replaced and I was asked to provide a new photo, ID/Address proof as well as some Rs.150. The lady in the counter provided me with two SIM cards stating that one was free and came with minimum amount loaded and I could recharge that and use if I wanted. Didn't think much about it at that time and I came back home. A couple of days later, I get an SMS acknowledging that they have received the SIM replacement charge, something in the lines of 50 odd rupees. Basically, the remaining 100 was for the new (free) SIM, which I was scammed to pay for. |

| |  ()

Thanks ()

Thanks

|

| | #26 |

| BHPian Join Date: Apr 2019 Location: Bangalore

Posts: 414

Thanked: 3,877 Times

| Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Another unbelievable scam is the 1MDB or 1Malaysia Development Berhad scandal (uncovered in 2015 and ongoing) and where the chief culprit, Jho Low, a Wharton Graduate, was accused of stealing ~$4.5 billion dollars. Yes, one person swindled $4.5 billion dollars from the Malaysian public through clever accounting, deceit, fraudulent bonds, and what not leading to Malaysian PM Najib Razak losing elections and facing criminal charges. Low's chief antics were: 1. Portraying himself as the son of a Chinese billionaire and throwing lavish parties which got him the title of the "Asian Great Gatsby" 2. Spending $2million in one night on alcohol and $300 million in a couple of months on parties which were attended by top stars like Leonardo DiCaprio, Jamie Fox, Paris Hilton, Kanye West, Alicia Keys and scores of other Hollywood's celebrities. In fact Low dated Miranda Kerr who was later required to return the jewellery (worth $8million)given to her by Low. And oh yes, Britney Spears popped out of his birthday cake at a 2012 Vegas bash. 3. Low financed The Wolf of the Wall Street and hoped to become a huge production studio in Hollywood one day. He is credited in the movie. DeCaprio even thanked him during his Golden Globe winner speech 4. At one time, Low was about to buy the brand Reebok from Adidas for $1 billion but the deal fell through owing to the dubious source of the funds 5. Low even diverted money to the first lady of Malaysia (called Bag lady for her penchant for expensive bags) who was photographed with 500 luxury handbags, hundreds of watches, and 12,000 items of jewellery said to be worth up to $273 million 6. Low bought the super yacht The Equanimity for $250 million Jho Low is currently a Cypriot citizen and on the run, under investigation in more than 10 countries. The book, Billion Dollar Whale: The Man Who Fooled Wall Street, Hollywood, and the World by Tom Wright, Bradley Hope is a great source of insight in this scandal. Sources: Articel-1 Article-2 Article-3 Articel-4 Last edited by ajmat : 6th July 2020 at 22:19. Reason: Cypriot not Cyprian |

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank ValarMorghulis for this useful post: | alpha1, digitalnirvana, DrANTO, Herschey, rajvardhanraje, Shrayus_shirali |

| |

| | #27 | |

| BHPian Join Date: Oct 2012 Location: Chennai

Posts: 828

Thanked: 3,482 Times

| Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Quote:

Some of the outright scams and frauds - Mortgage Selling Scam - Here is one such paper (just 1 of 100's) describing one of the scams in mortgage selling. http://www.nber.org/papers/w20947 Very simply put, unscrupulous mortgage lenders connived with bank due diligence officers and greedy customers to simply inflate incomes on lending forms. Another paper says income inflation was rampant in sub prime loans, the Real estate brokers even termed it "Liar Loans". http://www.mitpressjournals.org/doi/...2/REST_a_00387 As this was still troublesome to banks (as they needed to falsify income records) they invented the.... Low Doc / No Doc loans, https://www.investopedia.com/terms/l..._doc_loans.asp What is this? Well, you could for higher interest rates, borrow massive sums with little or no documentation, hence the Low Doc / No Doc loans. This still needed some basic verification so banks came up with NINJA Loans, No Income, No Job, No Assets (NINJA) loans. Yes That's right, a mortgage loan with no income, job or assets! How is this fraud? Simply put, the chain was as follows, Mortgage advisors (brokers) were making money from Banks Banks were selling these essentially junk rated investments to investment funds Ratings agencies willingly rated these junk as AAA Investment funds who only invested in AAA are arguably the only players not at fault and purchased said loans. Imagine today a PSU or Indian private bank offers housing loans and does the following, 1) DSA's start falsifying loans info and forging income statements? 2) To cover this up Banks offer loans with low documentation 3) However as banks still had to do due diligence and thus fail many of these loans, they 4) Invent a new category where anyone, literally anyone is eligible for a loan 5) Declare these disastrous loans as investment grade and sell it to LIC 6) When it all fails, take $ 100's of billions as bail out money 7) Declare crazy bonuses to their management team with said bail out money Will you not scream fraud and ask for heads to roll? I have not even touched 1% of the iceberg, i had the misfortune of being in product design for ALT A and HELOC loans in one of the largest (pre crash) sub prime institutions. Luckily for me, I Had a soul and left a solidly paying job because I just could not cope with the financial skulduggery that went on. 6 months later the institution went bankrupt was purchased by another large entity and a year later entirely shut down. At its peak it was making $ 450 mn in revenue (in 2002-3 money), $ 75 mn in profits and held in excess of $ 2bn in assets, and it literally went boom overnight. It was all fradulent money. Yes, they started out with an admirable agenda, offering loans to those with low credit and marginalised (Hispanics, Blacks) groups, but in 2-3 years it went from this to just falsify documentation, cheat 60 year old semi literate black ladies, anything just to make a quick buck! | |

| |  (7)

Thanks (7)

Thanks

|

| The following 7 BHPians Thank Stribog for this useful post: | alpha1, ankan.m.blr, digitalnirvana, GeneralJazz, rajvardhanraje, Shrayus_shirali, V.Narayan |

| | #28 | ||

| BHPian Join Date: Aug 2017 Location: Udaipur

Posts: 460

Thanked: 1,833 Times

| Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Speaking of bubbles, how are we forgetting this? This celebrity family kept blowing the bubble out of proportions always. Latest in the link is Kylie Jenner and her path to becoming a billionaire, at least by themselves. Few excerpt from the Forbes coverage, read the full article for details: Quote:

Quote:

Source (Forbes): https://www.forbes.com/sites/chasewi...a-billionaire/ | ||

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank PrasunBannerjee for this useful post: | digitalnirvana, RaviK |

| | #29 |

| BHPian Join Date: Jan 2009 Location: Hyderabad

Posts: 473

Thanked: 166 Times

| Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Chinese companies listing in US market exploiting a loophole in SEC rules . several hundred Chinese companies were able to list on U.S. exchanges through a process called a reverse merger, which allowed them to enter the markets without the same level of scrutiny that most initial public offerings receive. US small investors and pension funds have lost billions of dollars and still unable to prosecute the culprits due to chinese laws . |

| |  ()

Thanks ()

Thanks

|

| | #30 | ||

| BHPian Join Date: Feb 2020 Location: Thane

Posts: 149

Thanked: 436 Times

| Re: Financial Scams, groupthink, speculative bubbles & irrational exuberance! Quote:

Quote:

Moreover, if a wealthy investor buys a property at 100 million, he gets a line of credit of 80 million on that property, then the investor buys another property at 80 million and again he gets a line of credit of 50 million on second property, then the investor buys a yacht for 50 million and gets a line of credit of 30 million on that yacht and so on and so forth. No income proof is needed and the world is full of banks like that. Of course this privilege won't be available for all but only for rich people who can invest large amount of money. But will we say that this is a scam! If we do then then the whole financial system which is based on dollar can also be termed as a scam. Iran not being able to sell it's oil in dollars therefore jacking up prices of other sellers can also be termed as scam. Alright there are financial sanctions or whatever but the end user is getting scammed as the prices would have been a little lower with more supply. The idea is to separate the group of people who take risks to make money for themselves from the group of people who swindle money from others. | ||

| |  ()

Thanks ()

Thanks

|

|