Quote:

Originally Posted by ranjitnair77  The Ken has analyzed the data. |

That sent alarm bells for me. I used to be a subscriber for an year and I used to be quite impressed by their hard-hitting long reporting. However, whenever they addressed an issue I was very familiar with, I found them quite inaccurate. Then I wondered if that was the case with other articles, where I am not familiar with the issues. Eventually I didn't renew the subscription, I preferred to be uninformed rather than misinformed.

But this time I couldn't possibly argue back without taking a look at the article you cited. So I became a subscriber once again, so that I can understand what you learned from that article.

Frankly, I was horrified. I don't really blame them; this is not a topic some journalist can casually report on. However, it is so misleading, and comes up with such wrong conclusions, I was just bummed. In fact, they have come up with stats that are just plain meaningless. What does

engineers per billion valuation ratio even mean? We already know their valuations are meaningless, and now that is used for measuring other things??? Reminds me of synthetic CDOs from sub-prime era. How about engineers per billions-lost ratio while they are at it?

How do I know better than them? I have played every role in IT in the last 32 years (products and services), have worked in large companies as well as multiple startups, including last two as co-founder. And I still design and write code actively. So, I deeply care about this topic. When I used to run a rural IT product company for 16 years, I used to hire from 4th/5th tier engineer colleges and mentor them for 2-4 years before they flew the coup. Most of them now work for various hi-tech companies including Google. In other words, I have turned plenty of good/excellent engineers out of folks coming out of below average colleges. Many of them have told me how much difference their initial mentoring helped them later in their career. The first few years of mentoring is very important to create good engineers, if they didn't receive good training/mentoring/exposure before that. That is how most of the good engineers are made, since only small percentage can make it to NIT/IIT.

As a technology stack provider to other technology companies, I extensively cater to startups these days, with lots of visibility. Due to NDAs, I can't mention any details. But I can speak in general. Practically every startup is in the race for either revenue or market share, with VCs wielding the whip. They simply have no time for mentoring/training new hires. So, they hire experienced engineers and expect them to be productive from day one. However, they can hardly poach top talent from FANGMA unless they are hiring for top tier. So they end up hiring from regular IT companies which spent years mentoring talent, but don't have the finance to compete with highly funded startups. If regular IT companies try to pay startup salaries or FANGMA salaries, they would all go bankrupt. We should not forget that at least 90% of engineers are working for IT services giants, and other companies (of any size) that are not startups or not even IT companies. Only about 10% might work for FANGMA and all the highly funded startups put together. Yet this 10% category behaves like they are the norm, while they are actually the outliers.

Next let's address the quantity vs quality issue. If you are a technology provider, then you will need much higher quality engineers compared technology enabled company. FANGMA are all primarily technology providing companies, while most startups are technology enabled companies. Most startups do B2C services and are not technology companies. And even within each company you don't need all engineers to be of high quality. There could be 10 times talent difference between the guy who designs an algorithm vs the guy who builds a web page. Therefore, no company really needs all their engineers to be great or good. Most of the work in IT is really very mundane, boring and clerical. Putting very good engineers on mundane work is a waste. However, cash rich companies often do this.

If you need engineers in large numbers, the

68–95–99.7 rule becomes applicable. If you need 1000 engineers, mere 3 need to be geniuses, 50 of them to be very good to good, 267 to be above average and the rest can be average to below average. These number may vary a bit across different companies, but the rule holds good in general.

Therefore, when someone just invents a 10000 engineer rule out of thin air, without any domain knowledge, we don't have to give any importance to it. That's not analysis, and it gives no insight.

(6)

Thanks

(6)

Thanks

(2)

Thanks

(2)

Thanks

(15)

Thanks

(15)

Thanks

(4)

Thanks

(4)

Thanks

(1)

Thanks

(1)

Thanks

(6)

Thanks

(6)

Thanks

(10)

Thanks

(10)

Thanks

(3)

Thanks

(3)

Thanks

(4)

Thanks

(4)

Thanks

(32)

Thanks

(32)

Thanks

(6)

Thanks

(6)

Thanks

(6)

Thanks

(6)

Thanks

) is estimated to be in the 700 range, and they have laid off folks since then. Amazon adds 2000 engineers (conservatively) on a yearly basis. That's just one example, there are more.

) is estimated to be in the 700 range, and they have laid off folks since then. Amazon adds 2000 engineers (conservatively) on a yearly basis. That's just one example, there are more.

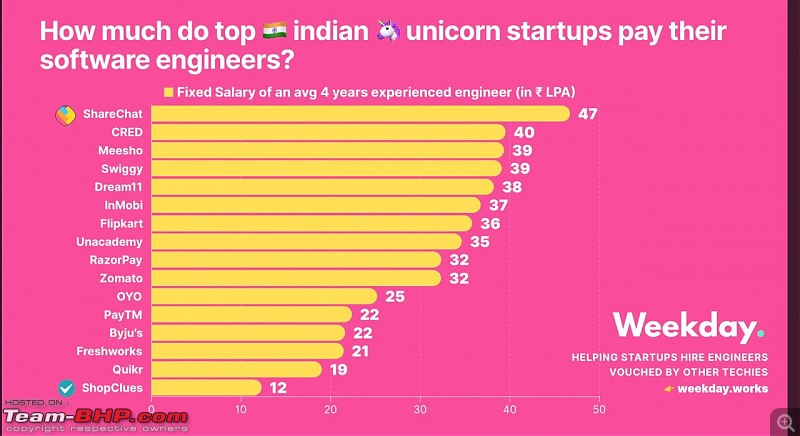

as I thought of my hiring plans vs my cashflow. Fun times indeed. Sharechat, at the top of the pile, made as much revenue last year as we make this year. Another

as I thought of my hiring plans vs my cashflow. Fun times indeed. Sharechat, at the top of the pile, made as much revenue last year as we make this year. Another