| | #31 | ||

| BHPian | re: The Cryptocurrency & NFT Thread Quote:

Quote:

If I am running Reliance Industries, I better be making more money from refining crude oil than I would if I was mining cryptocurrencies. If this is not true, it is time to evaluate my ability to do my job well or change the direction of the company. Hypothetically speaking, if too many oil refineries switch to mining, what happens to the price of refined oil? It shoots up. Simple supply and demand and all of a sudden, refining oil just became a lot more attractive than mining. Last edited by Tanmay K : 24th September 2017 at 15:41. Reason: typos | ||

| |  ()

Thanks ()

Thanks

|

| |

| | #32 | |

| Team-BHP Support  | re: The Cryptocurrency & NFT Thread Quote:

There are - 1) Super Geeks (who make the rules) 2) Semi Geeks (who mine the coins) 3) End users (who actually use coins for making transactions, but quickly convert bitcoins to $) 4) Speculators (who hold a part of their wealth in bitcoins, because they believe its value will go up) Perhaps crypto-currencies would be a bit more palatable to me, if its 'value' remained stable. Perhaps the super Geeks should make rules that discourage 'investment' or 'hoarding'. Mission Impossible can offer some clues - cryptos that self-destruct after 5 days perhaps?  Last edited by SmartCat : 24th September 2017 at 16:09. | |

| |  ()

Thanks ()

Thanks

|

| | #33 | |||||||

| Team-BHP Support  | re: The Cryptocurrency & NFT Thread Quote:

Quote:

Lack of regulation is not self-regulation. Most of us donít like the highhandedness of police, but do we want to live in a society that has no police presence? Can you call it self-policing? Bitcoin doesnít control inflation. In fact, it can cause deflation if everybody hordes bitcoins like they do now, and it is the only currency around. And central banks can't intervene to ease the problem. Quote:

Quote:

Quote:

Let me throw a Milton Friedman video back at you, but from 2005. In here, he gives major credit to Fed for the economy stability since the 90s. Which goes against the stand he took most of his life. And two years later, the world economy got flushed down the toilet. So he was wrong again about the stability created by the Fed. Not only that, he tells that the holy doctrine of monetary economists have been proven wrong. Guess who is considered the most influential monetary economist? Milton Friedman.  Quote:

What did Keynes say about who should be an economist? Quote:

I have previously addressed these here and here. | |||||||

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks Samurai for this useful post: | vamsi.kona |

| | #34 |

| Distinguished - BHPian  Join Date: Aug 2014 Location: Delhi-NCR

Posts: 4,179

Thanked: 68,008 Times

| re: The Cryptocurrency & NFT Thread Thank you for educating all of us on this new avenue for investment. Nice for folks like me to read. As far as investment goes I prefer the real thing that you can see, hold and control - gold, a real business that sells a product or service etc. I think it will take many years and several heart breaks and ponzi scheme like events before electronic coins get credibility and value. A prosaic item suddenly acquiring price because of an impending believed shortage and a perception of value is as old as the Tulip scheme of the 1636-37 where the price of a tulip flower climbed 20 times and a single tulip bulb was being exchanged for two fat oxen. I better stop here before I get branded as old fashioned and out of date.  |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks V.Narayan for this useful post: | vamsi.kona |

| | #35 | |||||||

| BHPian | re: The Cryptocurrency & NFT Thread Quote:

Quote:

Quote:

Quote:

Quote:

Quote:

Quote:

| |||||||

| |  ()

Thanks ()

Thanks

|

| | #36 | ||

| Team-BHP Support  | re: The Cryptocurrency & NFT Thread Quote:

Quote:

Basically, you are saying lack of regulation allowed them to abuse it. That means we need stricter financial regulations and not lack of it. Basically, you are saying lack of regulation allowed them to abuse it. That means we need stricter financial regulations and not lack of it.Last edited by Samurai : 24th September 2017 at 22:18. | ||

| |  ()

Thanks ()

Thanks

|

| | #37 | ||

| BHPian | re: The Cryptocurrency & NFT Thread Quote:

Edit: I mean incentives other than just "not breaking the law and going to jail". Edit 2: Quote:

The upside? Bitcoin itself or some other present crypto succeeds in what it aims to do and everyone is happy. Or it sets up framework for some better future crypto. Last edited by Tanmay K : 24th September 2017 at 22:45. | ||

| |  ()

Thanks ()

Thanks

|

| | #38 | |

| Team-BHP Support  | re: The Cryptocurrency & NFT Thread Quote:

And secondly to regulate cash it is easier because cash can be de-legitimized. However crypto cannot. If crypto again moves underground, you will have realisitic prices. It also is directly proportional to the freedom in the world. The more countries start cracking down, the more valuable crypto becomes. In a very free and open world with proponents of life liberty and happiness ruling over us, crypto is needed only for evil. However, in the absence of that, crypto gets legitimacy. So yes, crypto is currently a bubble, but its not going to vanish, eventually it will settle to a value which will gradually change. Last edited by tsk1979 : 24th September 2017 at 23:26. | |

| |  ()

Thanks ()

Thanks

|

| | #39 | ||

| BHPian Join Date: Aug 2009 Location: Bangalore

Posts: 169

Thanked: 797 Times

| Quote:

A severe lack of understanding of economic history is what prompts such stands taken by pure capitalists who hate the governments. Coming back to the point, the idea of asking for "Intrinsic value" for the money is another similar thought process. Bitcoin or anything that you can measure in intrinsic value without a Govt intervention sooner or later just breaks the economics of the country. I will try to explain, I am not sure if it will be clear. Bitcoin could be equated to Gold standard. Yes, Bitcoin is not naturally available like Gold, but mining gold could be equated to making new bitcoins (pls set aside the mining part in bitcoin for now). Making new bitcoins is limited by aspects like productivity of the technology at this stage or time period. Eg. the best achieved processing speed for computers at this period of time. Plus a hundred other factors not controllable by Govts. The minute your country's productivity reaches this stage, the country will spiral into stagflation. Lets say, with the current technology and productivity levels, the number of bitcoins which can be produced (thus available in circulation) would be 100. If the economic activity in the country reaches that level, it hits a ceiling and there it stops. It goes into economic downturns to stagflation level from here. This is what had happened for any country that followed the Gold standard. This is also what had happened to countries that pegged its own currency to another currency ( an external factor, not controllable by its own government). A democratically elected government ( ie. people) should be able to set the value of the money ( a medium they use to transact). Anything not controllable by the govt means the government cant control the monetary policy. Cryptos will never become currency. Of course it can run as a medium of hoarding, before and after Govts find a mean to tax transactions. Quote:

The whole idea of freedom equated to crypto is highly far fetched fiction. In the past, through out history, there were people who controlled other people's lives. These were learned men, or powerful men, or skilled men or men born in the right families etc. And world over people joined together and decided that doesnt work out for them, and created collectives where they do a collective decision making as to what to do with their lives. Such entities are democratically elected governments. People do not need freedom from themselves. They only need to realize and act on their freedom. Of course its not perfect, but its the best system we have. And best system based on historical experiments manifested by people themselves. Government policy making is not about lobbying. Yes, it happens all the time, but that is not the definition. Last edited by Samurai : 25th September 2017 at 17:13. Reason: merging | ||

| |  ()

Thanks ()

Thanks

|

| | #40 |

| BHPian Join Date: Oct 2005 Location: @ Driver's Seat @

Posts: 728

Thanked: 106 Times

| re: The Cryptocurrency & NFT Thread Guru's @ Cryptocurrency, Need a few clarifications on crypto. Understand we have a few exchanges in India like Zebpay, Unocoin which deal in Bitcoin. Are there any other trustworthy exchanges in India that deal with other coins ? Looking for exchanges that are web based. Being a mech guy not comfortable with app exchanges. Is it always necessary to buy the coins from exchanges in India ? Can we buy from exchanges throughout the world ? Any reference please? Believe all these exchanges provide the user with Hot wallet. Assuming that there are some coins in hot wallets, can they be transferred to Cold wallets (like USB ones or Paper wallets ) ? All above knowledge was through reading some books. Need bhpians guidance on how to approach about the purchase of cryptocurrency. Thanks a ton |

| |  ()

Thanks ()

Thanks

|

| | #41 | |||

| BHPian Join Date: Dec 2009 Location: Bangalore

Posts: 249

Thanked: 352 Times

| re: The Cryptocurrency & NFT Thread Quote:

Quote:

Most of them require you to deposit foreign currency in their wallets before being able to trade. There are some that allow you to use your credit card, but using CC for foreign currency transactions where foreign currency is meant to be used for trading is illegal as per FEMA or some other RBI act. If you're a business, you might be able to find a legal way around this, but as an average individual, it is pretty difficult, unless you're a resident in another country and have a bank account there. Indian exchanges (at least the good ones) also adhere to KYC norms voluntarily, which might help you in case of a run-in with a government/tax official until official norms/guidelines come in. Quote:

Last edited by anku94 : 18th October 2017 at 00:53. Reason: Added details | |||

| |  ()

Thanks ()

Thanks

|

| |

| | #42 |

| BHPian Join Date: Mar 2015 Location: pale blue dot

Posts: 640

Thanked: 3,030 Times

| re: The Cryptocurrency & NFT Thread @anku94 thanks for the clarification. After purchasing a certain amount can we move it off the exchange website to say a Google drive account with 2 factor authentication? What is the safest or standard way to store? I've been reading about ETH with its recent fork and have been cursing myself for not investing (a little bit, in thousands not lakhs as per my limited capacity) earlier. Going by your profile picture, it seems you are well versed with ETH. What would you suggest an absolute newbie like me to the crypto world to do, with respect to investment in ETH, at this stage when it is near all time highs? Does it make sense to jump on the gravy train with small amounts or have I well and truly missed the bus? |

| |  ()

Thanks ()

Thanks

|

| | #43 | ||||

| BHPian | re: The Cryptocurrency & NFT Thread Quote:

Quote:

Quote:

Quote:

Please do not treat this as an investment advice. I personally do not think that cryptos are tools for financial investment as it is too volatile right now. 10- 30% ups and downs within matter of days are a common thing here. I am not a finance guy. I just love the technology behind it and have put my skin in game just to get involved with the tech. | ||||

| |  ()

Thanks ()

Thanks

|

| | #44 | |

| BHPian Join Date: Mar 2015 Location: pale blue dot

Posts: 640

Thanked: 3,030 Times

| re: The Cryptocurrency & NFT Thread Quote:

Off topic, but what is the ballpark that you have invested please, if you are comfortable to share? Is it a case of only putting in so much of money that you can afford to write off? Wanted a view from forum members about what is a good starting amount, and what drives them on when to buy crypto (say, a regular amount per month, or at dips, etc), before I put a few thousand in. Do they treat it as an ultra risky stock market that needs monitoring? Or is it just a buy-and-forget thing. I'll still have to read a fair bit and get a hang of this - the blockchain technology is fascinating. | |

| |  ()

Thanks ()

Thanks

|

| | #45 | ||

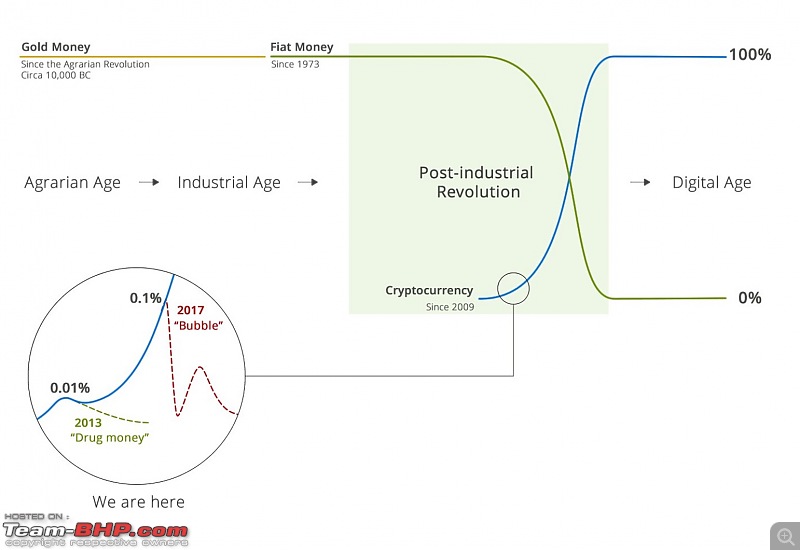

| BHPian | re: The Cryptocurrency & NFT Thread Quote:

Here's a reference pic which I feel shows where we stand right now in terms of Blockchain as well as cryptocurrencies.  Quote:

Having said that, the upside that I see is huge. We are not even at 2% adoption level right now. If and when adoption increases, the rates are just gonna skyrocket. Safest strategy for newbies would be to just buy and hold. I would also suggest to study as much about the tech behind it as possible. It truly is fascinating!  | ||

| |  ()

Thanks ()

Thanks

|

|