| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  58,083 views |

| | #31 |

| Senior - BHPian | Re: Sales of 500+ cc bikes fall in 2017-18. Why? Even from the manufacturer's perspective, they finally seem to be understanding that more and more horsepower is not necessarily the best way forward. Many of the new generation bikes have the same or even lower power outputs than the models being replaced, while higher torque is being achieved to make them much more rider friendly at lower rpms. The new Bonneville, the new Ducati Monster 821 are some examples I can think of at the moment. But many reviews of bikes I had read in the recent past have been conveying this message - usable performance. Though not on many Global rider's requirements, Indian riders certainly need a bike that manages engine heat efficiently to be rideable throughuot the year in a hot and humid country like ours. I still do firmly believe that there is a lot of potential for a 400-500cc Triumph Bonneville with half the output of the 900cc Bonnie and at half the price too - And I also think that is what the Bajaj-Triumph association would be working on at the moment too. Last edited by aravind.anand : 26th March 2018 at 14:49. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks aravind.anand for this useful post: | jpcoolguy |

| |

| | #32 |

| Newbie Join Date: May 2014 Location: Siliguri

Posts: 8

Thanked: 8 Times

| Re: Sales of 500+ cc bikes fall in 2017-18. Why? I'm very keen on an upgrade to the 650F, after enjoying the ownership experience of the 250R (non abs) for the last five years. The reasons I'm holding back are three.

Note from Support: Post fixed for spacing & readability. Excessive dots removed. Last edited by aah78 : 26th March 2018 at 21:26. Reason: See note. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks Saurabh Lahiri for this useful post: | androdev |

| | #33 |

| BHPian Join Date: Feb 2014 Location: Pune

Posts: 288

Thanked: 653 Times

| Re: Sales of 500+ cc bikes fall in 2017-18. Why? I can think of the following 3 reasons that make buyers apprehensive about taking the plunge: 1. Innovation in lower cc segments - BMW 310, KTM etc 2. Accessibility - ~100% mark up due to taxes taking away the VFM proposition for middle class: For ex. BMW 1200GSA vs Jeep Compass. 3. Infra: Sub optimal experience, users aren't able enjoy the capabilities - Cities and Highways getting crowded, Rider Safety and tropical weather |

| |  ()

Thanks ()

Thanks

|

| | #34 |

| Distinguished - BHPian  | Re: Sales of 500+ cc bikes fall in 2017-18. Why? The way I see it, the single major reason for the drop in big bikes sales is KTM 390s! Imagine it is 2011. Only affordable performance bike was a CBR 250R. People who were richer went for Ninja 250R, which retailed at 3.xx lakhs then. And when you wanted to upgrade, it had to be 650s which costed 6.xx lakhs. Now after 2013, we were spoilt by 390s, at an extremely affordable price, 2.05 lakhs otr to be exact. Suddenly CBR 250 and Ninja 250 became obsolete. Later the Ninja 300 and R3 also did not make sense. They costed 1.xx lakhs more than the 390s, yet lacked equipment and that sheer fun that the 390s provided. Having ridden a liter bike and a few 600/650s, logical upgrade to 390s will be 800+cc and not the 600/650s. Agreed, the 600s have higher top speed, but the acceleration to a 120 kmph is very similar to the 390s. Worse, 600s (except RRs) are heavy and not handling focussed hence can't match the agility of 390s. A lot of superbike owners sold their big bikes and bought the 390 because it was cheap, agile and fun. Heck most rich enthusiasts have a 390 just for ghats and track days and keep their big bikes for Sunday rides. Heck, blow up a 390 engine, you can get it to top shape with less than 20k. Why would you want to buy a 1000cc bike for 20 lakhs when 99% of the usage is going to be 100-120 kmph? Even if you want to do overtakes at 120, a 390 can do it like a cake walk. Think about a tyre replacement on big bikes, a minimum 30-40k a pair, atrocious spare and service costs, fear of vandalism etc keeps people away from big bikes. Last edited by PrasannaDhana : 26th March 2018 at 21:55. |

| |  (5)

Thanks (5)

Thanks

|

| The following 5 BHPians Thank PrasannaDhana for this useful post: | giri1.8, myavu, roby_dk, sammyboy, YaeJay |

| | #35 |

| BHPian | Re: Sales of 500+ cc bikes fall in 2017-18. Why? Being a superbike owner, i would like to give my perspective: Apart from the economic slowdown currently, i see following reasons for lack of growth in superbike sales numbers: 1. Most of the superbikes (especially the ones costing north of Rs 10L) are bought by businessmen and so they are not usable on daily basis for them because, in city commute during daytimes, riding with riding gear on will make you totally wet with sweat by the time you reach your workplace and you certainly don't want to sit for work meetings in such a condition. And without riding gear it is not safe, so many of us don't. Also, due to excessive engine heating in our traffic, hot climate and weight of those bikes, the journey isn't comfortable at all in the cities. 2. The general buying pattern is like that people buy around 600-800cc bikes costing around Rs 5-8 L as their first superbike and when they upgrade after some experience and additional budgets, they end up buying 1000cc or higher capacity bikes costing around Rs 15-25L. Once you reach this level, there is no further upgrade available (for practically usable performance on the roads) as already they have the best in segment bikes. For ex. I used to ride Ninja 650 from which i upgraded to ZX14r which already is a hyperbike with excessive performance and hence there is no upgrade available. Same is the case with few of my friends with Multistradas and Goldwings/BMW GTL in their respective segments. But in case of cars, we can have multiple stages in upgrades like Rs 7-10 L, 25-30 L, 50-70L, 1Crore and 1 Crore plus segment which actually provide more usable performance/better overall experience in each stage of the upgrade. 3. For the above said reasons my bike gets used around 4-5 days in a month on average when i go for riding out of the city and does around 8-10k kms/year and hence owning multiple bikes is also not justifiable unlike cars which can be used more often and by more number of family members. 4. Apart from above mentioned reasons, as stated by many here, there is a lot of resistance from family members because of safety concerns and only hardcore riding enthusiasts end up passing these barriers. Even if people buy superbikes for snob value, they end up selling them sooner or later only to not buy again after realising all the impracticality, risks, discomfort in the cities associated with them. |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank 46TheDoctor for this useful post: | hiren.mistry, lionell, roby_dk, The Great |

| | #36 |

| Senior - BHPian Join Date: Jun 2015 Location: Chicago

Posts: 2,991

Thanked: 6,889 Times

| Re: Sales of 500+ cc bikes fall in 2017-18. Why? I think urban India's traffic situation is a key contributor- Even the KTM Duke 390 gets hot in urban India, I can only imagine the liter class motorcycles being uncomfortable in chock a block traffic. Something like the KTM Duke 390 is the upper bound something you can use well in India. You can enjoy the acceleration, close gaps, use the meat of the performance and occasionally hit the red line. I've not ridden anything more powerful than the 390, but I'm reasonably sure you can't use the full potential of the power the machine. Big bikes are about fun and the driving experience. Luxury cars are mostly chauffeur driven and most buyers care about comfort and image. How many times will an owner slam the A pedal and hit 250 kmph on his S Class? Not to mention vandalism (mostly not a problem with chauffeur driven cars) and family-approval are other issues to consider. We don't have too many tracks for weekend racing. I'm sure people in a modified Polo, Laura and Yamaha R3s will enjoy the tracks in India more than people in BMW M5s and R1s. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks landcruiser123 for this useful post: | roby_dk |

| | #37 |

| BHPian Join Date: Mar 2014 Location: Chandigarh

Posts: 55

Thanked: 84 Times

| Re: Sales of 500+ cc bikes fall in 2017-18. Why? I own a Harley. The 1600cc engine develops enough heat to warrant restriction of rides to mostly weekends and 2-3 days a week of office to&fro in summers. Unless itís winter and I can ride it all the time. Last 6 months rode 8000kms. I think the single biggest pondering point for me was whether I would use the bike enough. The fact that Chandigarh has good roads helped. After buying the bike I realized that my office commute was more fun. That in itself was serious motivation. The bike reduces stress levels like anything. Heat apart, the only other irritant is the mindless horde of selfie clicking zombies that throng the bike everywhere. Coming to the point, why aren't people buying big bikes? I think it's to do with the way our new generations are getting programmed... Hail a cab via app rather than drive yourself, go on a mushy spa trip rather than rough it out in the countryside. It's a culture change. The new yuppie generation is molly coddled and going soft. They hide behind a veil called practicality. Well big bikes aren't practical in India that's for sure, but they are the most fun you can ever have. Also, the cost of ownership, high prices thanks to obnoxiously high taxes, play a deterrent to people buying their dream machines. My harley cost more than my XUV. I still get to hear that from my wife. So unless taxes become reasonable(are they ever?), people remain 'practical' (uber sasta hai, why buy a car), roads stay clogged, we can safely assume that there won't be a resurgence in the 500+ segment. Unless of course a bigger RE or cheaper Versys comes along and current 300-390cc owners do a practical upgrade. |

| |  (5)

Thanks (5)

Thanks

|

| The following 5 BHPians Thank Rathore_13 for this useful post: | Arvi95, giri1.8, Red Liner, roby_dk, udainxs |

| | #38 | |

| BHPian Join Date: Feb 2016 Location: Pune

Posts: 640

Thanked: 1,163 Times

| Re: Sales of 500+ cc bikes fall in 2017-18. Why? Quote:

I don't know the road/traffic conditions of Chandigarh. But in Pune/Bangalore and most Indian cities daily office commute with Harley at peak times will be pure torture. Also I have way more fun riding my Duke than I had riding Street 750 and Iron 883. | |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank timuseravan for this useful post: | AtheK, PrasannaDhana |

| | #39 | |

| Distinguished - BHPian  | Re: Sales of 500+ cc bikes fall in 2017-18. Why? Quote:

| |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks AtheK for this useful post: | Rathore_13 |

| | #40 |

| Distinguished - BHPian  Join Date: Aug 2006 Location: Bangalore

Posts: 5,271

Thanked: 18,704 Times

| Re: Sales of 500+ cc bikes fall in 2017-18. Why? One thing most folks don't realize is that almost every single 600CC+ motorcycle sales/service point is available only in Tier 1 Cities. And most folks chiming in here are from Tier 1 Cities. Harley, Kawasaki, and Triumph have recently begun making inroads into Tier 2 cities with sales and service centers. Trust me, this is where the real buying population actually resides. People here don't ever take loans to buy things they want - they just buy it. About 90% of Tier 1 buyers comprise of employees who need to take loans. About 95% of Tier 2 buyers comprise of business men/land owners. These numbers are not backed by stats, but just my understanding after having traveled to most of these places and also noticing owners of SBK's from these cities making the trudge to Tier 1 cities for service. Cash Rich Tier 2 cities like Coimbatore, Mangalore, Nagpur, Indore, Kochi, Trivandrum, Panjim, etc are going to drive growth for the SBK market in the next few years. All three manufacturers listed above have already detailed plans to set up in these cities within this calendar year. Business people from these Tier 2 Cities don't give a bloody damn about any argument against big capacity motorcycles on this thread. Hell, they are probably not even members here. For them, it is a childhood dream + prestige + just having that motorcycle parked in the garage of their lavish bungalow. Riding be damned. No offence at all to anyone - people buy motorcycles for various reasons - more the merrier! Last edited by Red Liner : 27th March 2018 at 12:17. |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank Red Liner for this useful post: | InControl, jpcoolguy, Shubhendra, YaeJay |

| | #41 | ||||||||

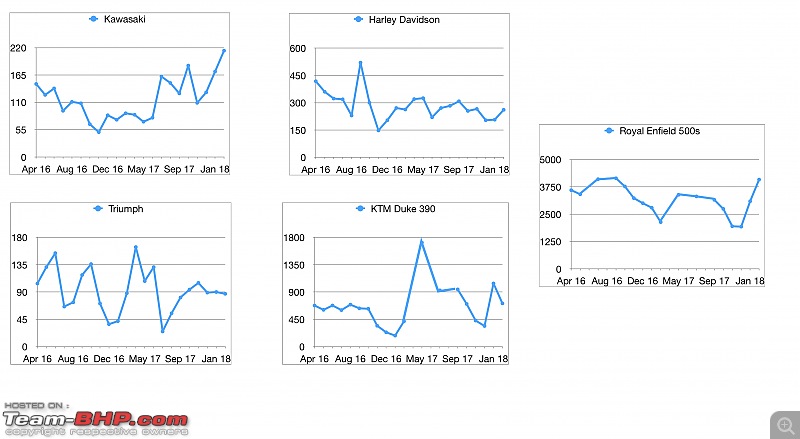

| Team-BHP Support  | Re: Sales of 500+ cc bikes fall in 2017-18. Why?

Thread has grown pretty large enough, but with my humble little experience living a big bike dream and being in a thankful position of having many friends living their dreams - I feel that most of the replies are not really on the dot. So, here's some work to plot down whatever data we have available (Mainly thanks to Autopunditz). * KTM 390s and RE 500s for comparison sake as many members refer to it. SIAM data does not include them. Quote:

1. Harley Davidson, as you can see from the charts - is generally on a decline, though I will not rule them out so fast. Infact, I believe they have big potential in India, as we have discussed earlier in some of the Harley global threads. A brand everyone tends to miss, and for which data is not really available easily is Benelli - and I'm willing to bet that they have been hit really bad during the previous year. Unlike Harley, I dont see a future for this company in India, now that DSK is in a big mess of its own. 2. You are right about the bikes from the below segment getting really good - and one bike in particular is a giant killer. No points for guessing - its the KTM Duke 390. Internationally, the 390s are viewed as a baby step to graduate to bigger and better motorcycles. However, the Duke enjoys two big factors in the Indian context - 1. That is almost a superbike in the Indian road and traffic conditions and 2. That the tax structure in India makes it a brilliant value proposition. It is certainly more bike for the money than any other bikes a segment above (All of which tend to attract big taxes for CKD / CBU assembly). This makes it difficult for the 390 owners to upgrade to a nearby segment, when they consider what less they get compared to the big money they are required to spend. But that said, the KTM 390 and RE 500 sales have been pretty consistent during the period, and they didn't witness much of growth either to eat into superbike sales. 3. Many preowned bikes in the market as well, with very low numbers on the odo. Most of these superbikes are not at all practical in the Indian context, and most owners do very less kms a year. Not pointing fingers at anyone in particular, but a casual glance at our ownership threads clearly suggest that it is the tourer (including sports & adventure tourer) class of motorcycles that enjoys good miles and most other styles like nakeds, superbikes, cruisers etc are really not very practical for our conditions - resulting in them being used only once in a while or for very special occassions. Fact is - Most new buyers didn't really knew what they were getting into. Many of them "upgrade" to more sensible options from the used bike market instead of new, thus minimising their financial damage. 4. New launches or the lack of it has also contributed to the scene. As seen from the graphs - it is clear that the most aggressive company during the last year (Kawasaki) has clearly seen growth amidst this slowdown whereas the others have slipped. The growth of Kawasaki was largely driven by new launches like the Versys 650, 2017 Ninja 650, Z900, Ninja 1000, Vulcan S etc - most of them having touring orientations. 5. Effect of the price drop should help push more sales soon - but speaking of the period under consideration, most of the prices went rather skywards. The Harley Street range and Triumph Boneville range for example saw a lot of price inflation during this period - affecting sales of what is essentially their entry level bread and butter models. Harley is offering big discounts on the Street range now (Since the Vulcan arrived) and it should help recover some sales for them in the coming months. Also, there is a renewed enthusiasm in the market thanks to the tax drops. I personally think there will be a slight growth witnessed during the same period next year. Quote:

Quote:

However, Street was on the decline, no doubt. The combined numbers of Street 750 and Street Rod is still less than the numbers achieved by the Street 750 alone in the previous year. Harley has more to worry about - since the Vulcan S launched by Kawasaki seems to have got off to a good start too. Many would prefer a Japanese competition with a proven reliable motor. Quote:

I believe the market is finally maturing from snob value to selecting big motorcycles that are actually suitable for the Indian context. I can see many BHP'ians upgrading to bikes like the Versys 650, Tiger 800, Ninja 1000 etc over the likes of the Harleys, Zs, litre class superbikes etc. See any of the ownership report for these kind of bikes and you see how they are being used the way a big bike should be - rather than spending time inside the garage waiting it out for different seasons to get over - monsoons cause roads are wet, summer because bike heats up and what not! Quote:

But I wouldn't really agree regarding the Bullet though. Highest number of upgraders in Versys and Tiger groups seem to be coming from Bullets, with some of them having a Harley for sometime in between. The next big segment is that of upgraders from the 390s, those who have got used to the power of it and explored the country with it - but seeking more practical, comfortable and safer options to upgrade to. Agree with your other points, except this one. None of the cars in any comparable price range have aspirational value anywhere close to a big capacity motorcycle. They make practical sense, no doubt. But a Baleno RS for example is absolutely nothing in front of something like a Triumph Tiger, the former will mostly be left drooling if one turns up next to him. A gang of 6L - 15L motorcycles can turn heads and attract a big crowd even in the presence of a good number of 50L cars (BMWs, Audis, Mercs etc). Quote:

Quote:

Secondly, the bikes have to be maintained at-least as per the stock specs. Most superbikes at rentals have the cheapest tyres possible, many even downsized just to save up on costs. Some have tyres with rather ridiculous speed ratings and some are pushed to the extreme end of their tread life. Not a safe option to enjoy sensibly, IMO. Quote:

Infact, I think the future has good potential for 500cc plus capacity motorbikes - 1. KTM 790, built in India, whenever it arrives. 2. Bajaj - Triumph partnership. 3. Kawasaki focussing on service network, spares localisation and more local assembly. 4. Trump batting for Harley and possible further reduction in duties. 5. Royal Enfield twins. The market is slowly but steadily moving upwards, for sure. Last edited by CrAzY dRiVeR : 27th March 2018 at 13:07. | ||||||||

| |  (20)

Thanks (20)

Thanks

|

| The following 20 BHPians Thank CrAzY dRiVeR for this useful post: | abhijeet080808, alphadog, aravind.anand, ebmrajesh, Full_Minchingu, Geo_Ipe, GTO, InControl, jpcoolguy, LordSharan, MaddyCrew, mh09ad5578, myavu, pixantz, Red Liner, Shubhendra, SmartCat, timuseravan, vishy76, YaeJay |

| |

| | #42 |

| Distinguished - BHPian  Join Date: Aug 2006 Location: Bangalore

Posts: 5,271

Thanked: 18,704 Times

| Re: Sales of 500+ cc bikes fall in 2017-18. Why? CrazyDriver, very well written man. You should seriously look at automotive journalism as a paying career switch. I am not joking at all! |

| |  ()

Thanks ()

Thanks

|

| | #43 | |

| BHPian Join Date: Apr 2009 Location: .

Posts: 489

Thanked: 131 Times

| Re: Sales of 500+ cc bikes fall in 2017-18. Why? Quote:

These are the main reasons for me why I wont be going in for a 650 now. I think the KTM 390 twins are taking a big chunk off the bigger bikes, since it pleases some riders. | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks YaeJay for this useful post: | Red Liner |

| | #44 | |

| BHPian Join Date: Apr 2013 Location: Toronto

Posts: 393

Thanked: 957 Times

| Re: Sales of 500+ cc bikes fall in 2017-18. Why? Quote:

| |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank voyageur for this useful post: | agbenny, mh09ad5578 |

| | #45 |

| Senior - BHPian Join Date: Apr 2010 Location: Zurich

Posts: 2,964

Thanked: 3,560 Times

| Re: Sales of 500+ cc bikes fall in 2017-18. Why? Some reasons as I see it: - Safety issues for the rider; a lot of fatal accidents have been reported of late. This of course triggers the activation of parental controls - Aspiring biker population is already covered with existing bikes on the roads (including used market). Extending market to Tier 3 cities is another challenge altogether. - Visibly (and audibly) a target for vandalism; as shown in the recent incident near Bangalore - Bike rental services; or borrowed bikes from friends; or extended test rides taken to 'scratch the itch'  - Not everyone may be looking for a faired superbike. There could be many 'midlife crisis' people looking for a decent cruiser in a similar budget. What are their options today in this budget? Last edited by selfdrive : 27th March 2018 at 15:53. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks selfdrive for this useful post: | InControl |

|