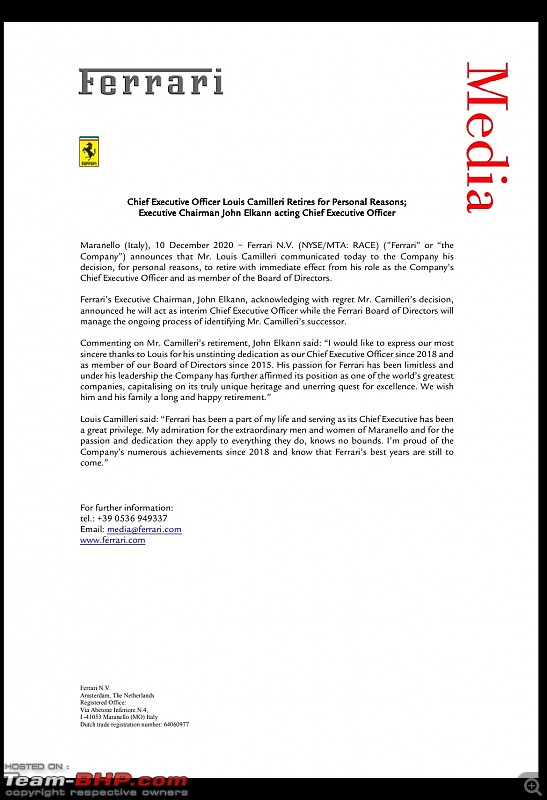

| Re: Ferrari CEO Louis Camilleri announces retirement

Surprised to hear he’s leaving Ferrari- he’s done a good job managing Ferrari during a challenging environment.

This is what a serial supercar owner has to say on the Q3 results of Ferrari - he owns an F40, F50 and does an brief analysis on quarterly results of Aston Martin (which is a train wreck according to him) McLaren and Ferrari. Quote:

On the Ferrari Q3 2020 Earnings Call, CEO Louis Camilleri comes off as both understated and completely in control. The earning’s call webcast is posted: Ferrari Q3 Earnings Call. There were some specific comments that I found interesting:

Electric Vehicles: Longer term Ferrari sees the move towards hybrid/EV as being margin accretive but has no plans to move to 100% EV and Camilleri doesn’t even see them reaching 50% in his tenure.

Portfolio: This year Ferrari has introduced two new models, the Roma and SF90 Stradale which are additions to their portfolio and not replacements of older models. While the Roma appears to be targeted at younger and new users, the hybrid SF90 has been dropped into a no man’s land between supercars and hypercars. Both add a considerable amount of production complexity and are unlikely to be margin accretive to the total portfolio. As a reference on the added complexity in the Ferrari supply chain, they will produce a total of 14 different models in 2020, up from 6 in 2010.

Product Mix & Profitability: Ferrari’s Q3

profits were €171 million up €2 million vs. Q3 2019. Reading through the report and comments, it would appear that it’s the Icona range Monza SP1 & SP2 that’s driving the gain. Icona was 2% of Ferrari’s Q3 production mix but over delivers on profitability per unit (in 2019 Icona was less than 1% of total production). 42% of the Monza SP1s & SP2s delivered YTD came in Q3 and that increase in units would certainly have swung Ferraris profitability from a potential year on year decline to a gain. Ferrari also flexed production to favor all the more profitable V12s with the mix rising from 24% in 2019 to 27% in Q3 2020 (total car revenues increased by €19 million Q3 2020 vs Q3 2019). If the reliance on the Icona range to goose profitability sounds familiar it’s because it’s a similar situation to the one McLaren put itself into. In McLaren’s case they became heavily dependent on the margins generated by the Ultimate Series and as a result ended up producing far too many models too quickly. In Ferraris case, unlike the LaFerrari where demand far outstripped supply, the Monza SP1 & SP2 were a much harder sell and Ferrari got plenty of push back from some of their longest term, most loyal, customers. In the call, it was mentioned that Ferrari would be launching one more model this year. This new model will most likely be in the Icona range and rumors point to it being a 21st century homage to the “F40”. What the demand is for a rebodied F8 or SF90 at $1.5-2 million right now is highly questionable.

Manufacturing Shutdown: The Covid-19 shut down cost Ferrari 2000 units in terms of lost production. Currently Ferrari is on track to recover 500 of these 2000 units. This is a clear indication that Ferrari has little to no excess manufacturing capacity in the system, but they do have the ability to switch the capacity across models as V8 production was down 12.8% and the more profitable V12s up by 15.4%

Order Backlog & Waitlist: The current waitlist for new cars is around two years which sounds like a great problem to have. In this case it does come with considerable risk. Ferrari has spent considerable efforts attracting new and younger consumers especially in the Asian markets. The Roma is doing very well against this target with orders running 50% above where the Portofino was in the equivalent time post launch. The risk and concern here is that it’s likely that a number of these people get tired of waiting, drop off, and look for alternative options.

Cash Flow: I was a bit surprised that there was no discussion around the major drop in free cash flow and the potential impact going forward. Current 2020 guidance is €150 million down from €700 million in 2019. This will likely have a significant major negative impact on investments in the short term.

Racing & Stores: The Formula 1 team is a major drag on Ferrari’s finances this year as are the Ferrari Stores where in store traffic has dropped significantly. The combination of store traffic declines and the lack of general competitiveness in F1, in particular Vettel’s SF1000 looks like its running on only half the cylinders in most races, will result in a financial hit of somewhere around €130 million in my estimation.

Overall, Ferrari has, and continues to be, very well managed.

|

Source : https://karenable.com/ferraris-q3-2020-results/

Sounds like Louis Camilleri was doing a good job managing Ferrari (from a business point of view) Will his replacement be as good as him? Only time will tell. Under his leadership, Ferrari shares rose around 50% and have hit record levels.

Also the 3 cars developed under him (Roma, SF90 Stradale and Monza SP1/SP2) are seriously impressive. Lamborghini, McLaren and Aston Martin have reason to be worried.

@BHPian Meta - any inputs?

Last edited by Aditya : 12th December 2020 at 04:40.

Reason: As requested

|

(3)

Thanks

(3)

Thanks

(2)

Thanks

(2)

Thanks

(5)

Thanks

(5)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(3)

Thanks

(3)

Thanks

(1)

Thanks

(1)

Thanks

(3)

Thanks

(3)

Thanks