Thanks Aditya for the Feb sales data and analysis:

Some more points to be noted:

The budget, BS4 discounts fails to bring cheer to the Auto. The industry declined in Feb by ~6.8 % Y-O-Y with many reporting negative growth. The Industry is currently reeling to liquidate BS-4 stocks and all efforts are aligned in the direction.

The Auto Leader has managed the transition to BS6 very well with over 80% of its portfolio now being BS6 compliant.

Even though Maruti Suzuki has seen a negative growth, it has ring fenced market share at 53% it leaves the second player Hyundai behind at 16%.

Kia created history by becoming the No.3 OEM in the shortest span of time. This feat was achieved within 7 months of sales operations and is a record by itself! Kia overtook the biggies like Tata, Mahindra, and Toyota & Honda to place itself in the Top 3 manufacturers list. Kia ( 6.2%) and Hyundai (16 %) together now records a healthy 22 % Market Share.

Unpreparedness in BS6 transition and COVID19 has seriously affected Mahindra’s production and the OEM registered a massive drop of -56%. The drop led M&M to slid into the No.5 OEM position and it also lost -4.8% Market Share in Feb’20 v/s Feb’19.

Tata Motors is not gaining any ground even with new launches in hand. Even post Altroz’s launch the Indian OEMs volumes dipped -31% YoY.

The biggest losers for the month are Mahindra’s and Honda (biggest market share drop)

Highlights for Jan-20

- Kia becoming the No.3 OEM in the shortest span of time.

- Maruti Suzuki gains market share of 2.4 %

- The Top 3 OEMs collectively shall command a humongous Market Share of 75.5%

Maruti Suzuki: The OEM anticipated the BS6 turmoil much well in advance and prepared its entire portfolio for transition. Even one of its bestseller Brezza went through the change and petrol only Brezza was launched in Feb’20. However; it is yet to be seen how the strategy shall turn out in long term. Basis Feb’20 performance alone; Maruti dominated the Market Share and registered over 53% MS.

Highlights: Maruti Suzuki now has almost all its cars leading in their respective segments. Would be interesting to see how Maruti Suzuki’s sales position is affected as BS6 rolls out from April 2020.

Hyundai: Hyundai too falls in a negative growth at 7%, loses market share and is now at ~ 16 %.

Its new launch Aura seems to have received a lukewarm response, need to see even if these numbers are sustained in the long run.

Highlights: Hyundai had 2 offerings in the Top 10 (Venue & Grand i10. Venue loses its leadership volumes and contributes to Hundai’s loss in market share.

Would be interesting to see the volumes post BS6 as Hyundai has upcoming new launches like Creta and i20 .

KIA: Kia created history by becoming the No.3 OEM in the shortest span of time with just 2 products in their portfolio. Market share grows to 6.2% which leaves established players like Tata’s and Mahindra’s in distant 4th and 5th in the listing.

TATA: Tata Motors is not gaining any ground even with new launches in hand. Even post Altroz’s launch the Indian OEMs volumes dipped -31% YoY.

Mahindra: Gaps in BS6 readiness, COVID19 have seriously affected Mahindra’s production and the OEM registered a massive drop of -56%. The drop led M&M to slid into the No.5 OEM position and it also lost -4.8% Market Share in Feb’20 v/s Feb’19.

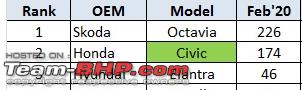

Volkswagen/Skoda: Nothing great for them, but has announced their new line up of diesel free portfolio in the mass market products. With its niche offerings in the form of CBU’s, that is how they can be in the limelight till mid-2021, when their SUV heavy portfolio kicks in. Even with this Skoda is still leading in two Luxury segments – Luxury and Premium sedan segments.

Entry Level: Maruti Suzuki dominates all the way!

Compact Hatchback:

Compact Hatchback: Swift, WagonR, Celerio does the trick for Maruti.

Premium Hatchback:

Premium Hatchback: Baleno+ Glanza =

19245  Compact SUV:

Compact SUV: This month it is Venue in the lead, Brezza's acceptance in its petrol guise will be known in coming months

MPV:

MPV: Ertiga+XL6 =15,668

Compact Sedan:

Compact Sedan: Dzire is another car whose market response is to be seen when BS6 kicks in

Mid-size Sedan:

Mid-size Sedan: Ciaz in its BS6 variant leads the segment.

Premium Sedan:

Premium Sedan: Skoda consistently leads this and the Luxury sedan segments

Luxury Sedan:

Luxury Sedan:  Mid - SUV:

Mid - SUV: The battle between Seltos and Creta will be interesting to see in April

Premium -SUV:

Premium -SUV: Toyota Fortuner is the consistent star here.

Source: Auto Punditz

(21)

Thanks

(21)

Thanks

(15)

Thanks

(15)

Thanks

(9)

Thanks

(9)

Thanks

(11)

Thanks

(11)

Thanks

(5)

Thanks

(5)

Thanks

(13)

Thanks

(13)

Thanks

(19)

Thanks

(19)

Thanks

(9)

Thanks

(9)

Thanks

(3)

Thanks

(3)

Thanks

(5)

Thanks

(5)

Thanks

(7)

Thanks

(7)

Thanks

(3)

Thanks

(3)

Thanks

(11)

Thanks

(11)

Thanks

(6)

Thanks

(6)

Thanks

(5)

Thanks

(5)

Thanks