| BHPian

Join Date: Aug 2009 Location: Kolkata

Posts: 305

Thanked: 26 Times

| Re: The Official Fuel Prices Thread

There is nice article about fuel pricing published in the "The Telegraph", Kolkata on 5th & 6th November, 2012. http://www.telegraphindia.com/112110...p#.UJoBhMXqnTo http://www.telegraphindia.com/112110...p#.UJoBtMXqnTo

I am re-producing the article as it is for the benefit of readers. Part I Quote: HOW IT ALL ADDS UP

- Towards a more meaningful petroleum pricing policy

Dipankar Dasgupta & Tushar Kanti Chatterjee

The prices of petrol, diesel, kerosene and liquefied petroleum gas, the four most sensitive of oil products in India, have mostly been administered by the government. As reflected in the price build-up formulae published by Indian Oil Corporation Ltd, Hindustan Petroleum Corporation Ltd and Bharat Petroleum Corporation Ltd, the so-called ‘desired’ Indian prices of these products (except for petrol) are computed by adding to the internationally ruling free on board, prices in Gulf countries (1) the import costs (customs duties, ocean freight, insurance and port charges), (2) the inland freight-cum-delivery costs and, finally, (3) the costs and profit margins of oil marketing companies run by IOC, HPCL and BPCL. The ‘desired’ prices arrived at in the process turn out to be too high according to the government. Consequently, lower ‘administered prices’ are fixed by the petroleum ministry, thereby generating a shortfall from the desired prices. This shortfall is described as an ‘under-recovery’ for the OMCs, which is claimed to be the raison d’être for oil-sector subsidization.

The procedure adopted for computing the ‘desired’ prices is questionable, however, since the final products so priced are mostly produced at home and not imported. Subsidies are normally in order when the cost of production exceeds the price of the final product, a matter totally unrelated to ‘under-recoveries’ from imported final products. What, then, is the cost structure for the critical petroleum products, and how would it relate to the revenue generated by a meaningful cross-subsidized administered pricing scheme?

To answer this question, we estimate the potential revenue surplus of oil refineries and marketing corporations. The latter is then viewed as a possible source of tax revenue for the Central and state governments. To begin with, we design a pricing scheme and apply it to the actual consumption data for the year, 2011-12, since the data for the financial year 2012-13 is not yet available.

The Pricing Scheme

Petrol: Petrol is an item of final consumption. Its price has little impact on inflation through forward linkages. Also, it is consumed by the relatively affluent sections and need not be subsidized. Thus, the price of petrol is fixed higher than the average 2011-12 international price (Rs 35.39 per litre) at Rs 60 per litre, which still falls short of the 2011-12 average petrol price of Rs 64.43 in India.

Diesel: According to the Parikh Committee Report on a Viable and Sustainable System of Pricing of Petroleum Products, the consumption pattern of diesel in India was: railways — 6 per cent; trucks — 37 per cent; buses — 12 per cent; taxis — 9 per cent; agriculture — 12 per cent; industry —10 per cent; power generation — 8 per cent; and private cars — 6 per cent. Thus, the diesel consumption for railways, trucks, buses, taxis and agriculture accounts for about 76 per cent of the total consumption, while that for industry, power generation and private cars constitutes the balance of 24 per cent. In other words, 76 per cent of the diesel consumed needs to be subsidized. We suggest the subsidized diesel price to be Rs 35 per litre, thereby ensuring that their impact on prices of essential commodities is bearable, and the non-subsidized price to be Rs 60 per litre.

Even if difficult to implement, a differential pricing formula for diesel can be sustained only through direct cash transfers. Every truck, taxi, bus and tractor should have a unique number assigned through radio frequency identification chips, which new vehicles already carry. The petrol pumps will scan the unique number for generating retail shop bills and sell diesel at a uniform price of Rs 60 per litre to all consumers. However, the drivers or owners of transport vehicles and tractors will receive a subsidy of Rs (60 - 35) = Rs 25 per litre per month against the deposit of original bills to designated authorities. Similarly, farmers may be allowed to use a maximum of 15 litres of diesel for each bigha watered by diesel pumps and receive a subsidy of Rs 25 per litre per bigha.

Kerosene: Estimates suggest that 35 per cent or more of public distribution system kerosene is diverted to take advantage of higher market prices. A single price in the market must therefore prevail as in the case of diesel. We suggest this price to be Rs 40 per litre. The subsidized price of PDS kerosene will be Rs 13.70 per litre for 65 per cent of total kerosene consumption. As with diesel, ration shops could sell it at a uniform price of Rs 40 per litre. The ration or BPL card-holders would need to open bank accounts in nearby nationalized banks. Under this arrangement, they would receive bank transfers of Rs (40 – 13.7) = Rs 26.30 per litre of kerosene purchased every month. The panchayats, too, may be roped in to ensure that the subsidy scheme is properly implemented.

LPG: The Parikh Committee observes that, on an annual basis, rural households consume 6 to 9 cylinders, whereas urban and semi-urban households use 9 to 20 cylinders. The figures suggest a yearly average urban household consumption of around 14 cylinders and rural household consumption of 9 cylinders. The supply of subsidized domestic LPG could therefore be rationed to one cylinder per month (that is, 30 days) for each household (as opposed to the 6 cylinders per year proposed by the government). We expect that around 10 per cent of the population will consume more than one cylinder per month.

The unsubsidized domestic LPG may be priced at Rs 800 per cylinder (operative for a second cylinder purchased within 30 days of the last purchase). The subsidized price is fixed at Rs 400 per cylinder. Also, as decided by the government recently, a common database of subscribers will locate families with multiple LPG connections in order to lock the extra connections.

The consumption pattern of these four essential petroleum products for the year, 2011-12, their actual internationally prevailing prices, the suggested rationed prices and the total revenue the latter would generate, assuming unchanged consumption rates, are presented in the table. As the table shows, at unchanged consumption levels, a total revenue of Rs 5,14,746 crore would be generated in 2011-12 from domestic consumption alone.

The prices suggested should not be treated as rigid in nature. Depending on the international scenario, our own prices will have to change too. However, through frequent monitoring (for example, once every fortnight) the price increases need to be absorbed as far as possible by petrol, unsubsidized diesel (24 per cent) and unsubsidized LPG (10 per cent).

The table assumes that the consumption pattern for 2011-12 would not be affected by the proposed alternative price structure. This assumption is motivated by the fact that till the arrival of alternative energy sources, petro-product demands are not expected to vary too much in response to price changes. Further, our rationing scheme depends on the success of the direct cash subsidy proposals. One expects that a sincere effort on the part of the Central government to improve this scheme, instead of mindless tinkering with prices, will contribute substantially towards solving the petro-pricing dilemma.

We proceed next to estimate the crude oil consumption related costs.

D. Dasgupta is a former professor of economics, Indian Statistical Institute. T.K. Chatterjee is a project and management consultant to the S.K. Birla Group

....TO BE CONTINUED | Part II Quote: HOW IT ALL ADDS UP

- From deficit to surplus

Dipankar Dasgupta & Tushar Kanti Chatterjee

Cost of Crude Oil: The Indian and Imported Crude Mix

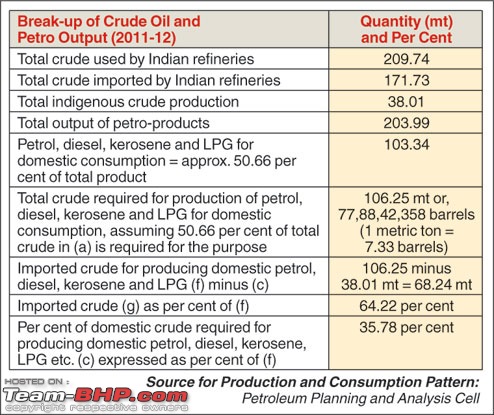

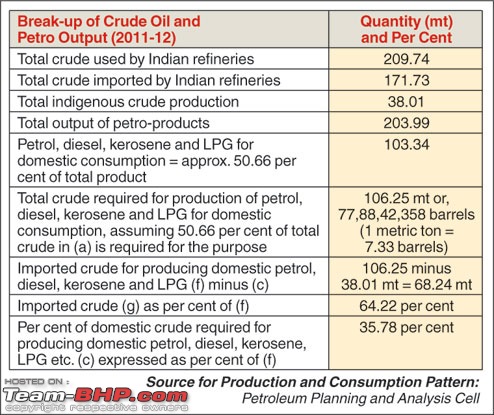

The total crude oil consumed by Indian refineries in 2011-12 was 209.74 million tonne, of which 171.73 mt was imported and 38.01 mt domestically extracted. The total production of petro-products by Indian refineries was 203.99 mt. Around 50.66 per cent of this total output, or 103.34 mt, consisted of petrol, diesel, kerosene and liquefied petroleum gas for Indian consumption. Technology suggests that the same percentage of the total (imported and domestically produced) crude mix, or 106.25 mt (or approximately 77,88,42,358 barrels), was needed to produce the petrol, diesel, kerosene and LPG for Indian consumption. The aggregate quantity of domestic crude produced (38.01 mt) turns out to be 35.78 per cent of the above calculated total mixed crude needed. This leaves a balance of (106.25 – 38.01) mt = 68.24 mt of imports to bridge the shortfall of crude mix required for the four essential products for domestic consumption. The latter equals 66.22 per cent of the total mixed crude used up. The crude cost calculations are summarized in the top table.

Thus, the average price of a barrel of the mixed crude should be calculated by attaching a weight of 64.22 per cent to the import price and 35.78 per cent to the indigenous price. This calculation is presented in the bottom table.

Thus, the total value of mixed crude used to satisfy the domestic need for the four products was Rs 3,91,101 crore. The balance amount of imported crude, (209.74 – 106.25) mt = 103.49 mt, was used to produce items other than the four major products for domestic consumption considered so far. These consisted of naphtha, ATF, LDO, lubes, furnace oil, LSHS, bitumen, asphalt and other exported petro-products.

Surplus Generated by the Suggested Pricing Scheme and Fiscal Gains

Under the adopted pricing scheme, the revenue net of crude cost of producing the four essential products (for domestic use) is then Rs 5,14,746 cr – Rs 3,91,101 cr = Rs 1,23,645 cr. This surplus would need to cover refinery expenses and margins, dealer commissions, VAT as well as Central taxes. As per the information available from the websites of the oil companies, the relevant figures for the year, 2011-12, were as follows:

Refinery Expenses: The total expense of the refineries (including power and fuel cost, employee cost, other manufacturing, selling, administrative and miscellaneous expenses) was Rs 48,520 cr and their interest and depreciation charges amounted to Rs11,369 cr. Assuming as before that 50.66 per cent of the expenditure was incurred in producing the four sensitive products for domestic consumption, their total production cost amounted to Rs 30,340 cr (approx).

Refinery Margin: The total margin of all three refineries was Rs 6,177 cr. Once again, applying the 50.66 per cent argument, the profit derived from the four products should have been Rs 3,129 cr (approx).

Dealer Margin: Based on the dealers’ margin for the four products prevailing in the very recent past, the total margin turns out to be Rs 14,141 cr.

VAT: In lieu of VAT, we suggest a consumption-based tax structure for unsubsidized petrol, diesel and LPG. More precisely, we propose a cess of Rs 10 per litre of petrol and unsubsidized diesel consumed and Rs 50 per cylinder of unsubsidized LPG. The motivation underlying the suggested tax structure is to leave the prices of the products unaffected and uniform across the country. As opposed to this, taxes (such as VAT) charged as a per cent of the price paid will raise prices above the norms we have adopted. Using the consumption figures in yesterday’s table, then, the total revenue generated by the cess for all the states taken together would be Rs 40,049 cr.

After taking account of these four deductions (refinery expenses, refinery margin, dealers’ commission and VAT) from the revenue net of crude cost (Rs 1,23,645 cr), we are left with a net saving of Rs 35,986 cr. This sum is available in its entirety to the Central government. Since our approach is based on cross-subsidization of products alone, the government’s subsidy outgo on oil account is not a part of the calculation. This means that the Central government is relieved of its claimed subsidy burden of Rs 1,41,802 cr for 2011-12, arising out of the so-called under-recoveries and central subsidies. In addition, it will earn an extra revenue of Rs 35,986 cr from the petroleum sector. Thus, instead of sustaining a fiscal loss, the government could have actually gained a sum of Rs (35,986 + 1,41,802) cr = Rs 1,77,788 cr, reducing significantly thereby its total fiscal deficit.

In addition, the trade account in 2011-12 for the oil companies shows a surplus of Rs 1,45,886 cr from the four products alone. Quite independently, there are net export earnings from other petro-products too. The surpluses associated with these other operations also need to be taken into account in calculating the total gain for the government.

PSU Merger as a Cost Saving Policy

Moreover, and this is an oft-neglected issue, a merger of the three PSU refineries will lead to a minimum extra saving of Rs 10,000 cr via cutting down on excess man-power, particularly at the executive level (to wit, Indian Oil Corporation Ltd maintains a highly uncompetitive executive-to-workmen ratio of 1:1.35), as well as operating, capital and overhead expenditures. We expect another 5-10 per cent feasible reduction in the prices of the four products through this channel. Also, a merger of the refineries with the marketing companies — at present, their separation is artificial at best — will reduce costs even further.

This has been a fairly complicated exercise. However, the complication is unavoidable, given the lack of transparency surrounding oil pricing in India. As we have already pointed out, the idea of ‘under-recoveries’ rests on the absurd assumption that oil refineries do not exist in the country at all, when the truth is that our refineries satisfy most of our oil needs and even produce an export surplus from petro-products. Once the imaginary concept of ‘under-recoveries is replaced by the actual revenues and costs of Indian oil companies, the latter will be found to be earning handsome profits and in no need to be subsidized at all. Besides, the claimed fiscal deficit arising out of government subsidies is convertible into a surplus. And since surpluses emerge for lower prices, one wonders what the higher price policy entails.

D. Dasgupta is a former professor of economics, Indian Statistical Institute. T.K. Chatterjee is a project and management consultant to the S.K. Birla Group

CONCLUDED | Source: The Telegrah, Kolkata |

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks