| Re: Q1 2023 : Indian Passenger Vehicle Market Analysis

Let me try to sum up things in Q1 2023 beyond one line. There are headwinds like car price inflation, besides general inflation, a higher interest rate, and the BS6-RDE transition, so order inflow (queries to retail) has moderated for all manufacturers. Fortunately, sentiments (an unpredictable variable) have not turned completely sour yet, unlike in 2013 and 2019 (pre-election years).

Successful products are selling well, as not every income group is equally affected by economic sluggishness or headlines coming from start-ups or tech layoffs. Supply chain constraints are behind us, so most manufacturers have flooded the dealer pipeline and also offered discounts for not-so-successful products to bring in sales.

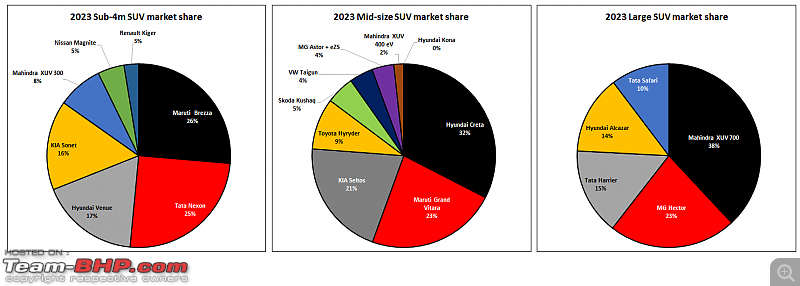

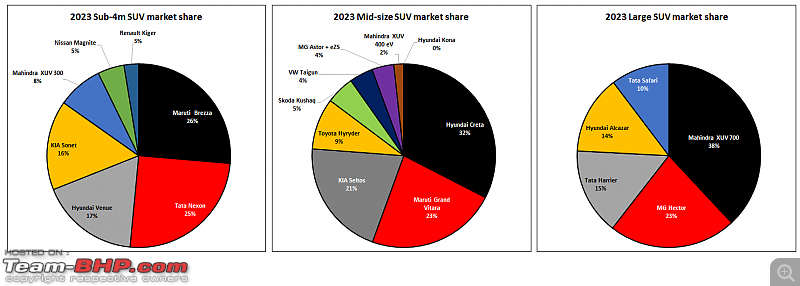

Here are some observations from the SUV category. 2023: mass market monocoque SUV  - The sub-4m SUV race is led by the new generation petrol-only Maruti Brezza, which has a tax advantage (45% GST vs 29%).

- Maruti Grand Vitara beats Kia Seltos in Q1 2023. Hyundai continues its winning streak despite postponing a facelift. Skoda, Volkswagen, and MG struggle to make a mark in the segment.

- Due to strong demand, the XUV 700 leads the large SUV segment, followed by the MG Hector facelift.

2023 premium SUV

With production ramping up, the Hyundai Tucson posted its best-ever sales and also nudged ahead of the seemingly overpriced Jeep Compass. A change in value proposition will change the markets size potential as well.

With production ramp-up, the petrol-only (disadvantage in the SUV segment) Skoda Kodiaq facelift posted its best-ever sales in March 2023 and also nudged ahead of the poorly planned diesel-only (advantage in the SUV segment) Jeep Meridian.

Toyota Fortuner, with over 3,000 monthly sales in 2023, crushed MG Gloster. Quote:

Originally Posted by ReventonLover  Hello. I was just curious to understand, the Q1 growth data has been charted w.r.t. which earlier time period? Was it 2022 Q1 or 2022 Q4? |

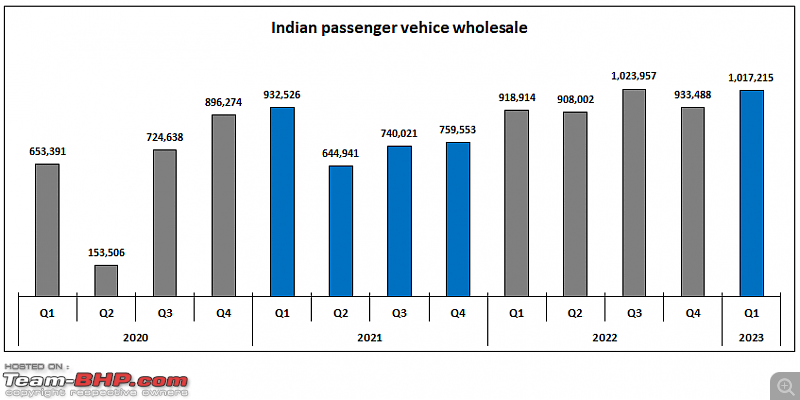

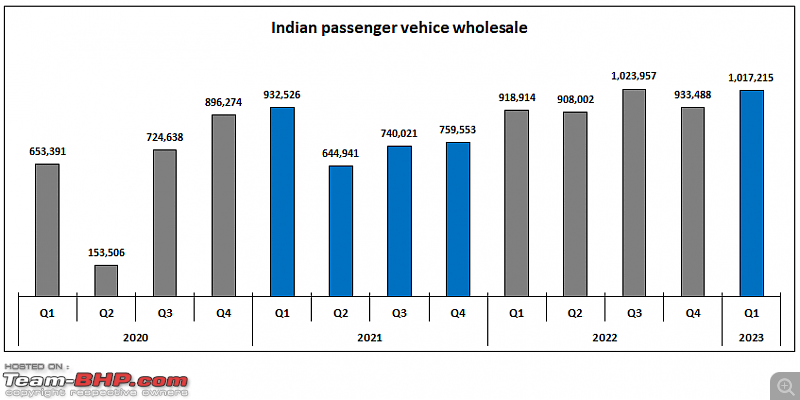

Due to the seasonality factor in the Indian passenger vehicle market, sequential quarter growth (e.g., Q4 vs. Q1) data sets do not give a clear picture, so comparisons are always made for the same quarter of different years. However, the below calendar-year (CY) data set will give a clear picture of how the market is developing during COVID-19 and supply chain disruption.

Last edited by pqr : 8th April 2023 at 20:27.

|

(22)

Thanks

(22)

Thanks

(4)

Thanks

(4)

Thanks

(5)

Thanks

(5)

Thanks

(1)

Thanks

(1)

Thanks

(6)

Thanks

(6)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks