| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  29,293 views |

| | #1 |

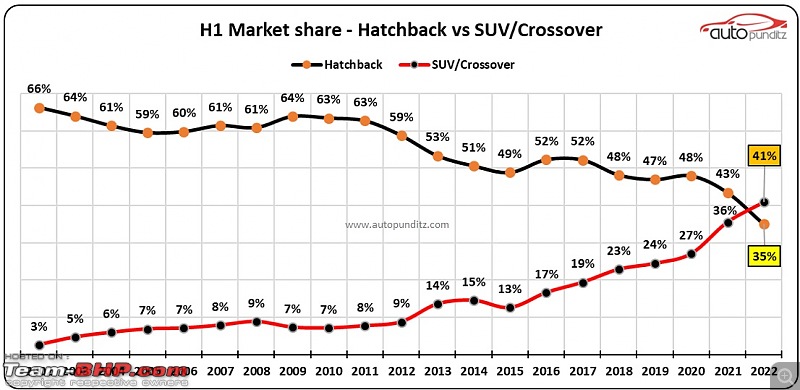

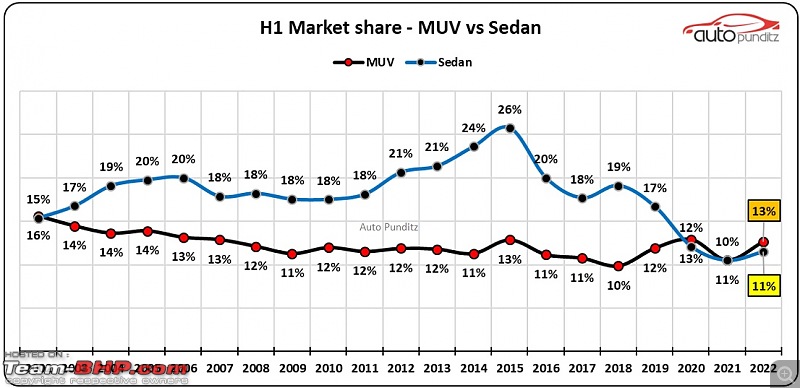

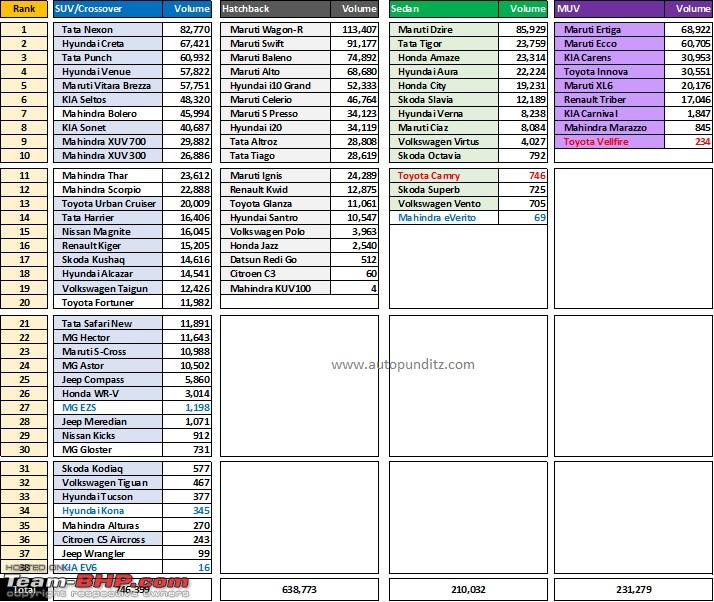

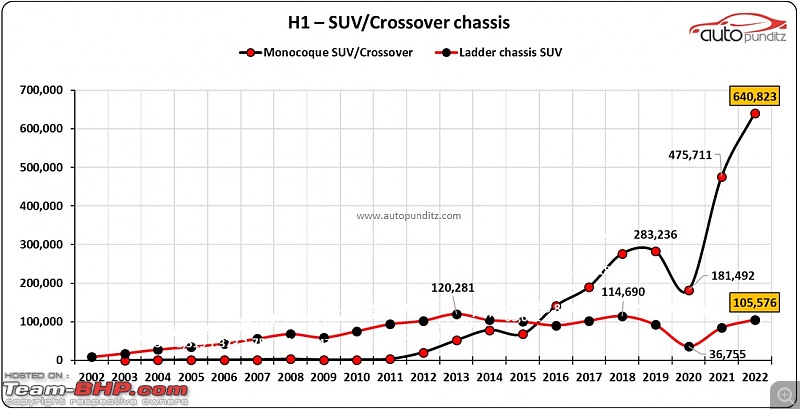

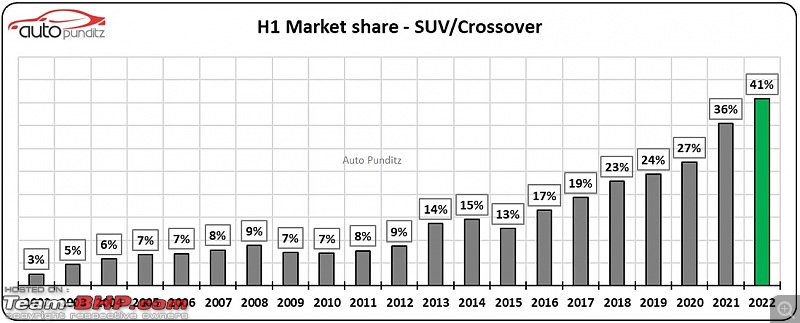

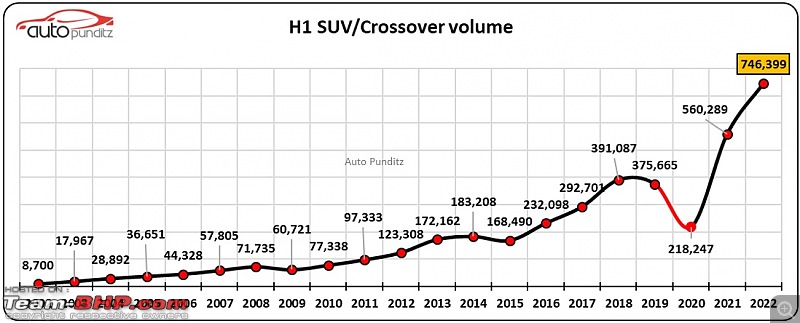

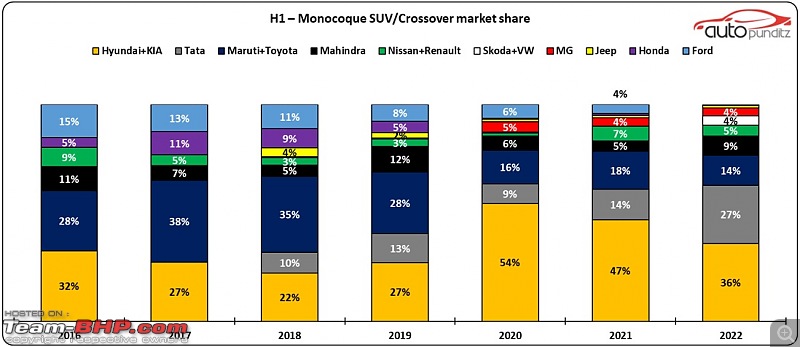

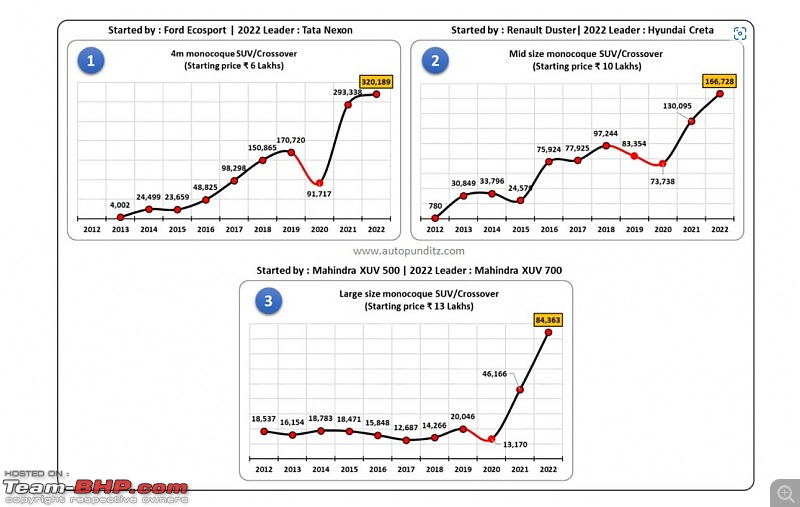

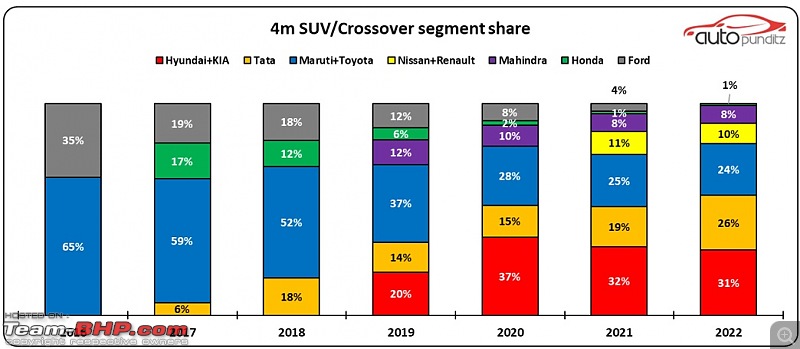

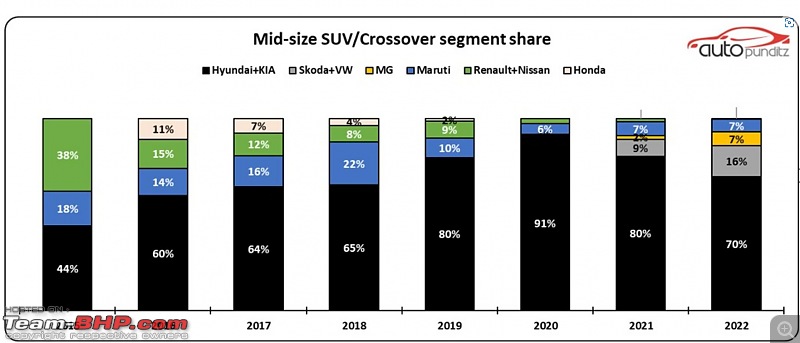

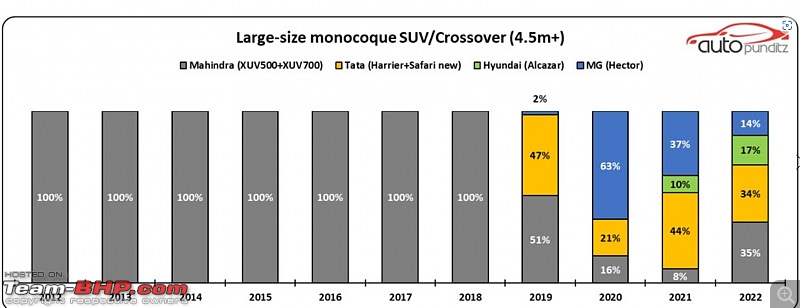

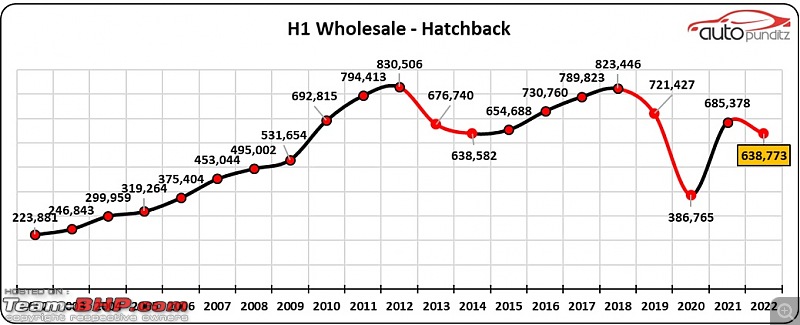

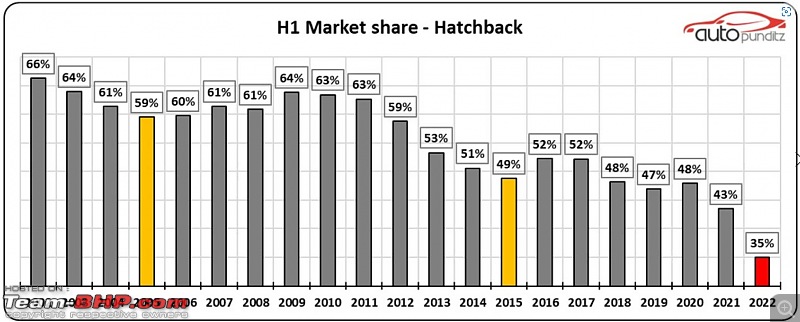

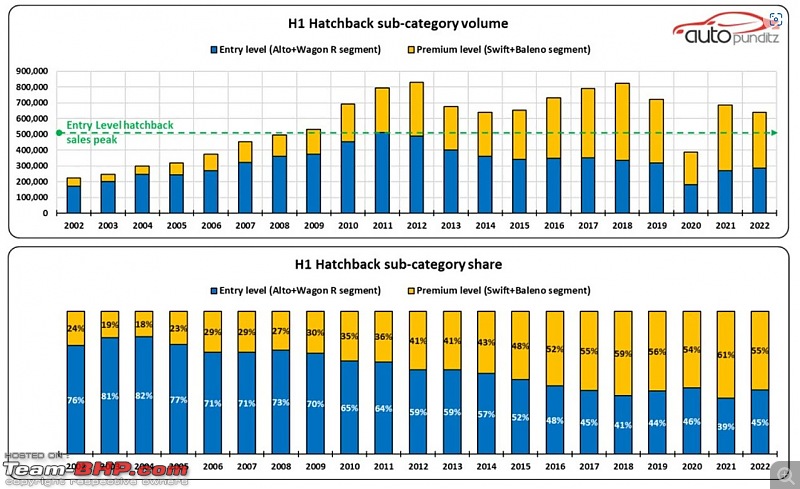

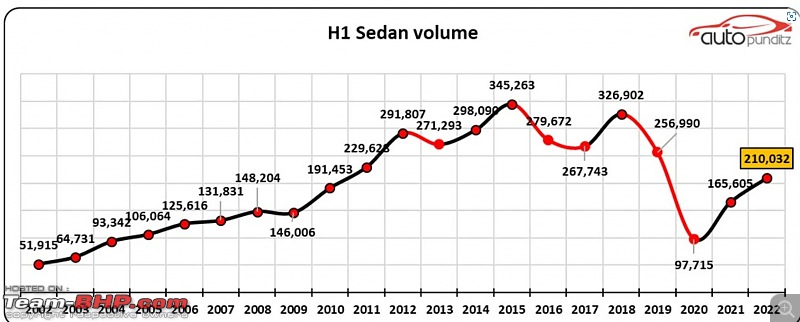

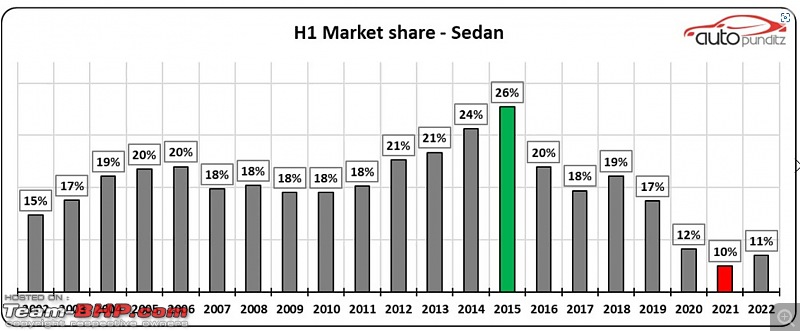

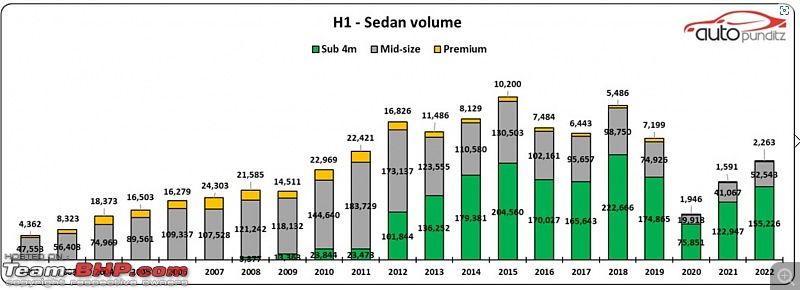

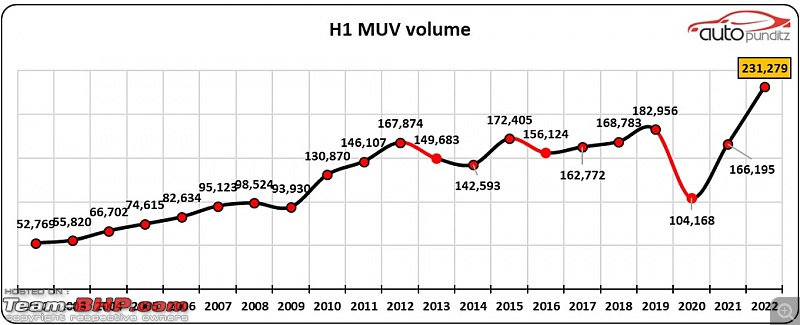

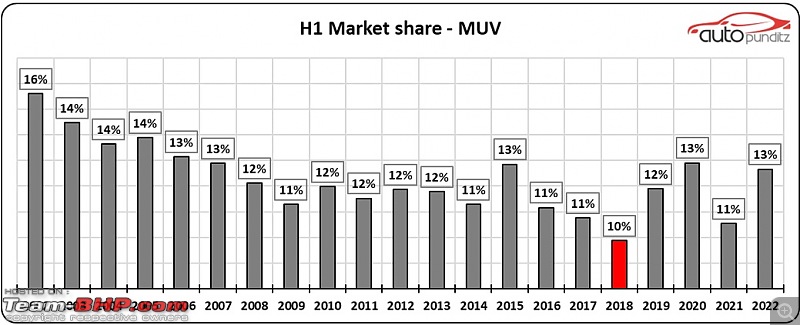

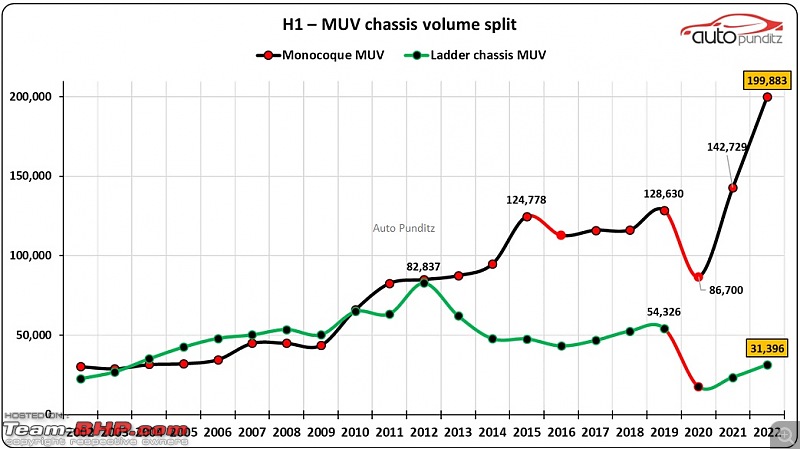

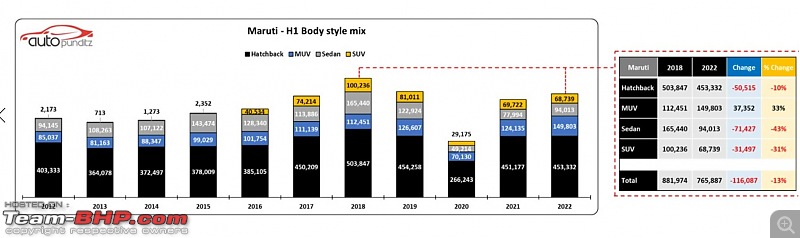

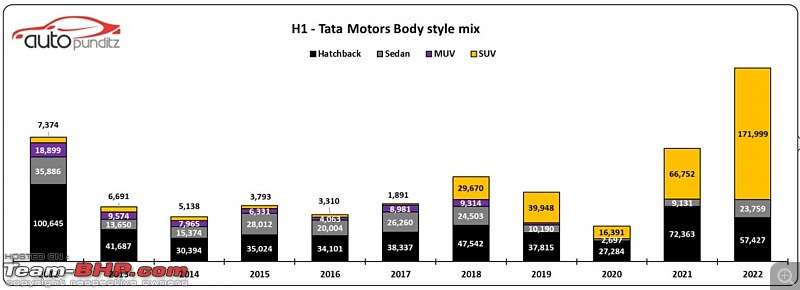

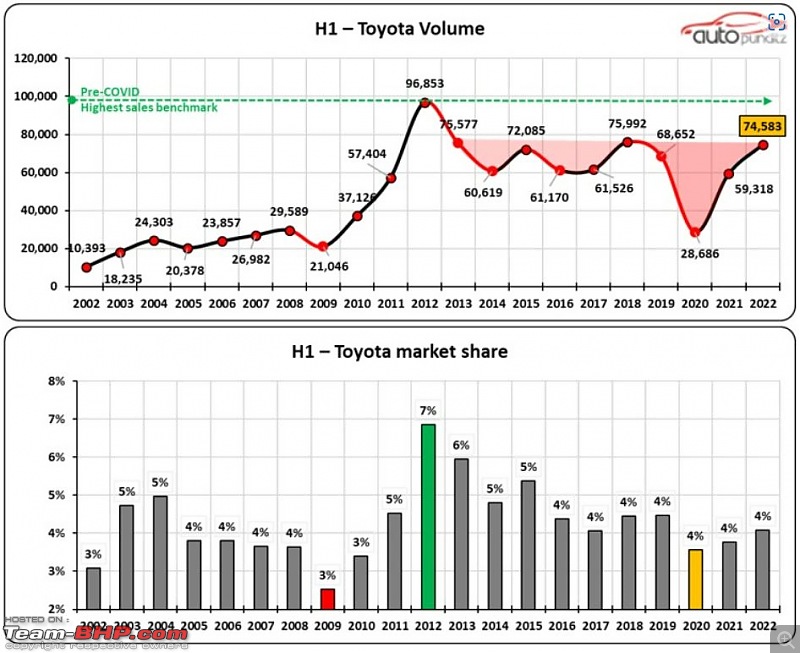

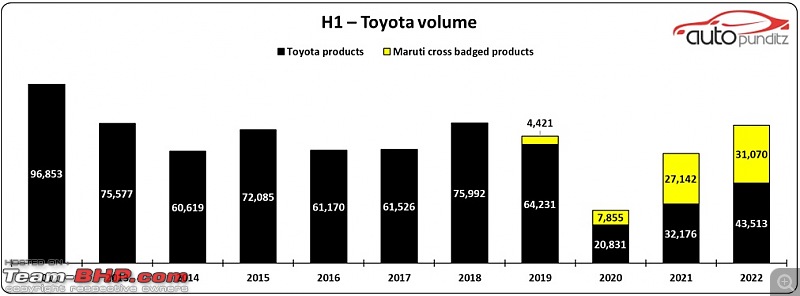

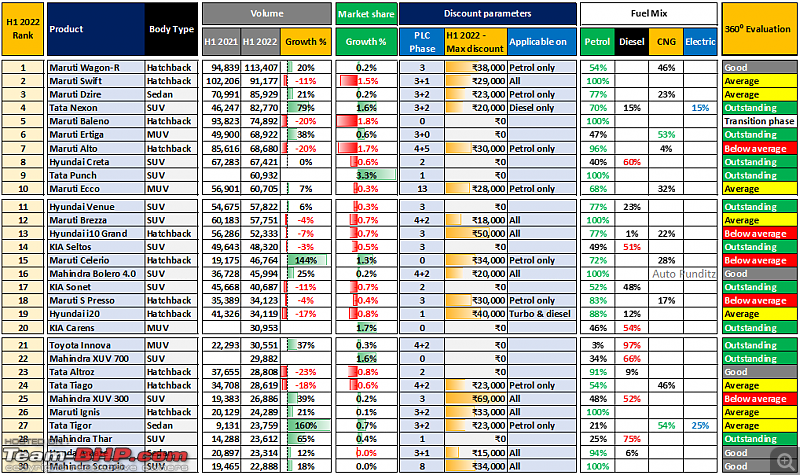

| Distinguished - BHPian  | Indian Car Sales for CY 2022 | Interesting charts depicting brand, budget & body style preferences H1 2022: SUV/Crossover body styled products now command 41% share of Indian passenger vehicle market. Hatchback segment is now reduced to 35% due to lack of demand for entry level products. MUVs and sedans gained some lost ground. Body Style: - SUV/Crossover body style is new favorite among Indian consumers - Hatchbacks lost considerable ground to new age crossovers -Kia Carens launch in 2022 has improved overall MUV market share - Sedans have gained some lost ground due to CNG option and new products introduced by Skoda-Volkswagen   H1 2022 Product list - Tata Nexon became the best-selling SUV/Crossover and Punch followed up at No.3 position - Technically Maruti Brezza and Toyota Urbancruiser (its rebadged version) is second best selling SUV/Crossover - SUV/Crossovers are selling better than erstwhile best-seller Maruti Alto That marks the shift in Indian consumers preference - Mahindra Thar reached to #11 position in SUV tally  Analysis – SUV/Crossover body style - Sales of SUV/crossover zoomed in COVID-19 recovery phase and nearly doubled in past two years. This is largely contributed by several new products introduced in the recent past. -Growth, however, is not uniformly spread. So, the data is spilt between body-on-ladder-frame SUV (also regarded as true blue SUV) and modern monocoque chassis based SUV/Crossover. Clearly growth is coming from the later and former is almost stagnant.    Monocoque chassis SUV/Crossover -Hyundai-KIA’s dominance was strongly challenged by Tata in 2022 and on a standalone basis Tata has become leader in moncoque SUV/Crossover segment. Maruti’s lack of right SUV product portfolio led to lower segment share.  Hot product segments Broadly there are three segments which are growing at breakneck speed.  1. Sub-4m crossover: This segment witnessed phenomenal growth in recent times. However, not every product has achieved significant market share. Tata Nexon facelift along with new EV drivetrain has fueled growth and Renault-Nissan added lower price spectrum, thus expanding the reach for customers with low budge  2. Mid-size SUV/Crossover (~4.3m): Segment is strongly dominated by Hyundai-KIA and Hyundai is selling even more Creta than ever. Skoda-Volkswagen and MG’s new products have expanded the segment further.  3. Large-size SUV/Crossover(4.5m+): This segment grew with new products introduced by Tata (Harrier & Safari new) and MG (Hector). Later in 2021, the segment was set on fire by the blockbuster entry of the all rounded Mahindra XUV 700.  Hatchback body style Major reason is lack of interest in entry level products which were available on discounts throughout H1-2022. Premium products have better demand and have improved market share above 55%. However, entry level crossovers from Renault-Nissan and Tata (Punch) have taken some sheen away from premium hatchbacks too.    Sedan body style Sedan segment in mass-market category has continuously witnessed loss in market share since 2015, unlike chauffeured around luxury segment, where sedan still commands nearly 50% of market share. However, after a quite long time the sedan segment saw some revival in 2022. This is largely driven by growth in 4m-sedan category fueled by availability of CNG options from Maruti and Tata. Mid-size segment too saw growth due to the entry of new Skoda-Volkswagen products.    MUV body style MUV sales growth was largely driven by improved sales of Maruti Ertiga 2nd Generation, XL6 and addition of KIA Carens in 2022. Similar to the case of SUV, it’s the monocoque chassis based MUV products touching new sales heights.    With more players now in the Mid-SUV segment, will the focus shift from the 4m segment ? Link |

| |  (31)

Thanks (31)

Thanks

|

| The following 31 BHPians Thank volkman10 for this useful post: | AdityaDeane, agm, AROO7, Arun_S, AVIS, Bubby, camitesh, GTO, hanzt, hdman, iamswift, Jeroen, khan_sultan, lamborghini, Madrasin_selvan, Meph1st0, Moto$apien, msdivy, nalinsaxena23, ninjatalli, Osteon206, quantobigboot, SanjayW, scarezebra, shancz, SoumenD, SSD2122, supertinu, The Rationalist, Vkap257, ysjoy |

| |

| | #2 |

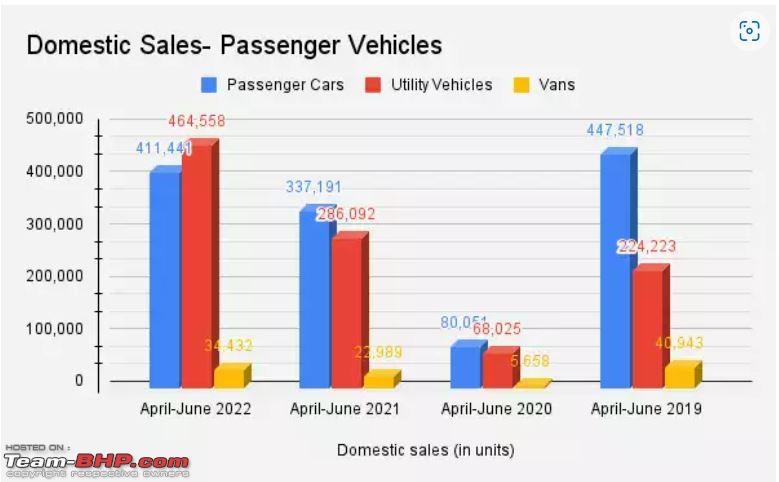

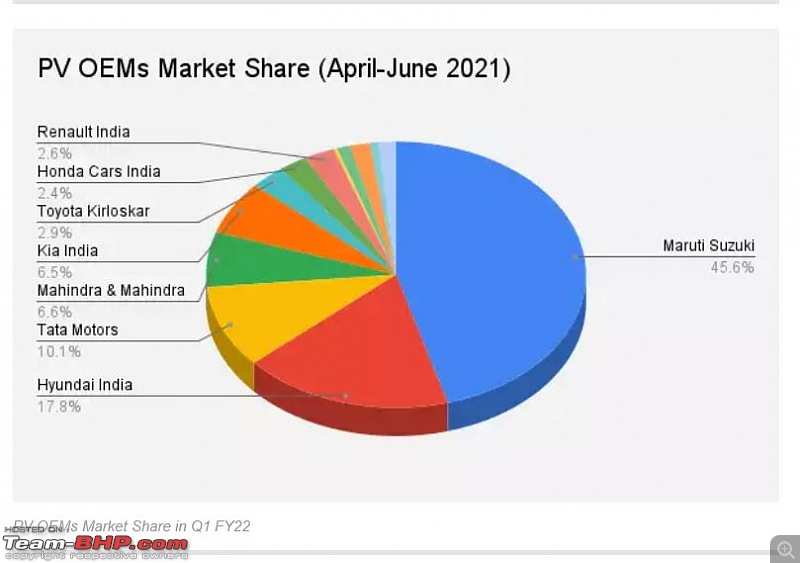

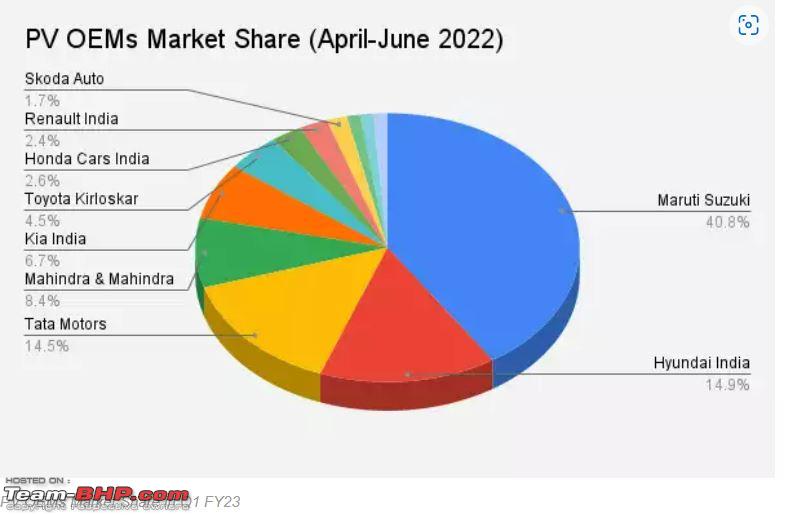

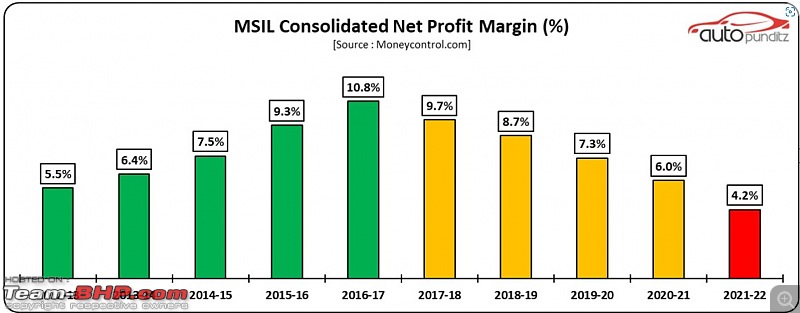

| Distinguished - BHPian  | Re: Indian Car Sales for H1 2022: Interesting charts depicting brand, budget, & body style preferenc More analytical data for H1 2022( Q1 FY 2023): High prices of commodities like steel, copper, aluminium, zinc, nickel, and of precious metals along with semiconductor shortage were the major challenges during the quarter. In spite of these, some passenger vehicle (PV) and two-wheeler (2W) manufacturers increased their market share while a few others lost their ground. Passenger Vehicles On a year-on-year basis, the passenger vehicle makers saw improved performance in the first quarter of the current fiscal year. With several new launches, easing of supply chains, softening of commodity prices, increasing interest for SUV style vehicles, and the upcoming festive season, the PV segment is expected to sustain this demand in the next quarter also. However, within the segment, the major stress has been on the entry-level mini cars category for over three years now. Since its peak in Q1 FY19, the sale of mini passenger cars has dropped 59% from 1.35 lakh to just 55,000 units in Q1 FY23. This may be attributed to the increase in ownership costs of these vehicles, new regulatory policies, multiple price hikes by OEMs and the decrease in gap of the average price range of entry-level SUV style vehicles. Auto industry body Society of Indian Automobile Manufacturers (SIAM) reported that for Q1 (April-June) of the last five fiscal years, the compounded annual growth rate (CAGR) in the PV segment has been only 1%. Maruti, Hyundai lose out; Tata turns out the biggest gainer In Q1 FY23, while some PV makers lost market share to their rivals, others gained by riding on customer traction over fresh product launches, new technology features and better management of chip supplies. The undisputed market leader Maruti Suzuki India Limited (MSIL) dispatched 3, 69,154 units in Q1 FY23 as against 2, 93,062 units in Q1 last fiscal. It reported about 5 percentage point decline in market share, majorly due to its subdued presence in the SUV segment. However the maker of Swift and WagonR has a lineup of new launches in the coming months. Hyundai India followed by reporting a drop of 3 percentage point in its Q1 market share. The maker of Creta sold 1,35,295 units during April-June 2022 compared to 1,14,499 units in the corresponding quarter of last year. Among the major gainers were Tata Motors, Mahindra & Mahindra (M&M), Toyota and Skoda Auto with the excitement of their new launches.     Link |

| |  (7)

Thanks (7)

Thanks

|

| The following 7 BHPians Thank volkman10 for this useful post: | ashking101, chinmaypillay, GTO, klgiridhar, nalinsaxena23, ninjatalli, ysjoy |

| | #3 | |||||

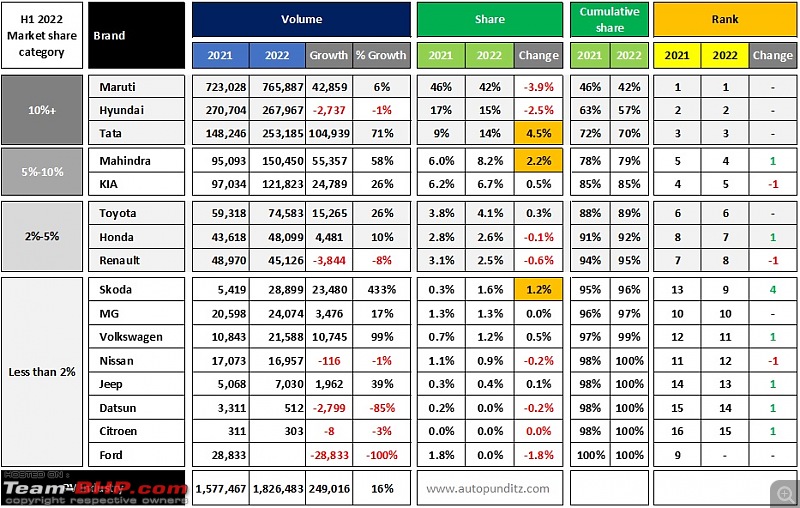

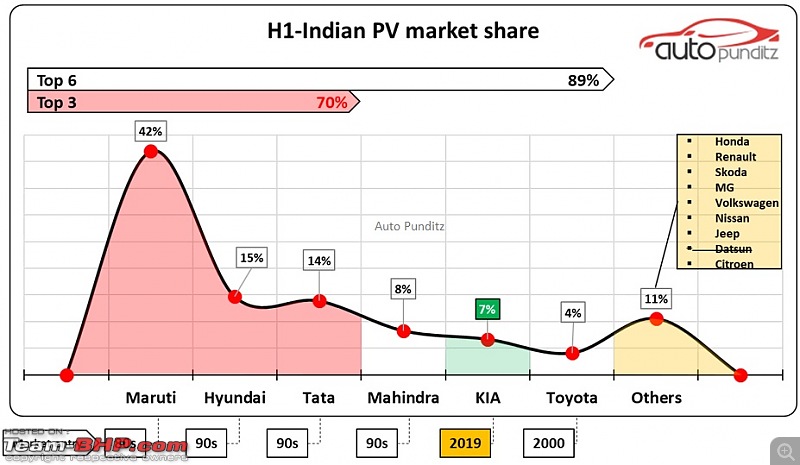

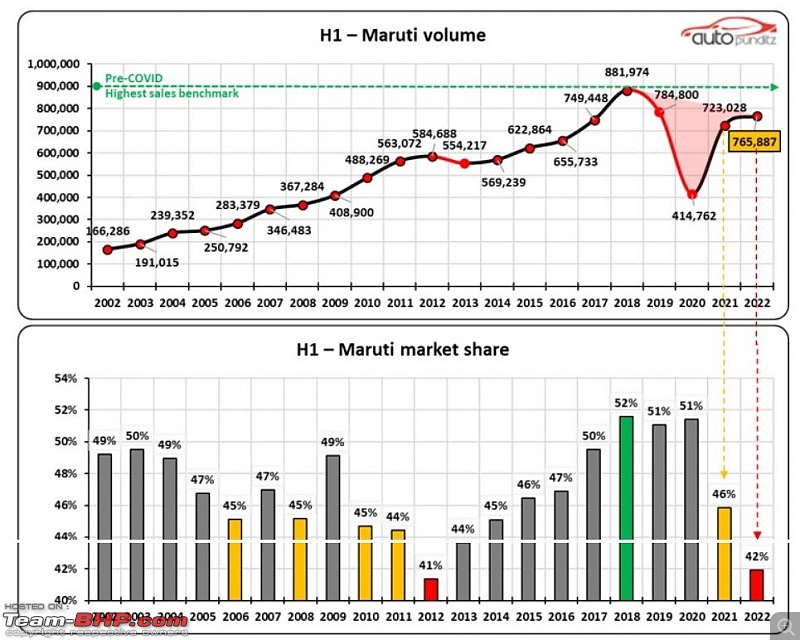

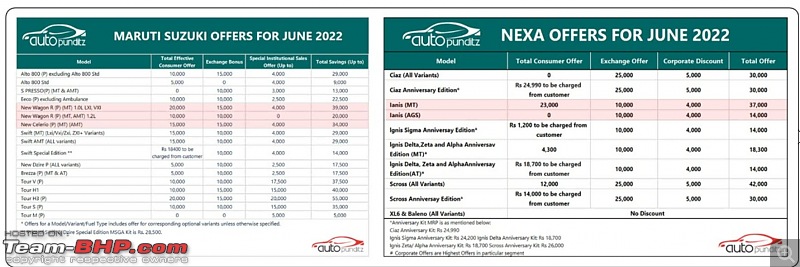

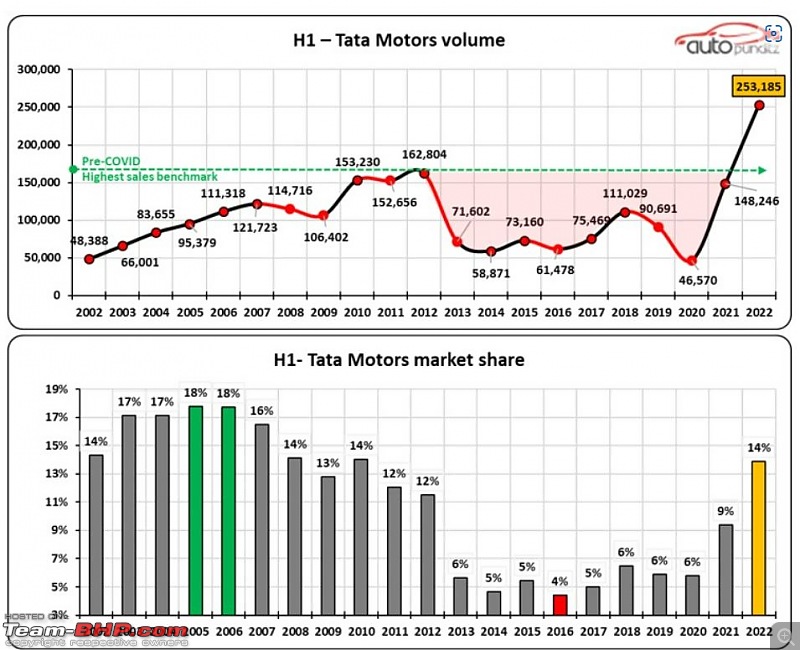

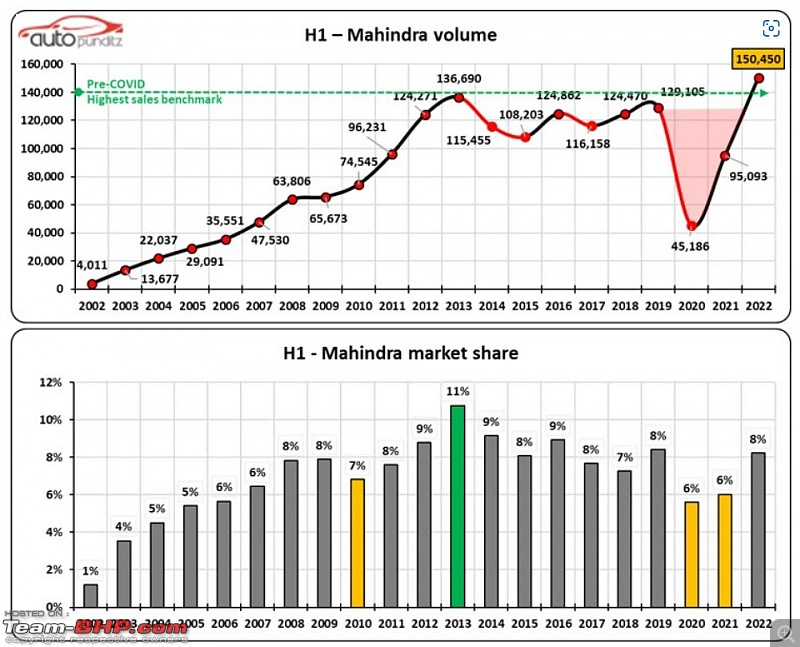

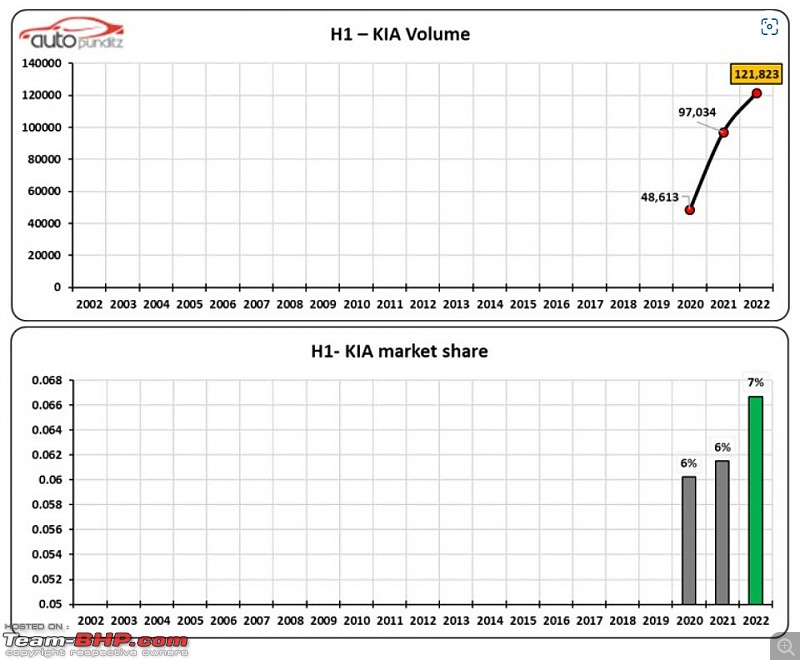

| Distinguished - BHPian  | Re: Indian Car Sales for H1 2022: Interesting charts depicting brand, budget, & body style preferenc OEM wise Passenger Vehicle Sales Analysis - H1 2022 Manufacturer Analysis: - Tata, Mahindra and Skoda gained significant market share with onslaught of new products. - Maruti and Hyundai lost significant market share. -Top-3 brands command 70% of Indian passenger vehicle market share. -Tata Motors registered highest volume growth of over 1 lakh cars -Tata Motors is just 14,782 units short for No. 2 position in H1 2022  Quote:

-Top 3 brands command 70% of Indian PV market share -Top 6 brands command 89% of Indian PV market share -This leaves other 9 brands with mere 11% market share -With right entry strategy Kia captured 7% market share in just 3 years of operation -Indian market could be challenging to crack but it is not unfathomable as proved by Kia  Top 6 Manufacturers - Deep dive analysis 1. Maruti Suzuki: Maruti has settled down to a new normal with lower volume and market share. Primarily there are two reasons for this fate. Quote:

Quote:

Quote:

Quote:

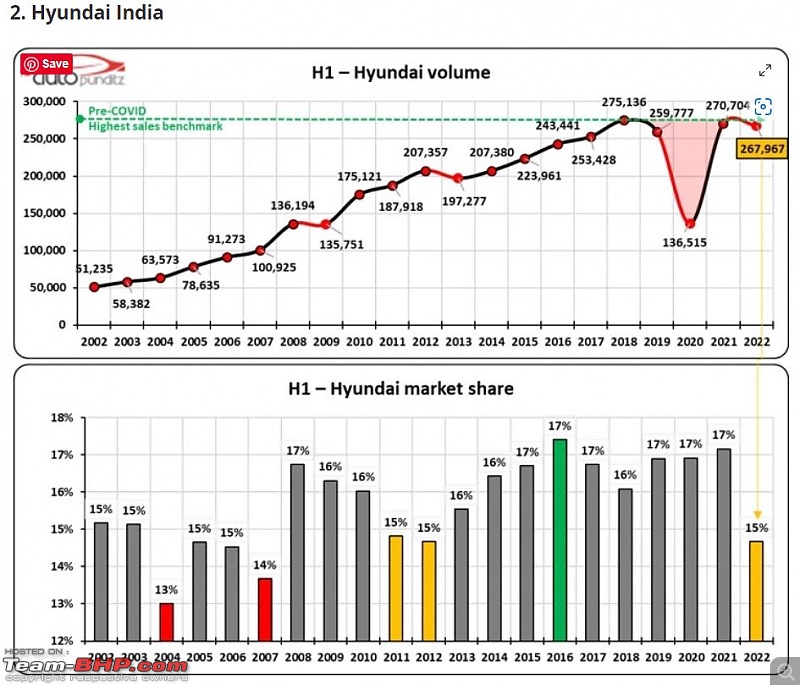

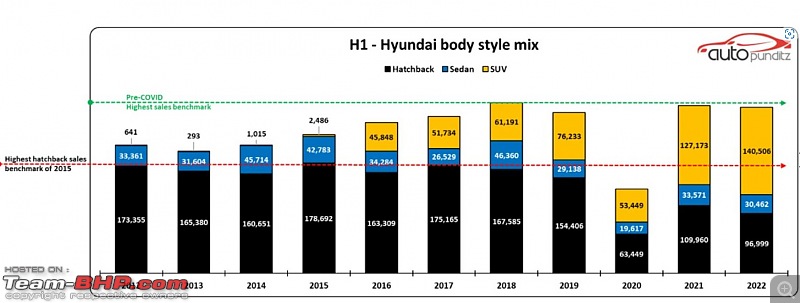

2. Hyundai Motors: - Hyundai did achieve a full V-shaped recovery in 2021. However, Hyundai lost some volume in 2022 - as Santro was discontinued and recently launched Alcazar could not achieve required market traction. - Major cause of market share erosion is the drop in hatchback volume since 2016. Though Hyundai successfully diversified SUV/Crossover portfolio to have high margin products, but it was not good enough to arrest overall market share fall. Alcazar too has lost traction in the fast growing segment thus limiting the expansion scope.   3. Tata Motors: - Tata Motors witnessed phenomenal turnaround with new products onslaught and achieved record breaking sales in H1-2022. - Growth of Tata is driven by SUV/Crossover segment and addition BEV brought incremental sales. Like most other manufacturers, Tata too had a drop in hatchback sales. Sedan (Tigor) sales were catapulted by addition of CNG and improved BEV drivetrain.   4. Mahindra & Mahindra (M&M) :  -Mahindra’s recovery was aided by blockbuster launch of Thar followed by XUV 700 and helped Mahindra to surpass past sales record. Market share improved; however, it is yet to claw back to past glory of 2013. But then Mahindra is selling relatively high value UV’s thus generating higher revenue per product line. 5.Kia India : -With three highly successful new product launches in India, Kia India has achieved what nobody else could in such a short span in the recent past. -Kia has secured a significant 7% market share and the fight for No. 4 position is still on between Kia and Mahindra.  6. Toyota India:   - Toyota’s V-shaped recovery is exactly over in 2022, however, sales remained at 2018 level and not the best year (2012). - As a part of partnership, Toyota is now selling a good number of Maruti’s rebadged products from its own showroom. It is a win-win situation for Maruti and Toyota as the later got its showroom filled with high volume products and the former got incremental customers for its existing products. Source: | |||||

| |  (8)

Thanks (8)

Thanks

|

| The following 8 BHPians Thank volkman10 for this useful post: | AVIS, chinmaypillay, GTO, hdman, lxskllr, Miel, ninjatalli, ysjoy |

| | #4 |

| BHPian Join Date: Apr 2012 Location: Delhi

Posts: 917

Thanked: 2,375 Times

| Re: Indian Car Sales for H1 2022: Interesting charts depicting brand, budget, & body style preferenc In the midsize crossover bar chart for 2022 (post #1), there is no bar segment for Skoda/VW. Please clarify where the Taigun/Kushaq are included? Last edited by GTO : 21st July 2022 at 11:05. Reason: Typos |

| |  ()

Thanks ()

Thanks

|

| | #5 |

| BHPian Join Date: May 2022 Location: Earth

Posts: 98

Thanked: 549 Times

| Re: Indian Car Sales for H1 2022: Interesting charts depicting brand, budget, & body style preferenc

Non-Indian here, any particular reason why Tata's market share fell sharply in 2013, but somehow they gained huge sales boost in 2021-2022? Sure they launched some strong products like the Altroz, Punch and Safari, but there was a time when Nexon and Harrier sales was sluggish despite being new products. |

| |  ()

Thanks ()

Thanks

|

| | #6 | |

| Senior - BHPian Join Date: Mar 2008 Location: Hyderabad

Posts: 1,064

Thanked: 636 Times

| Re: Indian Car Sales for H1 2022: Interesting charts depicting brand, budget, & body style preferenc Quote:

Add to that, the quality of cars themselves and the quality of service too put off many potential buyers. Only since the middle of 2014 did Tata made an effort to turn around with the launch of Zest. Zest wasnt exactly a great looker nor did it set sales charts afire but the vehicle was robust ( I know because I am very much satisfied with the car almost 8 years and 1,35,000 kilometres later). Service too improved. Hexa was touted as a very competent vehicle but at that time not many felt confident to part with that much of money on a Tata. Later, when Tiago and Tigor were launched, market started noticing Tata as both cars were very good looking and the perception of inferior quality started to change slowly. With the launch of Nexon, tables finally turned for Tata. Its funky design invited many comments but the 5-star safety rating caught the attention of prospective customers. Service improved, and the perceptions changed. With Harrier, it was almost same as with Hexa. Who would invest on a Tata that much money kind of questions raised but the car was a very handsome looking one. Tata still has a long way to go even sustaining the present momentum. To grow even more, it must do even more than it is doing now. Service centres | |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank simplyself for this useful post: | Astargea, Bhupi_BHP, for_cars1, hdman |

| | #7 |

| Distinguished - BHPian  | Re: Indian Car Sales for H1 2022 | Interesting charts depicting brand, budget & body style preferenc Best selling cars for H1 2022. -Maruti Wagon-R continues to be the best-selling passenger vehicle in India. -Twin Tata products - Nexon and Punch - made it to the top 10 list. -18 of the top 30 products were having some form of discounts throughout H1-2022. 360⁰ Performance evaluation Based on these key parameter of PLC, a comprehensive 360⁰ evaluation method, which takes into account several key aspects to know the correct health of the product in competitive landscape. PLC timeline : Longer PLC usually means higher discounts in later phase, successful products are exception Discounts on offer : Manufacturer/dealer sales push indicator Market share growth : Acceptance among customer segment Volume growth : This need to be seen in tandem with discount Waiting list : Proxy for quality of demand generation Rating system: best first Outstanding: Exceptional performer Good Average Below Average  Analysis - Top-10 list is still dominated by Maruti’s products, followed by Tata, now with two products and Hyundai is left with only one product - SUV/MUV/Crossover are now taking over higher ranks away from hatchbacks and sedans - Except for Renault Triber and Maruti Ecco, all other MUVs in the list (Maruti Ertiga, XL6, KIA Carens and Toyota Innova) are doing quite great, as there are no discounts and order backlog is also good - CNG has a kind of supercharged performance of some products as they are selling without discounts with a long waiting list – Maruti Wagon R, Ertiga, Dzire and Tata Tigor. Maruti: - Wagon-R with twin engine and bi-fuel option continues with the tag of best-selling PV in India. This is largely driven by CNG options that contribute 46% of sales and have a good order backlog. However, on the downside, petrol variant is selling at a huge discount in H1-2022 - All Maruti products on sale carries discounts in H1-2022, except for – CNG variants of all products, XL6, Baleno & Ertiga - Maruti Celerio is struggling as the new generation is available with huge discount within a few months of launch - Maruti Alto too has lost sheen due to shift in market preference Hyundai-Kia - Despite low sales due to chip shortage in H1-2022, Hyundai Creta is the best performing product here. Even in third year of PLC, product is selling like hot cake, without any discount whatsoever, in highly contested segment, still with long waiting list - Other products from Hyundai-Kia that enjoys similar performance are – Hyundai Venue, Kia Sonet and Kia Seltos - Availability of BS6 compliant diesel engine is also a key driver of Hyundai-Kia SUV/Crossover products in India - i10 and i20 slipped out of top 10 category and are available with discount for several variants Tata Motors - Post facelift in 2020, Tata Nexon has shown phenomenal growth in successive years with feature addition. BEV variants introduced around the same time now contribute 15% of volume and that came on top of the existing volume. - Punch too is following the successful foot step of Nexon, and made it to top 10 tally by creating a whole new micro-SUV/Crossover category, having currently all to itself - CNG and updated battery and motor of EV version has given new lease of life to otherwise languishing Tata Tigor Mahindra - Mahindra’s XUV 700 and Thar are doing exceptionally well, whereas XUV300 launched around the same time as Hyundai Venue is desperately waiting for a comprehensive facelift and has the highest discount on offer in the list - Bolero and Scorpio - workhorse from Mahindra’s stable – seems to be having routine success in an uncontested market territory Toyota - Innova - lone product from Toyota in this list is back on track without any discount and remain uncontested so far. Link |

| |  (5)

Thanks (5)

Thanks

|

| The following 5 BHPians Thank volkman10 for this useful post: | catchjyoti, CEF_Beasts, echo77, Maky, Miel |

| | #8 |

| BHPian Join Date: Dec 2011 Location: BLR-COK-TRV

Posts: 276

Thanked: 886 Times

| Re: Indian Car Sales for H1 2022 | Interesting charts depicting brand, budget & body style preferenc To me, the Ertiga and XL6 are more than 90% the same car. One is the MUV and the other a premium crossover variant. So I would make that a cumulative sales figure of 68922 + 20176 = 89,098 Considering the above, the 5 Top Selling popular cars in India for H1 2022 are:

Now that's insightful 'coz there are 2 hatchbacks, 1 MUV/Crossover, 1 SUV, and 1 (sub-4m) Sedan. The Hatch is still the leader at 204K+ units, with the UV close behind at 171K+ units, while the Sedan is far behind at about 90K units. The market has definitely shifted towards UVs over Sedans. Also, if you are a conservative buyer looking to buy a top selling model, which by virtue of its popularity and high market exposure will have greater availability of spares, accessories, and maintenance know-how (both via Authorized SS and FNGs) in the long-term, then you should choose one of these 5. Your chances of going wrong with buying any of these 5 are virtually nil. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks Miel for this useful post: | CEF_Beasts |

| | #9 |

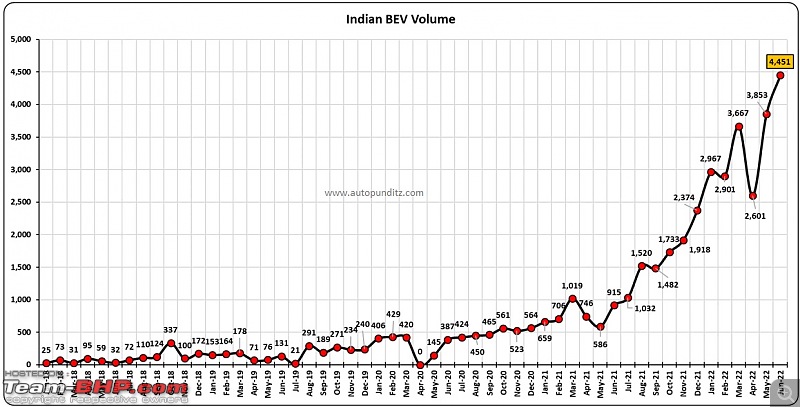

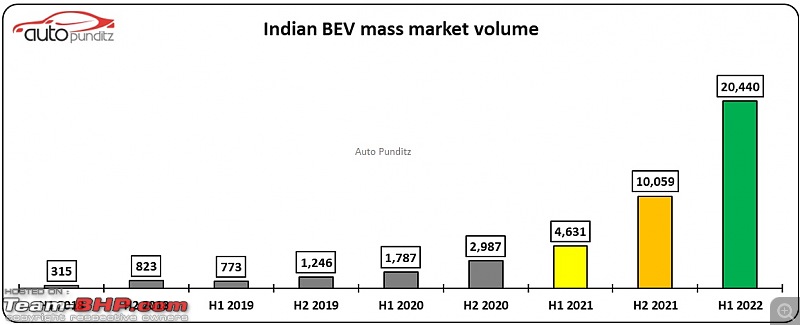

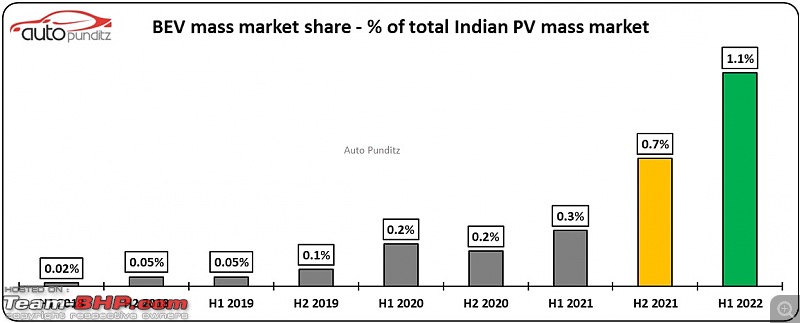

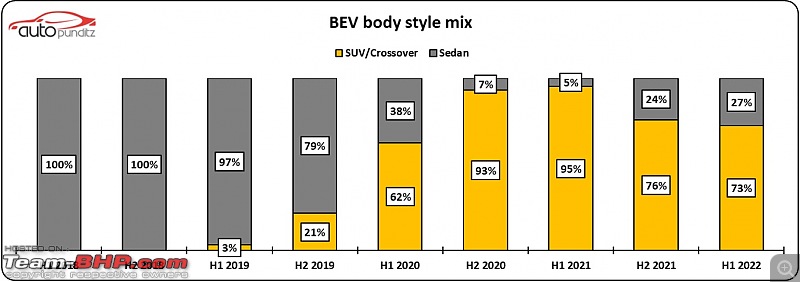

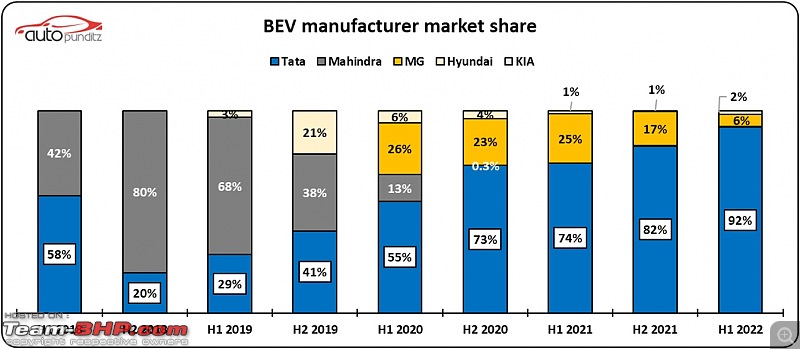

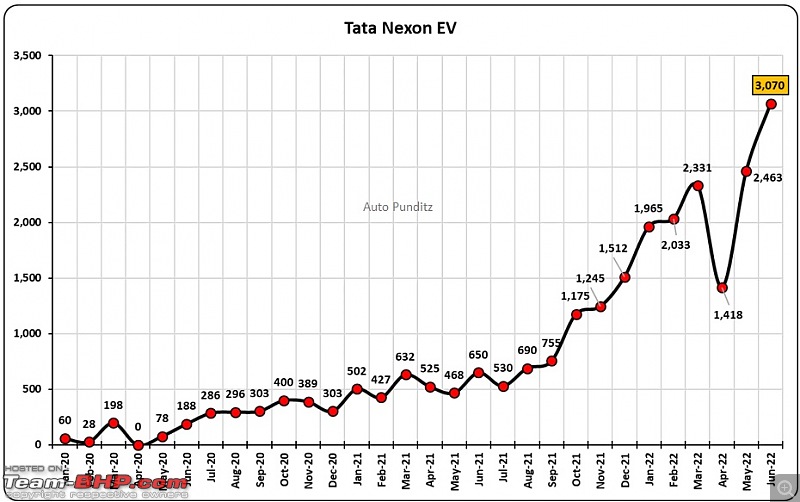

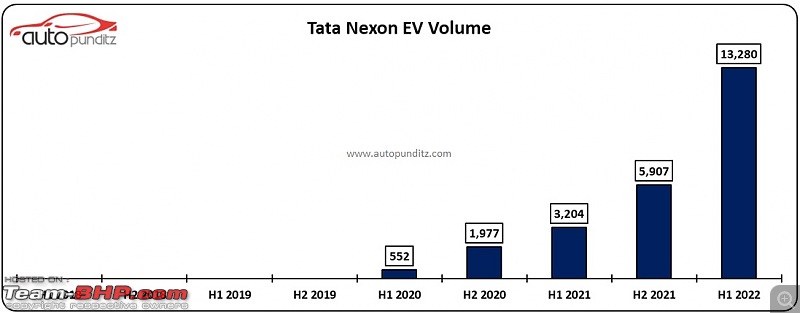

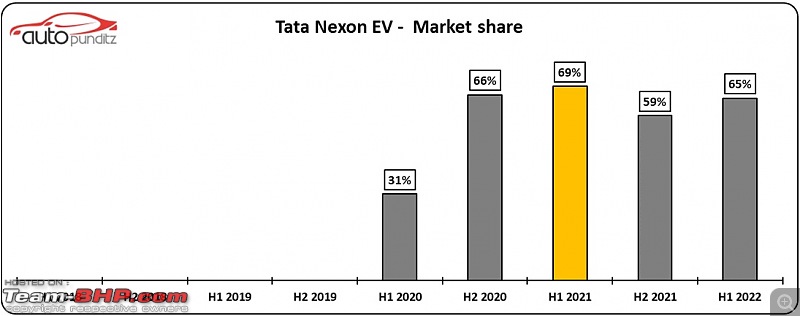

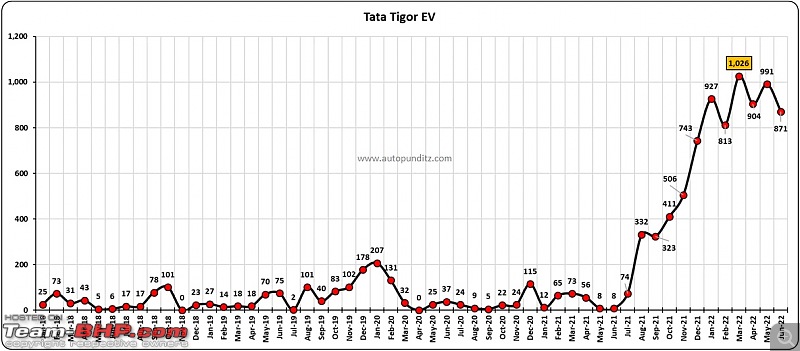

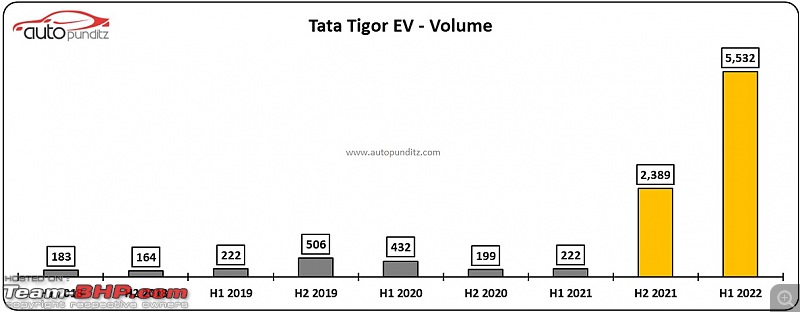

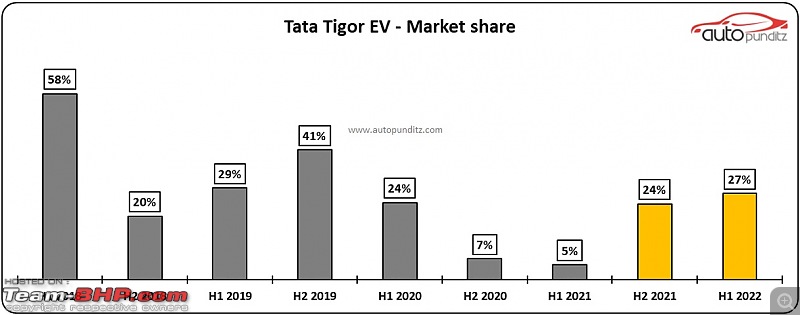

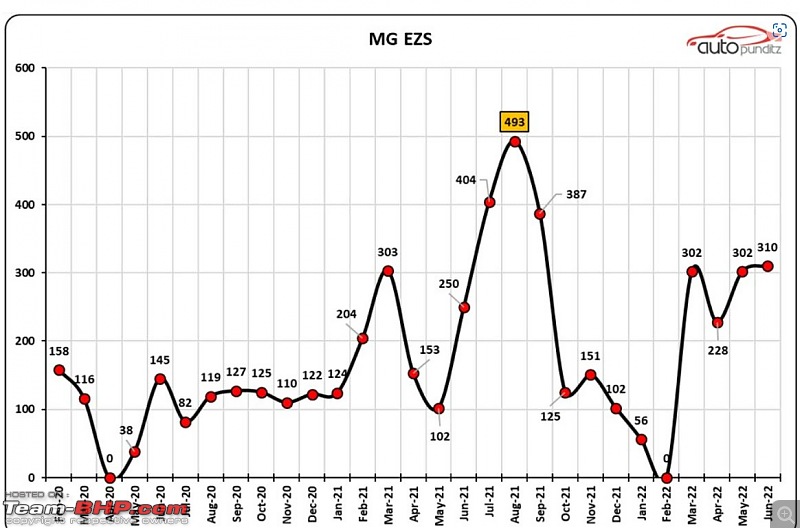

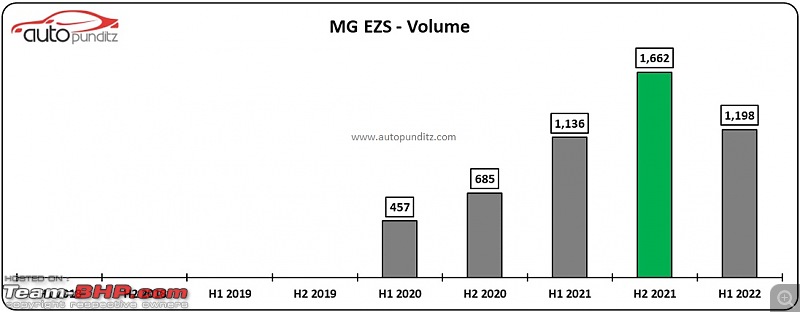

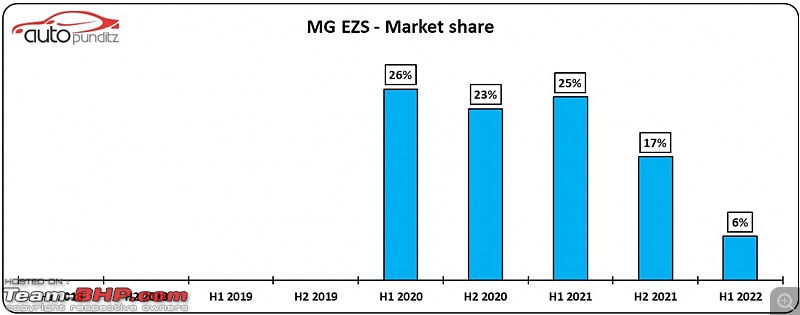

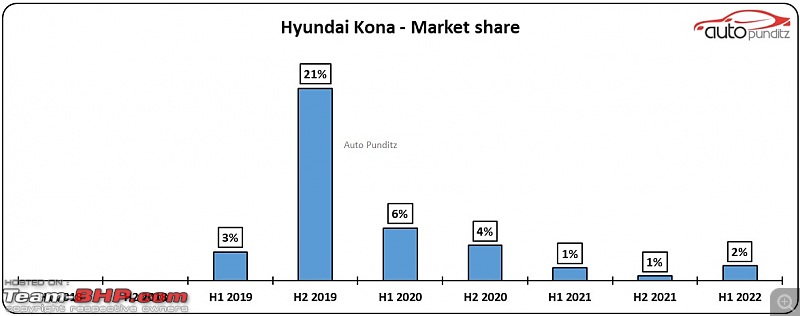

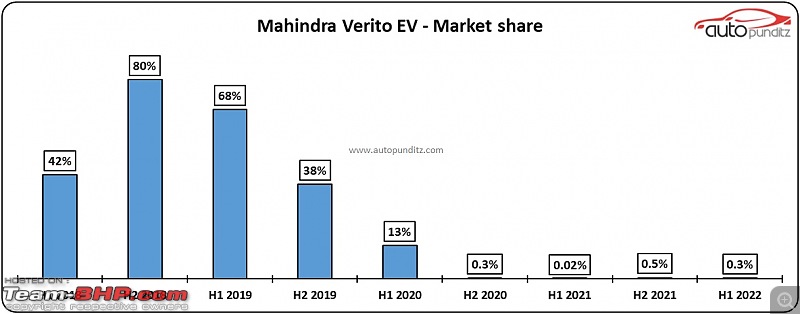

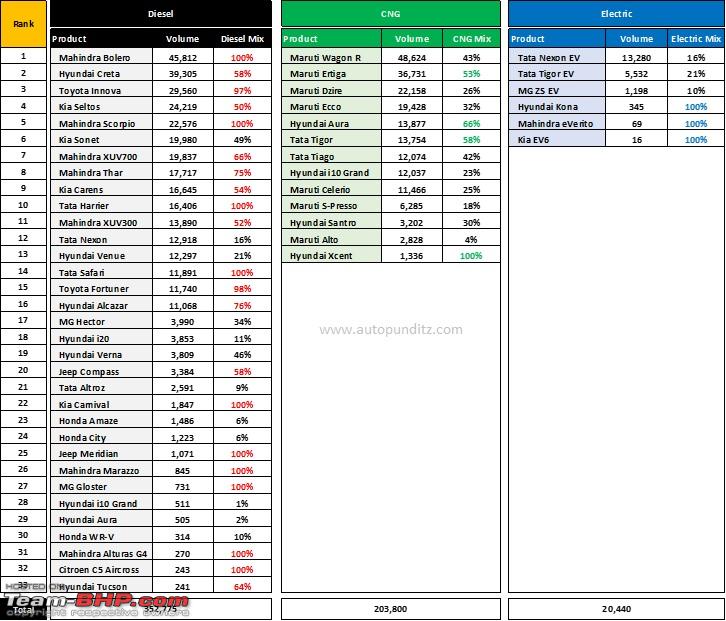

| Distinguished - BHPian  | Re: Indian Car Sales for H1 2022 | Interesting charts depicting brand, budget & body style preferenc Electric Passenger Vehicle Sales in India for H1 2022 - In a nascent market like India for EV's the market is dominated by a few players only. - H1-2022 registered highest ever half-yearly Battery Electric Vehicle sales of 20,440 units. - June 2022 is the all-time best sales month with 4,451 units. - Tata Motors command 92% Indian BEV market share. - Tata Nexon EV is bestselling product followed by Tata Tigor EV. - BEV market share accounts up to 1.1% total PV sales in India - SUV/Crossover body styled products command 73% share - Improved Tata Tigor EV launched in H2-2021 scaled sedan share to 27% - Tata Motors command 92% market share followed by MG Motors 6%, rest are fringe players as of now      Product-wise Analysis Tata Nexon EV (Local production with imported battery cell) -With larger battery pack Nexon EV Max introduced recently took the finally tally to an all-time high of 3,070 units -Tata Motors sold 13,280 Nexon EV in H1-2022 - Nexon EV command 65% market share in H1-2022    Tata Tigor EV (Local production with imported battery cell) -With improved battery and motor, sales of Tigor EV sales grew since August 2022 -Tigor EV now commands 27% market share    MG ZS EV (CKD) -After facelift, CKD MG ZS EV sales settled around 300 units per month - ZS EV lost considerable volume and market share during facelift transition in early 2022    Hyundai Kona (CKD), Mahindra eVerito (Local) & KIA EV6 (CBU) -Both the products have miniscule share in growing Indian BEV market -Kia EV6 wholesale stands at 16 units in H1 2022   Source: |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks volkman10 for this useful post: | CEF_Beasts |

| | #10 |

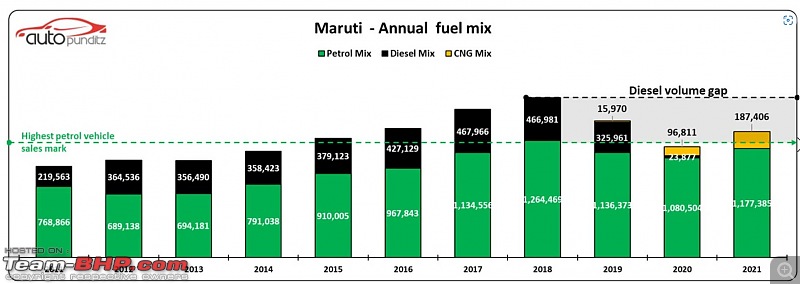

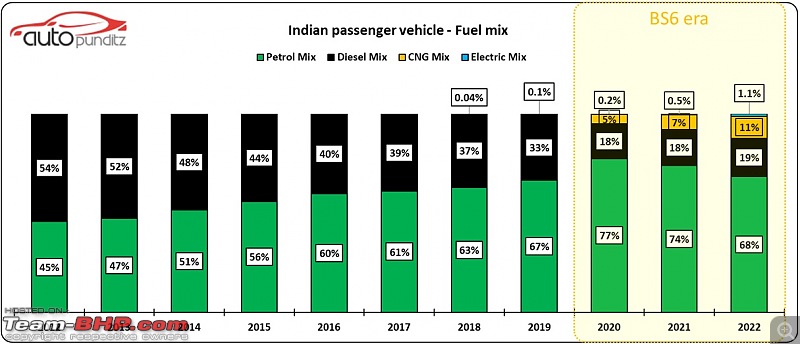

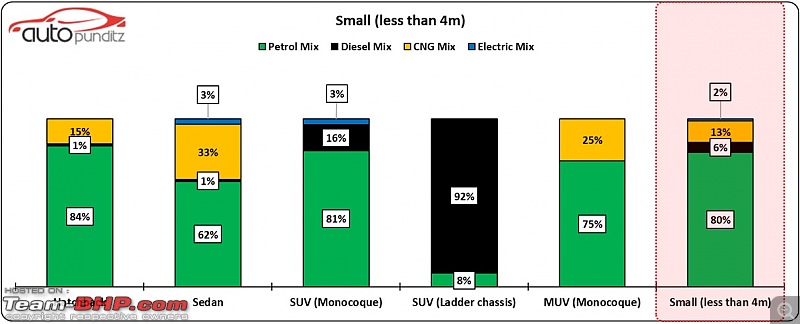

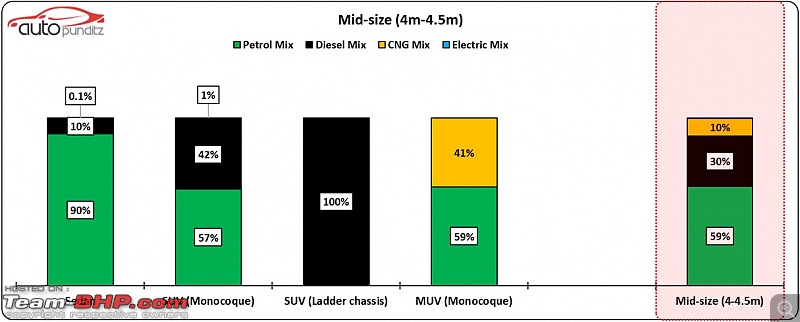

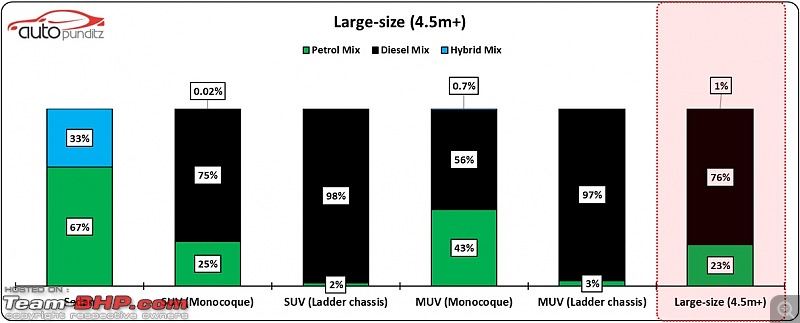

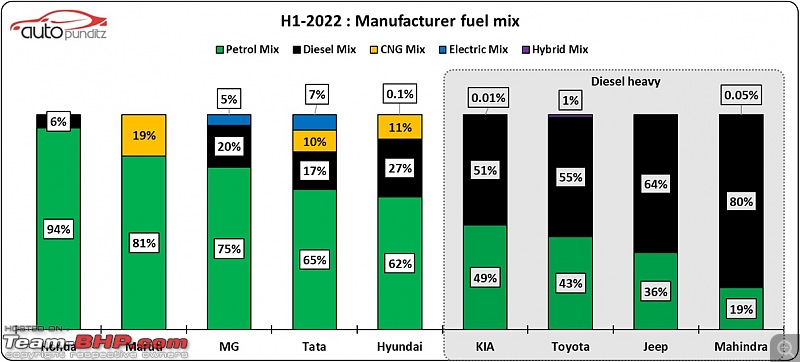

| Distinguished - BHPian  | Re: Indian Car Sales for H1 2022 | Interesting charts depicting brand, budget & body style preferenc Fuel Mix Analysis - PV Sales H1 2022 - Diesel mix settled around 19%, CNG mix reached to 11% and electric mix to 1.1%. - Petrol is dominating fuel in small vehicle category and diesel dominates large vehicle category. -Mahindra, Toyota, Jeep and KIA have diesel heavy mix due large UV product portfolio. -Mahindra Bolero is best-selling diesel vehicle, Wagon-R is best-selling CNG vehicle & Tata Nexon is the best-selling EV.  Body style, Chassis & Size Data based on size, chassis and body style gives a clear picture of fuel choice in each category. Small (Less than 4m) - Petrol remains dominant fuel for small vehicles - CNG has emerged as popular choice of fuel in small vehicles - Diesel is preferred choice of fuel for ladder-frame-chassis vehicle - Diesel is almost dead in hatchback category  Mid-size (4m-4.5m) - Overall fuel mix is widely distributed in this size-wise category - Petrol is major mix in sedan category as most manufacturers don’t offer diesel engines or diesel automatic option - Monocoque chassis SUV have strong diesel mix - CNG has made strong in-road in monocoque MUV sub segment  Large size (4.5m+) - As weight and size goes up, diesel becomes preferred choice - For ladder chassis, diesel is the most preferred choice for hauling thirsty vehicles - Diesel engine is still a must in this category to churn good volume  Manufacturer: - Mahindra, Jeep, Toyota and KIA have heavy diesel engine portfolio due to UV range of products - Maruti’s CNG mix reached to an all-time high level of 19% - Tata and Hyundai are following Maruti’s footsteps for CNG vehicles - Now BEV contributes significant volume for Tata and MG  Product: - Mahindra Bolero is best-selling diesel vehicle, Wagon-R is best-selling CNG vehicle & Tata Nexon is best-selling BEV - Hatchback and small sedan gained volume due to addition of factory fitted CNG option - CNG Maruti Ertiga is quite popular among fleet operators - SUV/MUV/Crossover completely dominate diesel vehicle list - Some SUV/Crossover have low diesel mix due unavailability of automatic transmission option - Tata Nexon, Hyundai Venue & MG Hector - Mahindra Thar petrol mix is stable around 25%, clear indication of what city dwellers with limited mobility need with alternate lifestyle choice prefers  Link |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank volkman10 for this useful post: | Arun.K, AYP, CEF_Beasts, ninjatalli |

| | #11 |

| Distinguished - BHPian  | Re: Indian Car Sales for H1 2022 | Interesting charts depicting brand, budget & body style preferenc Summary of Passenger Vehicle sales H1 2022: Industry : - H1-2022 registered highest ever half-yearly sales of 18,26,483 vehicles - 2022 average monthly volume stood at 3,04,414 mark – highest in the history - March 2022 and June 2022 are 2nd and 3rd best sales month in entire history - Improved supply side situation and demand spillover from 2021 are the major factors Body style: - SUV/Crossover body styled products now command 41% share of Indian passenger vehicle market - Hatchback segment is now reduced to 35% due to lack of demand for entry level products - MUVs and sedans gained some lost ground Manufacturers : - Tata (+4.5%) and Mahindra (+2.2%) gained significant market share with onslaught of new products - Maruti (-3.9%) and Hyundai (-2.5%) lost significant market share - Top-3 brands command 70% of Indian passenger vehicle market share - Top-6 brands command 89% of Indian passenger vehicle market share - Other 9 brands have 11% combined market share Products : - Maruti Wagon-R continues to be the best-selling passenger vehicle in India - Twin Tata products - Nexon and Punch - made it to the top-10 list - 18 of the top-30 products were having some form of discounts throughout H1-2022 Fuel mix: - H1-2022 diesel mix settled around 19%, CNG mix reached to 11% and electric mix to 1.1% - Petrol is dominating fuel in small vehicle category and diesel dominates large vehicle category - Mahindra, Toyota, Jeep and KIA have diesel heavy mix due to SUV/MUV/Crossover product portfolio - Mahindra Bolero is the best-selling diesel vehicle & Wagon-R is the best-selling CNG vehicle Battery electric vehicles: - H1-2022 registered highest ever half-yearly BEV sales of 20,440 units - June 2022 is the best sales month with 4,451 units - Tata Motors command 92% Indian BEV market share -Tata Nexon EV is best-selling product followed by Tata Tigor EV Link |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank volkman10 for this useful post: | CEF_Beasts, hanzt, SanjayW |

| |

| | #12 | |

| BHPian Join Date: Jul 2022 Location: Mumbai

Posts: 108

Thanked: 130 Times

| Re: Indian Car Sales for H1 2022 | Interesting charts depicting brand, budget & body style preferenc Quote:

Given Toyota's brand proposition of superior 'quality/reliability', why would it sell so little (when the Brezza sells so much)? | |

| |  ()

Thanks ()

Thanks

|

| | #13 |

| BHPian Join Date: Jul 2021 Location: Siliguri

Posts: 266

Thanked: 1,051 Times

| Re: Indian Car Sales for H1 2022 | Interesting charts depicting brand, budget & body style preferenc

Suzuki dealer and service network is much bigger than Toyota, so Brezza would end up being sold in higher no. than Urban Cruiser. Moreover Urban Cruiser's production has ended with the previous gen Brezza and whats being sold is the existing dealer stock. Its not clear yet if we will see a next gen Urban Cruiser. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks Black_Star for this useful post: | hanzt |

| | #14 |

| BHPian Join Date: Jul 2022 Location: Mumbai

Posts: 108

Thanked: 130 Times

| Re: Indian Car Sales for H1 2022 | Interesting charts depicting brand, budget & body style preferenc

can you plz share the source of this information? I was at lakozy toyota showroom today, and they said that the production of UC is still going on and no plans to end mfg., and it is unlikely that Toyota will launch the new-Brezza version of the UC. |

| |  ()

Thanks ()

Thanks

|

| | #15 | |

| BHPian Join Date: Jul 2021 Location: Siliguri

Posts: 266

Thanked: 1,051 Times

| Re: Indian Car Sales for H1 2022 | Interesting charts depicting brand, budget & body style preferenc Quote:

https://www.team-bhp.com/forum/india...ml#post5365734 (Toyota Urban Cruiser launched at Rs. 8.40 lakh) | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks Black_Star for this useful post: | hanzt |

|