Team-BHP

(

https://www.team-bhp.com/forum/)

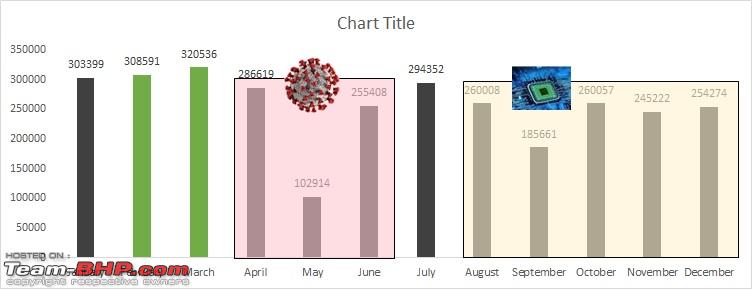

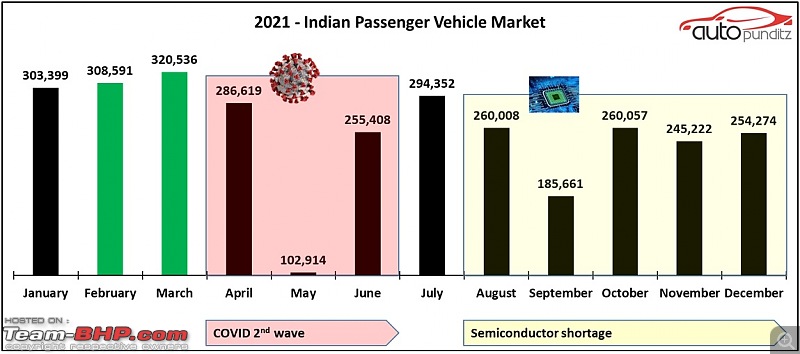

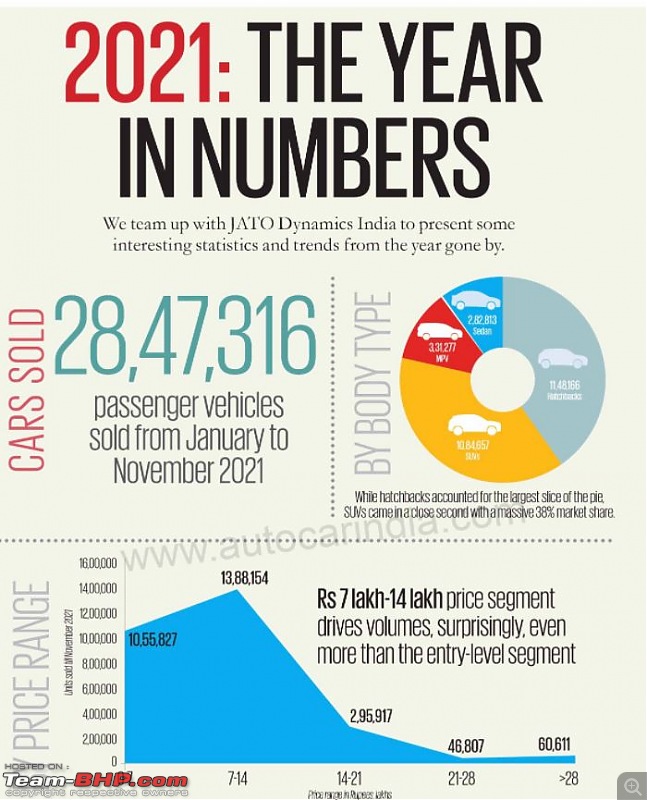

As pent-up demand in mid-2020, in the post lockdown period, has turned into strong demand and helped the passenger vehicle industry to achieve V-shaped recovery.

The Calendar Year 2021 registered itself as the 3rd best year for the Indian passenger vehicle (PV) market, after 2018 and 2017, when sales crossed the 30 lakh mark for the third time.

Demand remained strong for successful product lines of PV manufacturers, with some products enjoying a long waiting list.

Highlights:

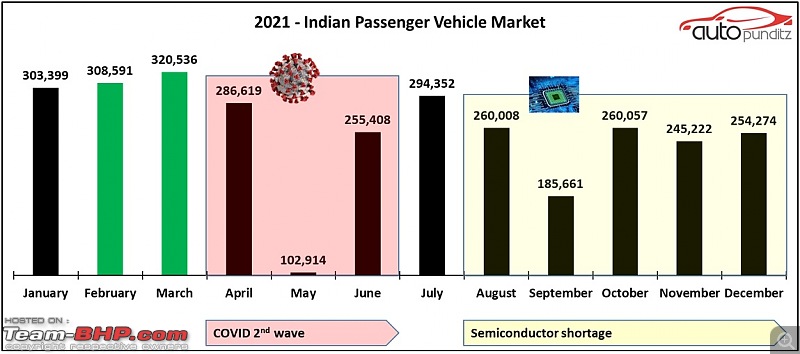

- Indian passenger vehicle sales crossed the 30 lakhs mark again in 2021 (after 2017 and 2018)

- Semiconductor shortage disrupted supply chain in the second half of 2021

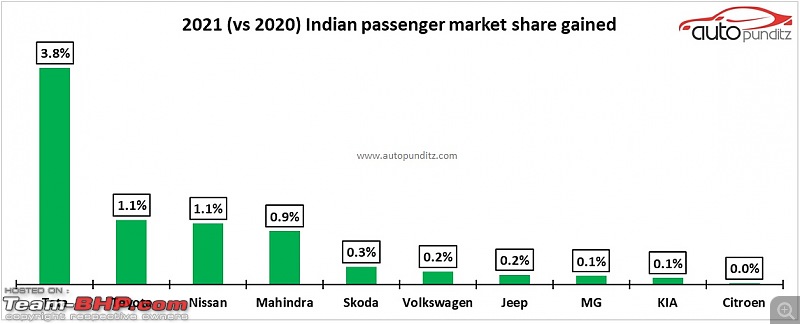

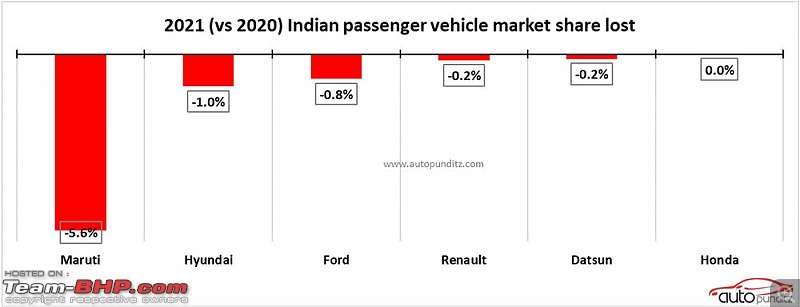

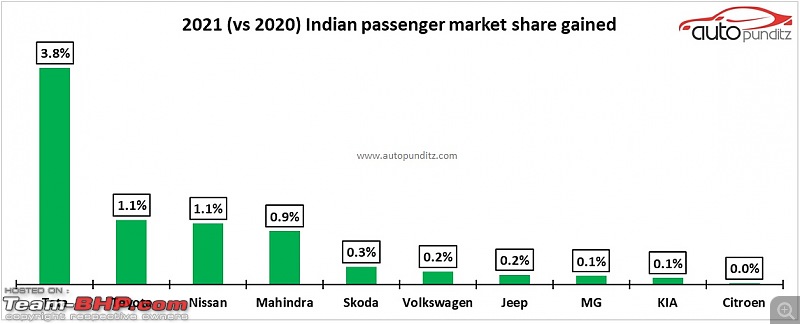

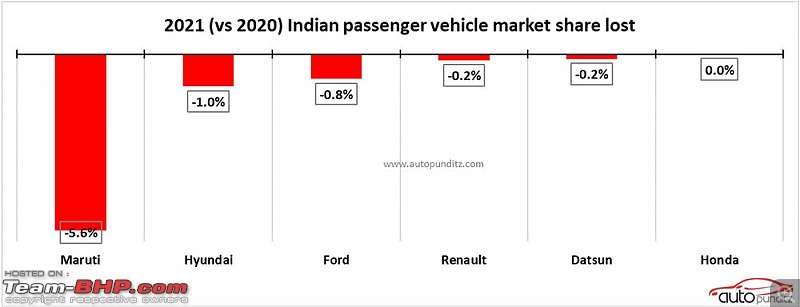

- Maruti lost 5.6% market share and Tata Motors gained 3.8% market share

- SUV/Crossover body styled products captured 38% of market share

- 8 out of top 10 best-selling passenger vehicles were Maruti Suzuki

-

Maruti Baleno (+ cross badged Toyota Glanza), with a combined sales of 1,98,563, is the best-selling product in 2021

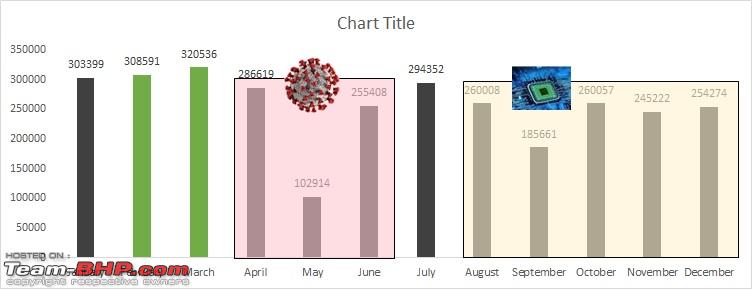

- February and March month of 2021 became the two best months of vehicle sales in Indian PV market history, October 2020 still remains the best (3,33,625 units)

-In the month of April and May, sales disruption happened due to the pandemic

- July once lockdown was lifted, that is when the semiconductor shortage hit the Indian PV market hard which also hit the festive season sale.

- Tata Motors has remained the only exception in 2021 ( chip shortage)

Manufacturers/OEM wise Performance for CY2021:

- The Top 5 manufacturers command 84% of the Indian PV market

- Every brand (except Datsun) recovered from the low of 2020

- Maruti and Hyundai’s unchallenged 67% market share dominance over the years came down to 60% in 2021

- Tata Motors posted its historical best numbers in 2021, on account of the success of products and better management of semiconductors than others

- Nissan India jumped 5 ranks backed by the success of Nissan Magnite launched in late 2020

-Thar launched in late 2020 has added a large chuck to Mahindra’s annual sales

-Tata Motors has witnessed a strong gain in market share due to strong sales of Nexon and Altroz

-Toyota’s market share increase is largely due to the addition of Urban Cruiser (cross badged product from Maruti) and production recovery of Innova and Fortuner

-Magnite has resurrected Nissan back in the Indian market

-Next-generation Thar is a major contributor to Mahindra’s market share growth

-Maruti witnessed a steep drop in market share in absence of a proper SUV portfolio and diesel engine

-Also, drop in Dzire and Alto’s sales has badly impacted Maruti’s market share

-Hyundai’s market share drop is largely due to loss of traction in the hatchback segment

- Ford motors has decided to exit the Indian mass-market vehicle segment in 2021 due to piled up losses and the collapse of JV with Mahindra

- Right product (attributes that meet or exceed customer/consumer’s need) at the right price has given new lease of life to Tata and Nissan in India, the key is to sustain in a fiercely competitive scenario

Link

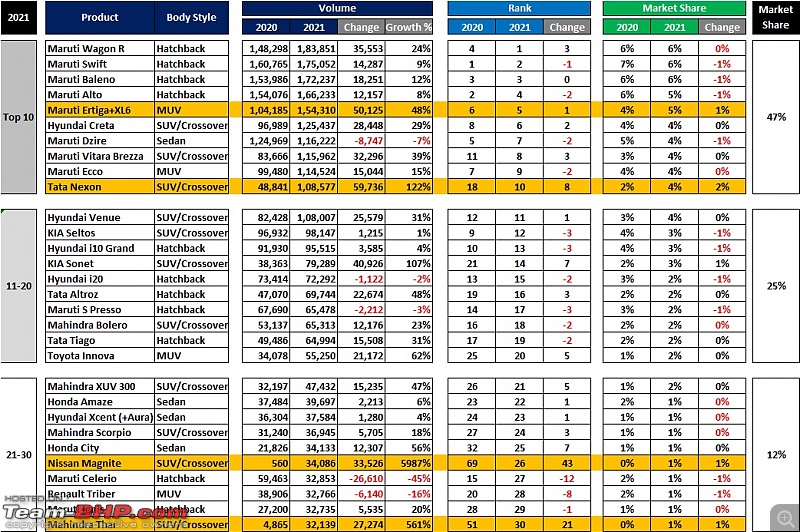

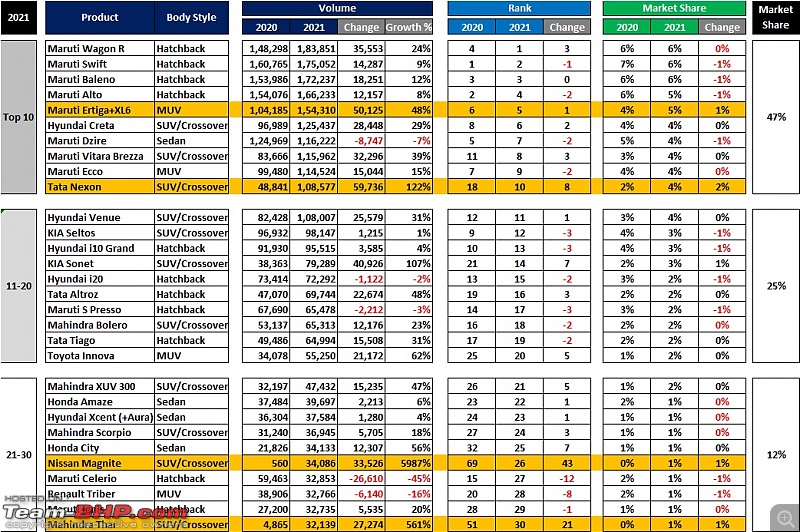

Top 10 best selling cars of 2021:

- Maruti Suzuki models contribute over 83 per cent of the total volumes of top 10 selling models while the remaining two spots have been taken by Hyundai India and Tata Motors

- Hyundai Creta took the fifth sop selling 1,25,437 units, the Tata Nexon claimed the tenth position at 1,08,577 units.

Link

Link

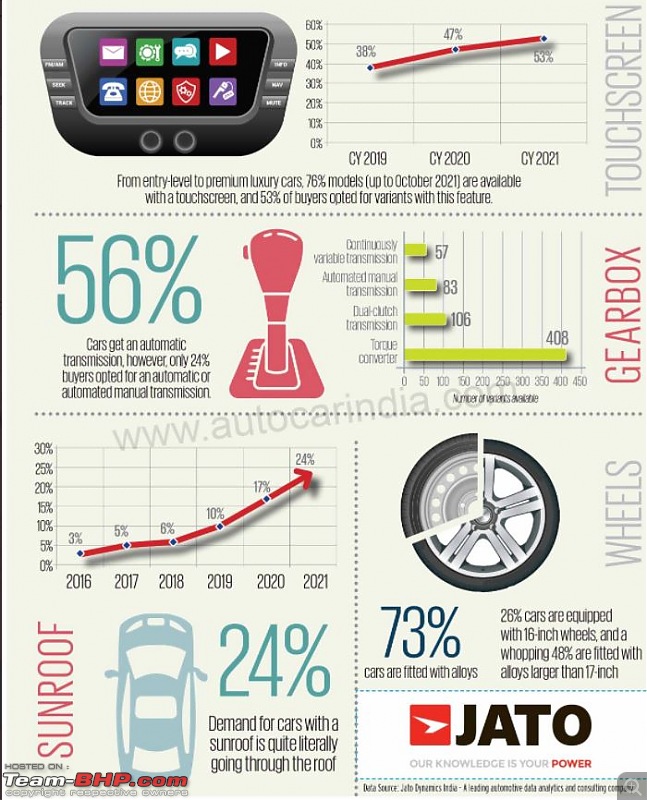

I think from technology standpoint 2021 marked the launch of ADAS enabled cars in India through XUV700 and Astor. While 2019-20 had the theme of connected cars, 2021 has ADAS.

In times to come I guess we will see more tech enabled cars. I don’t know if I am happy about this, but the smile my 90 HP Punto puts on my face, no tech can beat it.

Quote:

Originally Posted by volkman10

(Post 5233079)

The Tata Nexon claimed the tenth position at 1,08,577 units.

|

Nexon entering the top 10 ahead of both Venue and Sonet is a phenomenal achievement. I think in the last 4-5 months, most of the Ecosport customers turned to Nexon which made all the difference!

PS: In charts like this, doesn't it make sense to add Glanza, XL6 and Urban Cruiser numbers to its siblings so that we get a better picture?

Market share CY2021 :

Quote:

Maruti Suzuki dominates the list with 13,64,787 units sold in CY2021, up 12.48 percent over 12,13,381 units sold in CY 2020.

It was the only automaker to see its sales cross the 10 lakh unit mark in the past year. It was however a 6.15 percent de-growth in terms of market share which dipped to 44.91 percent over 51.06 percent held in CY 2020

|

Quote:

Volkswagen (26,930 units), Skoda (23,858 units) and Jeep (11,652 units) completed the list, each posting a substantial percentage increase in YoY growth over CY 2020 and marginal increase in market share.

|

Link

Link

Body Style Sales Analysis for 2021: SUV/Crossover body style market share has reached its all-time high level of 38%.

-Products like Nissan Magnite, Renault Kiger, and Tata punch towards the lower end of the price spectrum has made the segment more lucrative for customers

- Lack of demand for entry-level hatchback Maruti Alto was one of the reasons for the drop in hatchback segment share

- Hatchback segment also witnessed cannibalization from low priced sub 4m SUV/crossover

- The S/CUV segment will further grow with new products in the anvil for launch

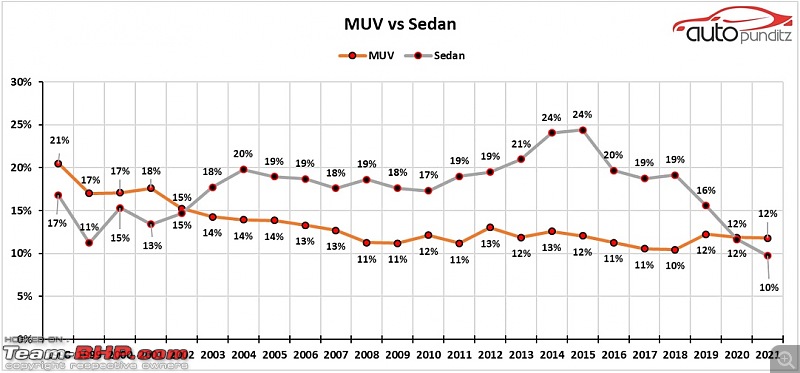

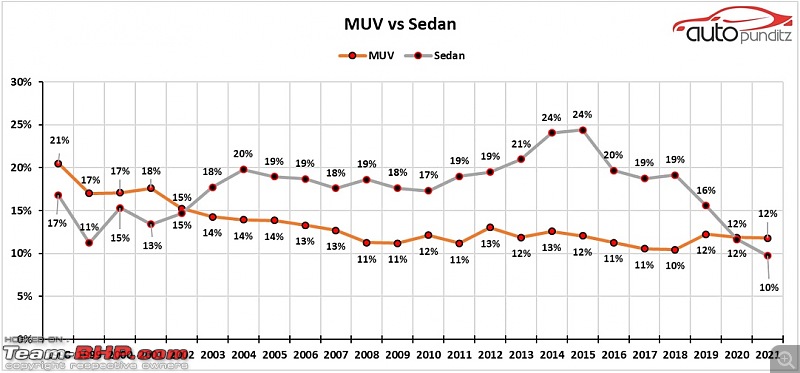

MUV Vs. Sedan:

- MUV body style overtook ever declining sedan segment in the Indian PV market

- Drop in Maruti Dzire sales ( fleet market drop due to pandemic) has badly impacted overall sedan segment share in the Indian PV market

Hatchback dilemma:

- Over the years - Maruti, Hyundai, and Tata established clear triopoly in the Indian hatchback market (since 1998)

- Together they commanded over 80% market share at any given point in time

- Other manufacturers tried but could not achieve sustainability

-In 2021, Altroz and Tiago helped Tata to make considerable in-roads into Hyundai’s hatchback territory

- New i20 lost the plot completely and also loss in market share in 2021 due to high prices and i10 has been selling at discounts throughout the year

Link

Maruti's

lack of new products, abandoning diesels, lack of focus on safety and no EVs / hybrid tech shows the attitude of an ageing warrior.

Kudos to Tata Motors :thumbs up. Growth totally driven by product, and also securing their chip supplies.

Mahindra will grow strong in 2022, thanks to the XUV700 which is a rare combination of volume + fat profits.

Nice insights.

If MSIL doesn't do something now, sooner or later, they'll also follow Kodak and Nokia as case studies in colleges.

Tata must surely be appreciated because not only they have risen up, they have done so with personnel who provide poor dealership experience, people's impression of Tata (as a taxi manufacturer).

Quote:

Originally Posted by volkman10

(Post 5232923)

- February and March month of 2021 became the two best months of vehicle sales in Indian PV market history, October 2020 still remains the best (3,33,625 units)

-In the month of April and May, sales disruption happened due to the pandemic

- July once lockdown was lifted, that is when the semiconductor shortage hit the Indian PV market hard which also hit the festive season sale.

- Tata Motors has remained the only exception in 2021 ( chip shortage)

|

Can't help but notice the improper scale on the above graph. If I did the same graph, the columns of May and September months will be taller :D

Best Selling Cars in India for 2021.

In a photo finish for the top slot , Maruti Suzuki's Wagon R gets the coveted spot piping its siblings Swift and Baleno!

- Maruti continues to dominate the top 10 space with 8 products

-

In reality, Maruti Baleno+Toyota Glanza (cross badged), with a combined sales of 1,98,563, is the best-selling product in 2021

- MUV Ertiga+XL6 became the 5th best selling product line in India

- Hyundai Creta continues to be the best-selling SUV/Crossover in India

-

In reality, Maruti Brezza+Toyota Urban Cruiser (cross badged), with combined sales of 1,42,288, is the best-selling SUV/Crossover in India

-Nexon, crossing the 1,00,000 mark in 2021 and enters the Top 10.

-Tata Altroz has significantly impacted sales of Hyundai i20

-Vitara Brezza and Dzire saw a considerable loss of traction due to the absence of a diesel engine

Link

Link

Quote:

Originally Posted by GTO

(Post 5233452)

Kudos to Tata Motors :thumbs up. Growth totally driven by product, and also securing their chip supplies.

Mahindra will grow strong in 2022, thanks to the XUV700 which is a rare combination of volume + fat profits.

|

Indian OEMs takes second place in market share for the first time in December 2021. Japanese, Korean and Indian OEMs now account for 94% of the total market.

Link

Link

More data of cars sold in 2021:

Link

Link

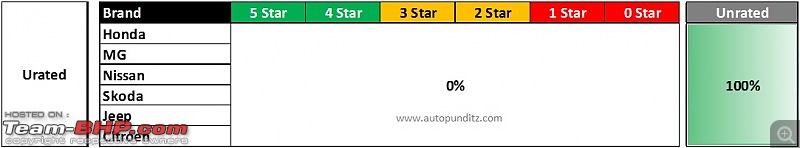

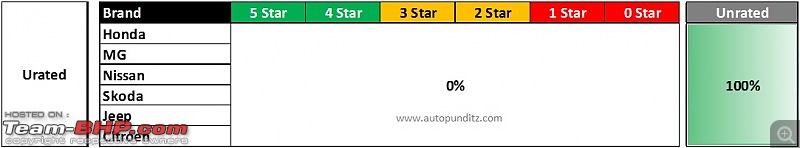

GNCAP Safety Rated Passenger Vehicles in India - 2021

- 8% of passenger vehicles sold in India have 5 star safety rating from GNCAP

- All 5-star safety rated products are from Tata and Mahindra’s stable

- 54% of passenger vehicles sold are untested cars( by GNCAP)

Manufacturer wise GNCAP of their product portfolio :

Manufacturer wise GNCAP of their product portfolio :

- Tata and Mahindra on their own started developing 5-star safety rated PV in India without any Government mandate

-Other manufactures have a mixed bag of offerings

-Toyota’s 4-star rated product (Urban Cruiser) comes from Maruti (rebadged Brezza)

GNCAP - Unrated manufacturers:  Body-style wise GNCAP Rating :

Body-style wise GNCAP Rating :

- SUV/Crossover body styled products have better safety ratings (not by default, but by design)

- Tata Altroz is the only 5-star rated product in the hatchback segment

- Renault Triber is the only 4-star rated MUV

- Tata Tigor is the only 4-star rated sedan

Link

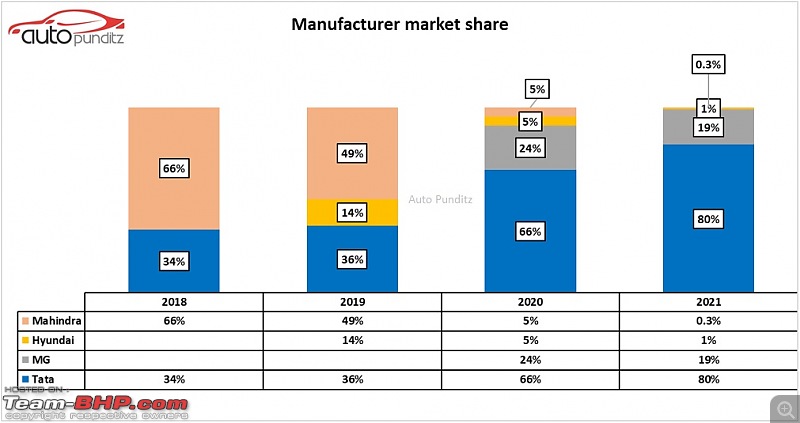

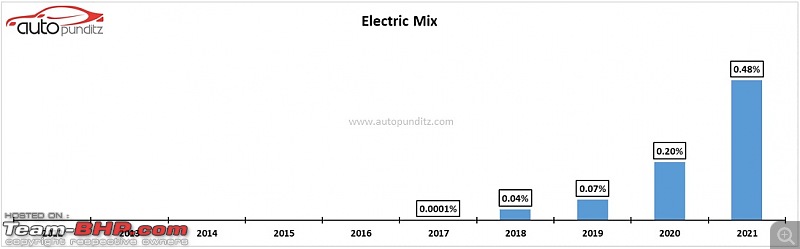

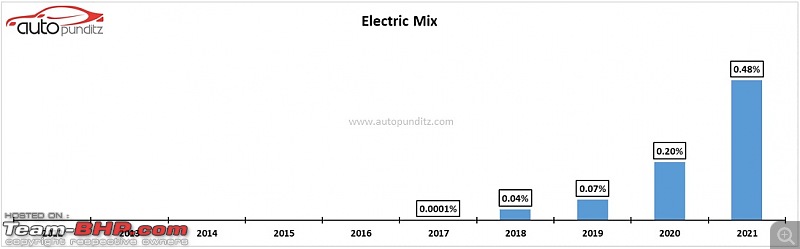

Electric Cars Sales Analysis - 2021

- BEV (Battery Electric Vehicle) passenger vehicle sales penetration level reached 0.5% in 2021, with 14,690 units sales, from 0.04% in 2018.

- Indian BEV market is powered by

battery cells made in China or South Korea, thus imported crude oil is getting replaced by imported battery cells in those vehicles.

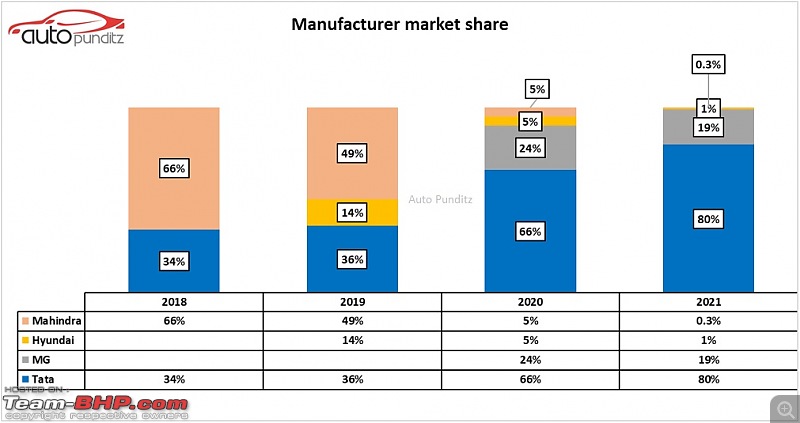

Manufacturer wise Electric Cars Sales :

Manufacturer wise Electric Cars Sales :

- Tata Motors became the biggest BEV manufacturer in India followed by MG Motors.

- Battery cells and electric motors are still imported.

- Mahindra - once EV pioneer is lost in oblivion for now.

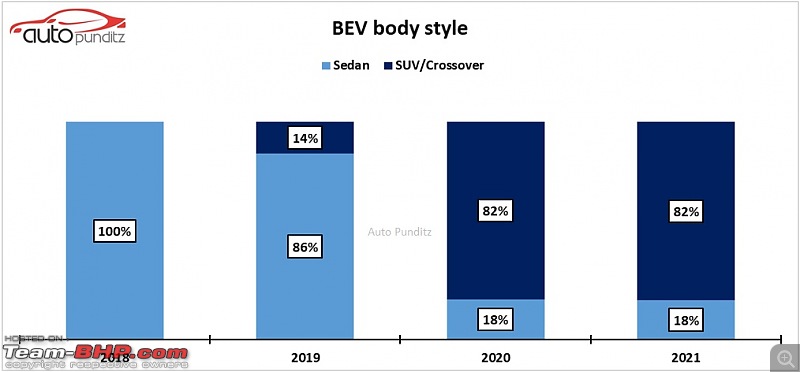

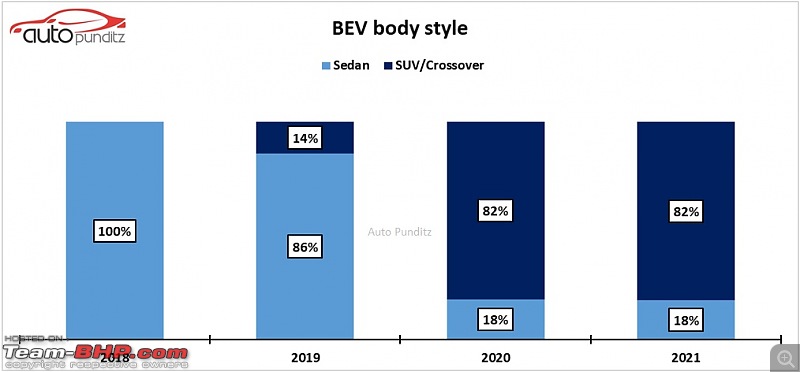

Body Style Sales Analysis

Body Style Sales Analysis

- In line with the passenger vehicles sales trend in India, SUV/crossover gained significance in the BEV segment as well.

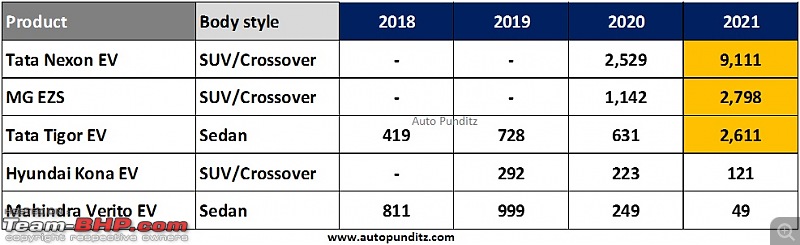

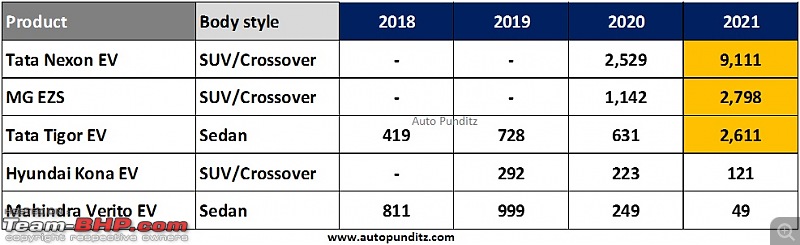

Model-wise Electric Cars Sales Trend

Model-wise Electric Cars Sales Trend

- Tata Nexon is the best-selling BEV in India followed by a much more expensive MG EZS. Tata Nexon EV market share reached 62% in 2021!

- The new larger battery pack on Tata Tigor has helped in sales growth.

-

All current products are based on ICE cars, and purpose-built BEV is yet to come into the Indian PV mass market.  Link

Link

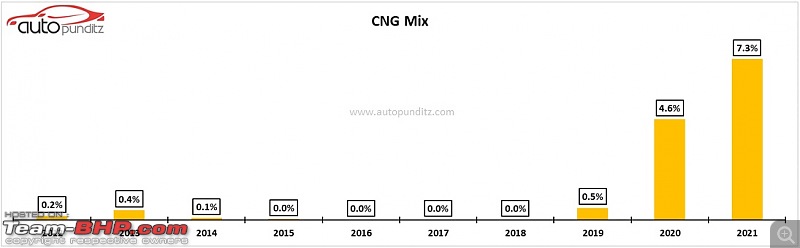

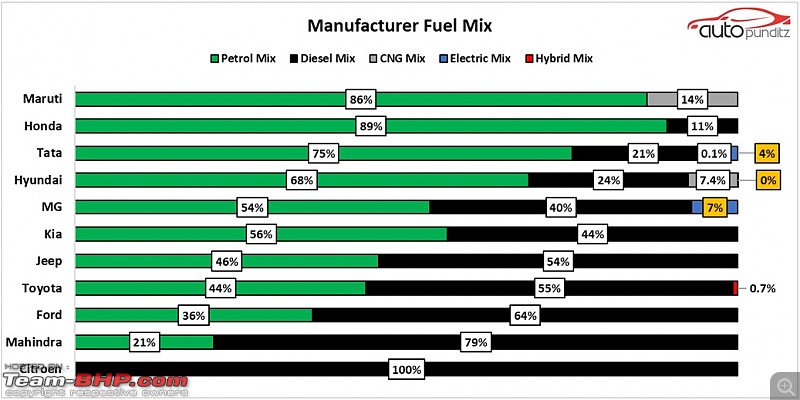

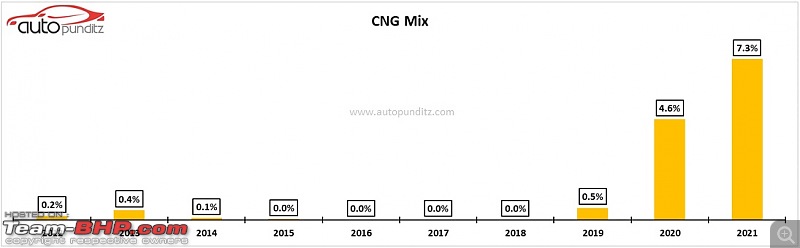

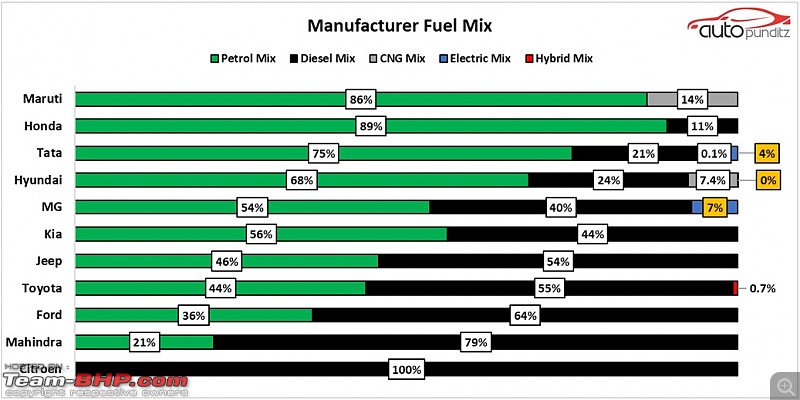

Fuel Mix Sales Snapshot - Indian Passenger Vehicle Market 2021

- 2012 was the year when the highest number of mass-market diesel passenger vehicles (PV) were sold in India and diesel mix reached its peak of 54% (prevailing emission norms - BS3+BS4).

- In 2021, 7 quarters of BS6 emission norms have already passed and diesel engine-powered PV sales have been reduced to 5,58,726 units only.

- With a full year (2021) of BS6 emission regulation – diesel mix has reduced to 18%, petrol mix reached to 74%, also making room for 7.3% CNG mix, and electric mix of 0.5%.

- Diesel mix has settled around 18%.

- Maruti’s CNG gambit is paying off, and it commands 83% CNG PV market share followed by Hyundai.

- Electric mix has reached a new level of 0.5% with two players , Tata motors and MG motors.

-Toyota is the only manufacturer selling strong hybrid PV (Camry and Vellfire) in India. Hybrids are likely to grow in 2022/2023.

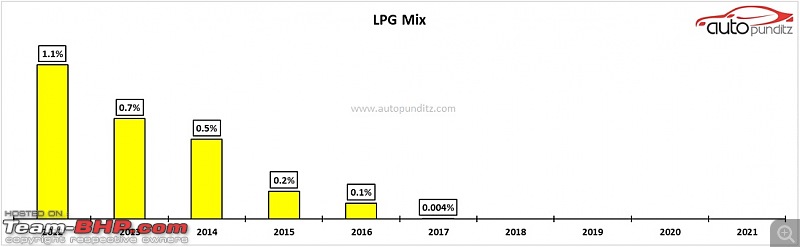

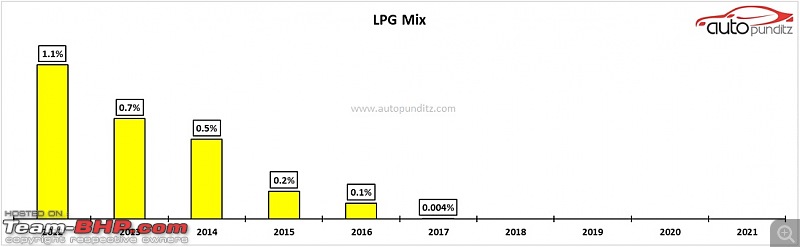

- LPG price deregulation has killed potential forever.

Link

Link

Petrol vs Diesel vs Electric vs CNG vs Hybrid Cars Sales in India - 2021

-Maruti rules in the Petrol and CNG cars sales.

- Tata's portfolio was the most balanced with a combination of Petrol, Diesel, and Electric models

- Tata Motors strengthened its hold with the launch of CNG models in January 2022 and sold over 3,000 units of Tiago CNG and Tigor CNG in the first month itself

- Maruti has diversified its fuel mix portfolio by substituting diesel with CNG (14%) - for certain models

- Tata’s electric mix has reached to 4% level, all due to strong intent and efforts

- Hyundai’s diesel mix stabilized around 24% and CNG mix reached 7.4%

- MG’s electric mix reached 7%, showing good potential for BEV in the near term

- Toyota’s petrol mix is coming from rebadged Maruti products (Urban Cruiser & Glanza)

- Jeep’s diesel mix came down to 54% (60% in 2020)

- KIA’s diesel mix is stable at around 44%

- New 2L mStallion petrol engine on Thar and XUV 700 has pushed Mahindra’s fuel mix to 21% (12% in 2020)

- Honda’s diesel volume is too low to sustain, without a proper SUV/Crossover

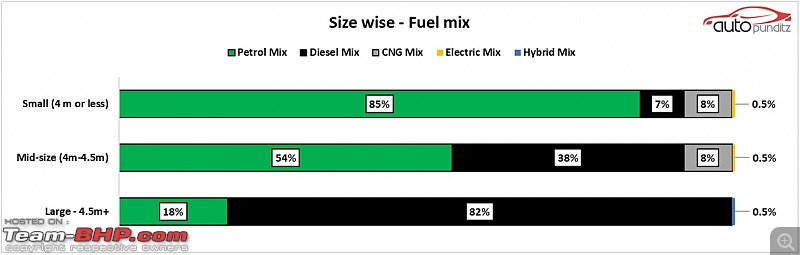

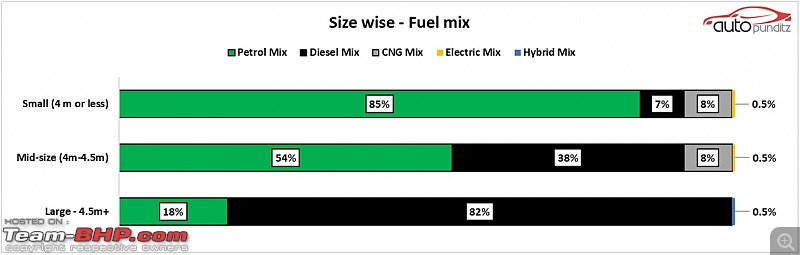

Body style Fuel Mix Analysis :

-Small diesel engine demand in the hatchback segment is nearing its end

-CNG is gaining presence in hatchback, sedan and MUV segment

- Toyota and KIA accounts for 16% diesel mix in MUV segment, rest is either petrol or CNG

- The rise in small monocoque crossover products have increased petrol dominance in SUV/Crossover segment

Size/Lengthwise Fuel Mix Analysis :

- As vehicle size increases, diesel become the obvious choice of fuel, due to higher efficiency and lower cost of running

- Sub 4m segment is dominated by petrol mix followed by CNG now

Chassis Frame wise Fuel Mix Analysis:

-Diesel is the choice of fuel for body-on-frame chassis vehicles due to weight factor

- For monocoque chassis - petrol is the highly preferred choice

Link

| All times are GMT +5.5. The time now is 04:48. | |