| | #1 |

| Team-BHP Support  | |

| |  (33)

Thanks (33)

Thanks

|

| |

| | #2 |

| Team-BHP Support  | |

| |  (17)

Thanks (17)

Thanks

|

| | #3 |

| Team-BHP Support  | |

| |  (13)

Thanks (13)

Thanks

|

| | #4 |

| Team-BHP Support  | |

| |  (18)

Thanks (18)

Thanks

|

| | #5 |

| Team-BHP Support  | |

| |  (4)

Thanks (4)

Thanks

|

| | #6 |

| Distinguished - BHPian  | |

| |  (20)

Thanks (20)

Thanks

|

| | #7 |

| Senior - BHPian Join Date: Aug 2010 Location: Madras

Posts: 3,469

Thanked: 5,246 Times

| |

| |  (6)

Thanks (6)

Thanks

|

| | #8 |

| Senior - BHPian Join Date: Feb 2011 Location: On-board JWST

Posts: 1,380

Thanked: 4,168 Times

| |

| |  (4)

Thanks (4)

Thanks

|

| | #9 |

| BHPian Join Date: Feb 2019 Location: Mumbai

Posts: 358

Thanked: 1,785 Times

| |

| |  (9)

Thanks (9)

Thanks

|

| | #10 |

| Senior - BHPian Join Date: Mar 2010 Location: Cubicle

Posts: 1,622

Thanked: 3,100 Times

| |

| |  (14)

Thanks (14)

Thanks

|

| | #11 |

| BANNED Join Date: Sep 2009 Location: Pune

Posts: 2,059

Thanked: 3,060 Times

| |

| |  (6)

Thanks (6)

Thanks

|

| |

| | #12 |

| Senior - BHPian Join Date: Nov 2006 Location: Bengaluru

Posts: 4,372

Thanked: 2,260 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #13 |

| BANNED Join Date: Mar 2020 Location: North India

Posts: 477

Thanked: 2,048 Times

| |

| |  (3)

Thanks (3)

Thanks

|

| | #14 |

| Senior - BHPian Join Date: Sep 2019 Location: Pune

Posts: 2,739

Thanked: 8,503 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| | #15 |

| Distinguished - BHPian  Join Date: Feb 2020 Location: Hyderabad

Posts: 8,697

Thanked: 47,607 Times

| |

| |  (20)

Thanks (20)

Thanks

|

|

Most Viewed

I wonder what sort of Q1 2021 sales we'll see.

I wonder what sort of Q1 2021 sales we'll see.

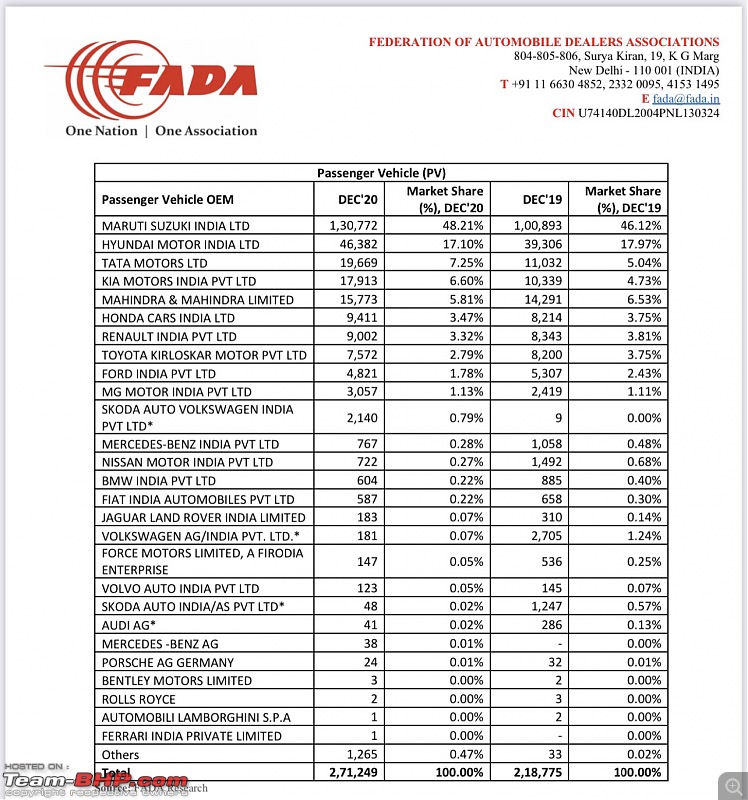

That's the way to work - Work silently, let the success make noise !! Great month for Maruti. Ideally Glanza and Urban Cruiser numbers should be included for Maruti as those are Maruti's only. That will take their share 52% plus.

That's the way to work - Work silently, let the success make noise !! Great month for Maruti. Ideally Glanza and Urban Cruiser numbers should be included for Maruti as those are Maruti's only. That will take their share 52% plus.