| |||||||

|

| Search this Thread |  48,829 views |

| | #16 |

| BHPian Join Date: Apr 2020 Location: Jaipur/Mumbai

Posts: 387

Thanked: 929 Times

| |

| |  (6)

Thanks (6)

Thanks

|

| |

| | #17 |

| BHPian Join Date: May 2020 Location: Mohali

Posts: 45

Thanked: 109 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #18 |

| BHPian Join Date: Jun 2020 Location: Trivandrum

Posts: 188

Thanked: 355 Times

| |

| |

| | #19 |

| BHPian Join Date: May 2015 Location: Pune

Posts: 43

Thanked: 76 Times

| |

| |

| | #20 |

| Team-BHP Support  | |

| |  (5)

Thanks (5)

Thanks

|

| | #21 |

| BHPian Join Date: Apr 2020 Location: Jaipur/Mumbai

Posts: 387

Thanked: 929 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #22 |

| BHPian Join Date: Jul 2008 Location: NCR

Posts: 737

Thanked: 637 Times

| |

| |

| | #23 |

| BHPian Join Date: Jun 2019 Location: Pune

Posts: 269

Thanked: 983 Times

| |

| |

| | #24 |

| BHPian Join Date: May 2020 Location: New Delhi

Posts: 399

Thanked: 1,040 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #25 |

| Distinguished - BHPian  Join Date: Sep 2008 Location: --

Posts: 3,592

Thanked: 7,516 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| | #26 |

| BHPian Join Date: Sep 2013 Location: BLR

Posts: 59

Thanked: 63 Times

| |

| |

| |

| | #27 |

| Distinguished - BHPian  Join Date: Sep 2008 Location: --

Posts: 3,592

Thanked: 7,516 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #28 |

| Distinguished - BHPian  Join Date: Sep 2008 Location: --

Posts: 3,592

Thanked: 7,516 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| | #29 |

| BANNED Join Date: Nov 2011 Location: Bangalore

Posts: 1,380

Thanked: 3,385 Times

Infractions: 0/1 (7) | |

| |  (1)

Thanks (1)

Thanks

|

| | #30 |

| Newbie Join Date: Feb 2021 Location: Hyderabad

Posts: 10

Thanked: 17 Times

| |

| |  (1)

Thanks (1)

Thanks

|

|

Most Viewed

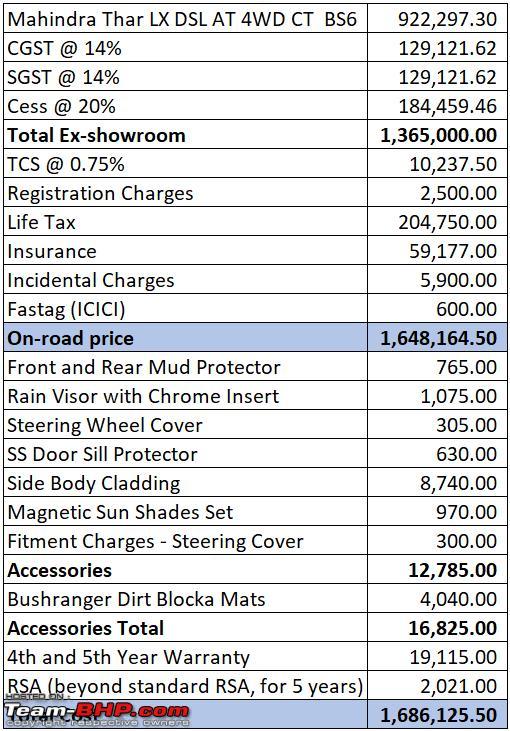

................Please note this amount does not include taxes paid by the component suppliers and insurance GST( both together I guess they would contribute to 5% or more of the total cost of vehicle).

................Please note this amount does not include taxes paid by the component suppliers and insurance GST( both together I guess they would contribute to 5% or more of the total cost of vehicle).