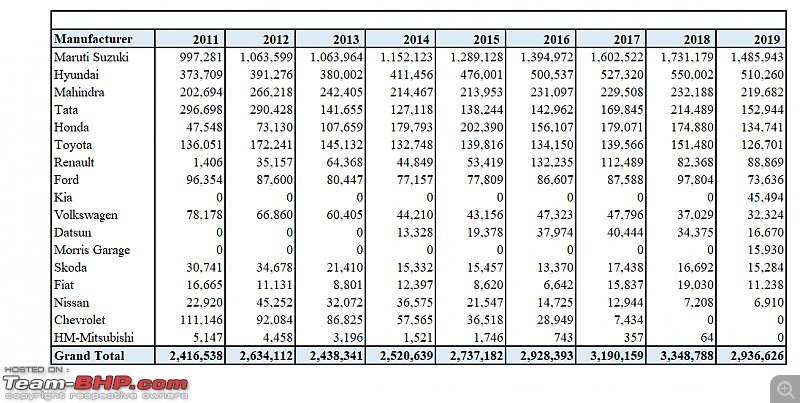

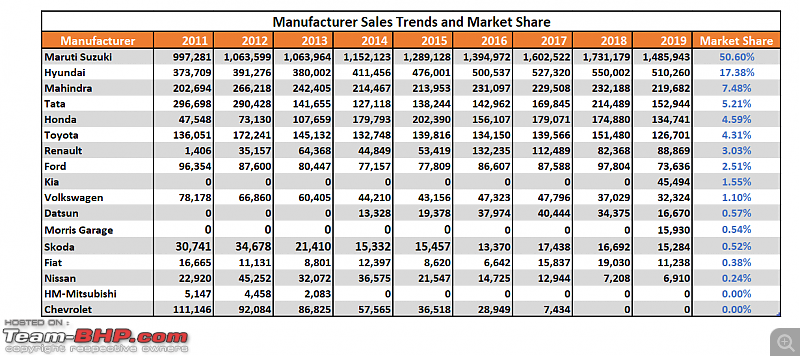

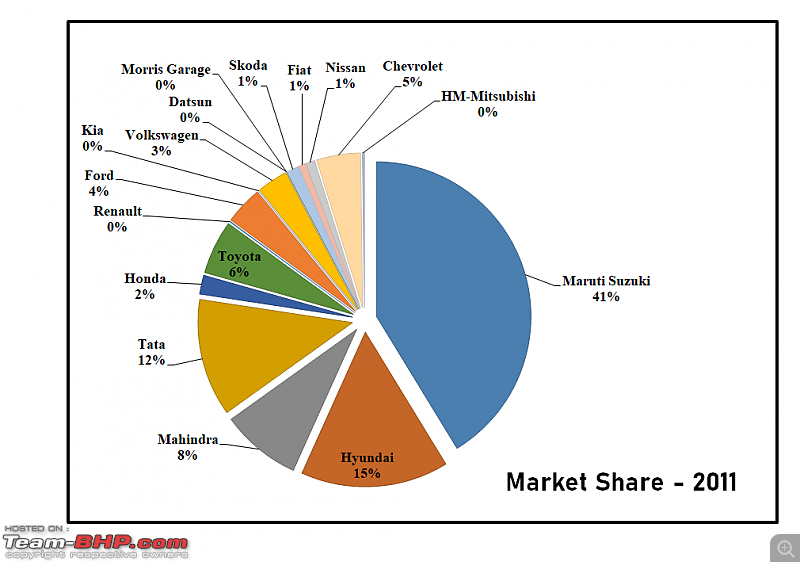

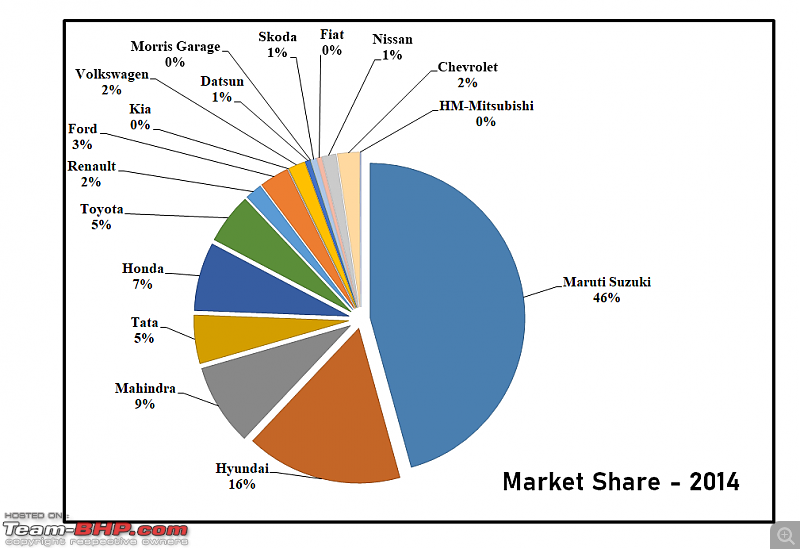

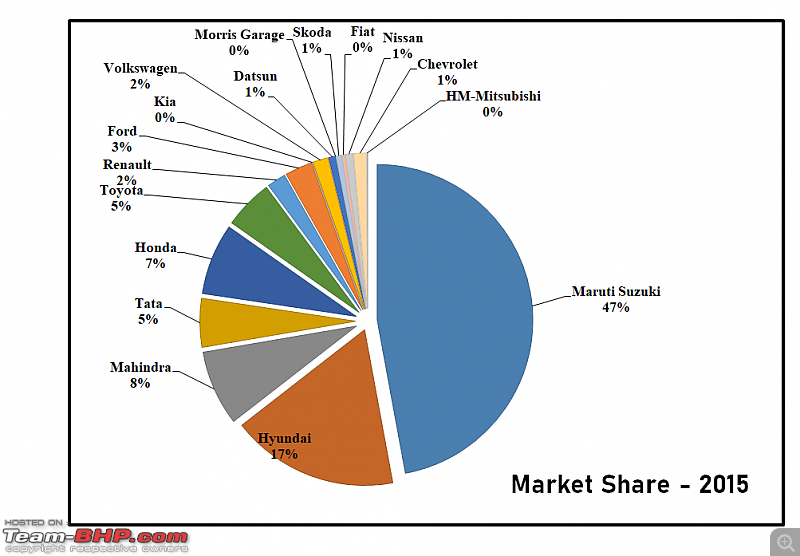

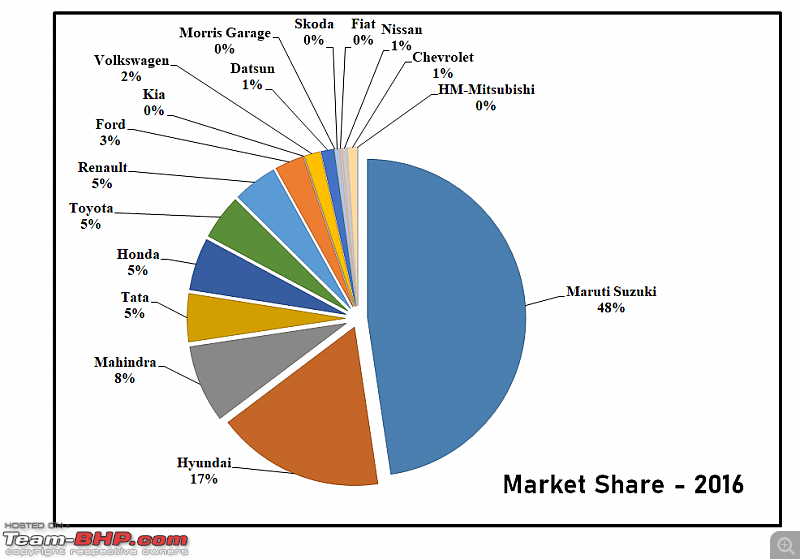

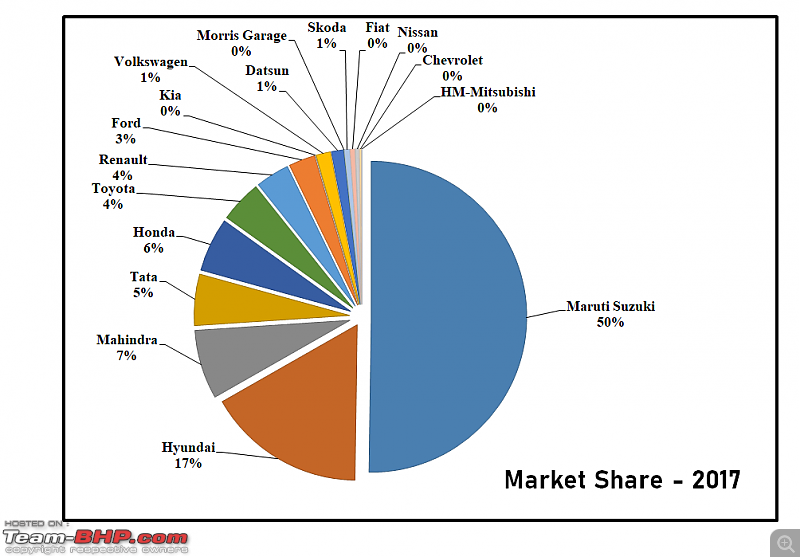

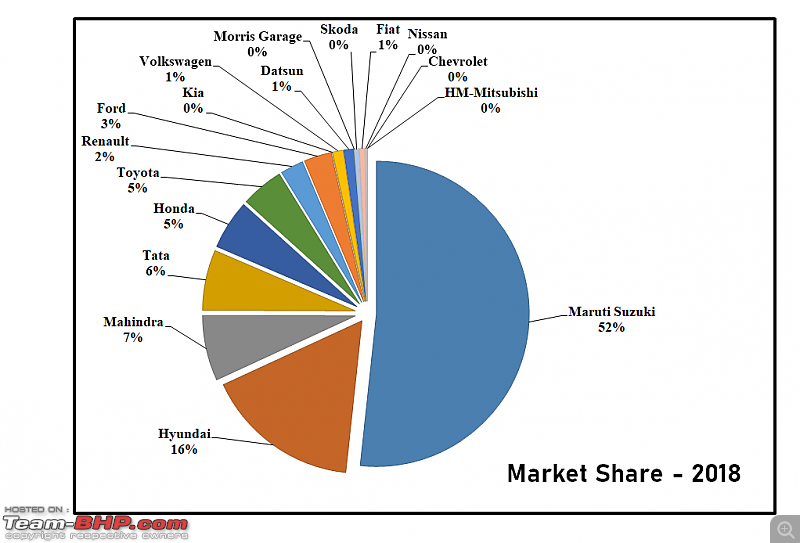

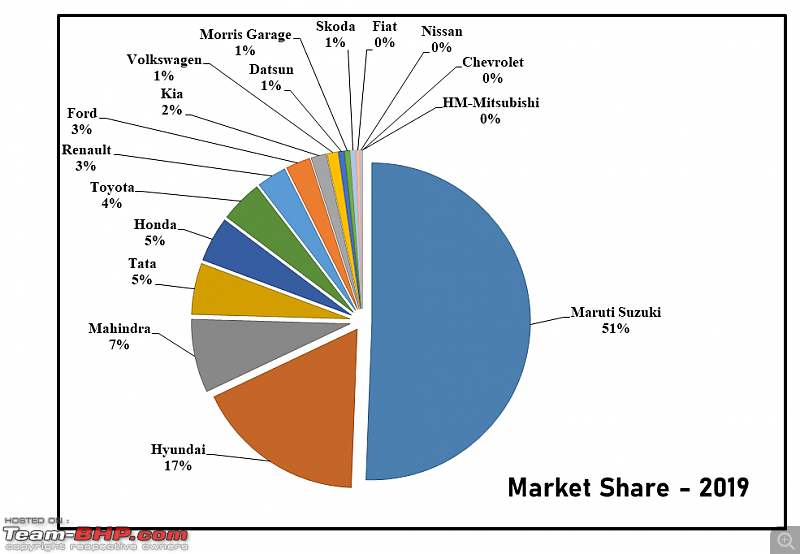

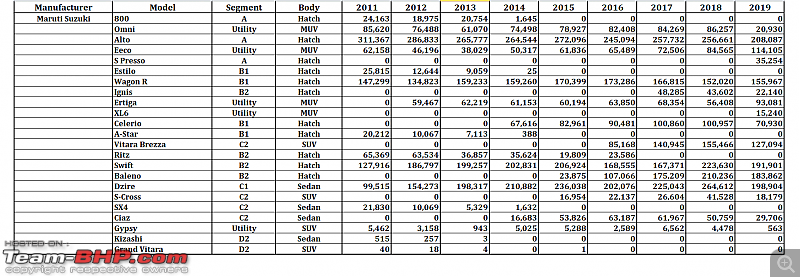

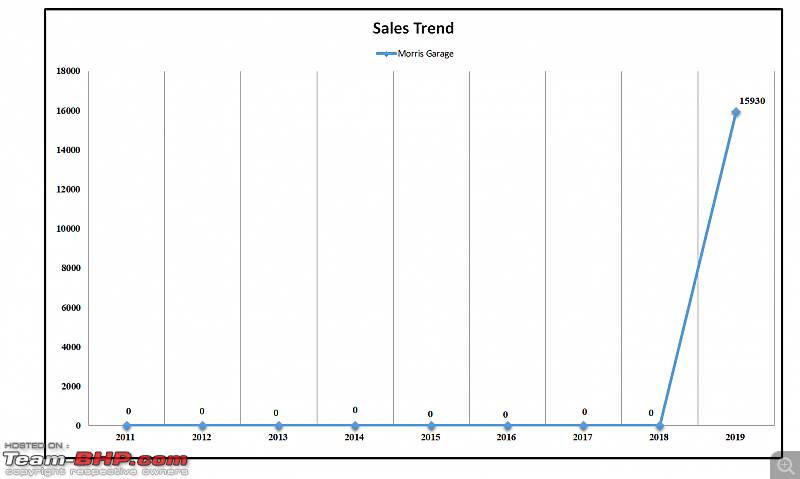

The 'BOSS' of the Indian passenger car market since ages holding 51% market share. Every manufacturer's dream to steal some market share from Maruti but I can hardly see that happening to a greater extent. Maruti reached its peak in 2018 at a whopping 17.3 lakh units and is currently down to ~14.9 lakh units thanks to BS6 fiasco (read implementation confusion and lack of readiness I feel). Coming days shall be the litmus test for Maruti thanks to BS6 implementation, crash test etc where it shall be a sight to watch how Maruti copes up and maintains its lead in the market without losing much of its sales to its competitors.

Maruti Arena + NEXA have helped Maruti gain an even greater footprint in the country and people do come out happy with a booking receipt in hand once they enter either of these showrooms. There is one car for every budget from those total 16 cars that are on offer to the junta and nothing that an average customer would be turned-off to run away from the showroom and get a competitor vehicle.

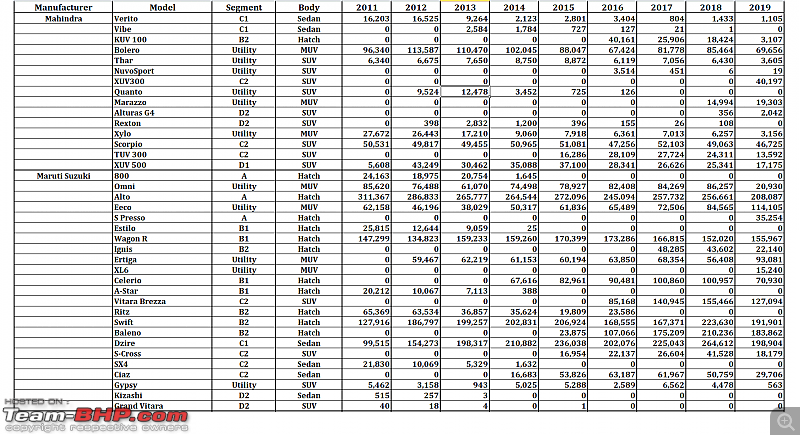

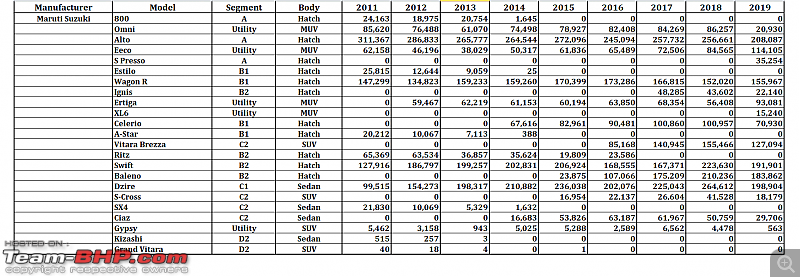

Model-wise sales

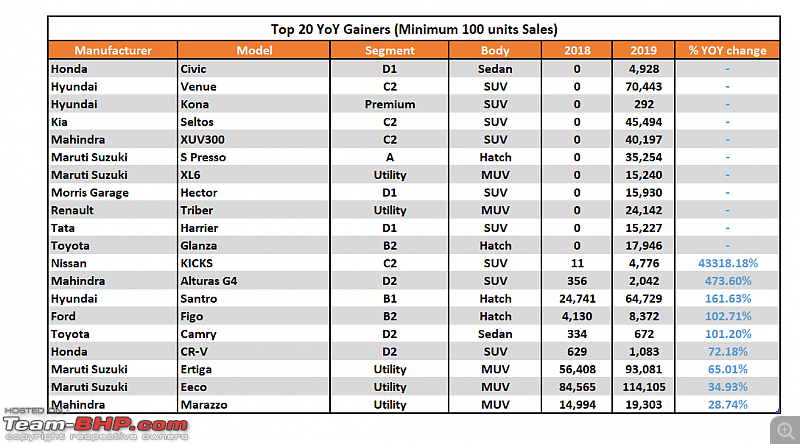

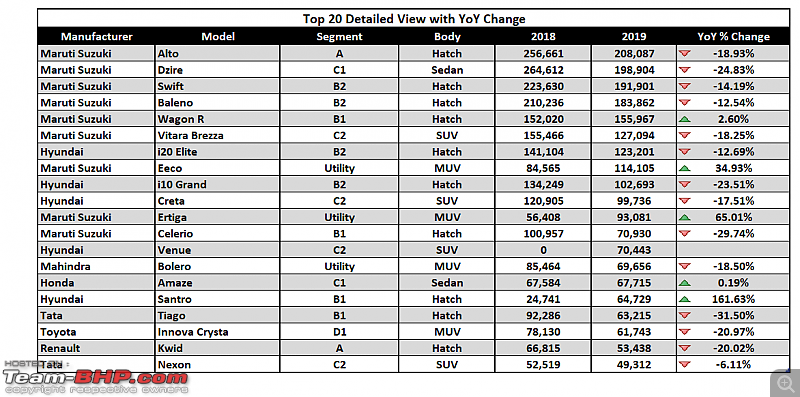

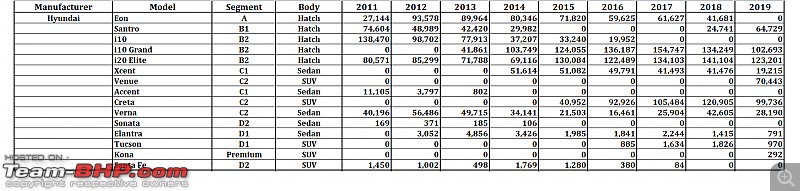

Compared to 2018, Maruti Suzuki didn't perform as expected as Y-o-Y % for most of their offerings were in negatives except for Eeco, WagonR, Ertiga (XL6 included).

Launched in 1999, the WagonR has been a consistent performer and in the early part of 2019, Maruti gave it a new lease of life by making it bigger (both inside-out) and also gave the car a new heart (1.2L K-Series) engine which makes it one of the best, no non-sense city car that is loved by every city dweller for what it offers in terms of FE, space, driveability and comfort over the competition (Hyundai Santro). Seeing a jump by 2.6% in sales over 2018, Maruti produced 1.55 lakh units of the WagonR and it contributes ~11% of total Maruti's sales in the country. Impressive I must say.

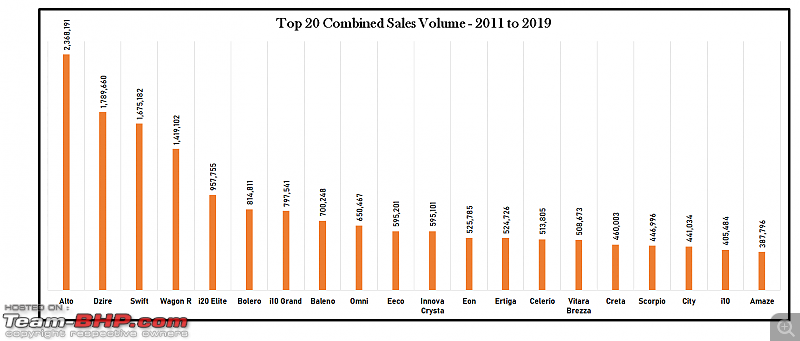

Alto, the next car that our junta just loves to no end and the cheapest (price-wise) on offer from Maruti for first-time buyers. It is a simple car with no frills and reliable with nothing underneath to go wrong. 2 lakh units a year, not a small feat for a manufacturer and this segment is pounced upon by many but hardly any success is gained except for Maruti and how it manages is commendable. Alto contributes to total car sales in India by 7% and 14% of total sales by Maruti in 2019.

Ertiga (+XL6) is the next in line dependant seller for Maruti in the people movers segment (MUV) with sales standing at 1,09,000 units (XL6 added) the next nearest competition price-wise coming from Mahindra's Marazzo (20,000 units) and Innova Crysta that is much costlier standing at a commendable ~62,000 units in 2019. Launched in 2012, it still has its fan following from both private car buyers & taxi segment due to the engines + space on offer for the price one is being charged. With a facelift in early 2019, re-designing it for better packaging and re-designed looks, helped it get more buyers to take it off the showroom floors in 2019. All said and done, with the addition of a proper petrol engine plus AT also in the line-up, I can't see any reason for an average family to not chose the Ertiga unless it is a large family requiring more space which is when Crysta will come into the picture. I can't find any other UV beating the VFM tag that the Ertiga can offer to the Indian junta. With the launch of the XL6 (through NEXA), it caters to the small premium buyers who need the same car with captain seats to travel around in class and more space inside. I feel it was good for Maruti to choose the 4-speed TC over the AMT for the Ertiga (+XL6) as it is much more acceptable and smooth in nature over the AMT. From 60,000 to 1.9 lakh units is a 65% jump contributing to almost 7.3% of total sales of Maruti Suzuki in 2019.

Swift (1.92 lakhs units), Baleno (1.83 lakh units) and Dzire (1.99 lakh units) in 2019 have seen a drop by 14%, 13% and 24% respectively. Maruti's bread and butter these cars have been since long and the drop in numbers must be worrisome to the top management. The other hatchback that didn't get the same love as the rest is the Ignis sitting in the NEXA section of the group. It dropped to 22K units in 2019, a 50% low over 2018. Not so great styling on the outside plus pricey offering didn't get to reach the households of many as Maruti would have thought when it was launched. In the B1 segment that is silently selling more in the taxi segment than the private side is the Celerio, a fairly successful model witnessed a drop of 30% in sales over last year.

In the C-SUV segment, Vitara Brezza contributes by 9% to the total sales managed by Maruti in 2019 with 1.3 lakh units being sold nation-wide. This car is in dire need of a proper refresh and not some sticker addition launch. It is losing steam now to the competition and Maruti needs to wake up and help it else shall fall-back in line to a point of no return. S-Cross, the other car that has been selling silently since launch but delays from Maruti's side to give it a petrol-powered heart, didn't help it in pushing off the showroom floors. Old and boring 1.3L DDiS engine wasn't helping when the competition was zooming ahead in all angles with different engine + transmission combo's being offered, Maruti was yet to act on it. This did drop the sales by 56% to 18,000 units in 2019. A petrol heart + AT transmission (for diesel engine too) should get the car back in form as ride, handling, comfort is great in the S-Cross and feels premium than any other Maruti on offer today. Great car but the parent is neglecting this child of its for reason best known to them.

The Utility segment is lit for Maruti with two offerings viz. Omni and Eeco that have been on our roads since ages and helped the commercial sector move items in the city and tight areas without much of an issue plus for start-ups these two cars are excellent VFM options. 1.1 lakh units of the Eeco and 20,000 units of Omni in 2019 is a commendable feat for all the crash safety-related awareness that the country is reeling under. Hardly can one find a suitable replacement for these two cars if they were to be banned/discontinued in future.

Sedan segment that is now suffering the most with hardly any sales happening for any manufacturer in the country, the Ciaz has seen 30,000 units of sale in 2019, a drop by almost 42% compared to 2018. I am not sure if the sales will sustain any longer in the months to come as everyone seems to be running behind the C-SUV/SUV segment.

At the end of 2019, Maruti launched an SUV (tall hatchback more so) named the S-Presso in the 3.5-4.5 lakh bracket. Odd styling and 1.0-litre engine with MT or AMT options, customer have lapped it up decently and how well it sustains, the future months shall say.

(11)

Thanks

(11)

Thanks

(4)

Thanks

(4)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks