Team-BHP

(

https://www.team-bhp.com/forum/)

The difficulties facing the automotive industry started long before the outbreak of Covid-19.

Quote:

Last year the global economic landscape was negatively impacted by several factors around the world, complicating operations for manufacturers.

Data published by 28 of the most important car makers* indicated that they saw less profit in 2019, with their operating profits falling by 11% to €86.4 billion**.

|

VW Group was the world’s biggest car maker in terms of sales and revenue both. The German major reported €252.6 billion in revenue v/s €250.8 billion reported by Toyota.

However in terms of profit;

Toyota was ahead and posted operating profits of €21.2 billion.

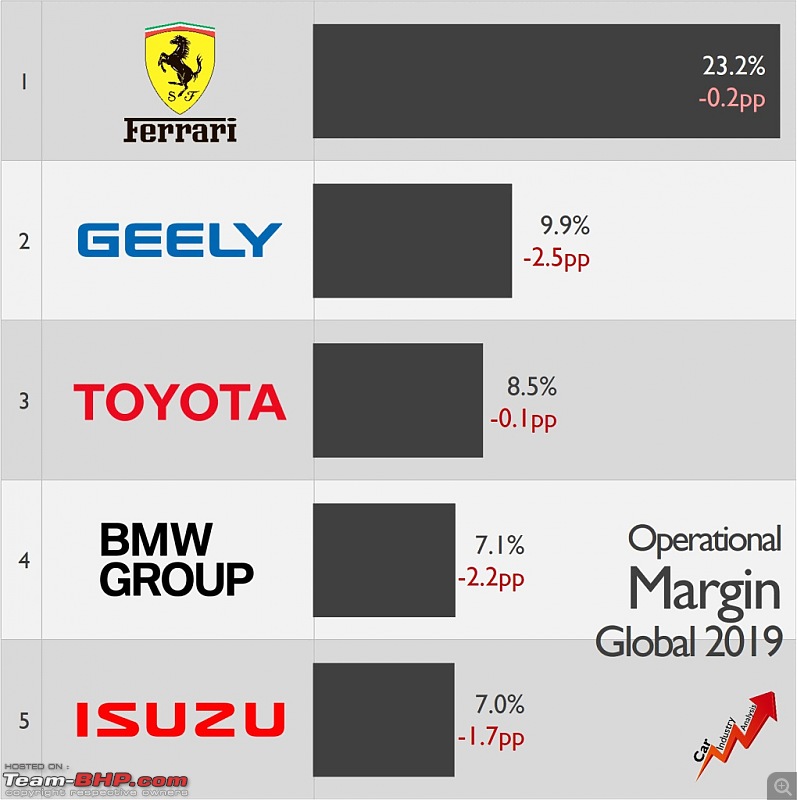

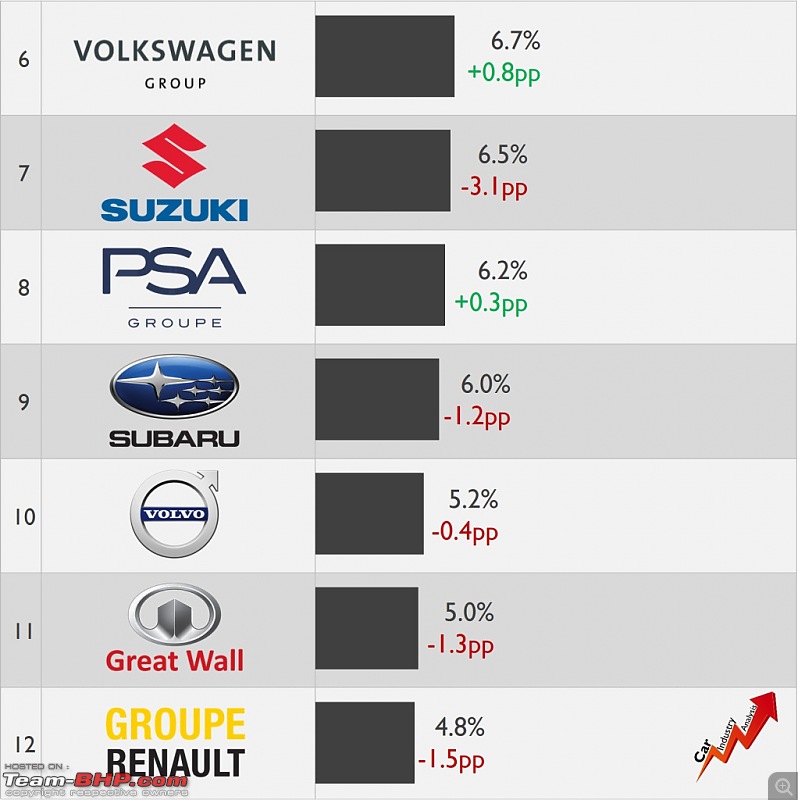

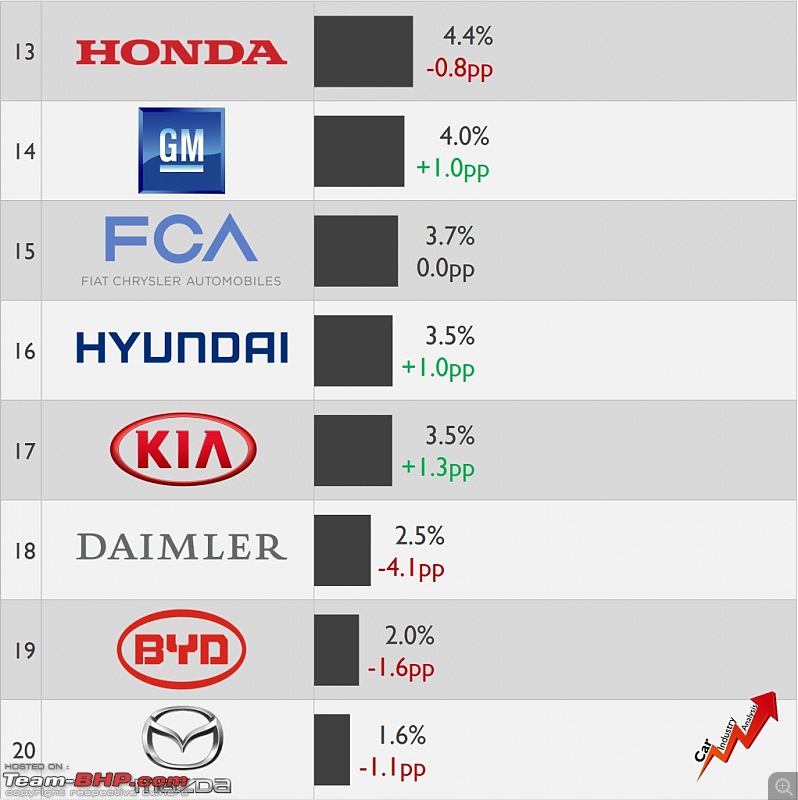

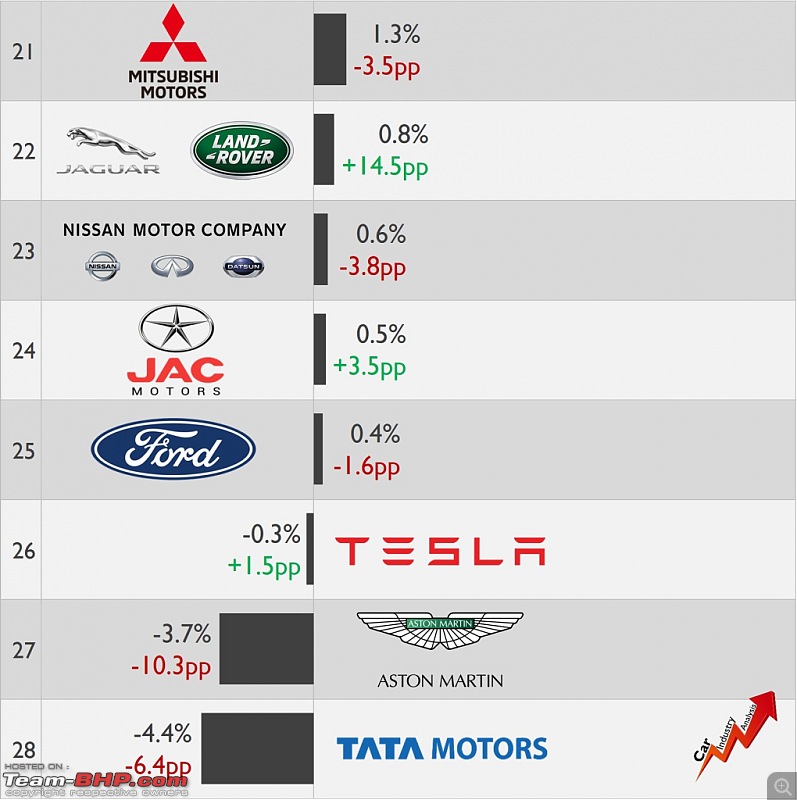

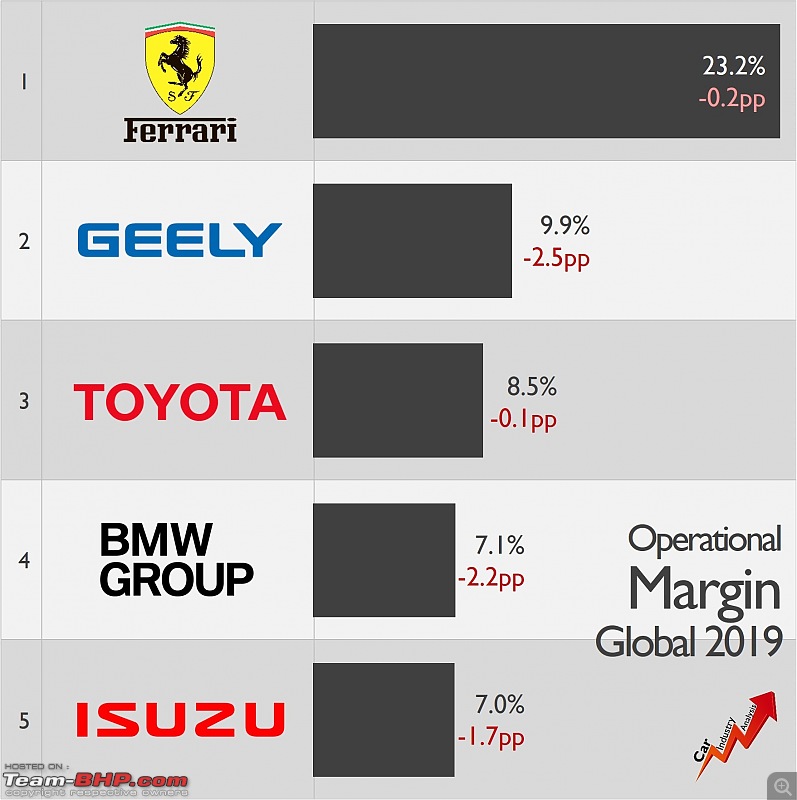

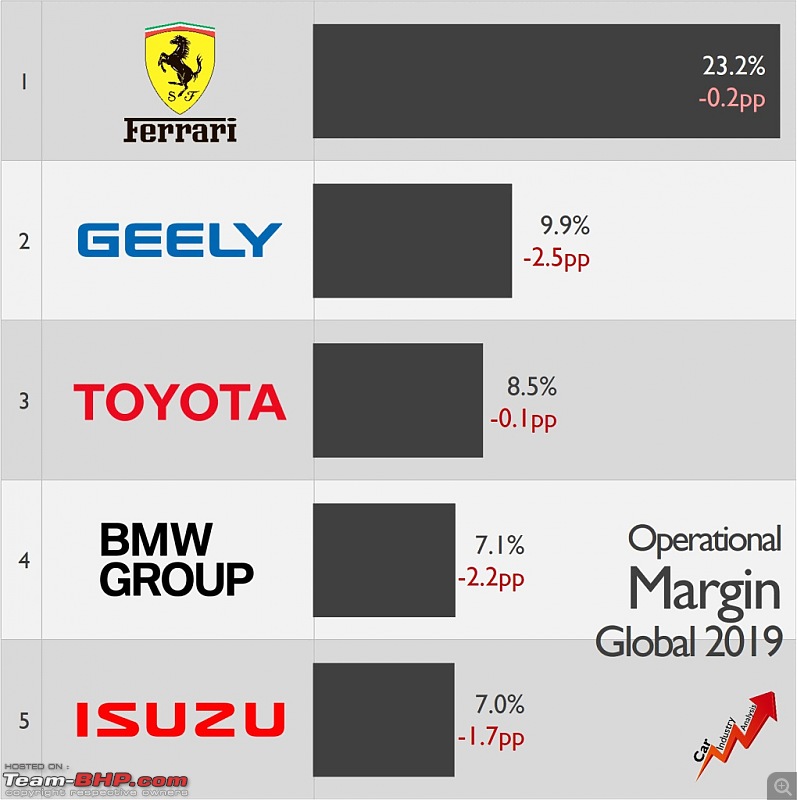

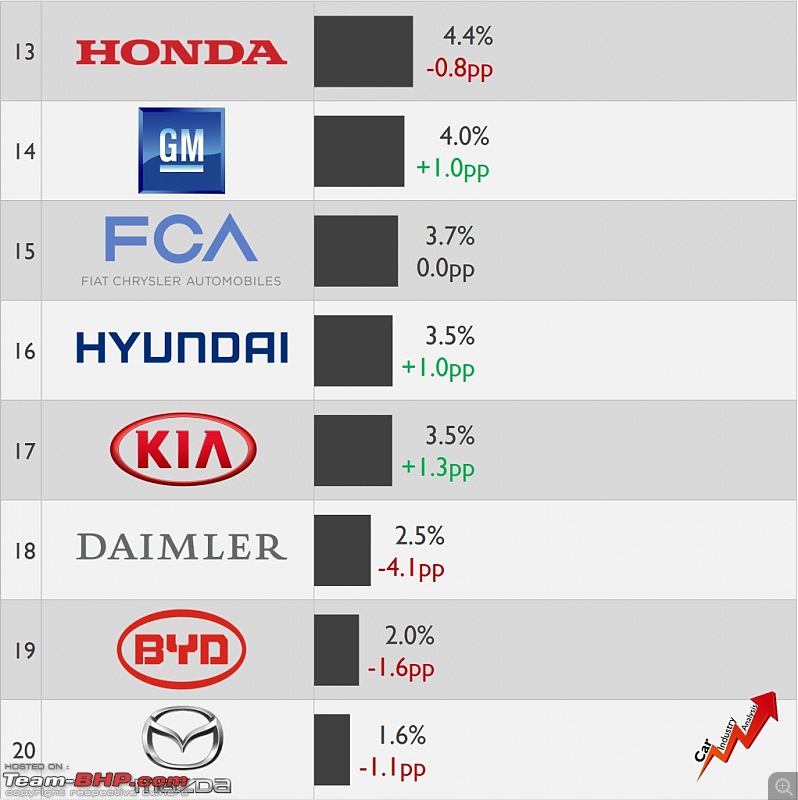

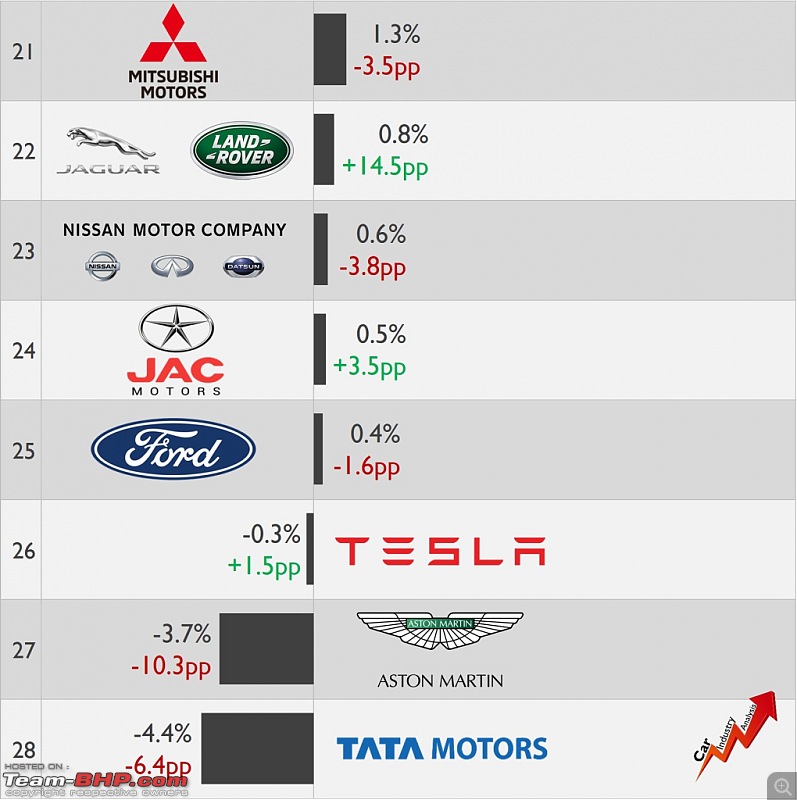

Here is how manufacturer wise Operating Margin calculation for 2019.

Tata Motors Operating Margin was the lowest among the 28 manufacturers listed above. Ferrari became the Top Brand to earn highest operating margin

Tata Motors Operating Margin was the lowest among the 28 manufacturers listed above. Ferrari became the Top Brand to earn highest operating margin – Primarily Ferrari earned most money per unit sold in 2019.

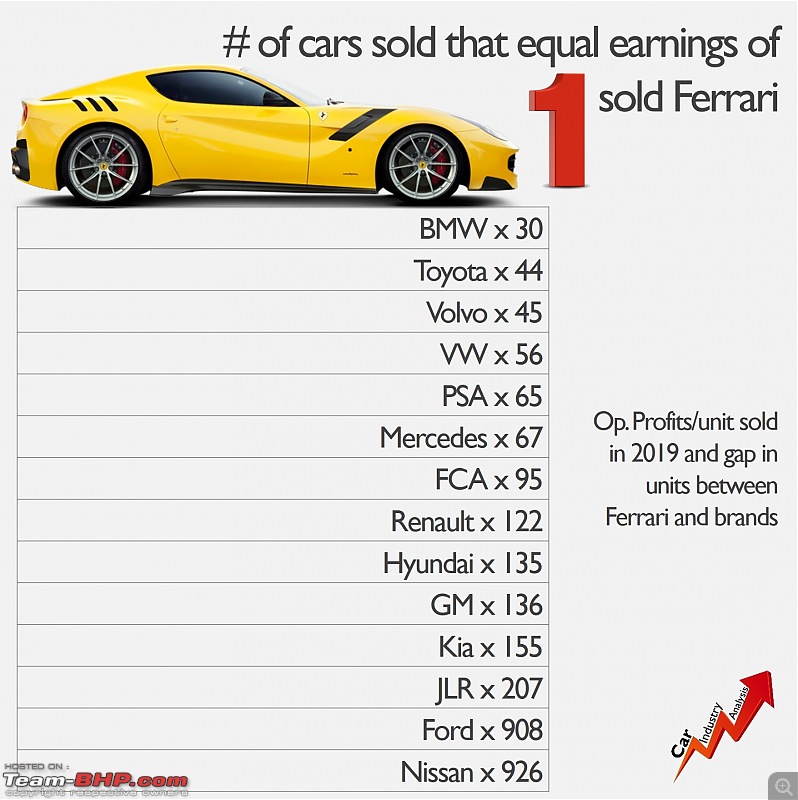

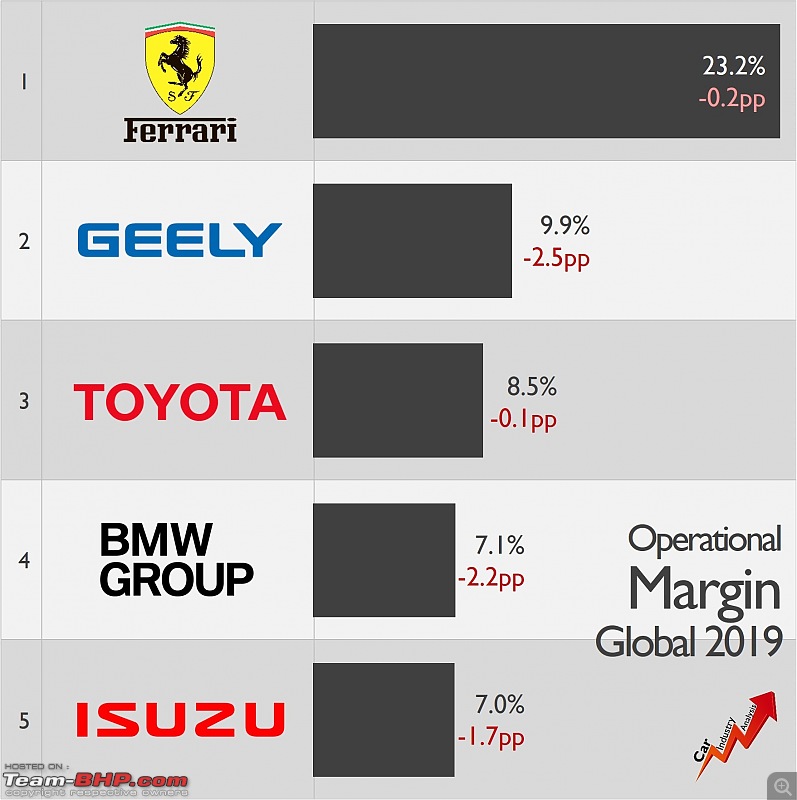

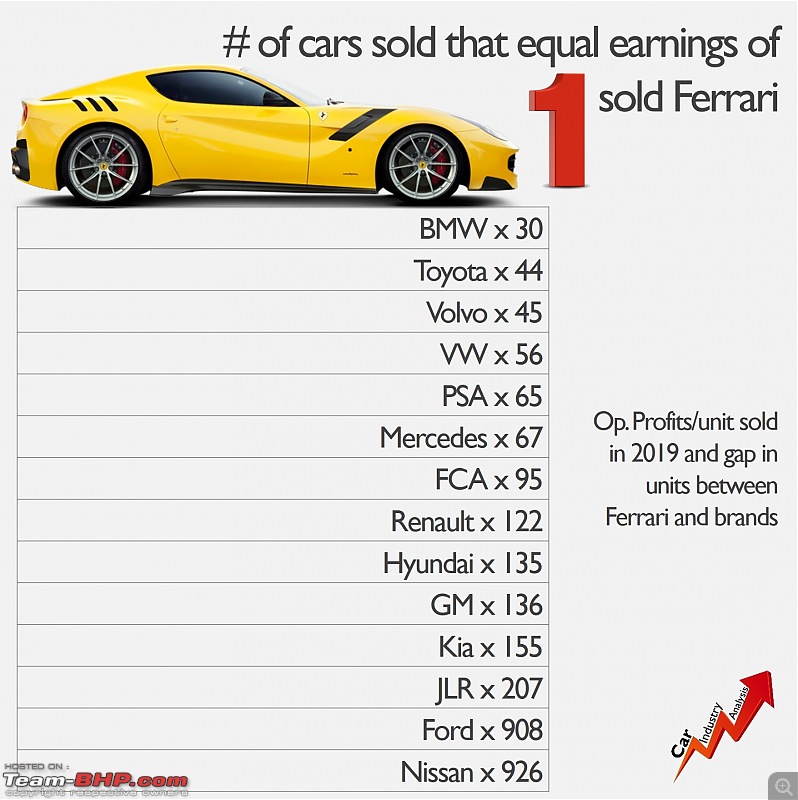

For Comparison: BMW Group needs to sell 30 units in order to earn the same amount of money made by only 1 Ferrari; while Nissan Group has to sell 926 cars!

Vehicle sales:  Profitability ranking:

Profitability ranking:

Ferrari continued to dominate the profitability ranking. After setting a record result of sales figures, the Italian car maker recorded a 23.2% operational margin, with each unit worth more than €86,000.

BMW Group needs to sell 30 cars in order to earn the same quantity of money made by only one Ferrari. Nissan Group has to sell 926 cars.

Link

Link

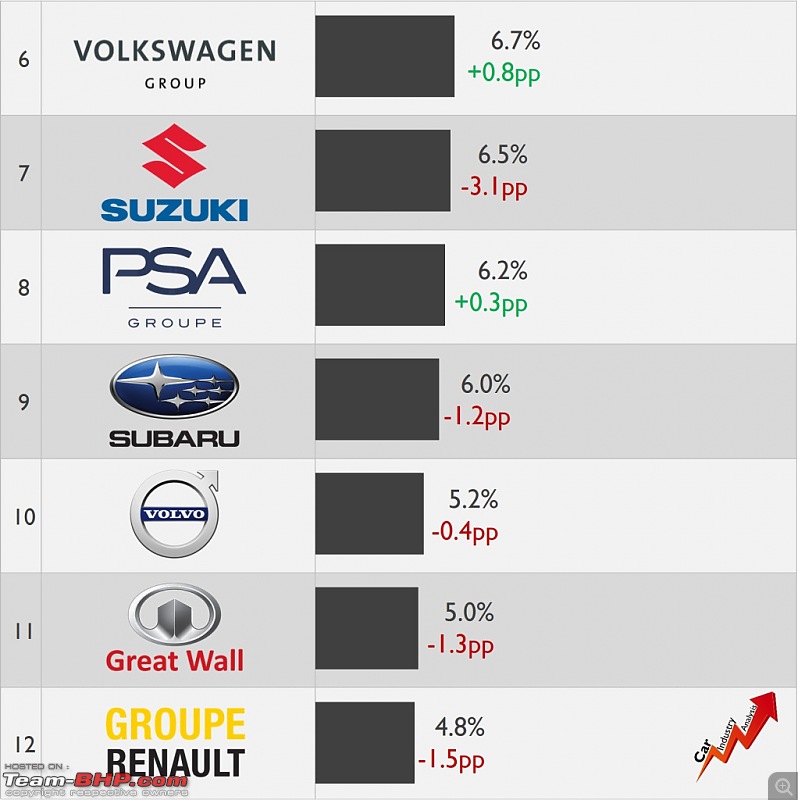

While we discuss on TATA - it is also interesting to see little Suzuki slotting in at 7th place, ahead of much more established players like PSA, Honda, Hyundai / Kia etc.

No doubt Maruti Suzuki has a major role to play in that! Not only do they contribute near 50% of the sales to Suzuki, but also fat operating margins as well compared to the extremely budget positioning of their international range.

All I can say is am really really surprised to see Geely and Isuzu in top 5!! In fact top 10 also has Suzuki which makes it even more surprising. To have margins, you need to have pricing power is my guess. I didnt expect these brands to have it!

Thanks volkman!!

Some big surprises in there especially the margins for Suzuki even after having a drop of 3.1% YoY, which means in 2018 it had more margins than BMW :Shockked:

Can someone tell me why did the Daimler group

(mainly Mercedes I guess) experience such a big decline in margins?

In 2019, Ferrari sold 10,131 units and continued to dominate the profitability rankings amongst OEM carmakers. The Italian carmaker recorded a staggering 23.2% operational margin and netted over €86,000 per car. Interestingly, this was achieved even without an SUV in their portfolio (The Purosangue is expected only in 2021). This means BMW needs to sell 30 cars to match the earnings of just 1 Ferrari while Toyota needs 44, Volvo 45, Volkswagen 56 and Groupe PSA 65. Former owners of Ferrari - FCA, need to sell 95 cars to match profits of just one Ferrari on an average. Towards the lower end, Ford needs to sell 908 cars and Nissan 926 to match earnings of 1 car sold by the Italian sports car manufacturer. Note the absence of Suzuki in this list.

Ferrari leads the manufacturers with a 23.2% operating margin. The remaining OEMs in the top 5 are Geely, Toyota, BMW Group and Isuzu:

BMW Group needs to sell 30 cars in order to earn the same quantity of money made by only one Ferrari. Nissan Group has to sell 926 cars:

Source

Source

I'm sorry but how does Mercedes have to sell more vehicles than BMW to manage Ferrari's margin?

Quote:

Originally Posted by nikhilthegunner

(Post 4788237)

I'm sorry but how does Mercedes have to sell more vehicles than BMW to manage Ferrari's margin?

|

BMW is hiring grill-botox injecting quacks masquerading as car designers to save money during the design phase. Their strategy is working quite well going by the profit numbers!

So do these numbers show how overpriced a Ferrari is, for what it offers?

How about Porsche, Lamborghini, Bentley or Rolls-Royce? Why aren't these manufacturers not in the list? (Or are they included in their parent companies? Kia and Hyundai are mentioned separately)

If not, how many cars do these manufacturers need to sell to match the earning from 1 Ferrari?

Looking at the numbers I guess BMW includes Rolls Royce and VW includes Audi/Lamborghini. I am not sure why they say brands when it is calculated based on the company's earnings. May be the companies don't split it out per brand?

Quote:

Originally Posted by Flyer

(Post 4788376)

How about Porsche, Lamborghini, Bentley or Rolls-Royce? Why aren't these manufacturers not in the list? (Or are they included in their parent companies? Kia and Hyundai are mentioned separately)

If not, how many cars do these manufacturers need to sell to match the earning from 1 Ferrari?

|

Why not compare Ferrari with the likes of koenigsegg, pagani, Hennessy, Aston Martin, etc?

Or the criteria is atleast 10k cars sold.

Or it might be a marketing ploy from the investors as recently Ferrari overtook ford and GM in mcap.

Quote:

Originally Posted by Flyer

(Post 4788376)

How about Porsche, Lamborghini, Bentley or Rolls-Royce? Why aren't these manufacturers not in the list? (Or are they included in their parent companies? Kia and Hyundai are mentioned separately)

|

I'd guess that they are included under the Volkswagen group numbers itself & Rolls Royce under BMW.

Surprised to see Honda so low. Especially looking at the extremely greedy HCI division.

Perhaps, world over they are still producing quality cars.

Quote:

Originally Posted by 07CR

(Post 4802330)

Surprised to see Honda so low. Especially looking at the extremely greedy HCI division.

Perhaps, world over they are still producing quality cars.

|

I hope you do realise that India contributes just 2-3% to Honda's Global sales. Honda sold 5 million+ vehicles last year, with just over 100,000 coming from India:)

Quote:

Originally Posted by tarik.arora

(Post 4802544)

I hope you do realise that India contributes just 2-3% to Honda's Global sales. Honda sold 5 million+ vehicles last year, with just over 100,000 coming from India:)

|

Goes to show that when companies take the Indian customer for granted, we respond likewise. If Suzuki can punch above its weight in these rankings thanks to MSIL, it will be interesting to note how much Hyundai India is contributing to its parentís global margins. Of course, Hyundaiís global sales are much higher, but in absolute numbers, it should be quite something.

| All times are GMT +5.5. The time now is 09:24. | |