Team-BHP

(

https://www.team-bhp.com/forum/)

2021:

Tata Motors Q2 results: Consolidated loss widens to

Rs 4,442 crore

The performance of the company took a hit owing to lower volumes at its Jaguar Land Rover (JLR) business due to the COVID-induced global chip shortage that hit production.

Tata Motors Ltd reported a consolidated net loss of ₹4,441 crore for the second quarter ending September (Q2FY22). The company had posted a net loss of ₹314 crore in the year-ago period (Q2FY21) and ₹4,451 crore in the previous June quarter (Q1FY22) respectively.

Quote:

JLR retails were down 18 percent year-on-year (YoY) to 92.7K units. The company’s India business continued robust growth and witnessed increase in both volume and average realisations for the period. The domestic volumes were up 77 percent to 162.4K units.

|

Link

Quote:

Originally Posted by volkman10

(Post 5065548)

Tata Motors Posts $1 Billion Loss As Jaguar Costs Hit Bottom Line.

|

Quote:

Covid-related lockdowns across major markets such as India, China and Europe

|

It's funny when I read comments from Fanboys saying "Boycott MG" for their Chinese origin, imagine if people in China, in-turn boycott JLR for its Indian origin!

Mods : delete if for to be offtopic.

Quote:

Originally Posted by giri1.8

(Post 5186781)

It's funny when I read comments from Fanboys saying "Boycott MG" for their Chinese origin, imagine if people in China, in-turn boycott JLR for its Indian origin!

Mods : delete if for to be offtopic.

|

:OT

One must be naïve to think china doesn't do such trade tactics? The Japanese boycott around 2012, Australian boycott ongoing currently, there's no need to trouble ones imagination it's a strategy china uses regularly.

Quote:

Originally Posted by shortbread

(Post 5186819)

:OT

One must be naïve to think china doesn't do such trade tactics? The Japanese boycott around 2012, Australian boycott ongoing currently, there's no need to trouble ones imagination it's a strategy china uses regularly.

|

Let's just not repeat what they do. Doesn't make any sense since Tata too uses lots of made in China components.

Quote:

Originally Posted by giri1.8

(Post 5186820)

Let's just not repeat what they do. Doesn't make any sense since Tata too uses lots of made in China components.

|

Perhaps we should move the discussion somewhere else.

It's imperative for India's own economic security to either diversify the supply chain or even better be self reliant, than be overtly dependent on a single hostile country!

Tata Motors Q3 Results: Posts Wider-Than-Expected Loss, Revenue Falls

The automaker's loss stood at Rs 1,516.14 crore in the quarter ended December compared with a loss of Rs 4,441.57 crore in the preceding three months and a profit after tax of Rs 2,906.45 crore a year ago.

Quote:

Revenue fell 5% year-on-year to Rs 72,229.29 crore, against the Rs 72,679.97-crore

forecast.

Earnings before interest, tax, depreciation and amortisation improved sequentially but was down 48% year-on-year to Rs 7,078.02 crore. That compared with the estimated Rs 6,791.20 crore.

Margin stood at 9.8% against 7% in Q2 and 16% a year ago.

|

Quote:

Tata Motors' net debt rose to Rs 53,000 crore, largely led by additional working capital requirement for JLR that required additional debt of Rs 17,000 crore.

|

Link

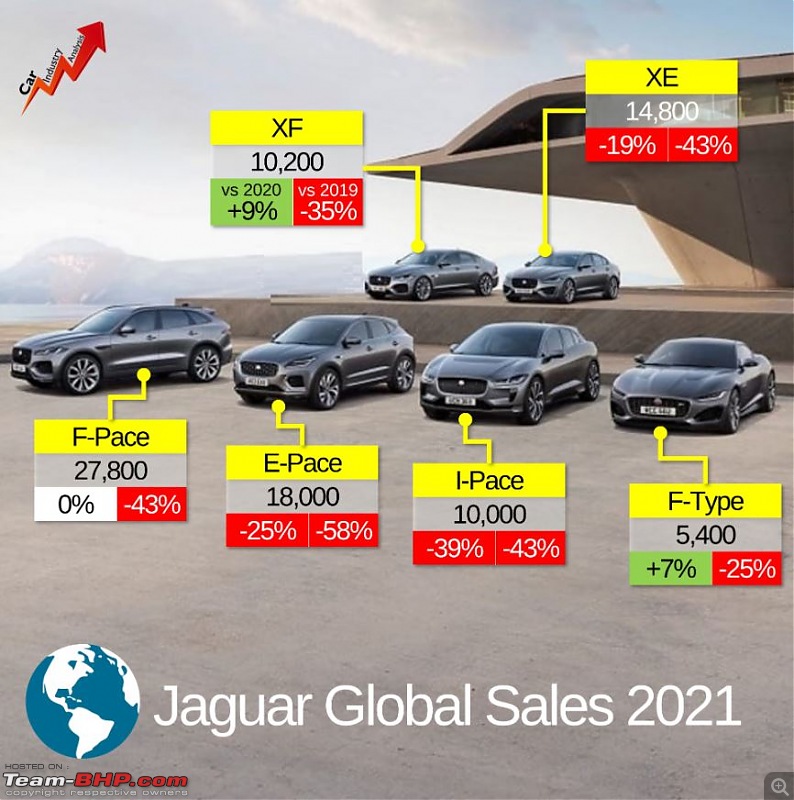

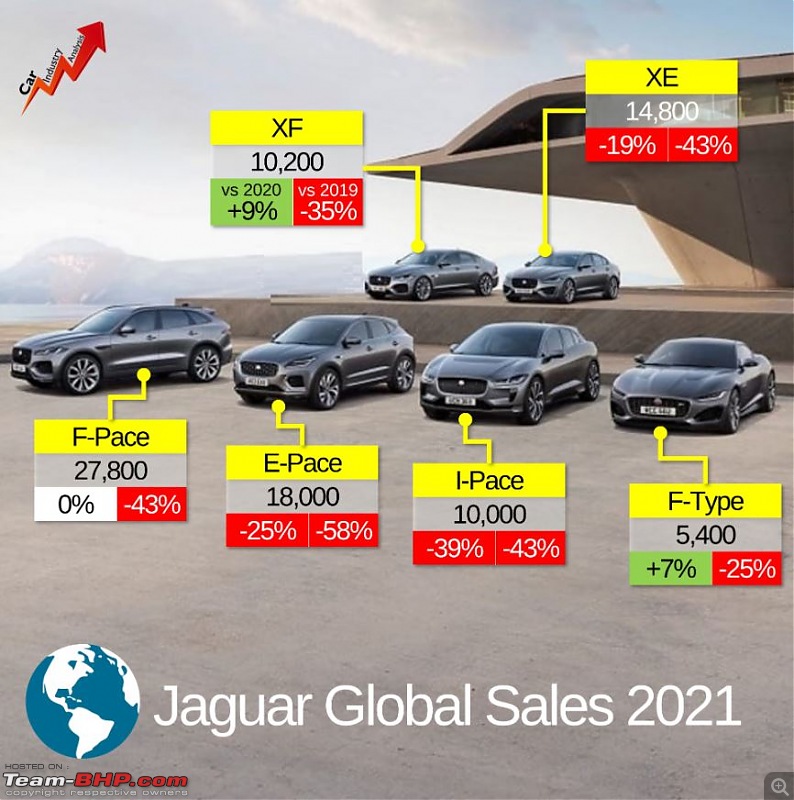

The drooping sales of Jaguar, an uphill task to revive the uptrend!

Quote:

Jaguar retail sales fell by 16% vs 2020 to 86,300 units. That's 47% less vs 2019, 52% vs record in 2018 (180,800 units). The brand struggles to gain traction partly because of reputation issues in the past, partly because it lost the brand hype/distinction it used to have

|

Tata Motors reports Q4 consolidated

net loss of Rs 1,032 crore; sales slump 11.5% YoY.

The company reported an 11.5 percent year-on-year decline in consolidated revenue from operations to Rs 78,439 crore for the reported quarter.

The weakness in the performance of the company was largely down to subsidiary Jaguar Land Rover, whose revenues in the reported quarter nosedived 27.1 per cent year-on-year to 4.8 billion pound sterling.

The weakness in the revenues of JLR was down to the company's inability to secure semi-conductors to ramp up production while disruption in the European and China business also weighed.

Link

2022:

Tata Motors Q1 results: Consolidated net loss widens to ₹5,007 cr, misses estimates.

Tata Motors Ltd reported a consolidated net loss (attributable to shareholders of the company) of

₹5,006.60 crore for the April-June quarter (Q1FY23). It reported consolidated net loss of ₹4,450.92 crore in the year-ago period (Q1FY22).

The passenger vehicle giant's consolidated revenue jumps 8% to ₹71,934.66 crore as against ₹66,406.05 crore from a year-ago period.

Quote:

British arm JLR saw a 11.3% YoY drop in sales at 4,406 million pounds. The company said that retail sales for JLR in the quarter under review were 78,825 vehicles, broadly flat compared with March quarter and down 37% compared with the year-ago period.

|

Quote:

Sequentially, JLR revenues were down 7.6%, impacted by supply challenges including semiconductor shortages, slower than expected ramp-up of the New Range Rover and New Range Rover Sport production and China lockdowns

|

Link

Tata Motors Q2 consolidated

net loss narrows to Rs 944.6 crore.

- Tata PV business continued its strong momentum with wholesales at 142,755 vehicles (+69% yoy and 10% qoq), amid strong festive demand and debottlenecking actions.

-Consolidated revenue from operations rose 29.7 percent on a year-on-year basis to Rs 79,611.3 crore for the reported quarter.

- Domestic commercial vehicles business registered a 19% growth in sales over Q2 FY22 led by led by stronger sales of MHCVs.

-Tata Motors' JLR revenue was £5.3 billion during Q2FY23, which is up 36% YoY from Q2FY22.

Link

| All times are GMT +5.5. The time now is 22:22. | |