| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  316,055 views |

| | #1 |

| Team-BHP Support  | Guide: Investing in shares of the automotive sector As car enthusiasts, we have an unique insight into the automobile sector companies when compared to others. Eg: We know how Maruti is killing the competition. We know that Bajaj is innovating & expanding into higher CC segment with the launch of Dominar, and it could change its fortunes. We knew before everybody else that Royal Enfield Bullet has become a lifestyle vehicle. Just look at the popularity of 'Indian Car Sales & Analysis' Thread or other threads in the 'Indian Car Scene' sub-forum. There is a way to harness this knowledge and actually make money - by investing in stocks of car makers, two/three wheeler makers and auto component makers. So yeah, while a car is a depreciating asset, shares in automobile companies are appreciating assets. Personally, I have been investing in the stock markets since the year 2000. Although my first car was bought on a car loan, I have never taken one since then. All my cars (and even real estate) have been purchased from sale proceeds of stocks.  On this thread, I would like to introduce you to the world of investing in stock markets in general, but automobile stocks in particular. A few important points: - You don't need to have MBA Finance degree or CA degree to invest in stocks. - Making money in stocks involves just two factors -> application of logic/knowledge (20%) and psychology (80%). PSYCHOLOGY & STOCK MARKET INVESTING - Remember that investing in stocks is not too different from investing in real estate. When one invests in apartment, this is what we do - 1) Find the right location. Will there be a Metro subway coming up soon? Is there a smelly drainage close by? Ocean view? How far from airport/mall/schools? 2) Check how much rent one can get. Is there an oversupply or shortage of apartments in that location? 3) How good is management of real estate company building the apartment? Have they delivered on time? 4) Is the apartment reasonably priced? Rs. 4,000 per sq ft apartment might be a great deal. But Rs. 1,000 per sq ft apartment (far away from city center) might be a bad deal. Extending the above logic to stocks: 1) Find the right sector & stock. Which car company is doing well (Eg: Maruti) and which company is struggling (Eg: Tata Motors)? 2) How much dividends can we get by investing in a stock? 3) How good is management of the car company? Have they made the right strategic decisions? (Eg: M&M Vs Tata Motors) 4) Is the stock reasonably priced? Remember that Rs. 4,000 stock might be "cheaper" than Rs. 400 stock. WHAT IF STOCK MARKET CRASHES?  The biggest problem with the stock market is that price of the investment changes every day. But the market price of a stock should not bother you much AFTER you made the investment. Let's take the real estate analogy again - Let's say you have bought an apartment for Rs. 40 Lakhs. Let's assume that you have put it on sale on eBay. Day 1: You got a bid for Rs. 40.2 Lakhs Day 2: You got a bid for Rs. 38 Lakhs Day 3: You got a bid for Rs. 41 Lakhs Day 4: You got a bid for Rs. 48 Lakhs Day 5: You got a bid for Rs. 20 Lakhs Here's the deal: just because you got a bid for Rs. 48 Lakhs on Day 4, it does NOT mean you have become RICH. Just because you got a bid for Rs. 20 Lakhs on Day 5, it does not mean you have "lost" Rs. 20 Lakhs. You don't go to a local real estate broker everyday and ask what is the market price of the apartment you just bought. Ditto with the stock markets - it does not mean anything is Maruti stock falls 50%. After you invest in an automobile stock, just ignore the market price. Because the market price changes everyday depending on bids for stock on that particular day. It does not mean you have 'earned' or 'lost' money - unless you sell. WHEN TO SELL: Easy. After you buy an apartment for long term investment, when do you sell? After 3 months? 3 years? Or when you need the money for some reason? GLOSSARY: There are some simple terms you need to understand before picking up an automobile stock. Note to experienced investors: I have simplified many of these parameters so that it's easy to understand. Market Capitalization: Marketcap is 'size' or 'value' of the company. Stocks with high market cap are safer for investment than stocks with small market cap. However, good stocks with small marketcap is likely to give better returns over time. PE Ratio: Roughly marketcap dividend by net profits. This is a measure of how cheap a stock is. Maruti has a PE ratio of 30 while Tata Motors has PE ratio of 20 implies Tata Motors stock is cheaper to buy than Maruti. Debt To Equity Ratio: Let's say Bajaj Auto is setting up a new factory for Rs. 1,000 Cr. It has taken a bank loan of Rs. 250 crores while it is investing Rs. 750 crores from its own pocket. In this case, the debt to equity ratio of this project is 0.25 (250 divided by 1000). Good companies have low debt to equity ratios. Return on Equity: Let's say Maruti has setup a new factory for Rs. 1,000 cr, entirely out of their pocket (no bank loans). This factory earned a profit of Rs. 200 crores in the first year. That means the return on equity was 20%. Good companies have high RoE's. Dividend Payout Ratio: Let's say M&M earned Rs. 1,000 cr in profits. They paid out Rs. 200 crores as dividend to shareholders. The dividend payout ratio of M&M works out to be 20%. Good companies pay out significant percentage of their profits as dividends to shareholders. Remember that when it comes to accounting, everything can be faked (Eg: Satyam). But dividends paid out is REAL MONEY, and can never be faked. Dividend Yield: It's like Rental Yield of an apartment. If you invest Rs. 1 Cr in an apartment and you get Rs. 3 Lakhs as rent per annum, then the rental yield is 3%. Similarly, if you invest Rs. 1 Lakh in a stock and you get Rs. 3,000 per year as dividend , then the dividend yield of the stock is 3% RESOURCES: - Company website - Investor section (for annual report & investor presentation) of company website - www.screener.in - www.valueresearchonline.com - www.marketsmojo.com - www.trendlyne.com (for brokerage reports) Last edited by SmartCat : 8th June 2017 at 23:42. |

| |  (166)

Thanks (166)

Thanks

|

| The following 166 BHPians Thank SmartCat for this useful post: | .anshuman, //AKS, 100BHP, 7000plusrpm, aargee, aditya.kapur, ajman28, ajmat, AMG Power, amit_purohit20, anandpadhye, anshumandun, antony.henry, APV, aravindkumarp, arbaz906, arjab, arunphilip, arvindmanju, Ashutosh, avingodb, avishar, bhappyharsha, BigBrad, bj96, blackwasp, blue_pulsar, bmw_lover, camitesh, carthick1000, catchjyoti, Chasing_Dreams, CliffHanger, CoolFire, crackparag, Crazy_cars_guy, dailydriver, DasJager, daverm, deepv, Déesse, deetjohn, denzdm, dhruvdangi, digitalnirvana, djay99, Dr.Vikas, DrANTO, drift87, DudeWithaFiat, dZired, EightSix, fine69, Fuldagap, ganesc, ganeshb, Gansan, gaurav_chopra04, GKR9900, glenmz, govigov, GTO, HappyWheels, haria, harry10, Holyghost, huntrz, InControl, ishankpatel, JackSparrow90, jetsetgo08, jnanesh, JohaanTJ, joslicx, k88k, kalleo4, Karthik Chandra, Kashish, KK_HakunaMatata, krackr, Leoshashi, lovetorque, Makin Rulesz, Maky, ManasN95, MDED, mh09ad5578, MidnightBlack, montsa007, moralfibre, Moto_Hill, mrvenka, mug:mush, navin, neeravnaik, NetfreakBombay, nikhil.neon, Nikhs, nishsingh, Nitish.arnold, Nohonking, Old_Salt, Omkar, OrangeCar, paragsachania, Pranay J Pandya, PrasunBannerjee, prkiran, procrj, r0nit7, Rajeevraj, Ramsagar, RavenAvi, redCherry, Rehaan, Revvglider, RGK, RoadSurfer, roby_dk1, rowonfield, ruzbehxyz, S.MJet, S2!!!, saargoga, sahibrain, samaspire, Santoshbhat, ScorpMan, shetty_rohan, shobhit.shri, Shrayus_shirali, Simhi, sinhead, skyocean, Slick, spd_tkt, spgv, Srikanthan, StepUP!, suhaas307, sukarsan, sukiwa, sumeethaldankar, sups, swiftdiesel, swiftnfurious, The Rationalist, theexperthand, TheHkrish, Torino, Turbanator, Turbo Diesel, uday.ere, vagabond128, VaibhaoT, vaibzi, Varun_HexaGuy, veyron_head, vigneshjairaj, Viju, Vik0728, vinya_jag, wheelguy, whitewing, yosbert, zosoin |

| |

| | #2 | |

| Team-BHP Support  | re: Guide: Investing in shares of the automotive sector HOW TO ANALYZE A STOCK - MARUTI SUZUKI CASE STUDY Step 1: Go to www.screener.in and type in Maruti Suzuki.

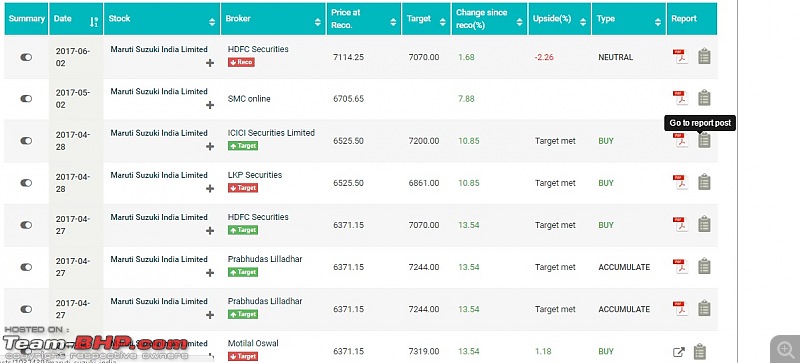

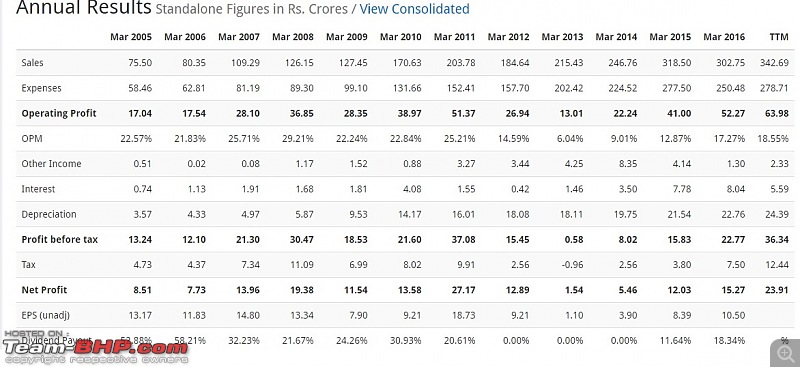

Step 2: Scroll down and look at the last 10 years financials of Maruti Suzuki.  Now the above numbers might look a bit intimidating, but one needs to look at 3 or 4 columns only -

The profit numbers for Ashok Leyland is extremely lumpy. Profits crashed 60% in FY09. Since FY11, profits fell for 3 consecutive years (631 Cr went down to 565 Cr, 433 Cr and even 29 Cr) before shooting back up again. Just looking at this 10 year sales & profit numbers gives you an idea that MARUTI is a classy stock when compared to ASHOK LEYLAND. Read 'classy' as financially well managed company. Step 3: Next, look at the growth in percentage terms.  Maruti's 10 year sales growth is 16% per annum (compounded annual growth rate or CAGR). But it has slowed down a bit in recent years - around 10% CAGR when you look at last 3 and 5 year numbers. Next, look at the profit growth numbers - it is consistently higher than sales growth. This means the company's margins are slowly increasing. We also get to know why Maruti trades at 30 times earnings (30 PE). That's because in the past 3 years, it has grown at 28% per annum. And the 'market' expects Maruti to continue growing at that pace in the near term. Similarly, Eicher Motors has 48 PE (48 times profit). Why? Just look at Eicher Motors (Eicher CVs + Royal Enfield) profit growth numbers -  Powered by Enfield bullet sales, Eicher Motors has delivered 42% per year profit growth in past 10 years and 48% per year profit growth in the past 5 years Step 4: No point in reading FY16 annual report of Maruti since new one for FY17 will be out soon. But one can read brokerage coverage of the stock you want to buy. Go to www.trendlyne.com and type 'Maruti'. Move the mouse to 'average brokerage target' and click on 'number of reports' link  There are a number of reasons why you need to read brokerage reports. These guys usually have direct access to top management of the company, and can help you track the company you have invested in. Example, here are some interesting bits about Maruti Suzuki from the ICICIDirect.com report - Quote:

Step 6: Do a quant analysis. A computer program can how cheap or expensive a stock is, analyze its financials and earnings potential. After all, stock analysis is all about number crunching. First go to www.valueresearchonline.com and type 'Maruti'.  Key takeaways:

Valueresearchonline.com can also be used to check past price performance. Rs. 1 Lakh invested in Maruti stock in Jun 2004 would be worth Rs. 13 Lakhs now. It's the exact opposite of what a Rs. 13 Lakhs car you bought in 2004 would be worth now!   There is another stock analytics site called www.marketsmojo.com. Their program checks the financials, valuations and future growth potential and has a simple traffic light type - RED/AMBER/GREEN system - for quality, valuations and financial performance.  Note the 'lights' of M&M and Tata Motors too. Step 7: Invest in Maruti stock! So we now know that Maruti is a quality stock (market leader, excellent profit growth, no debt, high RoE) but is also quite expensive (30 PE, poor dividend yield, future estimated growth is only around 15 to 16 percent per annum). Best strategy to adopt is to 'accumulate' the stock. 1) Let's say you want to invest Rs. 1 Lakh in Maruti, but you find it expensive. 2) Invest Rs. 10,000 right away. 3) And then invest Rs. 10,000 every month over a period of 12 months. Or Rs. 5,000 every month over a period of 24 months. Another strategy would be to invest something like Rs. 50,000 - and then invest more only when the stock falls below your purchase price. Last edited by SmartCat : 8th June 2017 at 23:49. | |

| |  (128)

Thanks (128)

Thanks

|

| The following 128 BHPians Thank SmartCat for this useful post: | aargee, aditya.kapur, ajmat, amit1agrawal, anshumandun, aravindkumarp, arbaz906, arjab, arvind71181, arvindmanju, asr245, audioholic, avingodb, avishar, bhavik.1991, BigBrad, blackwasp, C300, CarguyNish, carthick1000, catchjyoti, CliffHanger, CoolFire, dailydriver, daverm, dean5545, Déesse, deetjohn, Dennis, dhruvdangi, download2live, Dr.Vikas, DrANTO, drift87, dZired, EightSix, ganesc, ganeshb, Gansan, gaurav_chopra04, GKR9900, glenmz, GTO, HappyWheels, haria, Highh5, Holyghost, I10CG, ishankpatel, JackSparrow90, Jakku, jetsetgo08, johannskaria, joslicx, JustStarted, Karthik Chandra, Kashish, kat, KK_HakunaMatata, kmsithan, lemedico, LordSharan, lovetorque, Makin Rulesz, MDED, mh09ad5578, MidnightBlack, moralfibre, mpthy, mug:mush, neerajdan, nikhil.neon, nishsingh, Nohonking, Nonstop-driver, Omkar, paragsachania, Patriot_Vishwas, PraNeel, PrasunBannerjee, procrj, PSG, r0nit7, racer_m, rahulrajeev, raihan, Rajeevraj, ranjeetnair, RavenAvi, red.devil_19, Rehaan, Revvglider, RGK, roby_dk1, S2!!!, saargoga, sahibrain, sairamboko, Sangre, sdp1975, shetty_rohan, Shrayus_shirali, Simhi, Slick, Srikanthan, SteeringWheel, StepUP!, suhaas307, sukiwa, sumeethaldankar, sups, swiftdiesel, swiftnfurious, The Rationalist, theexperthand, Torino, Torquedo, Turbanator, uday.ere, Ultim8, vaibzi, vigneshjairaj, Viju, Vik0728, Vitalstatistiks, viXit, wheelguy, whitewing |

| | #3 |

| Team-BHP Support  | re: Guide: Investing in shares of the automotive sector CASE STUDY 2: PPAP AUTOMOTIVE Analyzing Maruti stock is relatively simple because almost everything is hunky dory about the company. We know it is a market leader and it has great financials. But what about investing in companies that nobody has ever heard of? A friend of mine whatsapped me and asked me to check out this auto component maker called 'PPAP Automotive'. But before that, here are a few pros and cons of investing in auto component makers - PROS:

CONS:

Coming to PPAP Automotive, the first thing you do when you come across a new unknown company is to check out their website - http://www.ppapco.in in this case. First impressions are good - very unique business with low competition possibly. They make 'automotive sealings' and interior/exterior plastic bits.   Spend some time checking out all the links (about us, products, infrastructure, technology etc) on the website. Doing that, you will get to know that company has a technology tie-up with a Japanese company for their sealings business. Since this is an unknown company, read up the first 10 or 15 pages of the FY16 annual report where the management talks about their business. Stop reading the annual report when the balance sheet stuff comes up. A small company like PPAP having 'Investor Presentation' too is a good sign http://www.ppapco.in/conference-call.html Quickly browse through the 40 something page PPT file because you don't have brokerage coverage on such stocks. Next, check screener.in for PPAP's financials. Key takeaways -

A mixed bag so far, with a slight tilt towards being a 'not so great' investment. Next step is to look at its 10 year financial history. Key takeaways -

You will come across many companies like above with lumpy profits. It might not be a great business like Maruti, but one cannot rule it out as an investment. To analyze such companies, you need to look at its 'book value'/net worth/reserves Book Value = Assets (cash/inventory/factory machinery/raw materials) minus Liabilities (bank loans)  Note that the networth has increased from Rs. 25 cr in FY05 to Rs. 200 Cr. in FY16. That is 8 times in 11 years or 20 percent per annum. Not too shabby eh? That's because although profits are lumpy, profits are profits and they are accumulated by the company. These accumulated profits might be invested in new businesses or capacity expansion in the future. Strong long term growth in networth means PPAP Automotive will take off like the GSLV rocket one fine day, and it did in Feb 2017 - stock value doubled in 3 months. MY TAKE: PPAP Automotive's networth is around Rs. 210 Cr (196 + 14 Cr) but its market cap is around Rs. 515 Cr. This means the Price to Book Value is around 2.3. I would buy a stock like PPAP Automotive only at P/BV of less than 1 - that is when market value is equal to networth of the company. Current price of PPAP stock is Rs. 368 but the fair value according to me is 368/2.3 = Rs. 160 But who am I to say what the fair value of a company should be? I'm a nobody. The 'market' decides what the fair value should be. That's where analytics websites help - let's see what valueresearchonline and marketsmojo have to say about PPAP Automotive.   Key takeaways from analytics websites:

CONCLUSION: As mentioned before, if you like particular company with an interesting business and decent financials, INVEST! But invest a small amount first and add more depending on improved financials (higher profit) or correction in stock price. Last edited by SmartCat : 9th June 2017 at 00:11. |

| |  (89)

Thanks (89)

Thanks

|

| The following 89 BHPians Thank SmartCat for this useful post: | aargee, aditya.kapur, amit1agrawal, anshumandun, aravindkumarp, arbaz906, arjithin, arunphilip, bhavik.1991, blackwasp, C300, CarguyNish, catchjyoti, CliffHanger, CoolFire, dailydriver, dean5545, deepv, deetjohn, Dennis, dhruvdangi, Dr.Vikas, DrANTO, dZired, feluda86, ganesc, gaurav_chopra04, GKR9900, GTO, HappyWheels, haria, harry10, Holyghost, ishankpatel, JackSparrow90, jetsetgo08, jnanesh, JohaanTJ, Karthik Chandra, Kashish, kat, KK_HakunaMatata, Leoshashi, lovetorque, Makin Rulesz, MDED, mh09ad5578, MidnightBlack, moralfibre, mrbaddy, mug:mush, nikhil.neon, nishsingh, Nonstop-driver, Omkar, OrangeCar, paragsachania, PrasunBannerjee, r0nit7, racer_m, rahulrajeev, RavenAvi, Rehaan, Revvglider, RGK, roby_dk1, S2!!!, saargoga, sahibrain, sairamboko, samm, Simhi, Slick, slicvic, smilenow, SteeringStar, StepUP!, suhaas307, sukiwa, swiftnfurious, The Rationalist, theexperthand, Turbanator, uday.ere, vaibzi, vigneshjairaj, Viju, wheelguy, yosbert |

| | #4 |

| Team-BHP Support  | re: Guide: Investing in shares of the automotive sector THE EASIER WAY You are in Manali and want to get to Leh. You can either drive a car yourself or take the bus! The equivalent of taking a bus is to invest in the UTI Transportation & Logistics Fund. This mutual fund invests only in automobile stocks and auto component makers. Basically, let the professionals manage your investment. This fund has returned an average of 20% per annum since its inception in 2005.  This is what their portfolio looks like. The fund manager will decide which stock to buy/add more/sell a bit or exit completely. Last edited by SmartCat : 8th June 2017 at 21:01. |

| |  (84)

Thanks (84)

Thanks

|

| The following 84 BHPians Thank SmartCat for this useful post: | aargee, Abhinav V, aditya.kapur, amit1agrawal, amtak, anshumandun, arbaz906, arjab, arunphilip, arvindmanju, BigBrad, blackwasp, C300, CarguyNish, carthick1000, CliffHanger, CoolFire, dailydriver, DasJager, dean5545, deetjohn, Dennis, desiaztec, dhruvdangi, Dr.Vikas, DrANTO, DudeWithaFiat, feluda86, gaurav_chopra04, GKR9900, GTO, HappyWheels, haria, Holyghost, ishankpatel, JackSparrow90, jetsetgo08, jnanesh, johannskaria, Karthik Chandra, Kashish, kat, lovetorque, MDED, mh09ad5578, MidnightBlack, moralfibre, Mtv, mug:mush, nishsingh, Nonstop-driver, Omkar, OrangeCar, PrasunBannerjee, r0nit7, racer_m, rahulrajeev, Rajeevraj, ranjeetnair, RavenAvi, Rehaan, Revvglider, roby_dk1, S2!!!, sahibrain, sairamboko, Shrayus_shirali, SteeringStar, StepUP!, suhaas307, sukiwa, sups, swiftnfurious, The Rationalist, thoma, timuseravan, Turbanator, uday.ere, veyron_head, vigneshjairaj, Viju, viXit, wheelguy, yosbert |

| | #5 |

| Team-BHP Support  | re: Guide: Investing in shares of the automotive sector For those who like to hunt for treasure, here is a LIST OF LISTED AUTOMOBILE COMPANIES & AUTO COMPONENT MANUFACTURERS: Two & Three Wheeler Manufacturers: Bajaj Auto Hero Motocorp TVS Motor Atul Auto Passenger cars, Tractors & Commercial Vehicles Maruti Suzuki M&M Tata Motors Eicher Motors Ashok Leyland Force Motors Escorts VST Tillers Automobile Corporation of Goa SML Isuzu Auto Component Makers (You can figure out what they do by decoding their names!  ) )Shivam Autotech Alicon Cast. Amtek Auto ANG Industries Asahi India Glass ASL Industries Auto Stampings Autoline Ind Autolite India Automotive Axle Automotive Stamp Banco Products Bharat Forge Bharat Gears Bharat Seats Bosch Castex Tech Duncan Eng Endurance Technologies Enkei Wheels Fag Bearings Federal-Mogul Go FIEM Ind Frontier Spring Gabriel India GNA Axles Guj Auto Gears Harita Seating Hind Composites India Motor Part India Nippon IP Rings Jagan Litech Jamna Auto Jay Bharat Mar. Jay Ushin JBM Auto JMT Auto Jullundur Motor L G Balakrishnan Lumax Auto Tech Lumax Inds. Machino Plastic Menon Bearings Menon Pistons Minda Corp Minda Inds. Motherson Sumi Munjal Auto Inds Munjal Showa NRB Bearings Omax Autos PAE Phoenix Lamps Porwal Auto PPAP Automotive Precision Camshf Pricol Ltd Rajratan Global Rane (Madras) Rane Brake Rane Engine Val. Rane Holdings Rane Madras Rasandik Engg Raunaq Auto Remsons Ind Rico Auto Inds Samkrg Pistons Setco Auto Shanthi Gears Sharda Motor Shivam Auto Shriram Pistons Sibar Auto SKF India Sona Koyo Steer. Spectra Ind Steel Str. Wheel Subros Sundaram Brake Sundaram Clayton Suprajit Engg. Talbros Auto The Hi-Tech Gear Timken India Triton Valves Tube Investments of India UCAL Fuel WABCO India Wheels India ZF Steering Gears Battery Manufacturers: Exide Ind Amara Raja Batt Engines: Cummins Kirloskar Oil Greaves Cotton Swaraj Engines Kirloskar Ind Tyres: MRF Balkrishna Ind Apollo Tyres Ceat JK Tyre & Ind TVS Srichakra Goodyear Indag Rubber Lubricants Castrol India Gulf Oil Tide Water Oil (makers of Veedol) Savita Oil (makers of Savsol) GP Petroleum Fuel Retailing Indian Oil BPCL HPCL IT (with focus on automobile sector) KPIT Technologies IZMO cars Tata Elxsi Finance (with focus on automobile sector) Shriram Transport Finance Sakthi Finance Muthoot Capital M&M Finance Motor & General Finance Sundaram Finance Magma Fincorp Cholamandalam Insurance & Finance Co Last edited by SmartCat : 9th June 2017 at 07:54. |

| |  (143)

Thanks (143)

Thanks

|

| The following 143 BHPians Thank SmartCat for this useful post: | //AKS, aargee, Abhinav V, aditya.kapur, ajmat, alashkari, amit1agrawal, amitpunjani, Annibaddh, anshumandun, anubshar, arakhanna, arbaz906, arnav17, arunphilip, arvindmanju, Ashir, audioholic, avishar, BigBrad, blackwasp, CarguyNish, carthick1000, catchjyoti, CoolFire, Crazy_cars_guy, dailydriver, dean5545, deetjohn, Dennis, desiaztec, dhruvdangi, Dr.Vikas, DrANTO, drift87, dZired, EightSix, freakmuzik, ganesc, Gany, GKR9900, glenmz, GTO, HappyWheels, haria, harry10, Highh5, iron, ishankpatel, JackSparrow90, jetsetgo08, jnanesh, johannskaria, jvm_1986, Karthik Chandra, Kashish, kat, Khushrav, KK_HakunaMatata, KMT, Latheesh, lemedico, lovetorque, Makin Rulesz, ManasN95, MDED, MidnightBlack, moralfibre, mpthy, mrbaddy, msdivy, Mtv, mug:mush, Musa, Nair.V8, Naman_Ferrari, neoonwheels, nikhil.neon, nishsingh, Nohonking, Nonstop-driver, Omkar, OrangeCar, paragsachania, Patriot_Vishwas, pavan_6818, PearlJam, PrasunBannerjee, pulsar56, r0nit7, racer_m, rahulrajeev, Rajeevraj, RavenAvi, Rehaan, Revvglider, RiGOD, rkv_2401, RoadSurfer, roby_dk1, Ruchitya, ruzbehxyz, S2!!!, sahibrain, sairamboko, samaspire, samm, sandsun7, ScorpMan, shetty_rohan, Simhi, Slick, SR-71, sri2012, SteeringStar, StepUP!, suhaas307, sukiwa, sumeethaldankar, swamaz, swiftnfurious, Teesh@BHP, Tgo, The Rationalist, thirugata, thoma, timuseravan, Torquedo, Turbanator, uday.ere, VaibhaoT, vDragon3, vigneshjairaj, Viju, Vik0728, Vitalstatistiks, viXit, wheelguy, WhiteFang, whitewing, wolg, yosbert, zavegur |

| | #6 |

| Team-BHP Support  | Re: Guide: Investing in shares of the automotive sector Thread moved from the Assembly Line to the Indian Car Scene. Thanks for sharing! Rating 5 stars, hits subscribe  . . You have a great way of explaining things, SmartCat. I'm looking at strengthening my portfolio with some additional automotive stocks and will be following the discussion closely. Thanks again. Since you analyse so closely, what are your current top 3 picks in the automotive sector? Last edited by GTO : 9th June 2017 at 08:57. |

| |  (21)

Thanks (21)

Thanks

|

| The following 21 BHPians Thank GTO for this useful post: | Abhinav V, Annibaddh, anubshar, arunphilip, avishar, CarguyNish, DrANTO, EightSix, haria, lovetorque, ManasN95, MDED, nishsingh, Nonstop-driver, PrasunBannerjee, roby_dk1, SmartCat, spd_tkt, swiftnfurious, uday.ere, WhiteFang |

| | #7 |

| BHPian Join Date: Nov 2007 Location: Bangalore

Posts: 966

Thanked: 1,580 Times

| Re: Guide: Investing in shares of the automotive sector Awesome level of detail and great explanation. Thanks for sharing. Like GTO, I too am interested to hear your top three picks. |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank Mad Max for this useful post: | Abhinav V, arunphilip, SmartCat |

| | #8 |

| Senior - BHPian Join Date: Dec 2007 Location: CNN/BLR

Posts: 4,337

Thanked: 10,625 Times

| Re: Guide: Investing in shares of the automotive sector Thanks smartcat for starting this wonderful thread! I have following auto stocks in my portfolio Tata Motors Minda Corporation Sona Koyo Last edited by Latheesh : 9th June 2017 at 10:07. |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank Latheesh for this useful post: | Abhinav V, GTO, SmartCat |

| | #9 |

| Senior - BHPian Join Date: Oct 2006 Location: Mumbai - The city of Sea Link!!!

Posts: 2,983

Thanked: 1,108 Times

| Re: Guide: Investing in shares of the automotive sector Wonderful thread! Always followed automobile stocks, but never invested in it; however, as recommended by you, took the easier way out and invested now through UTI MF. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks amtak for this useful post: | SmartCat |

| | #10 |

| Senior - BHPian Join Date: Dec 2007 Location: Gurugram

Posts: 7,971

Thanked: 4,808 Times

| Re: Guide: Investing in shares of the automotive sector Right now with a tectonic shift in technology on the cards, it is impossible to predict who will become the Kodaks. The EV leaders may just kill off the IC engine industry as we know it. What will be the trends, who will succeed I do not know. |

| |  (15)

Thanks (15)

Thanks

|

| The following 15 BHPians Thank sgiitk for this useful post: | aargee, amtak, anandpadhye, bhavik.1991, Crazy_cars_guy, GTO, haria, Latheesh, r0nit7, searchingheaven, shobhit.shri, SmartCat, The Rationalist, uday.ere, WhiteFang |

| | #11 | ||

| Team-BHP Support  | Re: Guide: Investing in shares of the automotive sector Quote:

When we invest in auto sector stocks, we are not betting on internal combustion engine. We are betting on smart management who can identify the shift in customer preferences and act on it. Quote:

Greaves Cotton (makes small diesel engines for CVs like Piaggio, Tata Ace Zip etc) Goodyear India Bajaj Auto Hero Motocorp Ashok Leyland KPIT Technologies is my "12th man" (meaning I need to do more research. I have recently bought a tiny amount) I won't say I'm "bullish" on the above stocks. Instead, I will say that I find "value" in these companies. These are not "hot stocks" that will be discussed on CNBC or recommended on whatsapp groups. They have strong brand value and customer stickiness, good RoI, no debt, high dividend yield and payout ratio. But they are not "fast growers" as of now. Once you invest in such stocks, it is as exciting as watching a bowl of milk on a gas flame. But when you are not looking, these stocks are likely to boil over. Last edited by SmartCat : 9th June 2017 at 11:47. | ||

| |  (62)

Thanks (62)

Thanks

|

| The following 62 BHPians Thank SmartCat for this useful post: | amit1agrawal, amtak, anandpadhye, arbaz906, arjab, arunphilip, arvind71181, arvindmanju, avishar, BigBrad, blackwasp, bluevolt, C300, Carmine_pepper, catchjyoti, Crazy_cars_guy, dailydriver, deetjohn, DrANTO, DudeWithaFiat, dZired, E = mc², ganesc, Gany, GTO, HappyWheels, haria, harry10, ishankpatel, jetsetgo08, jvm_1986, kat, Leoshashi, lovetorque, madhu33, ManasN95, MDED, MidnightBlack, NetfreakBombay, nishsingh, PrasunBannerjee, procrj, r0nit7, raihan, RavenAvi, roby_dk1, ryzen7@5800u, sairamboko, smilenow, suhaas307, swiftnfurious, The Rationalist, theexperthand, thoma, Turbanator, uday.ere, VaibhaoT, Viju, vinit.merchant, Vitalstatistiks, viXit, wheelguy |

| |

| | #12 |

| BHPian Join Date: Sep 2013 Location: New Delhi

Posts: 104

Thanked: 178 Times

| Re: Guide: Investing in shares of the automotive sector Thanks Smartcat for the awesome read, plenty of information. Me too curious to know your top 3-5 picks. I have personally invested in Steel Strip Wheels, Ashok Leyland, Maruti Suzuki, JK Tyre, Lumax Auto Tech, and sold Tube Investment at a profit during de monitization drive. Your post gives me confidence to invest more into Auto/Auto Ancillary industry. |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank desiaztec for this useful post: | MDED, SmartCat |

| | #13 |

| Senior - BHPian | Re: Guide: Investing in shares of the automotive sector Smartcat, much thanks for this. Of all the stocks listed, its definitely the automotive ones that have an edge over the others for our ( enthusiasts ) investment. I invested in 3 shares of Eicher Motors just when we had the rumours of the Himayalan launch. Plus seeing the positive responses on the thread, I was sure of its success. At that time I was a student and invested all my savings into this. Definitely a decision I won't regret. Before the BS3 deadline, I had invested in UCAL Fuelsystems, and that too gave a nice return. Currently I have the shares of GNA Axles, UCAL fuel, and MSIL. Dad holds some of Tata Motors. Being a Bhpian gives me unique insights to the Automotive sector in India and I can closely monitor the news of those companies. Also it's actually interesting to read about things one is interested in rather than reports of some textile, or cement company. |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank blackwasp for this useful post: | DrANTO, PrasunBannerjee, SmartCat |

| | #14 |

| BHPian Join Date: Dec 2014 Location: Bangalore

Posts: 200

Thanked: 449 Times

| Re: Guide: Investing in shares of the automotive sector Great thread!! I am also an active investor and always thought that team-bhp users who are passionate about auto sector have potential to get an edge even though auto is one of the most followed sectors. For those interesting in learning more about Investing and specifically in Indian context please look at Valuepickr forums. It is definitely the best source for learning. There are threads on books etc. to read or approaches that senior investors take. Remember Investing is a a lifelong learning journey so you are never going to be right 100% . You will make a lot of mistakes and learn from it. But it is all about getting involved and constantly learning. Some watchouts/comments from my very limited experience 1. Investing even in a single company is a constant process - you have to follow the performance on quarterly basis and take actions based on it. You may have developed a conviction about a stock but stories change over time. Especially in Auto the whole industry and individual companies go through cycles. 2. Great product not equal to great company - This is a trap a lot of us enthusiast are likely to fall into. WE may be irrationally in love with a brand but it may be one of the worst run company ever. SO while investing please keep your love for the products aside. This is going to be even more difficult for enthusiasts. 3. Great company is not equal to a great stock - A company can also be great business also but still it can be too expensive a stock to give you any reasonable return. Valuations are important! 4. Past is not the future - It has already happened and it is not a guarantee to repeat. Eicher motors has made people rich multiple times over riding on success of RE. But it is now at really high valuations. 5. Have a healthy dose of skepticism with everything especially financial numbers. This is a mindset/attitude not found among enthusiasts like us! 6. Avoid leverage!! Now this is going into more specific philosophy of choosing stocks but applies even to your own life. DO not take debt to invest and also try to avoid companies heavily into debt. 7. Sort your personal finance plans. Before committing money to any investment mode (stocks/land/gold/etc.) do you have an overall plan- do you know your long term goals and what are doing to meet them. What is your asset allocation? Follow some blogs like freefincal, subramoney etc. to learn more At the end be open to learn always |

| |  (37)

Thanks (37)

Thanks

|

| The following 37 BHPians Thank neeravnaik for this useful post: | amit1agrawal, asr245, bhavik.1991, blue_pulsar, Carmine_pepper, dailydriver, deetjohn, DrANTO, E = mc², ganesc, harry10, ishankpatel, JackSparrow90, jetsetgo08, Latheesh, lovetorque, Maverift, MDED, NetfreakBombay, PrasunBannerjee, r0nit7, raihan, RavenAvi, red.devil_19, roby_dk1, Santoshbhat, shobhit.shri, Simhi, sinhead, SmartCat, swiftnfurious, The Rationalist, uday.ere, Viju, Vitalstatistiks, VWAllstar, WhiteFang |

| | #15 | |

| Team-BHP Support  | Re: Guide: Investing in shares of the automotive sector Great post! Quote:

However, if you notice falling levels of quality (Eg: Tata Motors between 2010 and 2016) or customer experience at the service center - and it shows in stagnating/dropping sales, then you might want to avoid both the product and the stock. Last edited by SmartCat : 9th June 2017 at 13:01. | |

| |  (19)

Thanks (19)

Thanks

|

| The following 19 BHPians Thank SmartCat for this useful post: | asr245, bhavik.1991, blackwasp, blue_pulsar, Carmine_pepper, deetjohn, ganesc, Gany, giri1.8, jvm_1986, lovetorque, neeravnaik, PrasunBannerjee, sinhead, swiftnfurious, The Rationalist, Viju, viXit, wheelguy |

|