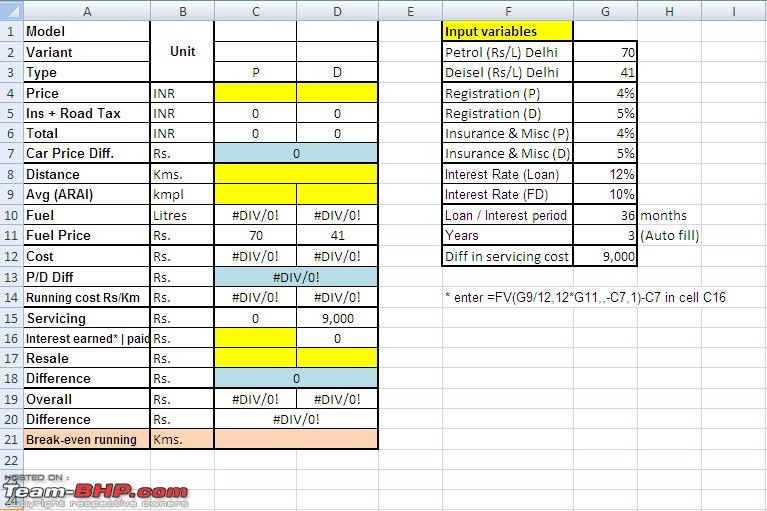

Petrol or Diesel car? This is the biggest question on every car buyer’s mind. I have worked out a calculator for finding out the cost of running a petrol car versus a diesel car and also to arrive at the break-even in terms of the number of kilometres. This is not a very accurate depiction, but I have tried to include all parameters and arrive at a cost of ownership as realistic as possible.

Just enter the requisite values in the boxes highlighted in yellow to arrive at the cost of ownership. One needs to enter a value in the Distance box (highlighted in yellow) to get an idea of the cost involved for running the vehicle (petrol / diesel) for that distance. The break-even point is arrived by hit and trial method by entering 2-3 values within a range to determine the approximate break-even distance in terms of kilometres travelled.

Price

Ex-showroom Delhi – taken from company’s website

On-Road Price Calculation

Registration: 4% & 5% of ex-showroom price for petrol cars & diesel cars respectively

Insurance & Misc: 4% & 5% of ex-showroom price for petrol cars & diesel cars respectively

Please note that the Insurance & Misc charges are fixed percentage estimates only for the sake of uniformity.

In the hatchback illustrated comparisons, only cars below 4 metres in length and engine capacity below 1200CC for petrol & 1400CC for diesel are considered

Average / Mileage

ARAI figures taken as a standard in order to maintain uniformity. One can assume that the difference between real-world and ARAI mileage figures would be similar for all vehicles.

Fuel Price

Current prevailing price of petrol & diesel in Delhi

Servicing Cost

Extra service cost for a diesel vis-a-vis petrol vehicle taken as Rs.9,000 (Rs.3000 each for 3 services within 3 years). This is just a guesstimate.

Interest Rate earned on cash saved on loan amount (if considered)

Interest rate on extra capital invested by buying a petrol vehicle instead of a diesel vehicle: Taken as 10% for a total of 3 years.

Although my take on this is that if a person has say a budget of Rs.5 lakhs – s/he’ll either buy a top end petrol variant or a base diesel variant which falls within the budget. I don’t think many people will buy a petrol car for Rs 4 lakhs and put the balance Rs 1 lakh in-hand in a bank fixed deposit. But anyways I believe this is called ‘Opportunity Cost’ in economics and can be considered. It is to be noted that if we consider the interest earned criteria, the break-even point increases drastically over say a five year period.

*For the illustrations I have not considered this factor and if for the calculator one wants to consider it, the following formula can be entered in cell C16 (in front of the interest earned/paid cell)

* enter =FV(G9/12,12*G11,,-C7,1)-C7 in cell C16

Interest Rate on extra loan amount

Interest rate on extra amount paid for buying a diesel vehicle: Taken as 12% for a total of 3 years on reducing balance

Resale Value

Resale value checked for a car that is 2 years old and has done 20,000 kms (rates checked on Car Wale for May 2010 manufactured vehicle). Data if not available has been taken as an approximate. Since resale value of recently launched cars is not available for later than 2 years, have taken the resale value for a one year old car.

The

difference in amount between the resale value of a diesel and petrol car for a similar usage period is considered and not the actual resale value for each. This way the difference (assumed to be constant) is what matters and not the actual value, which may vary from year to year. Let’s take an example of the Swift & Figo:

One can see that, barring a variation of a couple of thousand rupees, the

difference between the resale value of a petrol versus a diesel variant is similar. So the

difference between resale value of two different cars (eg Swift Petrol vs Figo Diesel) will be similar for a one year old car or a five year old car.

(12)

Thanks

(12)

Thanks

(7)

Thanks

(7)

Thanks

(14)

Thanks

(14)

Thanks

(4)

Thanks

(4)

Thanks

(7)

Thanks

(7)

Thanks