| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  143,017 views |

| | #1 |

| BHPian Join Date: Feb 2008 Location: manipal

Posts: 82

Thanked: 470 Times

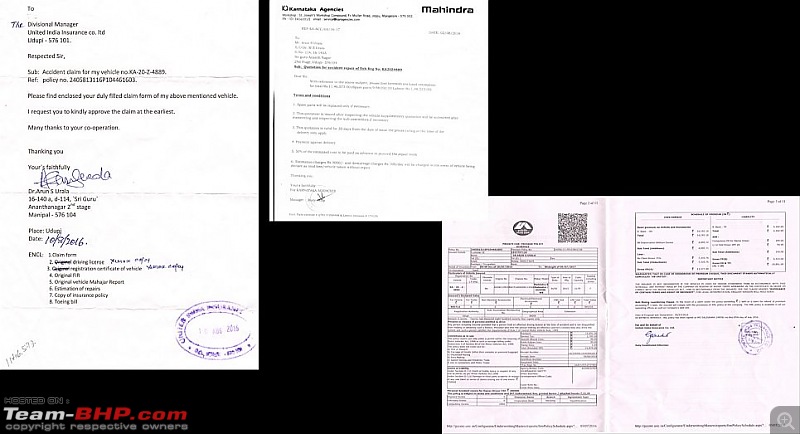

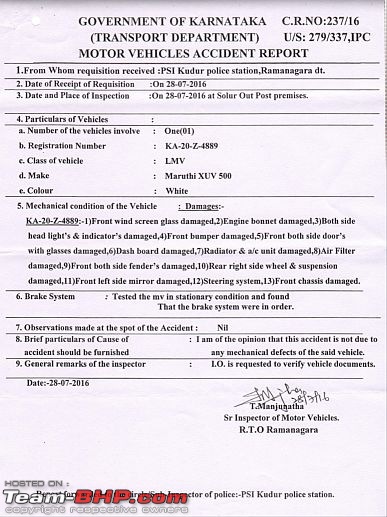

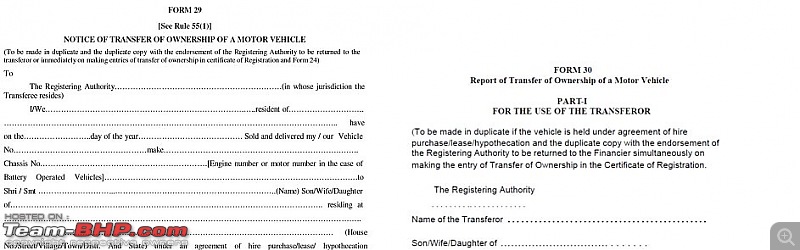

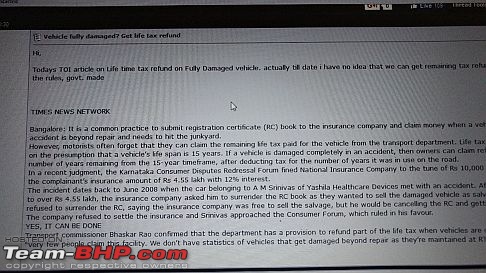

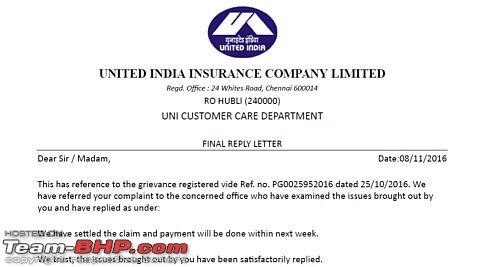

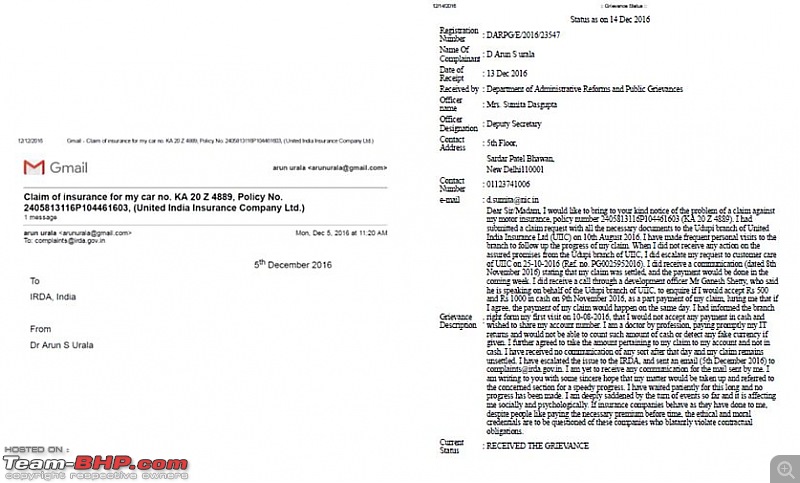

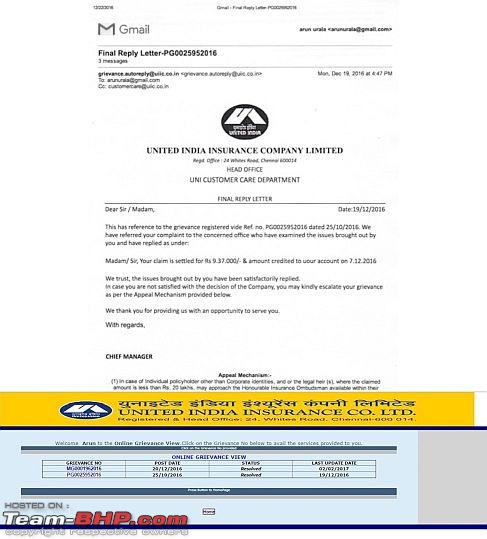

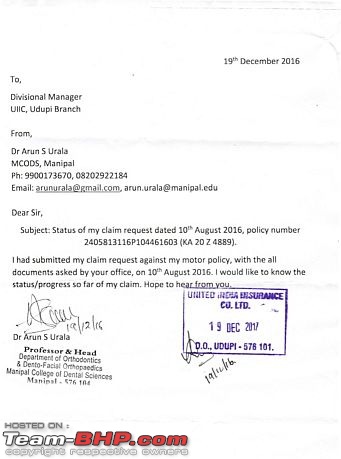

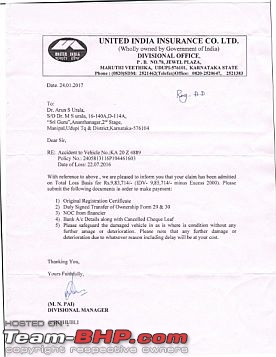

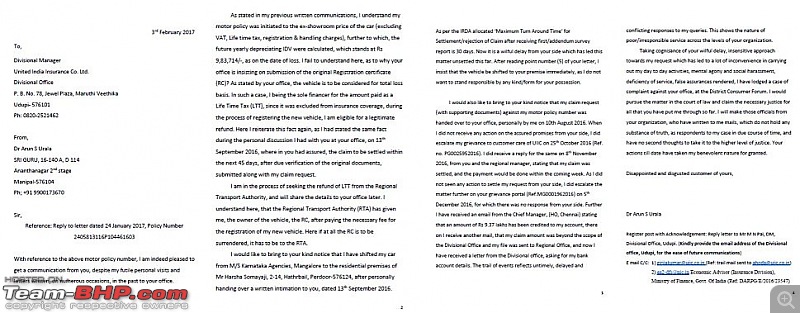

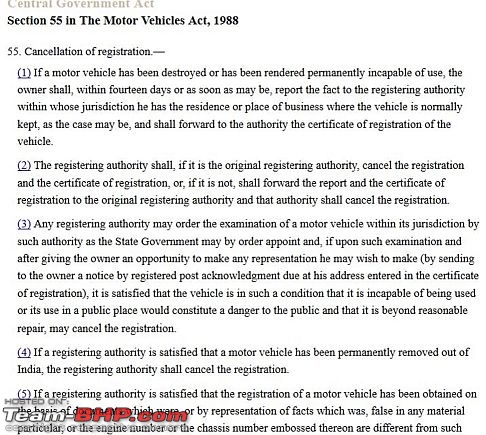

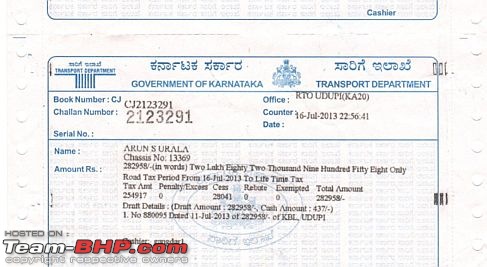

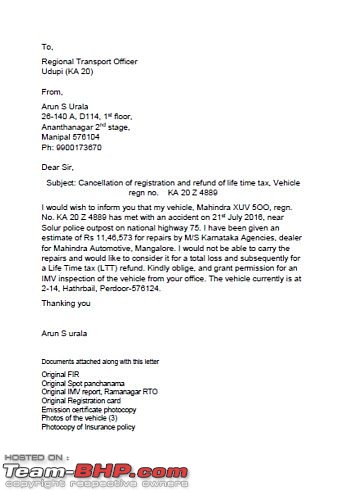

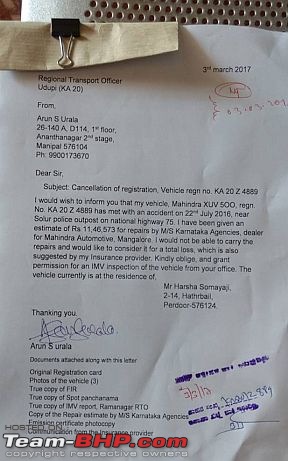

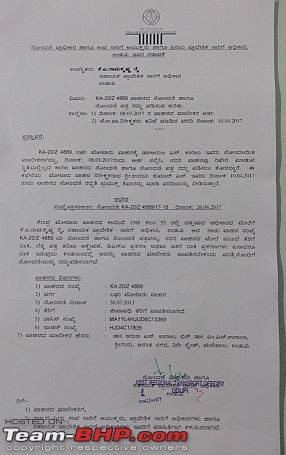

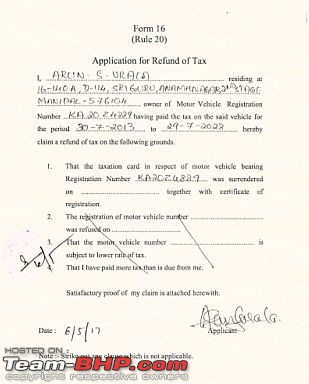

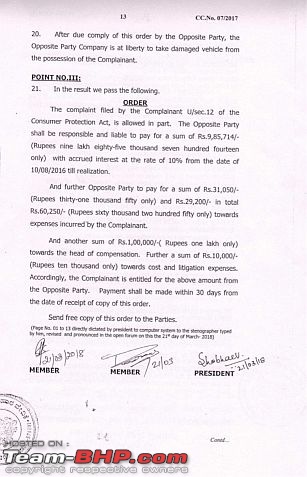

| The tale of a Total Loss Claim I begin my story from the time I posted, couple of years back: http://www.team-bhp.com/forum/road-s...ml#post4081809 After the impact I asked my mother if she was ok. The rear passengers were my sister, niece and nephew. They had not belted up and were sleeping horizontally and on braking, they fell in between the front and rear seats. Since the XUV has covered front seat foundations, they did not have any injuries. After a couple of minutes, a few cars stopped and inquired about the occupants' safety. Soon it grew to many cars, people stopping their cars next to mine on the road, clicking photos, creating a recipe for one more accident. I asked my mother and sister to be inside the wrecked car, but soon realized, there could be one rear impact as there was a mild curve on the road. So, I made them sit away. My next priority was to take the bag containing the valuables, purses and phones out of the car. As a crowd was building around it. Immediate chain of events I made a call to one of my colleagues, who had friend as a DCP in Bangalore. The DCP promptly called me and sent the highway patrol officers on duty to the accident spot in 10 mins. They were a team of two - one being in the rank of an Inspector and the other a Constable. They dispersed the crowd and cautioned the buses and other heavy vehicles coming in the same direction with an LED torch. They also dumped some cut plants behind my wrecked car, so that the oncoming traffic could be alerted from a distance. They also called the tow truck owned by the toll company, to ferry my car to the police outpost at Solur. Though this is provided as a free service by the company, they do demand a fixed fee (Rs. 1,000). The police officials were courteous enough to offer seats in their jeep to my family, as it had started drizzling. I made calls to my relatives, so as to move my family to Bangalore. Some of the passersby offered a lift to my family members, but since I could not accompany them at that moment, I could on risk sending my mother, sister and kids. Since, my relatives had already started from Bangalore, an hour and half distance away from the accident spot, I made my family wait. My relatives, with 4 cars, arrived in about 90 minutes, from the time of the impact. I made my family get in to their cars. With all the luggage transferred, we began the process to towing the car to the police outpost, which was 5 kms away. The police officials informed me that some parts from the car may be stolen as it could not be monitored overnight. NHAI has a Mahindra pickup with necessary modifications to do the job. Unfortunately, since the XUV is front heavy, the pickup jeep’s front end was lifted up in the air and the XUV did not lift enough to move. A milestone was placed under the wheels of the XUV, then jacked up again, to lift it adequately and my relatives sat on the bumper of the towing jeep, so as to make it have enough traction. Finally, the XUV started moving, and at an ant's pace, was relocated to the police outpost at Solur (12 PM). I thanked the patrol officers on duty for their help. They were very considerate and briefed me about the release process for the car to be done the next day. Police station experience I made a phone call to my DCP friend, who had helped me the previous day to guide me through the release formalities of my XUV. He made a call to the concerned police station, before I reached (10 am). There was one senior police constable, who acknowledged that the DCP had called him and told me that I could take my XUV away in an hour’s time, after he issued the PO (Petition Order). He convinced me that it was sufficient for the insurance claim as there was no personal injury and a FIR would require an inspection from RTO, Ramnagara. Ignorant of the rules, I agreed to his suggestion. On preparation of my complaint, I committed that I hit a truck from behind, blinded by its exhaust smoke, which did not have any tail lights/reflective stickers or safety bar. Immediately I was told by the senior constable, since I did not have the number of the truck, it could not be included in the complaint, as they would be compelled to carry out a search for the truck. He, later on, compelled me to sign on the typed format, that I hit a wild animal. On me and my cousin disagreeing to it, he changed the format, which now mentioned that I hit a culvert. In spite of us disagreeing to the reason of the accident, I had to sign on it as things were not moving forward with regards to release papers. Everyone in the police station assured me that a PO would be enough for the insurance claim. I called my insurance agent and informed him about the same. He was non-committal and convinced me that there may not be any issue. I shifted the vehicle to the Mahindra dealer at Mangalore by hiring a private flatbed truck after the previous evening's experience with the NHAI pickup. I was offered a deal of Rs 24/km, plus tolls paid. As we waited for the flatbed truck to arrive from Mangalore, I was hopeful to get the XUV repaired under insurance. My cousin however, was highly skeptical of the repairs and was implying that it would end in a total loss settlement. He insisted I remove the amplifier, subwoofer, mats, K&N air filter, Infinity door speakers, light bar and the 50 odd liters of fuel still in the car, all of which was transferred to my cousin’s Ertiga. I spoke to my insurance agent (United India Insurance), with whom we have been doing business since 20 years, regarding the prevailing situation and the way ahead from now regarding the claim. The flatbed truck came from Mangalore after a 12-hour wait. We supervised the loading of the XUV and asked him to deliver it to the dealership in Mangalore. I tipped them well for their travel expenses, in addition to the Rs 10,000 part payment for the lift. I visited the dealership at Mangalore the day after we shifted the XUV from Solur (Saturday). On reaching the dealership, my mechanic friends were around the wrecked car mourning on seeing my car in such a shape, as they always handled my car with additional care considering my enthusiasm and knowledge. I was immediately told by my service advisor that the reason in the police report did not match with the damages suffered. He asked me to get it changed as soon as possible before we submitted the documents for an insurance claim. I was a bit shocked and called my insurance agent, who was again unsure of things, and a couple of insurance surveyors, who asked me to change the police report to actuals. I made the remaining payment of Rs. 12,000 to the towing service, who were waiting for me at the dealership. I was saddened to note many parts such as horns and ECU, which were very much present the evening we loaded it to the flatbed truck, were missing from my XUV. Tip: Never believe the towing service provider. In spite of me tipping them handsomely, they still stole parts. I called the Sub-Inspector of the police station who was accusing the insurance company and service advisor of high-headedness, for not accepting the report. I requested him to help me out. I made a call to the DCP who had helped me through the situation I was in. He promptly made a call to the inspector and asked me to meet him the next day. Me and my uncle left to Bangalore the same night and reached the police station by 10 am. We were asked to wait for the inspector, which we agreed. The inspector did not come to the station for the next three days, though he kept on answering my call, that he would report to the police station in a while. We made daily trips from Hulimav, Bangalore to Solur, waiting for the illusive inspector for almost 12 to 14 hours, every day. Desperation grew day by day as no police contacts were helping to get this inspector report to the police station. Finally, one of my patients who himself is a DySp, called the SP, Ramnagara (who also was a doctor by qualification) regarding my situation. He finally called me and assured me that the inspector would come in 10 mins to the station and would file an FIR regarding the accident. The fuming inspector did come to the police station in 10 mins. He was very upset that we had approached the SP and asked me to get the XUV back to Solur, to file an FIR, insisting an inspection from the RTO, Ramnagara, under whose limits Solur fell. I was stuck again, as it had costed me Rs. 22,500 to shift the XUV from Solur to Mangalore. TIP: Always seek help from the hierarchy, under whom the police station directly reports. Inspectors may not heed to requests from officials, from another range. Finally, one of the senior most police constables was deputed to lodge an FIR, in my case after closing the previous PO. Ironically he convinced the inspector that it was our headache to get an RTO inspection report. Luckily for me the very next day of my accident, an RTO official who had come to the same police station, had recorded the photos of my XUV, anticipating that we would approach them in the days to come. I had a friend who was an RTO inspector, posted elsewhere, but native of Ramanagara. He put in a word to the office there, as he knew the entire story. I was exempted from getting back the XUV from Mangalore, as on a casual visit by a junior official, photos of my car were already taken the next day of my accident, at Solur outpost. RTO, Ramanagara was very considerate towards us, thanks to my friend (Asst RTO) and my qualification as a doctor. He got the report ready in half an hour without expecting anything from us. I had no words to thank him as he saved me from the effort of getting back my XUV from Mangalore to Solur again (a minimum of Rs. 50,000 additional expense). We went back to the police station soon after and got hold of the RTO inspection report. My uncle lodged a complaint that I was driving fast and negligent and hit the truck in front. Ironically the inspector was surprised as to how we got the report form the RTO at Ramanagara, with the vehicle at Mangalore. We were told by the RTO Ramnagara that the final report would sent to the police station and I could collect a station certified copy of the same, in a weeks’ time. We thanked the senior police constable who saw us through the FIR process and requested him to send the certified copy of the RTO report. After a week of my unfortunate accident I had the FIR in hand, which stated actuals, as the incident occurred. I also wrote to the United India Insurance office about the description of my accident on 22nd July 2016 and asked them to issue a claim form. TIP: Insist the police to lodge an FIR with the accurate narration of the incident. They misguide us to lessen their work, later on blame us that we distorted the story, as we signed on it. Either an FIR or a spot inspection report from a local insurance surveyor is mandatory for claiming insurance. Never shift the vehicle from the police station unless all the necessary documents are obtained, verified by the service advisor at the dealership. The dilemma here is that the car could be stripped off some parts by people around the police station. I visited the United India Insurance Company (UIIC), Udupi branch with the necessary claim form, original FIR, spot panchanama/mahajar report by police, cover note of the insurance policy, estimate for repairs from the dealer, emission certificate, copy of registration certificate(RC), copy of the driving license (DL). I carried the original RC and DL, which are to be taken back by me, after verification at the insurance office. I also insisted for an acknowledgement for the submission of the claim form and associated documents. TIP: Always insist for an acknowledgement for all the documents handed over to the insurance company.   I was assured a speedy processing after the inspection by the company surveyor of the vehicle, now resting at the Mahindra dealership at Mangalore. After submission of the necessary documents to UIIC branch, I paid 4 to 5 personal visits to follow up the survey process. I even contacted my insurance agent, who happens to be a development officer as well at UIIC, about the progress. I was assured swift action with sweet words. After a month of submitting the claim form, I was told my case would be settled on a total loss basis. I was asked to submit a PAN card copy, cancelled cheque, duly signed form 29 & 30 (ownership transfer from, RTO, Karnataka) and original RC.  I informed the handling officer of my case that my policy states an IDV of Rs. 9,85,714, which was initiated for the ex-showroom price of the car at the time of purchase (Rs. 14 lakhs approx), excluding VAT and Road tax and not against the on-road price of my XUV (Rs. 18.5 lakhs). I refused to hand over the original RC and signed RTO forms 29 & 30. I frantically looked for any published evidence on Team-BHP of other internet sources. All I could get was the Times of India news regarding a similar situation by Mr. A M Srinivas Vs National Insurance company. I knew I was short on evidence, but still insisted on not handing over the RC and forms 29 & 30. I also went ahead and explained to them that no car in the market could depreciate 50% in a span of 3 years and 12 days.  Immediately, there was lethargy and indifference by the officials at UIIC, Udupi towards my claim process. I had already made at least 8 to 10 personal visits after, to explain my position, unfortunately none in the UIIC office took me seriously. They were adamant that without submission of the RC and forms 29 & 30, my claim process would not move. After about a month and few days of claim form submission, me and my uncle lost our patience and insisted on a written explanation for the delay in processing of the legitimate claim. We were made to meet the Division Manager, who asked us to compromise our stand, forgoing the road tax refund. We refused it outright and then he asked us to comeback after another 45 days, assuring he would look into the matter. Left with no choice we agreed and we requested his permission to shift the XUV out of the dealership at Mangalore, to my uncle’s premises (approx. 90 km from Mangalore), as it attracted a ground rent of Rs 100 per day. He agreed, so we shifted the car out of the dealership, submitting a letter seeking permission, to UIIC. We did take an acknowledgement for the same as well.  I waited for almost two months for a response form UIIC, Udupi branch. When I realized my wait was futile, I raised a complaint on their online grievance registration, on 25th October 2016. I was allocated a number for the same immediately and was also assure a response.  I received a reply from the regional office of UIIC, Hubli, 8th November 2016, from the Regional Manager, stating my claim was settled and the payment would be done by the coming week.  I further waited for almost another month, did not get any response. I escalated the matter online, wherein I got one more reference number. I did not get any response from UIIC for the next week. I even wrote an email in length to the Chairman of UIIC, again I did not get a response. I wrote a mail to IRDA, attaching all the communications I had with UIIC so far.  To my surprise the so called IRDA did not even respond to my email. IRDA has an advertisement campaign for insurance customers, which says ‘Jago Grahak Jago’. I wish it applied to them as well. I was out of options and was on the lookout of an office, which oversaw the functioning of IRDA. I found out form the internet that Ministry of Finance (MoF) oversaw the IRDA operations. To approach them I had to lodge an online complaint on Department of Administrative Reforms & Public Grievances. After a cold response from UIIC regional office, Chairman UIIC & IRDA, I was not too hopeful to get a response from MoF. To my surprise, I got an acknowledgement, and a reference number the next day. Every day, it moved from one desk to another, which reflected online and finally reached the Economic advisor, Insurance Division (EA, ID). For the first time in my life I felt someone in the government is looking into problems like the one I was drowning in. EA, ID forwarded the complaint to the UIIC head office, Chennai. I received the reply to my complaint on 19th December 2016, from EA, ID, which in turn was written by the Chief Manager, UIIC Head office, stating that a sum of Rs 9,37,000 was deposited to my account, on 7th December 2016. I was surprised and anguished to see this response. UIIC firstly did not take my account details and further states Rs 9,37,000 paid against the IDV of Rs 9,85,714.   I ran to the banks, where in I had accounts to check if the said amount was credited, as I assumed UIIC to have got my bank details through my PAN. I was further angered to see; no such credit had taken place till 19th December 2016. One can imagine what I went through, when a chief manager of a public sector undertaking, can write such an irresponsible, dubious reply to MoF. I immediately drafted a letter, inquiring about the status of my claim, to the UIIC branch, Udupi. As usual, I took an acknowledgement, for the letter given by me. I intentionally kept the Udupi UIIC office ignorant of the reply I did receive from their Head office, the very same afternoon.  As usual, I did not get any response to my letter from UIIC, Udupi Divisional office. I also wrote an email to MoF again, stating the blatant lie that the chief manager for UIIC, Head office, had written to them. Unfortunately, this time, I did not get a response from them as well. I made one more attempt by writing to the new chairman of UIIC, who had stepped in to position in early December. Again, I failed to get a response. By now it was clear, I had to move to the court of law, to get my claim, as all the windows of hope closed. I took the statement of my accounts, as on 19th December 2016, from respective banks, immediately started looking for a suitable lawyer at Udupi. I ran through all my contacts and was advised to meet Mr. Sankappa A, an expert lawyer in motor vehicle cases here. I took copies of all the communications I had to Mr. Sankappa, who went through the communications I had, immediately advising me to register a case with the District Consumer Disputes Redressal Forum, Udupi. He registered a case on 7th January 2017. Subsequently, the forum sent a notice for UIIC, Udupi branch. I immediately got my first written communication from UIIC, Udupi, dated 24th January 2017, through registered post with acknowledgement, stating that my claim was settled on total loss basis, IDV of Rs. 9,37,714 minus Rs. 2,000 deductables. I was asked to submit signed copies of form 29 & 30 from the RTO and also the bank account details. Here I knew they were in trouble, as the previous communication from the head office UIIC, Chennai, had committed of transferring an amount of Rs 9,37,000 on December 2016.   I also drafted a letter back to reply the same on 27th January 2017, through registered post with acknowledgement. By now, my letter writing skills had tremendously improved, thanks to UIIC.  http://www.hdfcgi.com/downloads/IRDA...ncHandbook.pdf I also came across this important section in the Motor vehicle act, which really made me believe, I could still have the last laugh in my pursuit. I cross verified it with my lawyer as well.  I appeared before the consumer forum the day my papers were submitted. It is mandatory for the complainant to be present before the forum on this day. The judge went through the papers and asked me some doubts, which she had. I was surprised to hear the lawyer appointed by the insurance company, accuse me of hardheadedness, which had led to the non-settlement of the claim. He also made a statement that ‘not all insurance claims can be as per law’, the most absurd statement to be made (ironically) by a lawyer, that too, in a court. The judge asked the company lawyer to settle the IDV value with me immediately, and then depending on the merit of the case, a suitable compensation could be arrived at, as this would exempt the insurance company from paying a hefty amount as interest. This was out rightly refused by the insurance company lawyer. I was then advised by my lawyer to initiate the process of obtaining a refund of the road tax paid, which is for a span of 15 years. I was given this idea by my friend, who himself was an assistant RTO, posted elsewhere. For XUV the road tax amount paid was Rs. 2,82,958.  Request letter for Road tax refund.  I followed the process of requesting a tax refund at the RTO. I was asked to take signatures from a couple of desks stating there were no cases against my car, no fines to be paid etc.  As usual, I had cultivated the habit of having a proof of anything I submitted, irrespective of the offices I had to deal with. My claim process abruptly stopped moving ahead, as in my subsequent visits, in the coming weeks, I was told the file of the XUV was missing at the archives at the RTO!!! (which was very much there a few weeks ago). Here I was unsure as to the file going missing at the RTO by oversight/misplacement or the insurance company flicking it out from the RTO, through a broker/RTO staff. But for my habit of having a photo of the letter I submitted, I would have been helpless. I waited for another 45 days, where I was told since the file was missing, my refund request could not be processed. I approached the main RTO, along with a friend of mine who runs a transport business, to enquire about the status of my tax refund. My friend was very firm in talking, and asked for way-out of the situation I was in (because of the file being misplaced and untraceable) or a letter stating the inability of processing my refund request, so as to pursue the matter with the transport commissioner at Bangalore. Sensing my friend’s persistence, a duplicate file was created immediately, and then the process of tax refund stated moving again, after 50 days of receiving my request. The inspection process was assigned to an assistant RTO, who again took some time to act. Finally, my friend who runs the transport business had to intervene, to get the wheels moving. I was asked to get a tracing of the chassis number of my XUV, on a paper. Now locating this number was my next task. Luckily I could manage to get a tracing of it, after repeated attempts.  Finally, I was handed over the letter stating the cancellation of registration certificate (expenses at RTO Rs. 3,000).  Once this letter was issued, then form number 16 had to filled and submitted at the RTO. In other words, claiming a road tax refund is a two-step process.  I received Rs 1,91,000 as refund (after a pro rata deduction for 4 years), transferred to my account transfer from the RTO in the coming week. I also submitted the original letter of cancellation of registration to the consumer forum, which was marked as an exhibit. Monthly hearings did happen, where I was exempted from appearing. The verdict from the District consumer forum, with regards to my case was awarded on the 21st March 2018. Yes, Life time Road Tax refund is very much possible. Well it’s been a journey, which had periods of uncertainty, learning, documentation, perseverance and emotions. I have to thank my lawyer and a friend, Mr. Sankappa A, TBHP friends who have so supportive, Sashas lending me his car, at some of my worst times in life. The satisfaction I am experiencing, honestly is not over the compensation I was bestowed by the consumer forum, but the satisfaction of being able to teach the United India Insurance company an unforgiving lesson and for an enlightening learning experience, for me, (reading almost 2,000 judgments related to insurance claims, online), to share with you all. The story of my new XUV began at uncle’s home (2013), ironically it is where the story exactly ended. ‘Rusting in Peace’. Coincidence … Destiny…. ? XUV gave me one of the best rides in life. I loved it more and more, every time I drove it (60,000 Kms). It behaved well till the last moment of impact. Well then, it appears this inspiring tale has come to an end, if that's the way it has to go. (Fast & Furious 6)  Now there is one pertinent question which arises here, as to why UIIC officials asked for the original RC and duly signed forms 29 & 30. At the first look, it looked that the concerned officials at UIIC (Public sector Undertaking) are hell-bent on following rules, that is the transfer of ownership to the company. But, they promptly handover the blank forms 29 & 30 before the payment of the claim. Their idiosyncrasy makes them believe that the moment a vehicle meets with a bad accident, the vehicle and all its benefits entitled, are theirs, conveniently forgetting the laws abiding a contract. Now, one needs to note, that the insurance policy for a new vehicle is generated, prior to delivery, on the ex-showroom (5% less as IDV) price of the car, excluding VAT (GST) and road tax. So in case of a total loss, they are not entitled to the tax refund. Luckily, RTO has made the refund process as a two stepped (cancellation of registration, refund of tax on pro-rata basis). So, these insurance company officials take our signature on the blank forms 29 & 30, in the pretext of rules (which clearly violates Section 55, subsection 1 of MVC act). From now they have two modus operandi, Scenario 1: They have a good understanding with the scrap dealers, who repair the vehicle, at their scrap yard, and sell it someone else, using signed forms of 29 & 30, (handed over to insurance company, along with our claim form) and internally declare it as a salvage loss, in their documentation to the company. Since the repairs are done off the records in the showroom, a majority of the buyers do not come to know what has transpired. He would assume that it has been sold as any other used car, transferred from the existing owner. These officials get a handsome kickback in the deal, though the insurance company finances are ruined (salvage loss). This reflects how loyal they are to their company. In my case this is the reason they were willfully delaying my claim process, hoping to get me (a doctor by profession, presumed to be ignorant of insurance claims, busy schedule etc) bend down to them on my knees, to agree to their organized corrupt practice, with time. Hence, getting a kickback close to a lakh, from the scrap dealer. Scenario 2: Use the registration to legitimize a stolen vehicle (same make & model), in their possession, selling it as a used car, further selling the parts salvaged from the wrecked vehicle. So the signed forms 29 & 30, lent from the insurance company, facilitates the deal smoothly, and still get a kickback, from the scrap dealer. Both of these scenarios do not reflect the insurance company or its officials in these corrupt practices, yet profitable deals. As far as I have web searched for the information on total loss claims practices by private/public sector insurance companies, only Oriental Insurance company, has a policy of cancelation of registration of a vehicle rendered for a total loss. So, it is not that other companies are much better off. Private or Public sector companies, for auto insurance As per the data from IRDA, the private insurance companies have a better claim to settlement ratio, when compared to public sector insurance companies. This I feel is because any official who handles a case, like mine, in a private insurance company, would be smart enough to settle the matter, before it reaches the courts, as it could cost him his job. All I asked for was the IDV. Now UIIC ended up paying Rs 3,00,000 more for the greedy, corrupt practices of its officials. Who loses the money finally? It is the Govt of India or the taxpayers. These public sector insurance company officials as so sure of their jobs, they least bothered to look at the bigger picture for the company. From the communication I had with UIIC, it is pretty clear that there is an organized corruption, at all levels (I wrote two emails to the chairman, UIIC, with all the evidence and did not get a response). Mod Note: Dear BHPian, There were several grammatical errors in your post. Kindly ensure that you proof-read your posts prior to submission. Last edited by Aditya : 24th August 2018 at 12:58. Reason: Spacing, grammar |

| |  (229)

Thanks (229)

Thanks

|

| The following 229 BHPians Thank manipal for this useful post: | --gKrish--, 2himanshu, a4anurag, Added_flavor, adneeraj, aeroamit, akash_v12, akshay81, AKTRACK, Alfresco, ananthacharya, Aniket6, anumod, arjithin, arunphilip, arvind71181, arvindb4, ashikthomson, Ashtoncastelino, asingh1977, asmr, audioholic, avaneesh., AVIS, avisidhu, ayankm, AYP, bejoy, bhavik.1991, bhp_maniac, BigBrad, bj96, blackasta, blackwasp, BoneCollector, bordeaux, Chetan_Rao, cn.vishnu, Col Mehta, Coyote, CptSlow, Crazy_cars_guy, crdi, Crow, dailydriver, damodar, Dani7766, daretodream, Deep Blue, defactorake, di1in, digitalnirvana, djay434, Dr.Naren, driverace, drmohitg, drsk, Eddy, Engine_Roars, Enobarbus, Ertigiat, fine69, Flyer, flyingkolors, Ford5, francis_vaz, Freewheelin_KD, frewper, ganeshb, Gannu_1, Geo_Ipe, ghodlur, gkveda, goswami.j, Govardhansupra, GrammarNazi, GT3, GTO, HappyWheels, haria, harsh79, Highh5, highway_star, hillsnrains, hiren.mistry, hmansari, hotspot, hrman, HTC, iabhishekkumar, ike, InControl, IndigoXLGrandDi, Insearch, Ithaca, jasonblr, JithinR, junky, k88k, Keynote, KK_HakunaMatata, kutts, lamborghini, lemedico, libranof1987, Lij, Lobogris, lsjey, Maky, mallumowgli, mantrig, mathuranuj, meetzap, megazoid, Meph1st0, mh09ad5578, mjumrani, mohan41, motorsan, Mr.Boss, Mtv, Mu009, mug:mush, nagr22, nareshtrao, naut, naveenroy, Nazzy, na_agrawal, neerajdan, nemodotme, NetfreakBombay, NG_EV, Night_Fury, ninjatalli, nishsingh, Nonstop-driver, NPV, NPX, pacman2881, papr23, parsh, pc73, PGA, Pigcee, PM - B, Ponbaarathi, pradeepnair, prajwalmr62, PraNeel, PrasunBannerjee, procrj, puntOOs, Quatro, R2D2, raamki, Ragul, raihan, Rajeevraj, rakesh_r, Ravi Parwan, reignofchaos, Researcher, revvharder, RICK004, rkv_2401, RoadSurfer, roby_dk, Rocky_Balboa, rohiT Nonu, rrsteer, rr_zen, saisree, sai_ace, saket77, samabhi, samaspire, samm, Samurai, samy1117, sandeepmohan, sanjaykk, Santoshbhat, sayakc, SDP, sdp1975, selfdrive, serious_maniac, Shanksta, shipnil, Shubhendra, sidzz, SmartCat, SnS_12, Soumyajit9, speedsatya, Spinnerr, sreerama, Srikanthan, SS-Traveller, strawhat, Su-47, sunilch, sunny29584, sups, swiftnfurious, tchsvy, Tgo, theexperthand, thewhiteknight, the_skyliner, Torino, TrailBlazer007, trichy, Turbohead, Turbojc, unni246, vaasu, VaibhaoT, Varun_HexaGuy, Vitalstatistiks, VivekCherian, vivtho, Voodooblaster, Vysakh, Waspune, Whiplash7, yamaniac, yoscenario2000 |

| |

| | #2 |

| Senior - BHPian Join Date: Oct 2008 Location: Pune

Posts: 1,988

Thanked: 4,101 Times

| Wow man, what a roller coaster of events! I have a few general thoughts: 1. Would the process be any smoother in case of private sector insurers such as Bajaj/HDFC etc? 2. Many instances were resolved because you knew the right persons. What would be the case if someone with no connection fell into similar situation? Thank you for sharing this in detail. |

| |  (12)

Thanks (12)

Thanks

|

| The following 12 BHPians Thank ani_meher for this useful post: | Arwin07, bhavik.1991, Dennis, digitalnirvana, GTO, hmansari, manipal, roby_dk, samy1117, shashanka, SnS_12, tchsvy |

| | #3 |

| Team-BHP Support  Join Date: Apr 2013 Location: Madras

Posts: 7,335

Thanked: 20,670 Times

| Re: The tale of a Total Loss Claim First off, really sorry to hear about your ordeal! Not many would be in a position to share the whole thing on a forum especially after going through such a mental trauma. What happened to the total loss claim? Did UIIC finally credit this amount? Sorry if I missed it somewhere! Thanks for narrating it event by event man. Appreciate it! Last edited by Gannu_1 : 22nd August 2018 at 23:58. |

| |  (12)

Thanks (12)

Thanks

|

| The following 12 BHPians Thank Gannu_1 for this useful post: | arunphilip, digitalnirvana, Dr.Naren, gauravanekar, GTO, manipal, Mu009, samaspire, shashanka, SnS_12, tchsvy, Voodooblaster |

| | #4 | |

| BHPian Join Date: Feb 2008 Location: manipal

Posts: 82

Thanked: 470 Times

| Re: The tale of a Total Loss Claim Quote:

Thanks ...yes I did get the amount credited, to my account. about a month back, through the consumer courts mediation. Last edited by Samurai : 23rd August 2018 at 00:30. Reason: quote fixed | |

| |  (16)

Thanks (16)

Thanks

|

| The following 16 BHPians Thank manipal for this useful post: | digitalnirvana, Gannu_1, gauravanekar, GTO, haria, Highh5, raamki, Researcher, roby_dk, samaspire, sayakc, shashanka, SmartCat, SnS_12, swiftnfurious, tchsvy |

| | #5 |

| Senior - BHPian | Re: The tale of a Total Loss Claim Oh my god ! Does a total loss claim have so such trauma involved or is it because it was a nationalized company ? I had friends who had to claim total loss, I doubt they had to go through so much. They had the money to buy a new car within 2 weeks of the incident. Hats off to your persistence though. |

| |  (9)

Thanks (9)

Thanks

|

| The following 9 BHPians Thank Altocumulus for this useful post: | bhavik.1991, digitalnirvana, GTO, hmansari, roby_dk, samy1117, shashanka, SmartCat, tchsvy |

| | #6 |

| BANNED | Re: The tale of a Total Loss Claim Usually PSU insurance companies are considered safe choices, but this makes one think twice about uiic. Hopefully the others aren't as bad |

| |  (5)

Thanks (5)

Thanks

|

| The following 5 BHPians Thank greenhorn for this useful post: | digitalnirvana, GTO, Mu009, roby_dk, SDP |

| | #7 | |||

| Distinguished - BHPian  | Re: The tale of a Total Loss Claim Sorry to hear about your ordeal. Hats off to your perseverance and your amazing set of friends and connect that helped you at police stations, RTOs and other places. Quote:

Quote:

Quote:

| |||

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank ninjatalli for this useful post: | Altocumulus, digitalnirvana, gauravanekar, GTO, Mu009, samaspire |

| | #8 | |||

| Senior - BHPian Join Date: Sep 2015 Location: Manipal / Udupi

Posts: 1,661

Thanked: 5,428 Times

| Re: The tale of a Total Loss Claim Quote:

Quote:

Quote:

| |||

| |  (21)

Thanks (21)

Thanks

|

| The following 21 BHPians Thank samaspire for this useful post: | Altocumulus, ani_meher, arunphilip, bhavik.1991, CptSlow, daretodream, defactorake, Dennis, digitalnirvana, Gannu_1, gauravanekar, GTO, hmansari, ninjatalli, Ragul, Researcher, SDP, shashanka, shipnil, SmartCat, tchsvy |

| | #9 |

| Distinguished - BHPian  Join Date: Sep 2010 Location: Liverpool/Delhi

Posts: 5,449

Thanked: 7,572 Times

| Re: The tale of a Total Loss Claim What a read. Thanks for such a detailed chronicle of your experience and many congratulations for being able to emerge victorious. What was the final compensation offered by the court or is there a non-disclosure at play here too? More than the amount, I am interested in knowing if there is any public shaming or monetary loss that the insurance company suffered since they tried all the tricks to cheat you. Second what did the court make out of the false claim by the insurance chairman/manager about crediting the said amount to your account and conveying the same to MoF. Lastly just from a financial point of view, you gained approx. 2L of road tax amount by going through this hassle that lasted for almost a year. And that too with help of such wonderful well placed friends. I shiver to think what would a normal person have done without the connections and the goodwill of your medical degree. Such a person might still be waiting for the SI to show up at the police station!  |

| |  (25)

Thanks (25)

Thanks

|

| The following 25 BHPians Thank drmohitg for this useful post: | Arwin07, daretodream, defactorake, Dennis, digitalnirvana, gauravanekar, ghodlur, GTO, hmansari, manipal, Mu009, pacman2881, parsh, Researcher, samaspire, Samurai, samy1117, sandeepmohan, shipnil, SmartCat, SnS_12, swiftnfurious, tchsvy, unni246, Voodooblaster |

| | #10 |

| Team-BHP Support  Join Date: Sep 2010 Location: All over!

Posts: 8,176

Thanked: 20,584 Times

| Re: The tale of a Total Loss Claim Thanks for sharing your unfortunate ordeal. Glad everything worked out the way you wanted at the end, although the journey there was clearly a hassle. Your experience is yet another example of how Govt. departments in our country fail to do the only thing they're expected to do: their job. There indeed has been some improvement in accountability and information sharing (through means such as RTI) but there's a long, long way to go. 9/10 people in your situation would have given up and taken whatever they got, for lack of connections, time and the need for money through the settlement. |

| |  (9)

Thanks (9)

Thanks

|

| The following 9 BHPians Thank libranof1987 for this useful post: | CptSlow, digitalnirvana, GTO, hmansari, Lobogris, manipal, MBstoTBs, Mu009, Researcher |

| | #11 |

| Senior - BHPian | Re: The tale of a Total Loss Claim Really sad to see the XUV damaged beyond repair and very pained to know that you had to go through an ordeal to get the amount which was rightfully yours. It is frustrating to see that the vehicle owners are at the mercy of the Insurance co who waste no opportunity to arm twist the car owners even in case of a valid insurance and we have the regulators blatantly increasing the Third party premiums at the drop of the hat. Its a pity that IRDA being a regulator was of no help at all. I must appreciate your patience and your acquired expertise in documentation in getting the insurance amount. A less patient person would not hesitate to get whatever he could lay his hands on. It is surprising to see that Insurance co have some dim witted lawyers on their payroll who dare to oppose the law itself. My heart goes out to you for the ordeal, hats off to you for your perseverance. |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank ghodlur for this useful post: | digitalnirvana, GTO, hmansari, manipal |

| |

| | #12 |

| Senior - BHPian Join Date: Jan 2008 Location: Bombay

Posts: 1,481

Thanked: 1,128 Times

| Re: The tale of a Total Loss Claim |

| |  ()

Thanks ()

Thanks

|

| | #13 |

| BHPian Join Date: Feb 2017 Location: DEL-TN-KA

Posts: 78

Thanked: 110 Times

| Re: The tale of a Total Loss Claim Appreciate the detailed account of your struggle with our "system". I strongly empathize with you and your story only adds to my frustration, a car owner in India has to face every now and then. I found myself in an ordeal with Bharati AXA & a 3rd party insurance services aggregator, a few days back over an IDV problem. I won, but not without due struggle and going through stressful situations which comes free while fighting with insurance companies and banks for what you deserve to get. My case was a lower IDV value : ~45% IDV depreciation for a 1.5 yr old car. My car was damaged a lot and was declared a total loss. The insurance company to compensate my IDV, sold the wreckage to a salvage buyer through Car Trade auctioning. Within a span of 15~20 days, the total loss case became "constructive" total loss and the car was planned for repairing and selling. I was immensely shocked by the fact that a severely damaged vehicle with a seriously questionable body & chassis condition, is again plying on Indian roads, and the laughable point here is that the final user (not the salvage buyer) saw the car when he had decided to repair it and use. Jai Ho!  Last edited by k88k : 23rd August 2018 at 09:52. |

| |  (10)

Thanks (10)

Thanks

|

| The following 10 BHPians Thank k88k for this useful post: | digitalnirvana, gauravanekar, GTO, hmansari, InControl, manipal, Mu009, R2D2, roby_dk, sandeepmohan |

| | #14 |

| Senior - BHPian Join Date: Feb 2010 Location: Wellington

Posts: 3,283

Thanked: 6,045 Times

| Re: The tale of a Total Loss Claim Thank you for sharing your experience. Sounds like almost 8-10 months of running from pillar to several stone walls. Fortunately; they all started to fall or crumble one by one, by your perseverance. Reading it all, it makes me upset and angry. The hell one must go through, to get a settlement from a car crash and that too without having anyone else involved in it other than yourself, your family and your own car (Yes; I am aware there was a truck). 20 years of being a loyal customer and giving the Insurance Company your business made no difference too. Why do we not care about such things is beyond me to understand. Why are our systems designed in such a way that they make you suffer. I will be honest, If I were in your shoes, I would have fallen apart. The very people who are there to protect us don't want to do their jobs the right way. How can a senior police officer make you wait for days on end and then show up out of the blue because of some pressure coming from above. To top it off, he had the nerve to show you that he was pissed off. Influence does help but even that could wane if it ain't the right level of influence. Police Officer's should function in the efficiency and transparency seen in the movie Action Hero Biju. Nobody should ever have to go through what you did. |

| |  (8)

Thanks (8)

Thanks

|

| The following 8 BHPians Thank sandeepmohan for this useful post: | a4anurag, digitalnirvana, GTO, hmansari, Lobogris, manipal, Santoshbhat, SmartCat |

| | #15 |

| Senior - BHPian Join Date: Apr 2009 Location: Bangalore

Posts: 1,154

Thanked: 4,761 Times

| Re: The tale of a Total Loss Claim The photo in the last (Pasting just for reference) is NOT ABOUT XUV - How it WAS and How it IS. It is a symbol of the Indian POLICE, INSURANCE COMPANIES, and SYSTEMS in India - How they behave in the begining and at the time when we need their support. For Instance, First Picture represents how Insurance companies fall behind you when they want you to buy a policy and second picture depicts the way they act when you claim the insurance. Our Entire System is like this. Really glad that you fought till the end against the system and WON it. My only sincere suggestion is, Forget the past. By the way, which car have you planned now ? New car is already in Garage ? Last edited by gkveda : 23rd August 2018 at 10:13. |

| |  (19)

Thanks (19)

Thanks

|

| The following 19 BHPians Thank gkveda for this useful post: | Abhi_abarth, blackasta, Deep Blue, digitalnirvana, drsk, hmansari, InControl, k88k, manipal, Mu009, Nazzy, PrimeDrive, raamki, Ravi Parwan, Researcher, roby_dk, SmartCat, SnS_12, tchsvy |

|