Rs. 54 lakhs government subsidy on Mercedes and Jaguar e-SUV

In October 2020, Mercedes-Benz India has launched EQC, their first all-electric SUV in India, at an ex-showroom price of Rs. 99.3 lakhs. Now it is available at an ex-showroom price of Rs. 1.04 crore, as per their website. Jaguar too launched its all electric crossover I Pace in March 2021, with a starting ex-showroom price of Rs. 1.05 crore for the base S variant and the range topping HSE variant at an ex-showroom price of Rs. 1.12 crore.

Under the current passenger vehicle tax system in India, Mercedes-Benz EQC and Jaguar I Pace get subsidy in form of tax benefit, of at least Rs. 54 lakhs, coming from taxpayer’s pocket.

How? I will go step by step to elucidate the case.

Electric Vehicle (EV) Subsidy

Government subsidy on pure electric vehicles is driven by two primary reasons. EVs have zero tail pipe emission and thus keep immediate surrounding clean of pollutants, and uses electricity as an energy source, thus helping country like India to cut back on imported crude oil supply (largest import item for India).

But battery electric vehicle (BEV) is almost 75% more expensive as compared to petrol powered vehicle right now. The best way to understand is to look at Tata Nexon price, as it is available with three different powertrains.

Without GST incentive, Tata Nexon EV would have an ex-showroom sticker price of Rs. 20.2 lakhs, and not many buyers would be interested then. So, to make EVs more affordable and promote fast adoption, incentive scheme has been put in place to reduce the cost barrier. In case of Tata Nexon, price difference is reduced to 28%, over petrol powered engine, which will eventually get offset in due course of time, owing to the low running cost of BEV.

GST - incentive

From 1st August 2019, GST on the electric vehicle was reduced from 12% to 5%. Whereas GST incidence on regular internal combustion engine (ICE) vehicle or hybrid vehicle, varies from 29% to 50%. In other words, the government has forgone GST to the tune of 24% to 45% on the sale of an electric car in India, in form of incentive.

Source :

https://www.siam.in/cpage.aspx?mpgid...8&pgidtrail=85 Road Tax - incentive

Each state in India imposes different road tax on new vehicle sale, which varies from 4% to 20%, based on fuel and price of the vehicle. Several states have either exempted or reduced road tax to make EVs more affordable for end user.

Source :

https://www.financialexpress.com/aut...price/2259887/

Now, by adding up all these incentives, the net tax amount forgone by the government on luxury brand BEV, come out to be staggering - Rs. 54 to 58 Lakhs.

Since the government in India has based the incentive system, on a percentage of the vehicle price, without any cap, subsidy outflow is huge. Well, some can still argue that this is having a bigger cause behind it. But question is, how fair is it to subsidize luxury cars, which is a symbol of conspicuous consumption?

To address this issue, other countries have set some criteria, and most important fact, a cap has been placed on subsidy amount.

Example from other countries China - world’s largest market for EV sales “China’s subsidies typically apply only to vehicles priced under RMB300,000 ($46,000) with a notable exception granted to vehicles built with battery swapping tech—a process that allows consumers to easily replace the car’s battery once it runs dead or needs an upgrade.” Source : https://fortune.com/2021/01/05/china...s-sales-tesla/

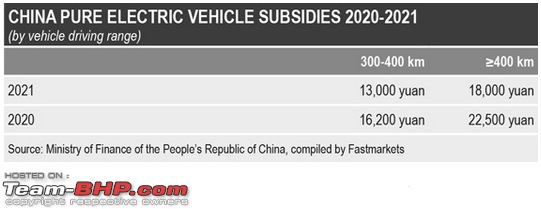

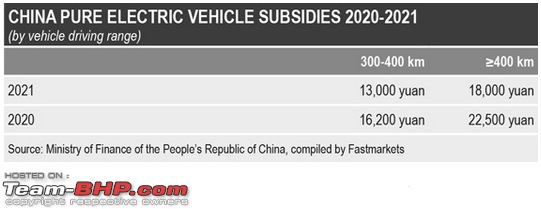

The subsidy is based on – rated range a vehicle can cover with a fully charged battery and for that too, the maximum incentive value is fixed at 18,000 yuan in 2021.

Source :

https://www.metalbulletin.com/Articl...lt-prices.html USA

The federal grant is restricted to $ 7,500 in form of a tax credit, though different states have their own incentive system. But there are further caveats, based on some logic, as explained by Edmunds.

“The government is phasing out the electric vehicle tax credits as sales increase, on the theory that the high initial cost of adding new technology to a vehicle will come down as economies of scale improve with more sales. That's supposed to eliminate the need for subsidies. The expiration date is separate for each manufacturer and only comes after an automaker sells 200,000 qualified vehicles. Tesla hit the milestone first in July 2018. As a result, there are no federal tax credits for Tesla now. Thus New Tesla owners don’t get any federal incentive. Though different states within USA can offer grants at their level.”

Source :

https://www.edmunds.com/fuel-economy...x-credits.html Tax credit - Tesla USA

Source :

https://www.fueleconomy.gov/feg/taxevb.shtml Tax credit - Mercedes Benz USA

Source :

https://www.fueleconomy.gov/feg/taxevb.shtml Tax credit - Jaguar USA

In fact, Jaguar I-Pace gets incentive of (~₹ 5,48,000) in form of a tax credit.

Source :

https://www.fueleconomy.gov/feg/taxevb.shtml UK

From March 2021, EVs priced above £ 35,000 (~ ₹ 36,26,000) are not even eligible for the government grants.

Source :

https://www.gov.uk/government/news/p...ake-the-switch Summary of federal EV incentive in other countries

The current exchange rate is used, in below table, to assess equivalent Rs. amount, and have better perspective of what incentive is being offered, and car price cap imposed. Though all of them are relatively high income country, and average car retail price is much higher than India, still federal incentive is in range of Rs. 2-5.5 lakhs, and overall car price cap is in range of Rs. 33-36 lakhs.

Government should immediately put a cap on subsidy amount for different category of EV

Government should immediately put a cap on subsidy amount for different category of EV

Just imagine if Tesla, Audi, BMW, Volvo et al, bring in their CBU EV, and start selling more than 1,000 cars a year. This might cause a subsidy drain of over Rs. 500 crores per year!

Just to give perspective, the total budget allocated as a demand incentive under the FAME II scheme for 'e-4 wheelers' is Rs. 525 crores for 3 years. This amount is reserved for vehicles to be used for commercial purpose only, thus ferrying more people throughout the day, rather than just sitting idle, as in the case of most personal cars. Look carefully table below, it has stipulated condition for battery, ex-factory price and incentive cap as well.

FAME II :

https://www.fame-india.gov.in/WriteR...tification.pdf

Since mass adoption of EV is a guiding principle, the need of the hour is to put a cap on subsidy limit, similar to what has been done in other countries. Subsidy should be directed to mass market vehicles only. Tata, Mahindra, Maruti, Hyundai-Kia, MG et al, are the ones who have factories in India, to produce EV locally, and of course - new entrants, and usher mass market adoption of vehicles without tail pipe emission.

This will push automakers for localization (to prevent substitution of crude oil import with battery import in India), also, to come up with EVs that are more affordable and thus suitable for mass adoption. Rather than having few niche products, mere for technology demonstration.

Without any cap, GST and road tax concession is working out to be the FAME I scheme. Where Maruti got an undue advantage with its SHVS technology.

https://www.team-bhp.com/forum/india...tech-shvs.html (Maruti gets notice for the second time for 'dubious' hybrid tech (SHVS)) Pointer

In India, almost 96% of cars sold, are under Rs. 20 lakhs ex-showroom price tag, by volume. If purchasing power is confined under Rs. 20 lakhs, then why subsidize luxury cars with taxpayer’s money, which will not help in mass adoption?

It is a clear pointer, setting the cap at Rs. 30 lakhs or lower, will bring the incentivized price down under Rs. 20 lakhs ex-showroom range, and it should come along with a well calibrated system for monitoring and future-adjustment.

Moreover, the government will always have limited resource, so they will certainly face trade-off, either to subsidize few luxury EV or large number of mass market EV. The trade-off decision becomes simple, when one knows, that, the cost of subsidizing one Mercedes-Benz EQC, can easily support incentive of 11 Tata Nexon EV.

Image source : respective website

Subsidy from tax payer’s money should always be meant for bigger cause, and of course – never for conspicuous consumption. A handful of imported EVs is not going to solve the air pollution problem, anyway. CBU EV should not get any subsidy at all, this will push luxury car makers in India, to invest in CKD EV assembly. In fact, CBU EV increases the import bill of the country, thus there is no offset for crude oil import.

Potential electric car buyers seeking performance orientated cars don’t even need subsidy from government.

(69)

Thanks

(69)

Thanks

(6)

Thanks

(6)

Thanks

(20)

Thanks

(20)

Thanks

(14)

Thanks

(14)

Thanks

(23)

Thanks

(23)

Thanks

(21)

Thanks

(21)

Thanks

(2)

Thanks

(2)

Thanks

(5)

Thanks

(5)

Thanks

(8)

Thanks

(8)

Thanks

(2)

Thanks

(2)

Thanks

(7)

Thanks

(7)

Thanks

(4)

Thanks

(4)

Thanks

for a moment I thought have woken up somewhere else or in a different time

for a moment I thought have woken up somewhere else or in a different time

That's a neat way to start your journey with Team BHP. And it is a very well drafted thread that gives us cause to pause and think. Certainly I had not given this a thought from the angle you present it.

That's a neat way to start your journey with Team BHP. And it is a very well drafted thread that gives us cause to pause and think. Certainly I had not given this a thought from the angle you present it.

.

.