Movers & Shakers

With about 2.03 lakh passenger cars sold in May 2014, the market is going through challenging times. Still, we've seen worse (e.g. May 2013 = 1.90 lakh). Those with fresh / relevant products and a fire in their belly weather the storm, while the lethargic sitting on a stale line-up watch the action from the sidelines.

I think it's amazing how some manufacturers go from strength to strength in rough waters. For instance, see how Maruti & Hyundai fiercely guard their turf in the mass market segment. They're absolutely relentless, showing no weaknesses in the product, marketing or after-sales functions. When it comes to the high volume segments, the two have successfully fought competition from major global players (Toyota, VW, Chevrolet, Ford), eventually demolishing their rival's compact car offerings. The industry is also watching Honda closely. The Japanese company is now a consistent 5-figure performer, thanks to volumes from the City & Amaze. Then, there's the impending launches of the Jazz, Mobilio & a possible compact SUV.

Auto CEOs are looking forward to reforms & initiatives from the powerful + stable new Government. Car manufacturers bring significant levels of investment & job creation to the country. You can bet those in power will keep this sector as a priority.

• The bestselling car in India isn't the Alto...this time around, it's the Dzire with nearly 19,000 shipments! Over 2 years since the Dzire's launch and the market just can't get enough of this compact sedan, fresher competition notwithstanding. The successful Swift isn't too far behind either at 17,936 units and grabs the no.2 overall rank. Since April, the Alto isn't able to hold on to the mid-20000 levels it managed earlier. This shows the weak sentiment of the entry-level segment and how a good number of potential first-time car owners are sticking it out with their motorcycles. Period. The practical WagonR continues to attract its usual tally of 12,000 customers, while Maruti is pushing out all the Celerios it can make. Remember, the AMT isn't localised yet and there is a massive waiting list for the VFM automatic. A noticeable improvement in Eeco numbers & the Omni's strong too; if the trend continues, it might signal confidence among the small business segments that these UVs serve. Meanwhile, the ol' Ritz has simply lost its sheen and is in dire need of an overhaul. In the 5 lakh and over segment, product freshness is incredibly important. Happy to see a handful of Gypsy 4x4s consistently roll out of Maruti's factory gates (unlike the zero-production months of 2013). Compare the Y-O-Y charts and you'll see that Maruti has gotten rid of 5 under-performers (800, Estilo, A-Star, Kizashi, Grand Vitara).

• Driven by new launches, Hyundai actually gains market share points! Look at the 'total manufacturer sales' table in the opening post; this is Hyundai's best month since March 2012. The Xcent - Hyundai's first compact sedan - adds 7792 units to the kitty, outselling the Amaze by a considerable margin. The 3 month trend seems to indicate that some Grand i10 customers are adding a small amount to their EMIs, going for the sedan instead (India's fascination with a 3-box is unmatched!!). Like the Alto, the Eon reflects the condition of the entry-level category. 6,300 sales is respectable, but the lowest this year, and far from Hyundai's original projection of 12K monthly units. The Verna is a distant no. 2 in the C2 segment, clearly losing a lot of walk-ins to the indomitable City. The old warhorses (Santro & i10) get 5.5K customers between them. Hyundai must be looking forward to launching the next-generation i20 soon (

related link) as the premium hatch's performance is far from the 6,000 average it maintained in year 2013. The Elantra relinquishes the top spot in the D1 segment after a long time, but we'll have to watch the new Corolla's sales over the coming months before passing verdict. The Santa Fe has its best month ever; 250 units is impressive for a Hyundai SUV costing between 30 - 35 lakhs on road. On the other hand, the Sonata has sunk & how!

• Mahindra holds on to the no. 3 spot by a big margin. It's the same story with the Bolero grabbing a chunk of sales, albeit not in the 5 digits. The Scorpio maintains its superb 4,000 run and the new model (launch isn't too far away) should bring in even more customers. The XUV500 is doing rather good for a premium-priced SUV from a not-so-premium brand. There's no other company out there that is able to consistently sell 3K units of a 15 lakh product. On the flip side, the Xylo & Quanto are sheer failures in terms of design & marketing, as they do offer a lot of car for the money. The cheap & outdated Verito & Vibe are a write-off, I'm surprised they even occupy space in a Mahindra showroom. In the meantime, working silently out of the limelight, the Rexton has its best month in a year. 155 shipments is pretty neat when you consider its 20 - 25 lakh price tag.

• With a 1.5L diesel in its arsenal, Honda stays put as the no. 4 manufacturer in India. Over 7,000 copies shipped and the City outsells all of its C2-sedan competitors

combined. Honda hit the bulls eye with the new City's evolutionary approach....this time with a diesel & better equipment levels. The Amaze rakes in 4,750 dispatches, although that's not too strong, keeping in mind that it's priced bang against the Dzire. Still, volumes are volumes and I have a feeling Honda is prioritising production of the more profitable City over the Amaze. The Brio is the dud from the portfolio. Truth is, Honda just can't get its hatches right in India. After the old Jazz, this is their second hatchback to fail :

related thread.

• The Innova thunders past the 5k mark for the first time since the facelift + price hike. Month on month, that's more than a 50% climb! With production getting stabilised, the Fortuner settles back at the 1400 - 1500 level it's comfortable at. The new Corolla also makes a great debut with 548 shipments, straight to the top of the D1 segment. Let's wait & watch on its longer term performance. In what is a first for the Camry, it matches the Superb's sales car for car, jointly occupying pole position amongst the D2 sedans. Not much has changed with the Etios & Liva though. They remain the laggards they've always been. More modern competition is giving them a thorough beating in the ring.

• April '14 was a low point for Tata with merely 7,441 cars out the door. May '14 is better at 9,230, yet that's hardly anything to write home about. As usual, it's the Indica / Vista & Indigo / Manza getting a majority of the volumes. Shockingly, the Nano is barely able to stay in the 4 digits, and the Aria sees 3 digits after 1.5 years! Tata is banking on the Zest & Bolt big time. Even if they are great cars (we're yet to drive them), there's nothing revolutionary about the duo (except for that first-mover diesel AMT advantage). They'll have to be priced very, very competitively to make any sort of impact. It's going to take a couple of years of determined hard work for Tata to climb out of this self-created pothole. Honestly, there's no problem that great products can't solve. Tata's current range of cars either lack a differentiator, are too old or badly marketed.

• The EcoSport's demand exceeds its supply, but there is hardly an improvement in the local numbers at 4,000. Ford exported 6,000 cars last month, presumably a large part of that consisted of the EcoSport. Nevertheless, for some variants, the waiting period has either come down or completely disappeared (depending on the city). Some BHPians have reported getting their EcoSports in less than a month of booking! Not much else to talk about at Ford as the old Figo & Fiesta Classic are losing favour in the market. The new Fiesta facelift is going to be launched anytime now and there are rumours of super aggressive pricing floating around. About time to get the new Endeavour in too, wot?

Related Link. It looks awesome!

• The Datsun Go clocked 2,000 pieces last month. That's not too bad considering it's from an entirely unknown brand and suffers dealership limitations. In fact, from Nissan's Indian portfolio, the Go is the top seller. We'll be keeping a close eye on its performance in the months to come. The Terrano is the only other car that Nissan has its staff busy with. The Micra, Sunny & Evalia are all flops! I'm glad that Nissan finally took up responsibility and divorced Hover. Only wondering if it's too little too late.

Related post.

• Confused marketing, inconsistent sales push and old + unappealing products have left Chevrolet in the doldrums. Year on year, the company has lost over 40% volume! It's only the Cruze that is revving healthily, selling in the whereabouts of its German competition. The Beat, Tavera & Enjoy somewhat keep the cash registers ringing, although they are severely under-performing, whichever way you look at it. I don't understand why GM has 8 cars in its portfolio when it can't support any of them. R-I-P to the failures (I'm talking about you, Spark & Sail), cut the fat and focus on the ones with potential. New boss Arvind Saxena is a genius.....he does have his work cut out though. Plus, there's only 3 years to do the magic as GM's retirement age is 60.

• Renault remains a one-trick pony with a single car (Duster) accounting for 90% of its sales. That said, the Duster is having a nice run, despite all the competition. The parent company will be happy too; combine the Duster & Terrano's numbers (same SUV, basically) and you are looking at over 5,000 shipments. Robust SUV aside, every other Renault sold in India is a sob story, be it the cheap Pulse or the expensive Koleos. Look at things another way: If it weren't for the Duster, Renault would've sold merely 323 cars in India!

• Year on year, the Polo & Vento lose about 50% of sales and VW can't do anything to stop the slide!! It's been ages since the two were launched and it sure doesn't help that they look so alike. New engine & transmission options will only take you so far. That said, the upcoming Vento Diesel DSG might just be the gamechanger (

related link). The premium-priced Jetta has a decent month (outselling the Octavia again), and VW seems to be cleaning up ol' Passat stock (all of 7 units).

• A similar story at Skoda as well. For a well-priced competent sedan available with diesel & petrol engines, the Rapid's poor show is inexplicable. The Octavia is working its way through the waiting list, only wish Skoda had more kits allocated for India. The Yeti facelift is shortly to arrive, but that's not going to do anything for its fortunes. This month, the Superb has quite a fall and ends up sharing pole position with the Toyota Camry. It's the Superb's weakest month since the facelift was introduced.

• The Punto & Linea are struggling, even when compared to recent numbers which were awful to begin with. I can only wonder how the dealers are surviving. It's been 5 years since they were launched and are now long in the tooth. The brand's negative reputation doesn't help matters either. Fiat is going to need a lot more than cut-price variants & dressed up versions.

• It's time to bring the curtains down on the Ambassador. Production of this iconic vintage car has stopped and, keeping in mind HM's troubles, the Ambassador isn't likely to be revived. The Pajero Sport deserves a pat on the back for selling 150 units, despite the horrendous backing it has. Says a lot about the value of 'brand Pajero' in India.

(34)

Thanks

(34)

Thanks

(46)

Thanks

(46)

Thanks

(19)

Thanks

(19)

Thanks

(14)

Thanks

(14)

Thanks

(27)

Thanks

(27)

Thanks

(5)

Thanks

(5)

Thanks

(2)

Thanks

(2)

Thanks

(3)

Thanks

(3)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

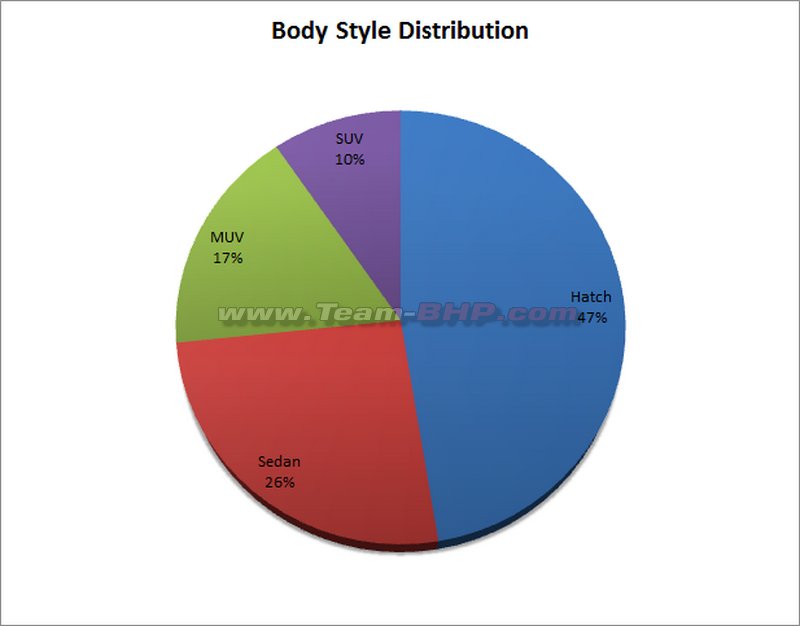

The market is evolving in value terms.

The market is evolving in value terms.